Aarogya Care | 5 min read

Health Insurance Discounts: Know About the 5 Types to Avail

Medically reviewed by

- Table of Content

Synopsis

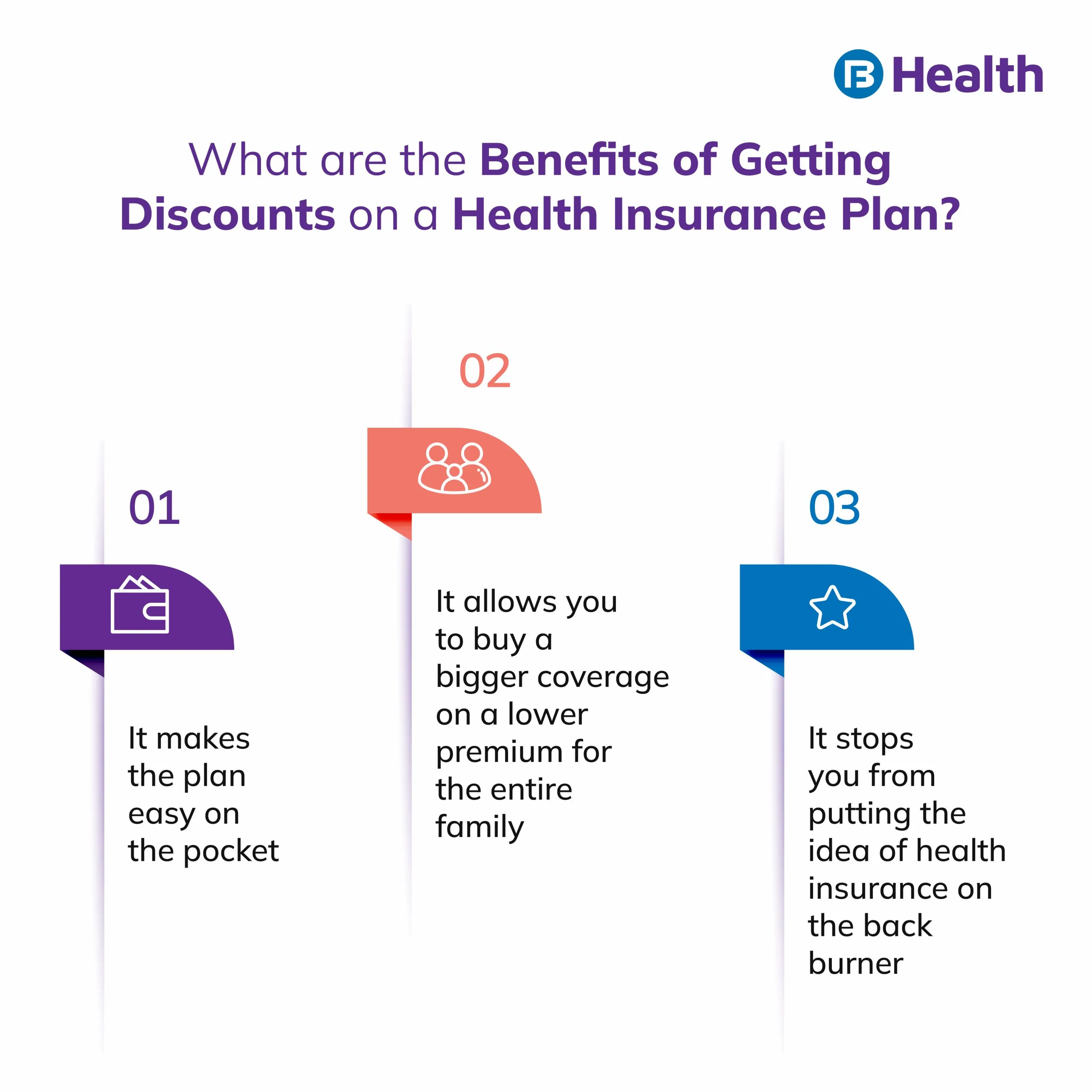

Health insurance discounts offer more cover at a lower cost and like other policies that offer a discount, health insurance markdowns also exist. Know of the types of health discounts plans here.

