Aarogya Care | 8 min read

Life and Health Insurance Policies: Key Differences

Medically reviewed by

- Table of Content

Synopsis

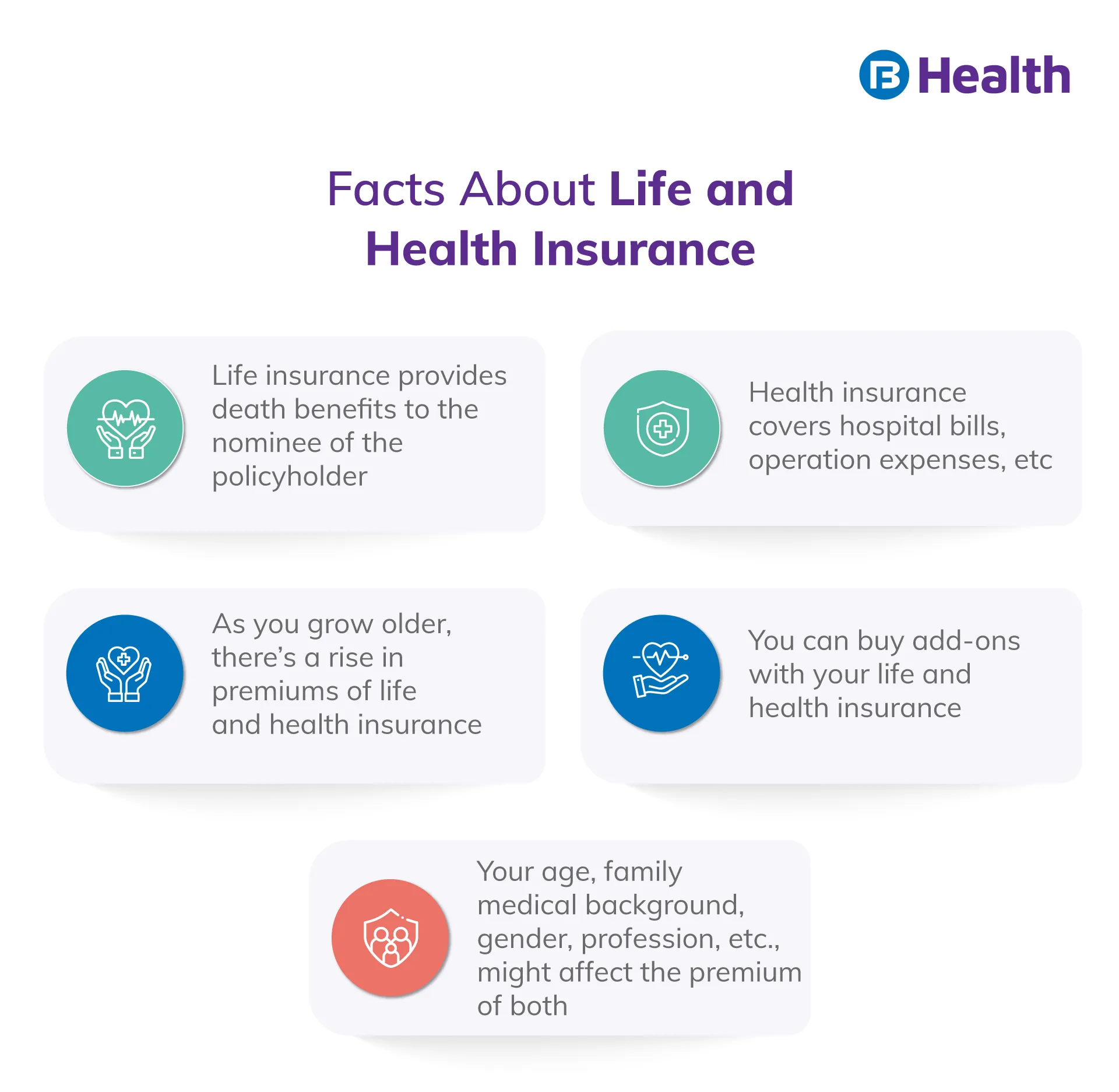

Getting life and health insurance is crucial in today's world. However, before deciding which one to buy, knowing the difference between life and health insurance is important.

Key Takeaways

- It's common advice for young couples to purchase life and health insurance

- Life insurance provides a lump-sum death benefit in the event of premature death

- Paying for life and health insurance becomes much less challenging when you purchase the coverage you actually require

Life insurance is an agreement between the policyholder and the insurance company where the insurer agrees to pay a sum in exchange for a premium if an insured person dies or after a certain period. Health insurance is a contract between the insured and the insurance company that provides financial protection in the case of a medical emergency. The insured pays a defined premium for health insurance. In this blog, we will learn more about life and health insurance and the differences between them.

Difference Between Life and Health Insurance

Let us look at some of the basic differences between life and health insurance policies.

Life Insurance Definition

Life insurance is a kind of personal safety that your family can access if you are not present to meet their needs. It is a contract between the insured and the insurance company that, in the unfortunate event of the insured's death, the life insurance for which the person paid premiums and financial benefits gets passed to the beneficiary/nominee.

In most cases, death benefits are tax-free. As a result, the assured sum reaches the family with no significant deductions. Consider it your future full-proof savings plan for your family.

