Aarogya Care | 5 min read

Here's How Senior Citizens Can Save on Taxes with Medical Bills in India

Medically reviewed by

Table of Content

Key Takeaways

- Resident individuals between the age of 60 and 80 years are senior citizens

- Senior citizens paying health insurance premiums get tax benefits of Rs.50,000

- Section 80D covers hospitalization expenses and doctor consultation charges

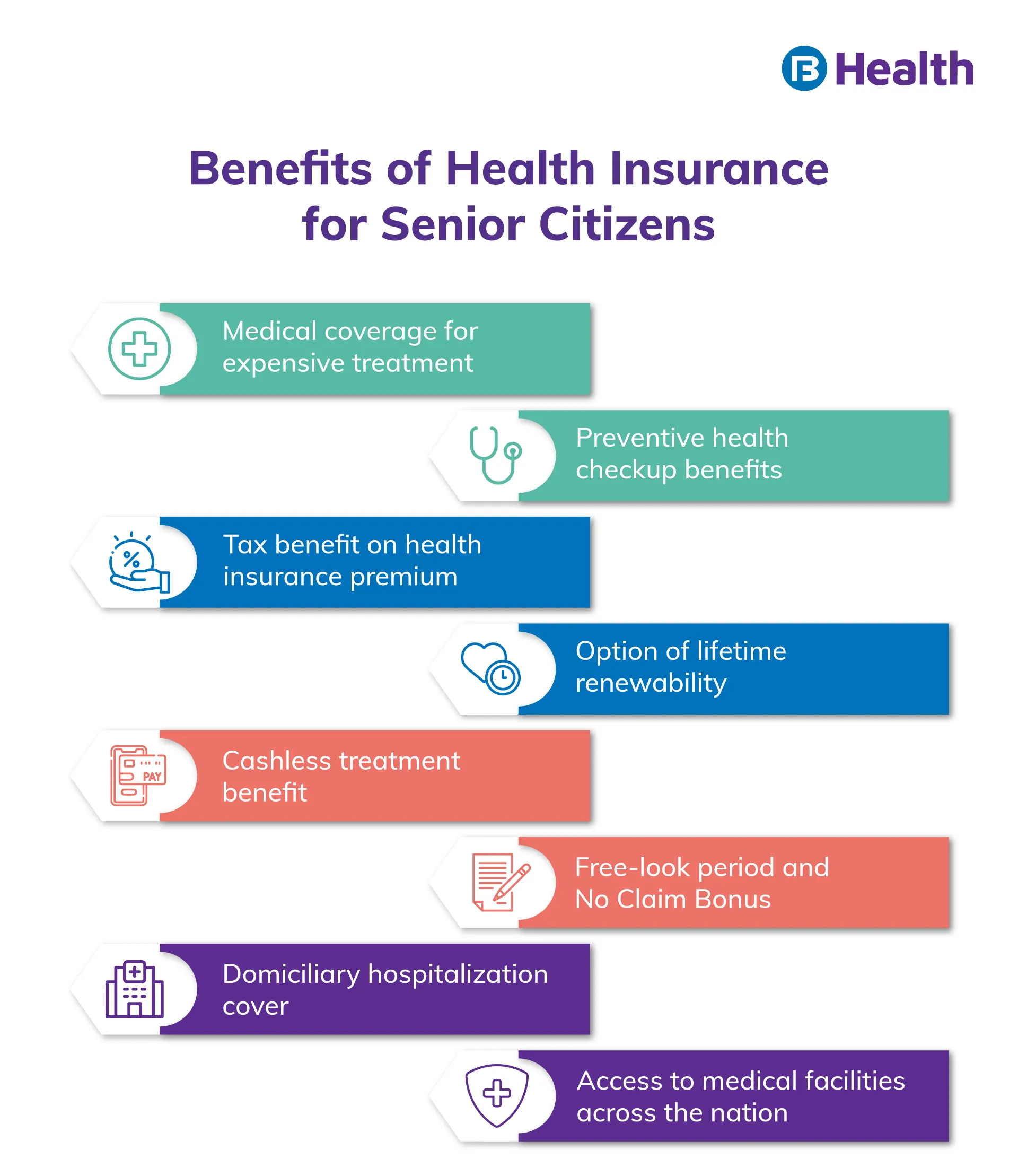

Medical costs for senior citizens, in general, are high as seniors are more vulnerable to lifestyle and age-related diseases [1]. Health insurance can help seniors live freely in their golden years without financial strain. In most cases, insurers hesitate to offer medical insurance to senior citizens with pre-existing diseases. With a long-term policy though, seniors can get cover. The premiums charged on senior citizen health plans are often higher to match the risk of the insurer.

