Aarogya Care | 9 min read

Health Insurance for Cancer: Benefits, Importance, Inclusions and Exclusions

Medically reviewed by

Table of Content

Synopsis

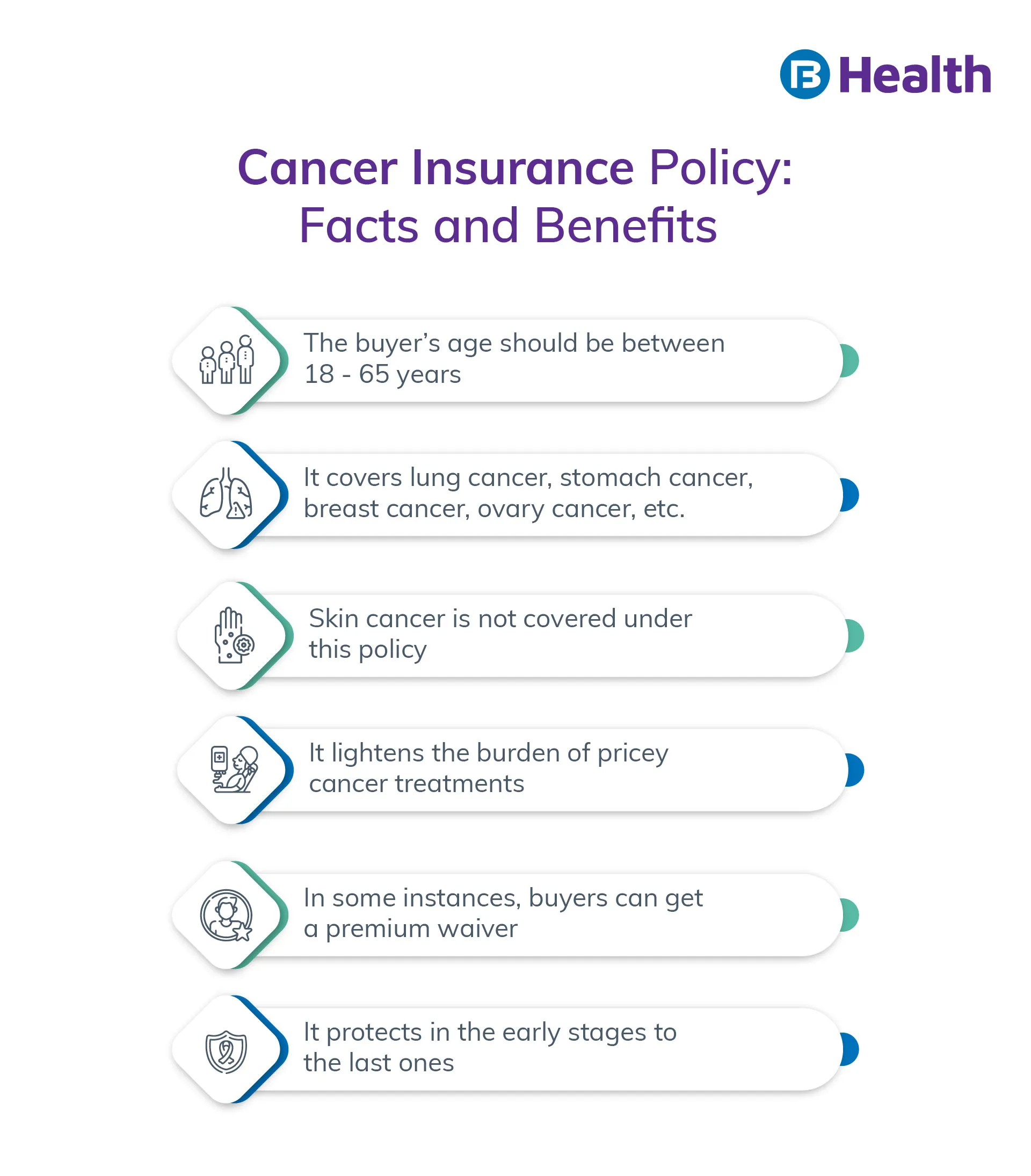

Cancer is a dreaded disease and costly to manage through the various stages of the long-term treatment process. The solution is to choose health insurance for cancer rather than the critical illness rider for its extensive cancer-related coverage. Consider seven critical factors to choose the ideal cancer insurance policy.

Key Takeaways

- Though the incidence of cancer is on the rise, early detection and treatment ensure complete patient survival

- Specialist health insurance for cancer can provide the necessary financial support during treatment and rehabilitation

- Choose the ideal insurance policy wisely, considering all the pros and cons

Cancer is a dreaded disease and one of the leading causes of death globally. According to WHO, the menace accounted for 10 million deaths in 2020 [1]. The death count in India alone was 7.84 Lac in 2018, and the reported cases were 13.92 Lac in 2020. Moreover, the cost of cancer management is prohibitive due to several factors. So, good health insurance for cancer is a great help to mitigate the financial woes of patients and their families. But before learning about the insurance plans, let us check what cancer is.

