Aarogya Care | 6 min read

Cooling-off Period in Health Insurance: 4 Top Questions

Medically reviewed by

Table of Content

Synopsis

Cooling-off period in health insurance is the duration that patients get to be fully fit after healing from certain illnesses before buying cover. Know more about cooling period in health insurance.

Key Takeaways

- Cooling-off period only applies if an applicant is yet to recover from illness

- Cooling period in health insurance is not the same as the waiting period

- Health insurance cooling-off period usually lasts between 1 week and 3 months

Ever heard the term cooling-off period when it comes to health insurance? This common term became more widely used during the pandemic when droves of people wanted to buy health insurance to protect themselves. While the cooling-off period has different connotations in this domain, there’s one primary meaning.

The cooling-off period is the length of time given to applicants of a health policy to be fully fit post their recovery from certain illnesses. During this phase, insurers do not approve new health insurance plans. So, if you apply for a health policy during the health insurance cooling-off period, the processing is on hold. Once you become fit, you can get your application processed.

It is important to note that the health insurance cooling-off period can vary between 7-90 days. It is best to know the policies of your chosen insurance company and understand the precise timeline. To get answers to the top 4 questions about the cooling period in health insurance, read on.

What makes the cooling period in health insurance so important?

When an individual who is yet to completely recover from a medical condition applies for a health insurance policy, the insurer underwrites the insurance, considering the risks involved. If documents show the applicant is suffering from a condition and will need a few more days to get well, the insurer may apply the cooling-off period. They will eventually approve the policy once the health insurance cooling-off period is over and the applicant has completely recovered.

The term ‘cooling-off period’ recently rose to prominence with the emergence of COVID-19. As the aftereffects of the disease are largely uncertain, underwriting new health policies for COVID-19 was quite challenging. There have been situations where patients suffered from post-COVID symptoms such as kidney issues, heart conditions, and stroke for a long time. Under such circumstances, the health insurance cooling-off period acted as a breather to allow these signs to gradually fade. As a result, when you get the new health insurance, the symptoms of the previous illness will not be marked as pre-existing illnesses. Keep in mind that the premiums for those with such conditions are usually higher.

Additional Read: Long Term vs. Short Term Health Insurance

How does a health insurance cooling-off period work?

A health insurance cooling-off period is decided by the insurer once they check a potential policyholder’s current and recent health. This could be via health reports for up to 1 year in the most recent past as well as a medical check-up when you apply for a plan. If it is found that you have a current illness, you will be asked to recover before the policy is approved.

During this phase, you should take proper care of your health and furnish a negative report to the insurer to ensure that you are no longer suffering from your last ailment. After carefully studying the health documents, the insurer will let you know whether it will approve the policy right away or postpone it further with an extended health insurance cooling-off period. However, remember that this cooling period in health insurance doesn’t impact your insurance premiums.What are the differences between the cooling-off period and the waiting period?

