Aarogya Care | 5 min read

7 Useful Ways to Get Health Insurance Benefit after a Job Loss

Medically reviewed by

Table of Content

Key Takeaways

- Losing your job make it difficult to pay for healthcare expenses

- Group health insurance policies can be ported to individual policies

- Opting for short-term health plans during a job loss can help

Losing your job can be quite a difficult change to adjust to, especially if your parents or children are dependent on you. Unfortunately, due to the pandemic, many people are facing unemployment worldwide [1, 2]. In the second wave of the pandemic, about 1 crore people across India lost their jobs. Such situations can make it difficult to pay for healthcare expenses. However, some companies may continue to provide group health insurance benefits for a specific period even after laying off their employees.

A job loss also means losing out on the coverage provided by the employer’s group health insurance. This makes it quite challenging to maintain existing health policies and pay other bills. Read on to know how you can protect the health of your family with health insurance benefits after losing your job.

Additional Read: Aarogya Care Health Insurance Plans BenefitHow to get health insurance coverage after a job loss?

Port your health insurance to an individual policy

Ask the human resource department of your former company for the procedure to migrate from a group health insurance to an individual health policy. You can port your group health insurance to an individual or a family floater plan with the same insurer, as per portability guidelines set by IRDAI [3].

Health insurance benefits of porting is that you don’t lose on the benefits and credits gained during your previous policy. The waiting period for pre-existing diseases you have completed with the group policy also gets transferred. However, make sure you submit the porting request to the insurer at least 45 days before your existing policy expires. The acceptance of your porting request solely depends on the insurer, who may underwrite a new policy with updated premiums and new terms.

