Aarogya Care | 5 min read

A Guide on How to Save Tax with Health Insurance Under Section 80D

Medically reviewed by

- Table of Content

Key Takeaways

- Over 80% of people in India do not have a health insurance cover

- Claim tax deductions up to Rs. 5,0000 for preventive care check-ups

- The tax deduction limit for senior citizens is Rs. 50,000 u/s 80D of IT Act

Today, health insurance is an essential tool for any individual. It protects you financially when you face medical emergencies or require expensive treatment. However, findings of the National Sample Survey reported that over 80% of people in India do not have any type of health cover [1].

Medical insurance not only safeguards your health but also helps you save money. What’s more, you can use it as a tax-saving instrument as well. The Government of India encourages people to buy health insurance by allowing tax deductions under Section 80D of the Income Tax Act of 1961. Read on to know how you can save tax with health insurance u/s 80D.

Additional Read: Section 80D of Income Tax ActWhat is Section 80D?

Section 80D of the income tax Act offers tax deductions on premiums paid for medical insurance in a financial year. It includes a premium towards health insurance for self, spouse, dependent children, and parents. The tax deduction benefit under this section is also available for premiums paid on top-up and critical illness plans along with the regular insurance premiums. This act provides deductions over and above the exemptions included in Section 80C of the Income Tax Act.

Who Can Avail Tax Deduction Under Section 80D?

An individual or Hindu Undivided Families (HUF) taxpayers can avail deductions on health insurance premiums paid for:

- Self

- Spouse

- Dependent children

- Parents

Which Payments or Expenses Are Deductible Under Section 80D?

An individual and HUF can claim tax deduction under this act for the following payments:

- Health insurance premiums paid for self, spouse, children, and dependent parents

- Expenditure made on preventive health checkups

- Medical expenses incurred for a senior citizen who is not included in any health insurance plan

- Contributions made to central government health schemes or any other government schemes

What Is the Deduction Limit Available Under Section 80D?

- Deductions u/s 80D

The tax deduction limit for individuals and HUF under this act is up to Rs. 25,000 per financial year. The deduction limit in the case of senior citizens is Rs. 50,000 [3]. The said limits apply to premiums paid for health insurance of self, spouse, children, and dependent parents. The deduction limit on health insurance premiums are as follows:

- If premiums are paid for individuals and parents below 60 years of age, both get the claim benefit of Rs. 25,000 each. Thus, the total deduction under this act is Rs. 50,000

- If an individual and family are below the age of 60 but parents are senior citizens, then the individual gets a tax benefit of Rs. 25,000 and Rs. 50,000 for parents. Thus, the total tax deduction will be a maximum of Rs. 75,000

- If an individual, family, and parents are all above 60 years of age, then both will get a tax benefit of Rs. 50,000 each. So, the maximum tax deduction limit will be Rs. 1,00,000

- In the case of a non-resident individual, individuals and parents get a tax benefit of up to Rs. 25,000. The maximum tax exemption u/s 80D is Rs. 25,000

- For members of the Hindu Undivided Family (HUF), the premium paid for individuals and parents has a tax deduction limit of Rs. 25,000. The maximum deduction in the case of HUF is Rs. 25,000.

- Deduction on preventive health checkups u/s 80D

- Deductions for super senior citizens u/s 80DAs per this act of the Income Tax Act, super senior citizens above the age of 80 years, who do not have any health insurance can claim a deduction. They can claim a deduction of up to Rs. 50,000 on medical checkups and treatment expenses every year. However, the section does not include their personal expenses.

Things to Consider While Buying Health Insurance for Claiming a Tax Deduction

There are certain things you need to note while buying health insurance, which are:

- Premiums on health insurance paid for siblings, aunts, uncles, grandparents, and other relatives do not qualify for tax deduction under section 80D.

- You cannot avail tax benefit on premium paid on behalf of working children

- If you and your parent have made a part payment, both are eligible to claim a deduction to the extent of the amount paid.