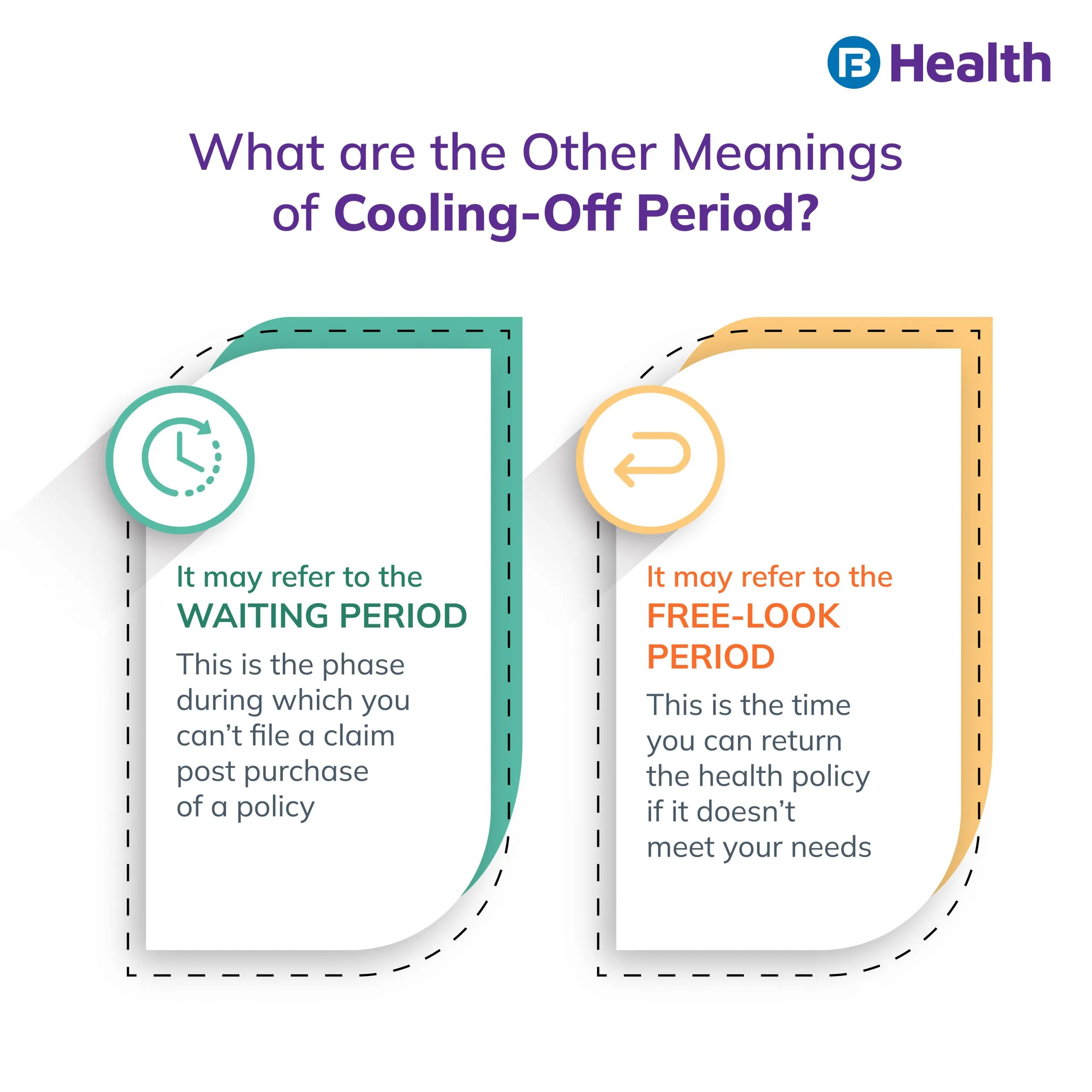

Though they may sound similar, it is important not to confuse the health insurance cooling-off period and the waiting period. Both of them are completely different when it comes to their definition and utility. A cooling-off period is the duration of a certain time after your latest illness, during which your health insurance application is not accepted. This makes it clear that a health insurance cooling-off period is a defined timeline before you buy a health insurance plan post an illness.

The waiting period signifies a phase with a duration between 15 to 60 days after purchasing a health policy when the insured cannot make any claims. So, it comes into play only after you buy the policy and have become a policyholder.

Additional Read: Network Discount in Aarogya Care

Was the cooling-off period decreased during the 3rd wave of COVID-19?

At first, it had become extremely difficult to get approval for a health insurance policy after suffering from COVID-19. This is because post-COVID complications were appearing and disappearing in incoherent patterns. In most cases, the health insurance cooling-off period was set at very lengthy durations. For some insurers, the cooling-off period stretched to six months! With time, people were more careful about following restrictions and other health measures to keep themselves safe. With more people wanting to secure their health, the medical insurance industry in India saw a 30% increase in demand during the third wave of COVID-19[1]. With vaccinations, more information on coronavirus, and IRDAI guidelines to help people in need, the duration of health insurance cooling-off period for COVID patients also decreased.

First, it was slowly decreased to 1 month. Now most insurers follow a cooling-off period of 7-15 days for all new applications. This reduction in the cooling period in health insurance for COVID-19 has made buying a health policy a lot more stress-free. It also enables you to access coverage sooner.

While you may wonder if you could simply ignore the cooling-off period, it is not possible to do so. A health insurance cooling-off period is set by the insurer and needs to be followed so that any future claims you make aren’t disputed. The best way to tackle this issue is to buy a health insurance policy not as a reaction to an illness but while you are enjoying good health. This way, you do not need to worry about coverage when you fall ill all of a sudden. To select one of the best health insurance policies, check out the Aarogya Care plans available on the Bajaj Finserv Health website and app.

By subscribing to these plans, you can avail exciting benefits for wholesome health apart from the comprehensive health cover of up to Rs.10 lakh. For example, with the Complete Health Solution plan, one of the Health Protect Plans available on the platform, you can insure yourself or cover two adults and four children altogether. While you and your family members enjoy health coverage for COVID-19, pre-and post-hospitalization, unlimited teleconsultations, road ambulance coverage, and more, you also get network discounts on medical services. What’s more, you get lab test discounts and reimbursements on in-person doctor visits, as well as a free health check-up package. Combine this with a health card also on offer to either split all your medical bills into EMIs or get added discounts from partner medical institutions. All this helps you save on costs while giving your health your care and attention!

References

- https://www.businesstoday.in/latest/trends/story/health-insurance-policies-see-growing-demand-as-covid-19-cases-surge-319771-2022-01-20

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.