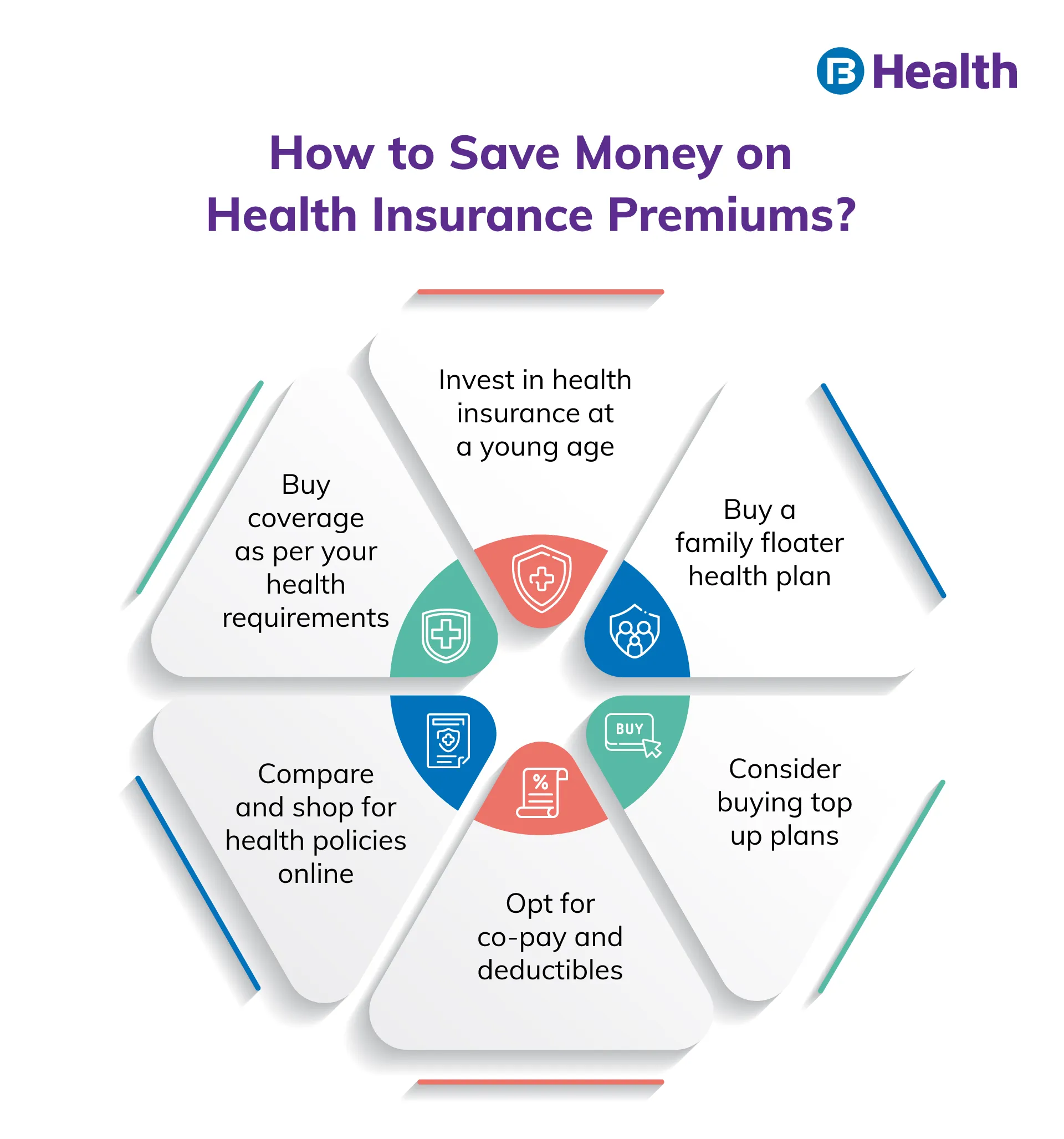

Analyze your budget and buy an affordable policy

Proper financial planning can help you stay afloat. Analyze your budget and look for an insurance plan that you can afford when you do not have a job. Calculate the amount you can pay towards the premiums from your savings. Be sure to pick a policy with affordable premiums to ensure optimal management of funds.

There are many health plans that offer a high coverage amount at a lower premium. Having health insurance protects you against high treatment costs. After you have chalked out your budget, choose the kind of coverage you need. This can be specific such as a pre-existing diseases coverage or critical illness cover.Opt for short-term health insurance plans

Short-term health insurance plans are ideal to fill the temporary gap in health coverage. These plans usually have a duration from 3 months to 1 year. If you have recently lost a job, then these non-renewable plans will help you get the necessary coverage during this difficult phase.

Short-term health plans are cheaper and more affordable than long-term comprehensive health insurance policies. But, note that short-term plans may not provide you extensive benefits like comprehensive plans. Such plans exclude pre-existing diseases cover, maternity benefits, mental health care, and preventive care. COVID-19 health plans are an example of short-term health insurance with a specific objective.

Enroll yourself in a family member’s plan

Your family members can add you to their health insurance policies or you can become one of the beneficiaries in a family floater plan. This way, you can ensure that your healthcare costs are covered at all times, even if you lose a job. Moreover, the premium you pay on an added family member is much lower than buying an individual health insurance policy.

Add yourself to your spouse’s employer’s group policy

If you have a working spouse with an employer’s group health insurance policy, you can get yourself added there as a beneficiary. A group health insurance allows a person to add their spouse, children, or even parents. You can join your spouse’s employer-based health policy and enjoy the health insurance benefits at much lower premiums.

Benefit from a job loss insurance

Job loss insurance policy is an add-on and not a stand-alone insurance policy. You can avail it against your existing comprehensive health insurance or personal accident insurance plan. The job loss insurance pays for the premium of your existing health insurance plan and prevents a lapse. It covers the three largest EMIs due on your policy.

It is usually capped at 50% of your income. Some job loss insurance policies provide monthly payments for 3, 6, or 12 months after your job loss. However, remember that job loss insurance has certain restrictions.

Register for central or state government health insurance schemes

There are several health insurance schemes provided by central and state governments to offer health coverage to certain sections of society. These schemes are designed to provide low-priced health insurance with adequate cover. Such plans are mostly offered on a yearly basis. Browse through the health plans offered by the central or state government and check if you are eligible to apply. Pradhan Mantri Jan Arogya Yojana (PMJAY) is one such scheme that offers insurance cover of Rs.5 lakh to individuals and families [4].

Additional Read: Ayushman Bharat YojanaWhat do you need to do before leaving a job?

Losing a job can be stressful and impact your financial stability. That is why proper planning is crucial during such times to tackle the situation efficiently. This includes taking steps and establishing adequate healthcare coverage. Before your last day at work, check if your employer offers a continuity benefit on the employer’s group insurance policy. This enables you to get covered for a period even after leaving the job.

If this isn’t possible, check with your employer if the group policy can be converted to an individual health plan. Before you opt for porting, compare the existing and new health policies. Make your decision accordingly as there will be some changes.

Having an extensive health cover is a must to protect you from medical costs during unforeseen events. To make healthcare more accessible during emergencies, Bajaj Finserv Health offers Complete Health Solution plans. These affordable health plans provide coverage of up to Rs.10 lakh without a medical check-up requirement. Ensure you provide all-around health cover to your family including yourself with preventive health check-ups, doctor consultation reimbursements, and lab test benefits with these plans.

References

- https://www.oecd.org/employment/covid-19.htm

- https://prsindia.org/theprsblog/impact-of-covid-19-on-unemployment-in-urban-areas

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/Regulations/Consolidated/CONSOLIDATED%20HEALTH%20INSURANCE%20REGULATIONS%202016%20WITH%20AMENDMENTS.pdf

- https://pmjay.gov.in/about/pmjay

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.