Aarogya Care | 5 min read

5 Tips on How to Appeal Against Health Insurance Claim Rejection

Medically reviewed by

Table of Content

Key Takeaways

- Claim denial appeals can help make your case and reverse the decision

- You will lose the claim benefits if your policy is expired

- Approach the insurance ombudsman as a last resort

Suffering from a health problem can be troublesome for both you and your family. During such times, health insurance provides the financial relief you need. But, what if your claim settlement gets rejected by the health insurance company? This can be quite a stressful experience, especially if you are dealing with an emergency.

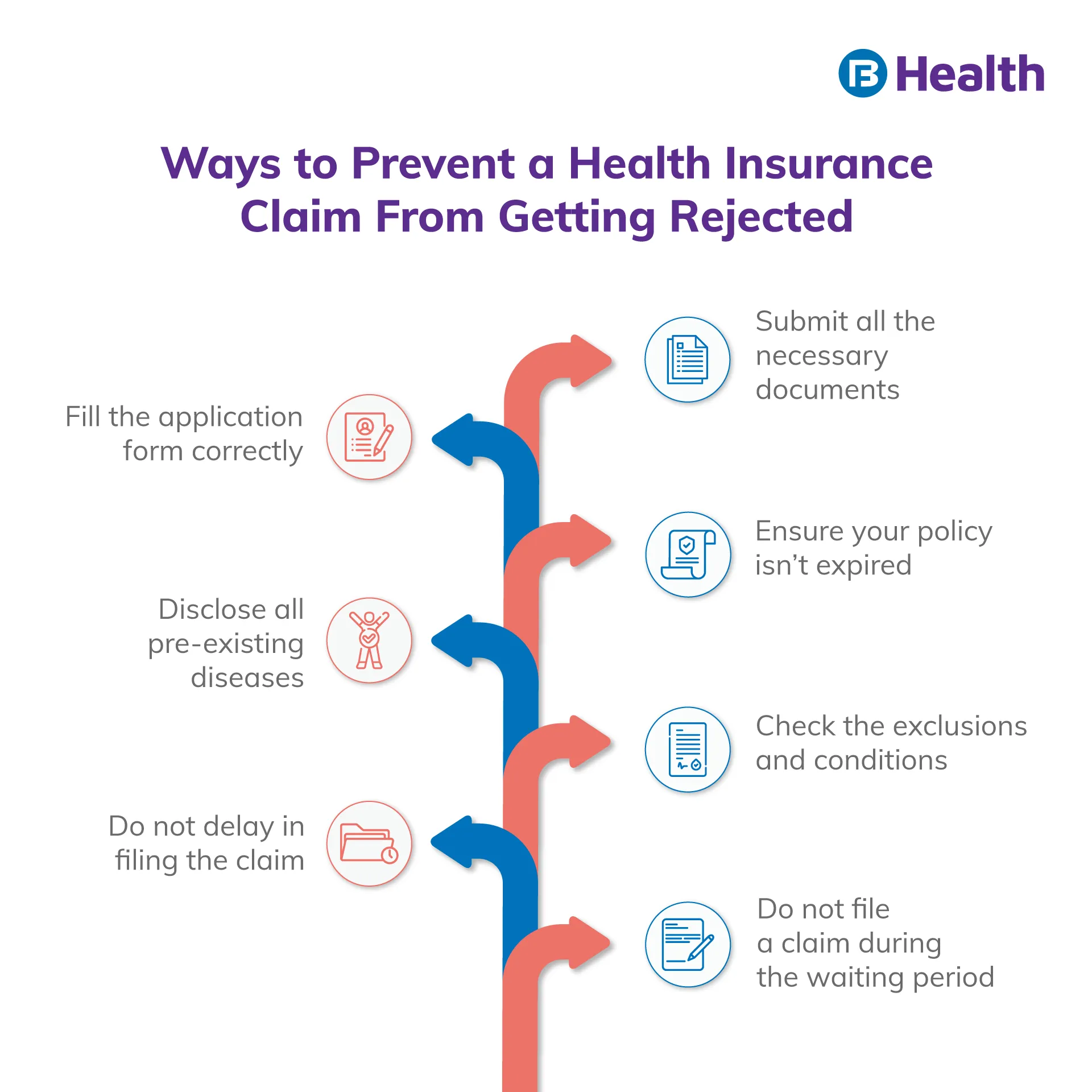

Note that health insurance claims may get rejected for several reasons [1]. The claim may get denied if the claim application is incomplete or incorrect. In such cases, insurers do inform you about the reasons for rejection. Do not lose hope as you can appeal against a claim denial. Read on to know why insurance providers may reject your claim and what you need to do if your claim gets rejected.