Understanding Cancer

Replacing old cells in the human body is a natural physiological phenomenon. But an uncontrolled growth of cells forming a tumor is the precursor to cancer, depending on whether it is benign or malignant. While the former confines to the place of its occurrence, the latter spreads to other body parts destroying normal cells. The reasons for the onset of cancer are varied – primarily genetic, environmental, and the individual’s specific constitutional characteristics.

Unfortunately, a cancer diagnosis drains the individual and the family emotionally and financially. Consequently, the individual suffering from cancer ends up spending life savings due to the high treatment cost and the criticality of the disease. Thus, a suitable cancer insurance plan is essential to absorb the rising treatment costs, especially the poor and middle-class patients. So, let us check out the options of health insurance for cancer.

What is Cancer Insurance?

A cancer policy manages health risks related to cancer. It is the financial safety net helping the afflicted face challenges of costly treatment while keeping the finances safe. Most Indian insurers offer health Insurance covering cancer treatment, but it is essential to analyze the inclusions to match your requirements.

Moreover, basic health insurance plans do not cover cancer treatment costs. Thus, you bear the costs of hospitalization for surgery, radiation therapy, chemotherapy, and rehabilitation. Whereas choosing a cancer policy for its specific coverage is sensible. So, let us first check the available types.

1. Mediclaim Plans

It is an uncomplicated health insurance plan confined to reimbursement of hospitalization costs to the policyholder. So, medical insurance coverage is the weakest among all the health insurance policies available in the Indian insurance sector.

2. Critical Illness Insurance

Most insurers offer many riders with their health insurance plans for enhanced coverage. Critical illness rider is one such that covers specific listed diseases, including cancer. So, the policyholder gets a lump sum amount on diagnosis of cancer, and the coverage terminates.

3. Standalone Cancer Insurance

Health insurance for cancer is an exclusive policy providing coverage for treatment of minor and major stages of the disease. Thus, the cancer-specific policy covers various costs, including diagnosis, hospital treatment, radiation, chemotherapy, surgery, etc. So it is prudent to purchase the cancer-specific complete health solution for the extensive coverage to meet challenges, which no other health insurance delivers.Critical Illness Insurance or Cancer Policy

The significance of purchasing health insurance is beyond question in the ever-rising medical costs and access to super-specialty hospitals. But cancer insurance is all the more critical because cancer needs prolonged treatment and care to survive the disease.

Most health insurance does not cover the impact of cancer. Thus, your choice is limited to two – critical illness cover and a cancer insurance plan. So, let us study threadbare and choose which is best.

Critical Illness Insurance

Critical illness is an add-on cover with the standard health insurance. The coverage extends to several acute illnesses, including cancer. Yet, policyholders with preexisting cancer lose insurance coverage, not only for the disease but also for complications arising from it. Moreover, insurance coverage depends on waiting periods. However, a survival clause applies even after the waiting period, and the scope triggers when the cancer is at an advanced stage, impacting the survival rate.

Cancer Insurance Plan

While the critical illness rider fails to meet the specific needs of cancer patients, a standalone cancer policy matches the distinctive requirements. The cancer survival rate has increased considerably with early screening, diagnosis, and advanced therapies. Thus, the cancer insurance plan covers the treatment costs of early and advanced stages of cancer.

Cancer Insurance Plan Importance

Cancer insurance is essential because it triggers a cascading effect on the patient and the family physically, emotionally, and financially. Moreover, the following downsides are the clincher for choosing the specialist cancer insurance policy.

- The coverage does not include complications arising from cancer.

- Cancer symptoms manifesting during the waiting period terminate the insurance policy.

- Critical illness coverage for cancer excludes the early stage of the disease to comply with the survival period clause. Thus, it effectively negates the cancer patient’s chances of survival.

The above conditions compel purchasing exclusive health insurance for cancer, especially for the vulnerable. Thus, the following individuals must consider a cancer insurance plan a safeguard.

- Individuals with a family history of cancer

- If the individual’s lifestyle and environment enhance the risk of developing cancer

- If the individual’s savings are not enough to bear the exorbitant costs of cancer treatment

- If the general health insurance coverage is inadequate

- If the individual is the only earning member of the family

Thus, make an informed choice of purchasing a cancer insurance policy that covers treatment of the following indicative cancers most prevalent in India. Moreover, the coverage extends to both the early and advanced cancer stages.

- Lung cancer

- Breast cancer

- Ovarian cancer

- Prostate cancer

- Stomach cancer

- Hypo-larynx cancer

Additional read: Health Insurance Review Importance

Health Insurance for Cancer Benefits

A specialist cancer insurance plan’s necessity is undeniable from the insight gained into its impact on patients and their treatment besides providing financial support. So, let us explore the benefits accruing from the insurance policy.

- The policy covers all stages of cancer, beginning from 0 to 4

- The policyholder gets a lump sum benefit upon cancer diagnosis per the policy terms.

- The policy provides a premium waiver under certain conditions.

- The policyholder gets a no-claim bonus amounting to a percentage of the sum assured.

