Aarogya Care | 5 min read

How to Understand a Summary of Benefits and Coverage in Health Insurance?

Medically reviewed by

Table of Content

Key Takeaways

- An SBC document explains the features and benefits of your health plan

- The header section provides information such as your coverage period

- The exclusion section mentions services that you cannot make claims for

A Summary of Benefits and Coverage (SBC) is a document for buyers or policyholders that clearly explains the coverage of a health insurance plan. With its help, you can understand terms and conditions of the policy easily.

In simple words, the SBC summarizes the cost-sharing structure of your plan. With the help of this document, you can compare different plans with ease by taking a look at the benefits and coverage. With it, you can also compare the costs of different health insurance policies [1].

The (Summary of Benefits and Coverage) SBC document serves as a guide and a quick snapshot of your insurance policy. If you have this document, you need not check any legal documents of the insurance provider. Read on to know more about the SBC and how simple it is to read and understand.

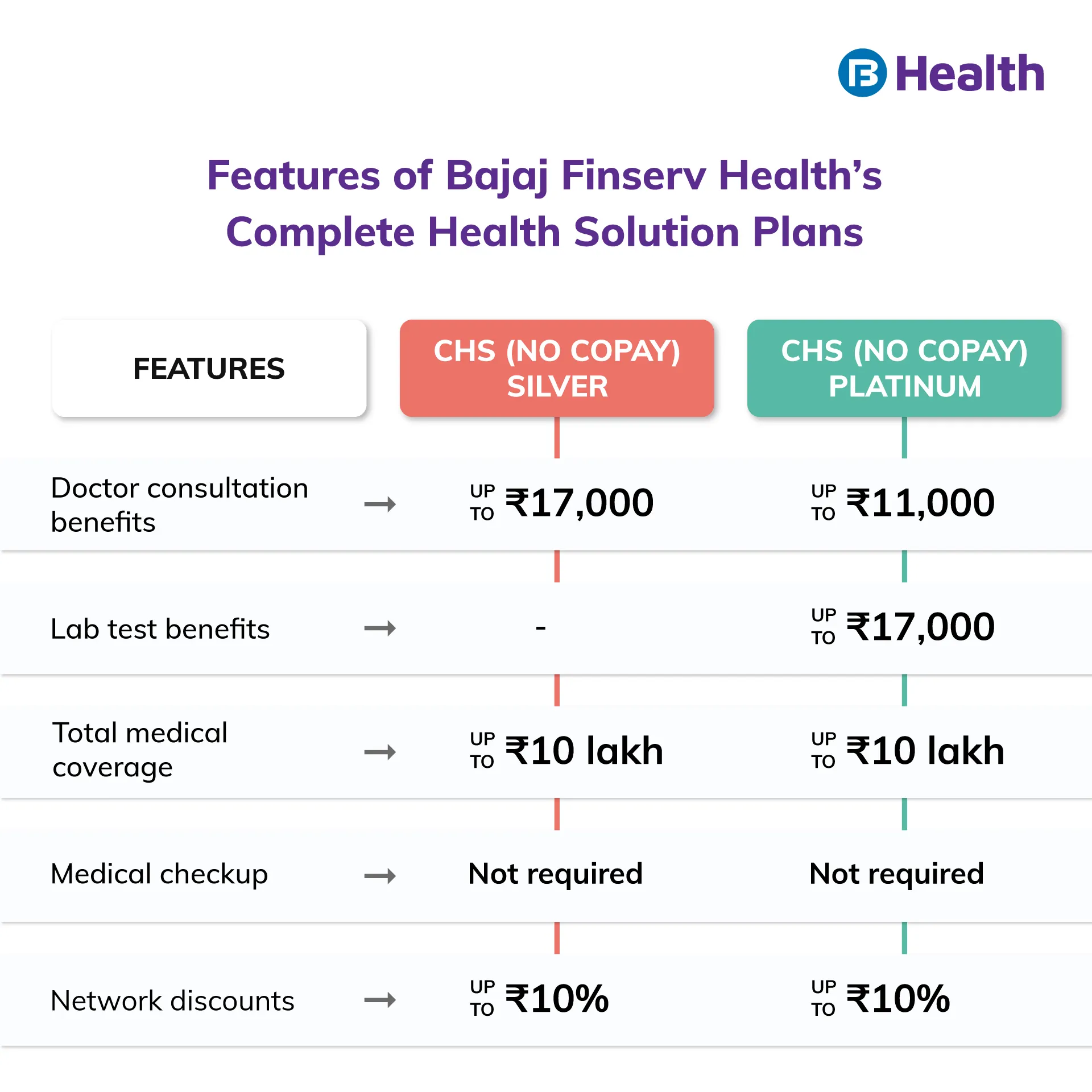

Additional read: Complete Health Solution PlansUnderstand what is mentioned in the header

As you open an (SBC) Summary of Benefits and Coverage document, the first thing to note is the header. It is the header that mentions important information such as:

- Name of your health insurance plan

- Coverage period of your plan

- Name of the insurance provider

- Type of the plan

- Who is the coverage for?

It is important to check the header section to ensure your plan is right for you. Note the starting and end date of the plan. Check if the coverage is specific for an individual or for a family as the costs differ in both cases. It is important to understand the coverage period of your plan as you get an idea how long its benefits last for. On this basis, you can decide if you want to avail this particular plan or not [2].

Check out some important questions to have a thorough knowledge of your plan

The next important section is where you get an actual idea about the plan. Some of the common information mentioned in this section covers topics like:

- Structure of the plan

- Deductibles

- What will happen if your bill amount does not meet the deductible?

- List of hospitals covered in insurer’s network list

Know about the common medical events table

This is another vital section one that you should go through properly. This table displays the expenses you may incur for various medical procedures. It also mentions the costs included for lab tests and doctor visits. How much you need to pay for all these events is clearly specified in this table. This section also gives you an idea of the costs incurred if you seek treatment at a hospital outside of the network list.