Key Takeaways

- A medical insurance plan and a life insurance policy are a must-have

- Health insurance discounts incentivize purchase of polices

- There are five common types of health discount plans

According to NITI Aayog, nearly 30% of the Indian population does not have a health insurance plan [1]. Lack of awareness and high costs of most comprehensive insurance policies are considered to be the primary reasons why people usually avoid buying health plans. Health insurance discounts play a crucial role here and encourage someone who is planning to buy an insurance plan to complete the purchase.

The rising medical inflation rate, which has gone up to 14%, is also driving up healthcare costs. This makes it nearly impossible for all strata of individuals in India to spend on extravagant medical bills [2]. Here, health insurance plays a significant role, and health insurance discounts act as motivating factors to encourage adoption. You, too, can make the most of such markdowns. Remember that in order to get a discount, health insurance premiums need to be paid by you on time and without failure. Read on for more on health insurance discounts.

Additional Read: Health Insurance Claim With Steps

Additional Read: Health Insurance Claim With Steps Health Insurance Discounts Available on Health Plans

Today, different types of health discount plans are available in the market that promotes ease of purchase. They allow you to better plan health insurance for yourself and your entire family. Here are the top 5 types of health insurance discounts you can avail of.1. Health insurance discounts on policy tenor

Some health insurance policies come with heavy premium discounts, which are normally proportionate to the overall policy tenor. This means if you purchase a policy for a tenor of 2 years or more and pay the premium upfront, you can gain an instant discount on the entire premium amount. This discount can be in the range of 5% to 20% and will help you save a lump sum on the premium. Usually, the discount will not be applicable on a tenor of one year, as the time period is insufficient for a concession from the insurer’s side.

2. Bag family discount to save more

Another prevalent type of health discounts plan is the family discount. This discount is applicable to your policy, provided you get health insurance for your entire family. The higher the number of family members included in the policy, the higher will be your discount on the premium. However, each family member will be treated as a unique entry only once, and next year when you renew the policy including the same member, you will not get an additional discount.

3. Get a discount as a woman policyholder

In order to encourage women to buy health insurance plans, most insurance companies offer special discounts to them. As part of health insurance discounts, a woman can bag up to 5% to 10% off on their policy purchase. However, the actual amount of discount and other offer terms vary across insurance companies.

4. Get health insurance discounts for being healthy.

Health insurance companies promote good health, and thus, in order to reward you for being healthy, they offer discounts on the premium rates. In many cases, the discount is not available on the very first instance when you buy the policy but is added to your premium when you renew it the next year. Here, you need to offer a health report during renewal that will show your year-long progress and showcase how you have maintained your health throughout the year.

5. Avail health insurance discounts from network hospitals or partners

Many insurance providers do not allow you to claim a discount on your insurance purchase but offer you discounts along the way. One such discount is the one you can receive against your hospital visits and health check-ups, provided you go to one of the network hospitals of your insurer. These are known as network discounts.

Additional Read: Need of Health InsuranceApart from these five types of health discount plans, you can avail of other discounts depending on the health plan you choose or the insurance company you choose to invest with. This includes the No Claims Bonus, which offers you a discount on your health plan premium provided you did not utilize any cover during the previous term. You can also benefit from this by choosing to increase your cover and paying the same premium amount instead of getting a health insurance discount on the premium.

To get the most benefits, you can avail of medical insurance under Aarogya Care on Bajaj Finserv Health. Here you can get access to 360-degree health care plans that allow you to shield yourself and your family from future health expenses. Equipped with an Aarogya Care health plan, you can access a number of preventive health check-ups and doctor consultations, get discounted healthcare facilities, and much more.

Apart from this, you can sign up for a health card on the Bajaj Finserv Health app or website to get discounts on lab tests and doctor visits from specific partners. Apart from getting medical insurance, make sure you buy a life insurance policy to offer an extra layer of protection to you and your family. With the right steps to secure your health and life, you can walk towards a merrier future!

- References

- https://www.niti.gov.in/sites/default/files/2021-10/HealthInsurance-forIndiasMissingMiddle_28-10-2021.pdf

- https://www.mordorintelligence.com/industry-reports/india-health-and-medical-insurance-market

- Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.