- The policyholder gets financial support through monthly payments for a specific period, subject to complying with the underlying conditions.

- The insurance coverage continues even after the first cancer diagnosis and the lump sum payment.

- The policyholder earns discounts for high-value cancer insurance policies over a specified threshold.

- The premium paid in a financial year is eligible for tax exemptions under the IT Act, 1961.

Inclusions and Exclusions in Cancer Policy

Awareness about the inclusions and exclusions is essential for the policyholder as it impacts the claim procedure. Contrarily, you can claim flawlessly, leading to an early settlement. But, it is sensible to check the policy documents, which may vary with the insurer and the cancer insurance policy. So, the list below is only indicative.

Inclusions

- A pathologist must confirm a cancer diagnosis with histological evidence of malignancy.

- So, the policyholder gets coverage for various types of cancer like sarcoma, lymphoma, and leukemia.

- Pre and post-hospitalization expenses

- Ambulance cover

- Domiciliary hospitalization and associated expenses

- Coverage for daycare procedures related to cancer

- Second opinion benefits if not satisfied with the first diagnosis.

Exclusions

- Non-invasive tumors showing malignant changes of carcinoma in situ

- Skin cancer other than invasive malignant melanoma

- Prostrate tumors with a Gleason score under 6

- Any cancer caused directly or indirectly by sexually transmitted diseases, HIV and AIDs.

- Cancer results from congenital or preexisting conditions besides biological, nuclear, chemical, and radioactive contamination from non-diagnostic or therapeutic sources.

- The above-listed exclusions are specific, whereas some exceptions apply to all cancer insurance plans, like the initial waiting period but with varied threshold limits.

Important Things About Health Insurance for Cancer

Now we come to the most crucial aspect of the factors to consider before making an informed choice. In other words, what should you look for in a cancer insurance plan before purchasing? But it is also vital to first learn about the eligibility criteria.

- Eligibility age: 91 days to 70 years

- Policy term: Usually one year, but there are versions with more extended periods

- Sum assured: Typically, from Rs.1 L:ac to Rs.2 Cr.

So, after learning the eligibility provisions for a cancer policy, let us explore the essential considerations.

1. Cost of cancer treatment

Cancer is one of the costliest illnesses to manage. Screening for cancer and diagnosis triggers prolonged treatment, care, and rehabilitation. Moreover, it drains the cancer patients and their families of financial resources and mental peace. So, the only solution is a specialist cancer insurance plan with extensive coverage providing the much need financial cushion.

Additional read: Tips to Get Health Insurance Plans

2. A shield for the vulnerable

There is no substitute for vulnerable individuals than purchasing a specialist cancer policy to shield them from the harmful effects of the dreaded disease. Thus, the insurance policy is ideal for those with a family history of cancer besides exposure to cancer-causing agents while pursuing an occupation.

3. Topping up comprehensive health insurance

The complete health solution may not suffice with their cancer coverage. So, instead of choosing a critical illness rider covering cancer, among other ailments, selecting a specialist cancer insurance policy for its extensive coverage is essential. The cancer policy covers treatment and other associated expenses besides non-medical expenses like commute and household expenses.

4. Understand cancer insurance plan coverage

Many insurers offer complete health solutions through their insurance products covering multiple diseases, including cancer. These insurance plans are indemnity plans paying the actual treatment cost within the overall sum insured. Contrarily, the specialist cancer policy is a defined-benefit plan providing better coverage and features across various cancer types.

5. Compulsory waiting period

Insurers place mandatory waiting periods on their medical insurance products, and cancer is no exception. The typical waiting periods for the claim process to kick in are between 90 and 180 days from the policy inception date. The policyholder cannot lodge any claim for cancer diagnosis during the period assuming that the condition is preexisting.

6. Understand the impact of the survival period

The policyholder does not get policy coverage benefits immediately after a cancer diagnosis. Contrarily, the palliative care and medical expenses cover kicks in after the survival period. The typical survival period in cancer insurance plans ranges from 30 days to 6 months.

7. The final four clinchers

The policyholder must look for a high sum assured to absorb the exorbitant expenses of cancer treatment.

- Ideally, the health insurance must cover all the cancer stages and not a few.

- Choose the plan with an extended policy term for uninterrupted protection.

- Long-term insurance plans are cost-effective as the premium remains the same throughout the policy term.

- Finally, choose the product wisely, considering the insurer’s claim settlement ratio, ensuring a seamless experience in the future.

Cancer incidence is rising by the day, and so is the cost of its management. Considering the significant impact of the disease on one’s financial resources and mental wellbeing, health insurance for cancer from Bajaj Finserv Health is the only solution. You not only ensure financial support through the cancer policy & Health EMI card but the coverage goes much beyond absorbing the long-term treatment costs. Moreover, the insurance policy also supports the family financially for the loss of income due to cancer’s domino effect.

References

- https://www.who.int/news-room/fact-sheets/detail/cancer#:~:text=Cancer%20is%20a%20leading%20cause,and%20rectum%20and%20prostate%20cancers.

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.