One of the most important parts of this table is the limitations and exceptions column. This column specifies what services you need to pay for and if there are any exceptions to the cover. In case you are visiting a specialist, the charges will be different. If there is an imaging test that is needed, the table specifies how much of its cost will be covered in the plan.

Learn about exclusions and consumer protection rights

This section gives an overview of the exclusions in your plan. While the Summary of Benefits and Coverage may not give a detailed list of all exclusions, some of the most important ones are covered. To get a comprehensive list, you may need to read the whole document. Some of the common exclusions include:

- Infertility treatment

- Cosmetic surgery

- Acupuncture

- Dental services

- Optical services

- Weight loss programs

Consumer protection rights are also mentioned in paragraphs here. These are important as they give you detailed information about the rights you hold as the insured. This section also explains how you can file a complaint in case of any grievance. While these rights are not important when choosing a health plan, knowing about them can help you in the future.

Clear your doubts by reading the coverage examples

To help you understand the structure of the plan properly, the SBC mentions a few examples. These scenarios explain how a specific treatment is covered in your plan. After going through them, you can get an idea about the different aspects of this insurance plan. In case you are investing in a health insurance policy for the first time, this section also helps you to generate your own estimate of medical expenses. Do remember that examples provided in this section are hypothetical and may differ from your actual expenses.

Additional read: Health Insurance Policy For FamilyNow you know how an SBC document gives a clear picture of the features and can help you make the right decision. In your search for the perfect health plan, browse through the range of Aarogya Care plans on Bajaj Finserv Health. One of the most affordable solutions is to invest in a Complete Health Solution plan. There are so many health insurances available in the market Ayushman health account is one of them provided by the government.

This is one of the most comprehensive plans with distinctive features such as medical insurance coverage up to Rs.10 lakh, amazing network discounts at hospitals, reimbursements on doctor consultations and preventive health checkup benefits. Availing this plan is so simple that the entire process can be completed in under 2 minutes. You need not worry about medical tests as well as they include a package of 45+ preventive lab tests. Answer two basic questions and you are good to go!

References

- https://marketplace.cms.gov/technical-assistance-resources/summary-of-benefits-fast-facts.pdf

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/RTI_FAQ/FAQ_RTI_HEALTH_DEPT.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.