To make healthcare more convenient for senior citizens, the Government of India amended Section 80D of the Income Tax Act of 1961 [2]. Medical expenses of seniors are now considered valid deductions for tax-saving purposes. Read on to know how senior citizens can save tax with medical bills using 80D.

Additional Read: Tips to Choose the Right Senior Citizen Health Insurance PolicyWhat are the age criteria for senior citizens to claim tax deductions?

The minimum age for an individual resident should be 60 years and above to be considered as a senior citizen for the purpose of taxation. But, the individual should be below 80 years of age. Individuals over the age of 80 years are considered super senior citizens [3].

Which type of medical costs are eligible for tax deduction?

According to the recent amendments in the Income Tax Act, there are a few expenses that qualify. Here is a list of some medical expenses eligible for tax deduction benefit.

- Expenses incurred on a doctor consultation

- Hospitalization bills

- Cost of medicines

- Expenses on medical devices which include hearing aids and pacemakers

- Debit card

- Cheque

- Net banking

However, you can make payments in cash of up to Rs.5,000 for preventive health check-ups. Any medical expenses or health conditions not mentioned in the Income Tax Act are not covered for tax deduction under section 80.

Apart from section 80D, costs for conditions like cancer, AIDS, and Parkinson’s disease can be claimed under Section 80DDB. Here, senior citizens can get tax rebates of up to Rs.1 lakh. You can claim the deduction under Section 80DDB if the medical condition fits these criteria. If it does not or if the limit gets exhausted, you can claim under section 80D up to the set limit.

What is the maximum deduction limit for senior citizens?

As of the financial year 2021-22, you can claim a maximum tax deduction of Rs.50,000 incurred on healthcare expenditures of senior citizens in a financial year. So, as a senior citizen, you can claim tax benefits on the medical expenses or the premium you pay towards your health insurance.

For a better idea of section 80D for senior citizens, consider these pointers.

- If you are a senior citizen and pay the health insurance premium for yourself, then you are eligible for a maximum tax deduction of Rs.50,000.

- If you are an individual below the age of 60 years and pay premiums for your parents, who are senior citizens, then you can claim a tax deduction for yourself up to Rs.25,000 and for your senior parents up to Rs.50,000. The maximum tax deduction under section 80D in such a case will be Rs.75,000.

- If you are a senior citizen paying the health insurance premium for yourself as well as for your senior citizen parents, then you can claim up to Rs.50,000 tax deduction benefit for yourself and up to Rs.50,000 for your senior parents. The total tax deduction under section 80D in such a case will be a maximum of Rs.1,00,000.

How can you avail tax benefits on premium payments?

When paying premiums on your health insurance policy or medical expenses, use online modes of payment. Avoid making medical costs and premium payments in cash. Instead, use digital or online modes such as debit or credit card, cheque payment, and net banking. You may also use digital payment alternatives like UPI and mobile wallets to pay for premiums.

However, expenses for preventive health checkups can be paid in cash to avail tax benefits. Preventive checkups help reduce your risk of illnesses. In case you pay health insurance premiums towards the health policy of your senior parents, then you as a taxpayer will be eligible for tax deduction benefits under section 80D.

What are the documents needed to claim tax benefits for senior citizens?

You do not require any specific documents to claim a tax deduction on medical bills paid for senior citizens under section 80D. The Income Tax Act has no specific list of documents to avail tax benefits. However, it is always better to save certain documents as evidence. Your insurer may ask for certain reports and proof of medical expenditures incurred to treat senior citizens. So, keep the following documents handy:

- Diagnosis test reports

- Medical bills and invoices

- Doctor prescriptions

- Reports of medical history

- Other medical reports

Buying health insurance for your senior parents should be your priority as they deserve to live a healthy life during their golden years. Purchase health plans that meet the needs of your whole family. Consider the Complete Health Solution plans offered by Bajaj Finserv Health. These plans provide a medical cover of up to Rs.10 lakh along with a host of illness and wellness benefits. Sign up today to enjoy a range of healthcare features!

References

- https://www.who.int/news-room/fact-sheets/detail/ageing-and-health

- https://www.incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

- https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-2

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.