Aarogya Care | 5 min read

A Quick Guide to Why the Right Child Health Insurance Plan Matters

Medically reviewed by

Table of Content

Key Takeaways

- Child health insurance plans cover medical and peripheral costs

- Individual health insurance for kids covers various health expenses

- Insurance plans for family cover the entire family with lower premiums

As a parent, you prioritize your child’s health and happiness. As they grow up, you also try to make sure your kids have all the support you can offer. That’s why children health insurance plans are wise investments. They take care of your child’s health by providing a financial cover. You can also avail tax benefits under section 80D of the Income Tax Act of 1961 when you buy these plans [1].

When getting child health insurance plan, you can choose from different options with a variety of features. Select the most appropriate one based on the sum insured and premium you are comfortable with. Health insurance for kids can either be individual child health insurance plans or part of insurance plans for family. Read on to learn more with this simple and quick guide to children’s health insurance.

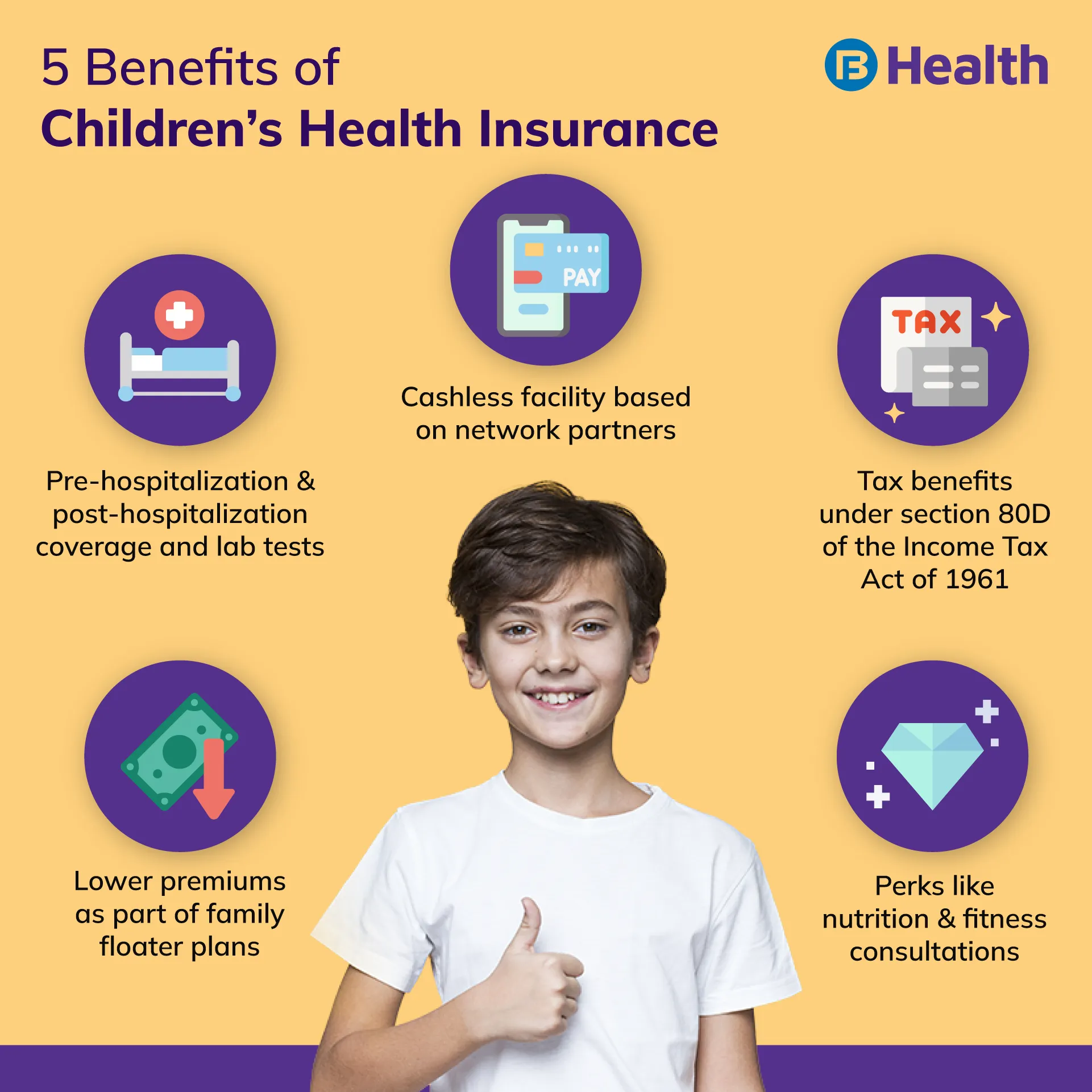

Benefits of having health insurance for kids

Child health insurance plans provide for costs related to healthcare services for children. They cover a wide range of illnesses and expenses. Some benefits of signing up for a children health insurance plan include the following.

