Aarogya Care | 4 min read

How to Claim Tax Benefits on Premiums Paid towards Health Insurance?

Medically reviewed by

Table of Content

Key Takeaways

- Section 80D allows tax deductions on health insurance premiums

- Individuals below the age of 60 years get a tax benefit of Rs.25,000

- Cash payments for premiums are not eligible for tax deductions

Medical emergencies can arise at any time and the treatment costs can chip away a huge part of your savings. Whether you are young or old, having health insurance by your side is a wise investment. This way, you pay a small amount towards your policy’s premiums every month or year. This is better than being hassled to pay a lump sum at a time when you incur huge medical expenses. The good news is that the premiums you pay offer tax benefits under section 80D of the Income Tax Act, 1961 [1].

The government allows these tax deductions to encourage you to buy health insurance and protect your health and that of your loved ones. Read on to know how you can claim tax exemption on your health policy premiums.

Additional Read: Dental Health Insurance: Is It Worth Investing in It?What are health insurance premiums?

Health insurance premiums are what you pay to the health insurer to provide you coverage against medical costs. You can select the term for premium payments. For instance, if you opt for a 1-year policy, you need to pay your premiums every year to keep your health insurance policy active. Similarly, if you buy a health plan for more than a year, you need to pay the premium during the purchase and before the renewal of the policy. Non-payment of the premium can lead your policy to get lapsed.

What Are the Tax Deductions You Get on Health Insurance Premiums?