Additional Read: How to Making Health Insurance ClaimReasons why health insurers reject claims

Health insurance companies will clearly state the reasons for rejecting your health insurance claim. If not, you can ask for the same. Moreover, health insurers usually reject a policy claim if they find a strong reason to do so. Here are some circumstances under which your claim may get denied.

- In case the duration of the policy has expired

- Some required details are missing in your claim application

- If you have not submitted any necessary supporting document

- If the procedure you went through was not medically required

- If you did not file the claim within the time frame as per the policy

- When the claim is raised for a person not covered under the policy

- If the health condition you raised a claim for is not covered under the policy

What to do when your health insurance claim gets denied or rejected?

Rectify your claim form and apply again

Once your claim gets rejected, do your best to find out the reasons for it. You can read the reason for rejection on the letter the insurer sent to you or communicate with the insurer to know the details. Upon getting to know the reasons, rectify them and reapply after carefully assessing and discussing with your insurer. If there were mistakes while filling the form, you can correct the details and send the necessary supporting documents. Remember that in cases of claim rejection due to ‘claim raised for expired policy’, you will not get any benefits.Collect all necessary documents

For the process of appealing against claim denial, collect all the necessary documents. Check the documents you had sent along with the claim form. See if there is insufficient or incorrect documentation or lack of attestation. If the claim gets rejected for the reason, ‘medical procedure deemed unnecessary’, get a letter from your doctor that states the importance of the treatment. Ask your doctor to send a letter to the insurer explaining why you needed the treatment. You should also request a copy of your claim and policy from the insurer before applying for an appeal. Likewise, you should also gather general documents including:- Copy of the payment receipt

- Medical records

- KYC documents

- Write an appeal letter to the health insurance company

Keep track of the communications and follow-up

Most appeals take days, weeks, or months. Keep checking with your insurer about the status of your appeal. Make sure you have made written communications with the insurer. Keep notes about whom you spoke to, their designation, date, and time of the conversation. When you submit an appeal, the employees of the health insurance company who were not involved in the original decision will have a look.

You can also request an expedited appeal to get the decision within 72 hours. The insurance company will communicate its decision to you. If it accepts the appeal, your medical expenses will get covered. If it stays with its original decision, you can ask for an external appeal. Here, an independent third party who does not work for the health insurance company will evaluate and provide their review.

Approach the ombudsman

If you do not hear from the insurer in 30 days, you can approach the ombudsman with a complaint letter and necessary documents. The ombudsman acts as a mediator to settle the dispute between the insurer and policyholder. The office of the ombudsman verifies the facts and makes a fair judgment. The insurance ombudsman was created by the Government of India to help policyholders [2].

The ombudsman is appointed by the insurer. You can complain against your insurer about the premium dispute, claim settlement delay, terms and conditions violations, and other issues as per the Insurance Act, 1938 [3]. The ombudsman employs an impartial and out-of-court approach. It is the last resort to validate your claim. After that, you may have to take legal help that may sometimes cost you more than your medical bill.

Additional Read: How to Get Medical LoanThe first and foremost responsibility of you as the policyholder should be to consider factors like the claim process and claim settlement ratio of the insurer before buying the policy. Buy a health plan that makes things easy for you and offers financial support when you need it. Consider buying the Complete Health Solution plans offered by Bajaj Finserv Health. They offer a high medical cover of up to Rs.10 lakh for you and your family. Sign up and get started with health and wellness benefits within minutes!

References

- https://www.sbigeneral.in/portal/blog-details/health-insurance-rejection-reasons

- https://www.policyholder.gov.in/ombudsman.aspx

- https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_Layout.aspx?page=PageNo107&flag=1

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.