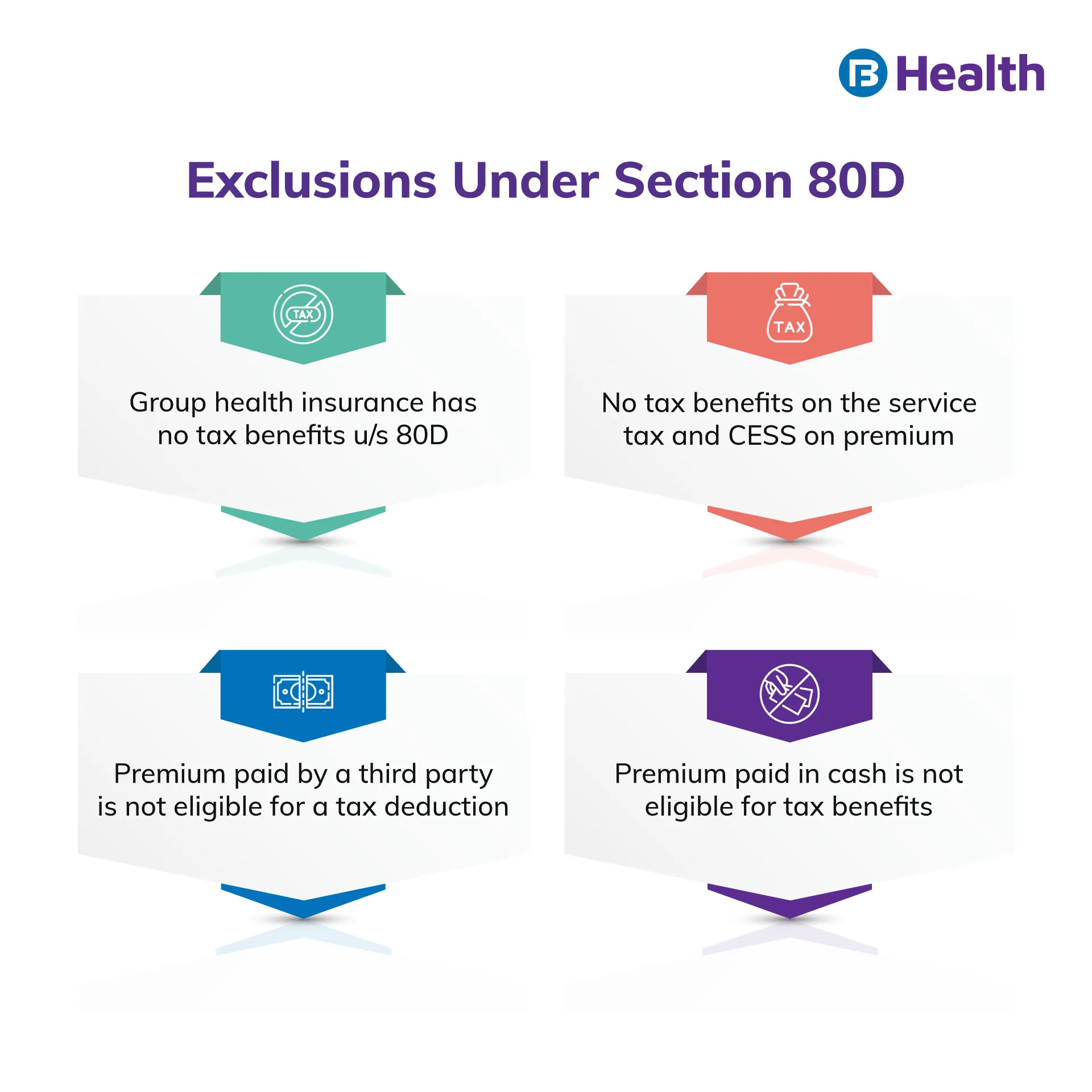

- Premiums paid on employer’s group health insurance cannot be claimed for a tax deduction.

- The tax deduction will have to be taken without showing service tax and CESS from the premium amount.

- Your premiums will not be eligible for tax deductions if you make the payments with cash. Only premiums paid online or digital modes of payment such as debit/credit card or net banking are considered.

The right health insurance policy reduces stress and gives a sense of protection. For this, you need to carefully choose a policy that meets the health needs of you and your family. Consider buying the Complete Health Solution plans offered by Bajaj Finserv Health. These plans offer you a medical cover of up to Rs. 10 lakh. With benefits like preventive health checkups, network discounts, and reimbursements on doctor consultations, these plans provide wide coverage to your family. Sign up now to start investing and save your taxes!

- References

- https://www.downtoearth.org.in/news/health/over-80-indians-not-covered-under-health-insurance-nsso-survey-72394

- https://cleartax.in/s/medical-insurance

- https://tax2win.in/guide/section-80d-deduction-medical-insurance-preventive-check-up

- Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.