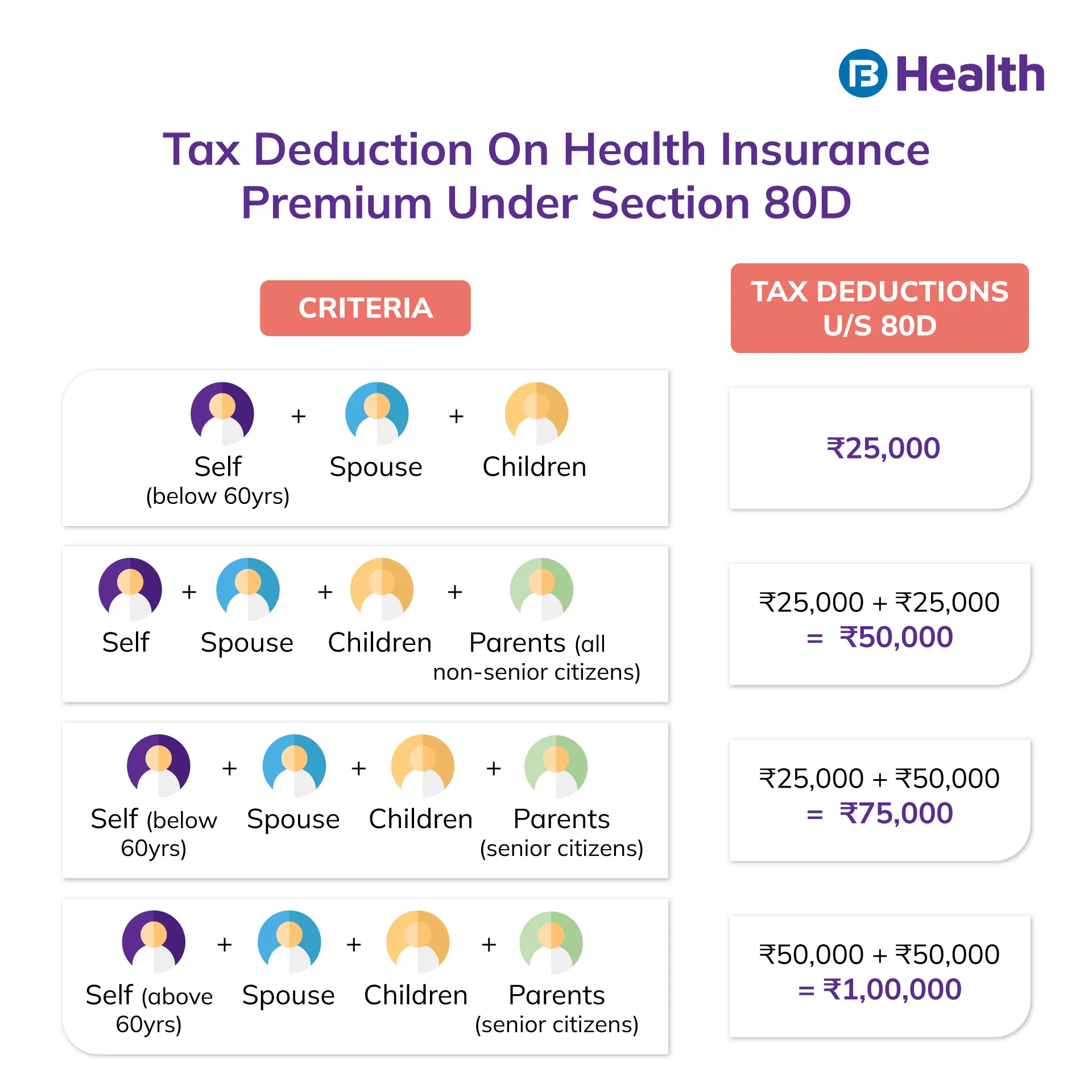

Here are the details of tax benefits you can claim against premiums paid for yourself, spouse parents and children [2].

- Tax deductions when both individual and parents are below 60 years of age

In such cases, you can claim a deduction of Rs.25,000 if your health policy doesn’t cover your parents. By including your parents, you can claim an additional tax deduction of Rs.25,000. Now the total deduction under section 80D would become Rs.50,000.

- Tax deduction when an individual is below 60 and one or both of the parents are senior citizens

- Tax deduction when both individual and parents are above 60 years of age

In the same rule, if you are a senior citizen with senior citizen parents, you can claim a maximum tax deduction of Rs.1 lakh.

Who Can Claim Tax Deductions on Health Insurance Premiums?

Section 80D allows tax benefits on health insurance premiums paid for the following:

- An individual paying health insurance premiums for self, spouse, dependent children, and parents

- A member of Hindu Undivided Family (HUF) [3]

Why Should You Claim Tax Deductions on Health Insurance Premiums?

Here are some reasons why claiming tax deductions on health insurance premiums is beneficial.

- Tax deduction benefit helps save you more money

- You can claim a maximum benefit of up to Rs.1 lakh every year

- Tax exemption of up to Rs.5,000 is included every year on preventive health checkup expenses

How to Claim Tax Deductions on Health Insurance Premiums?

You can claim tax deduction benefits while filing income tax returns. You need to follow certain steps for the same:

- While filing the ITR form, select 80D under the ‘deductions’ column for claiming tax deductions on health plan premiums

- Once you choose the section, a drop-down menu will appear. Choose the correct option under which you want to claim the tax deductions. Here are the seven options:

- Self and family

- Self (above 60 years) and family

- Parents

- Parents (above 60 years)

- Self and family with parents

- Self and family with parents above 60 years

- Self (above 60 years) and family with parents above 60 years

- Now, attach the supporting documents or proofs such as the premium paid receipt for the Income Tax officials to verify them.

Note that cash payments made for paying health insurance premiums are not eligible for a tax deduction. To claim tax benefits, you should pay the premium through credit cards, cheques, demand draft, or net banking.

Apart from protecting you financially, health insurance acts as a tax-saving instrument. Now that you know the tax benefits you can avail, invest in the right health insurance for yourself and your family. Consider the Complete Health Solution plans by Bajaj Finserv Health. These plans offer medical cover of up to Rs.10 lakh at affordable premiums along with a host of benefits. These include network discounts, preventive health check-ups, doctor consultations, and more!

References

- https://www.incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

- https://cleartax.in/s/medical-insurance, https://www.business-standard.com/about/what-is-hindu-undivided-family#:~:text=Hindu%20Undivided%20Family%20(HUF)%20consists,relaxation%20in%20computation%20of%20taxes.

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.