- Pay less premiums: As risks associated with the insured are low, you can save big on premiums.

- Get added perks: With these plans, you can get benefits like cashless hospitalization and more.

- Avail No Claims Bonus: Many policies offer this bonus, which you can get in case there is no claim made during the policy period. This helps you get more coverage for your child in the future at lower premiums.

In addition, you can get other perks such as nutrition, diet, and fitness consultations with experts and trainers. Diagnostic tests, consultations with doctors, purchase of medicines and medical equipment are also covered. Thus, you can ensure your child stays fit and healthy.

Additional Read: A Guide to Nutrition Therapy and its Health Benefits

Important factors to consider when purchasing kids’ insurance

While picking the right child health insurance plan, here are the things you can keep in mind.

- Healthcare and peripheral expense coverage: Check the level of coverage provided, and whether or not it includes pre- and post-hospitalization coverage, OPD treatment, lab service expenses, ambulance expenses, and more. Make sure that features important to you are included in the plan.

- Age: Consider the age range for which the child is eligible to receive coverage. This is true especially for a pre-existing family floater plan.

- Renewal policy: Some policies may only cover children up to a particular age. However, there are some insurance plans for kids that provide the option for lifetime renewal. So, check this beforehand.

Health insurance for child only vs coverage for kids in insurance plans for family.

- Individual plans for kids: These are insurance plan designed specifically to cover a child’s healthcare needs. In such cases, the entire sum insured goes towards the child. Coverage often includes pre-hospitalization and post-hospitalization costs, lab services and emergency ambulance services. Many policies also offer cashless treatment, which is a useful benefit in case of emergencies.

- Family floater plans: These are comprehensive plans that cover the entire family with a lower premium when compared to individual plans for each member. You can use the sum insured for any member of the family, and children can be added to such plans too. In fact, some policies provide the benefit of lower premiums if you add a younger family member to the plan.

A guide to health insurance for newborn baby

Health insurance for newborns is usually covered as part of a family floater plan or as an add-on extension of mother’s coverage. The particulars may vary based on the provider and the specific maternity health insurance policy you have chosen.

Remember, individual plans that provide health insurance for children do not provide coverage from birth. In most cases, babies can be added to the family plan once they turn 90 days old, and they are then equally eligible to use the sum insured. To get your newborn covered from birth, you can look into special maternity plans. They provide newborn-related expenses like vaccinations in addition to the mother's health expenses during pregnancy. [2]

As you can see, it is important to avail health insurance for your kids. To know your options, explore Aarogya Care health plans on Bajaj Finserv Health. Browse the Complete Health Solution plans to see how you can add up to 2 children to a family floater policy. You can avail refunds on doctor consultations, get cover of up to Rs.10 lakh and more, get tests worth Rs.17,000, enjoy free preventive check-ups and network discounts too.

References

- https://www.researchgate.net/profile/K-Saravanan-6/publication/330933150_Tax_Saving_Scheme_and_Tax_Saving_Instruments_of_Income_Tax_in_India_AY_2017-18_2018-19/links/5c5c2697299bf1d14cb30a7f/Tax-Saving-Scheme-and-Tax-Saving-Instruments-of-Income-Tax-in-India-AY-2017-18-2018-19.pdf

- https://d1wqtxts1xzle7.cloudfront.net/62619219/6576-Article_Text-12214-1-10-2020022220200331-2953-161wpa9-with-cover-page-v2.pdf?Expires=1636362486&Signature=AteVWjgcL4DNr0Yr8wonW2vM3hIEyKXiDIvHAzEtuVyJjZDGpCpmtsuPC1De5j08NrNoWVh5DvPQfAZHV-3ccso4k21zdCCIhKl4APfDfXOZF~ehSW5Zx95txMVjKVFcSRilk44uwO18zBN~X-AllrCCnPTz8YKxPUI5v4vs078jq5YBSO7dzKtu-fG-8reKu-J5A6e8RrUspQyT7YICvp38vfyhJrmepW20GiA-8WsxJhcYBh8LkD3To2ynkoo1ZNMFju1OxUYQtgK7I3h7e4vrL03dPyxziQh0zxYIOISxwOh0YfRGcG8aivRhh6ieU1~nkwRSh3Ox9UMwshBfNw__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.