There are Two Types of Life Insurance

• Whole life insurance has fixed premium payouts and provides a fixed sum assured to the beneficiary that is generally tax-free. This insurance is less expensive than universal life insurance due to its consistency and low or no-risk approach. It is possible, in some cases, to obtain a loan against this type of policy. [1]

• Universal life insurance also provides a death benefit to the nominee but can also be viewed as an investment policy. Policy premium payouts are generally flexible, with a portion of the payment invested in improving the cash value of the Sum assured. This type of insurance is more expensive than Whole Life Insurance or Term Insurance because of the nature of investing for higher returns, which can sometimes result in potential risks. With this in mind, the premiums for such plans are flexible, as are the death benefits.

Factors That Affect the Premium of Life Insurance

Several elements can affect the life insurance premium. These elements differ between life and health insurance in terms of premiums:

Age

Age is one of the main variables affecting the cost of a life insurance policy. Younger people pay less for life insurance, and as they get older, the premium gradually rises.

Gender

Research suggests that women generally live longer than men. As a result, women pay a lower life insurance premium than men.

Health conditions

The cost of your life insurance policy may be affected by your current and previous health conditions. You would get charged a higher premium if you have any pre-existing conditions or have previously experienced an illness that could resurface or negatively impact your current health.

Family medical history

If a disease runs in your family, your risk of contracting it is very high. Therefore, you might have to pay a higher premium if you have any hereditary diseases in your family. [2]Smoking and drinking

These lifestyle choices can harm your health and contribute to many health problems. Insurance companies, therefore, charge higher premiums for people who smoke or drink alcohol.

Coverage type

The premium for a life insurance policy may go up or down depending on the coverage you pick. Your plan's premium would go up if you included any riders. In contrast to a shorter term, a longer policy term may have a higher premium. Additionally, the kind of life insurance policy you choose impacts the premium. For instance, a term plan is the least expensive type of life insurance.

Amount of protection

A higher premium would follow a higher sum assured, and vice versa.

Profession

If you have a high-risk job, your life insurance premiums will be higher than average. For instance, the insurance provider will charge you a higher premium if you work in construction or if your job involves any type of risk, like regular exposure to chemicals.

Additional Read: How Health Insurance Works In India

Health Insurance Definition

Health insurance is a contract between the insured and the insurance company that provides financial protection in the case of a medical emergency. The insured pays a set premium for health insurance.

If you have health insurance, you can either have your out-of-pocket medical expenses reimbursed or have the insurance company pay the medical costs directly on your behalf, depending on the policy plan. A few health insurance plans will also cover the cost of your prescription medications.

There are Mainly Three Types of Health Insurance

Individual Health Insurance

An individual health insurance policy is for a single person to protect and cover them against various illnesses, hospital bills, accidents, and other medical emergencies that may occur during their lifetime. Individual health insurance plans include additional benefits such as Maternity benefits, Critical Illness Coverage, OPD expenses, and so on

Family Floater Health Insurance

A family floater health insurance is tailored to the entire family and gets paid for with a single premium. All family members are protected and covered against various illnesses, hospitalization, accidents, and other medical needs that may arise during one's lifetime.

Senior Citizens Health Insurance

Senior citizens' health insurance, as the name implies, is a type of health insurance policy designed for people over 60 years. It is tailored to several physical and psychological needs of senior citizens and includes benefits such as Domiciliary Care, AYUSH, Organ Donation expenses, and Critical Illnesses, among others.

Difference Between Life and Health Insurance

The table below shows the differences between life and health insurance policies:

Life insurance | Health insurance |

| Life insurance is a comprehensive cover that provides insurance throughout your life and is not limited to a specific expense. It is covered in the event of the insured's death when the sum assured is paid to the beneficiary. | Health insurance is typically limited to only catering to your medical/surgical/hospital needs, with only medical emergency coverage provided as and when needed. |

| Depending on the type of life insurance chosen, the premiums are both fixed and variable. Some life insurance policies also include future investment value policies for increased cash value. | The premiums are mostly fixed. Health insurance covers expenses incurred during medical emergencies. The goal of these plans is not to invest but to protect. In some cases, a No-claim bonus is available. |

| Life insurance is a long-term strategy. | Health insurance is a short-term strategy. |

| Life insurance is typically for a set period. It usually gets terminated when the term of the insurance expires. | The insurance duration is not fixed. In most cases, the insured renews the policy annually to continue receiving the protection coverage it provides. |

| In the event of the insured's passing, life insurance primarily serves to financially protect your family, beneficiaries, or person designated. | Health insurance is a type of personal and family protection that aids in the prevention of unfavorable outcomes such as a fatality caused by financial hardship. |

| Depending on the kind of life insurance you have, Survival and Death benefits are available after the insurance term. | Health insurance only covers your current medical needs and treatment; it does not provide a Survival or Death benefit. |

| In some circumstances, by adding a small premium, the money you invest may get returned to you tax-free at maturity, should you live past the policy's term. | At the end of the policy term, there is no money refund. The money only gets returned as reimbursement against the costs incurred for your illness or other medical expenses during the tenure. |

Benefits of Life and Health Insurance

Let us look at some of the most crucial benefits of life and health insurance.

Benefits of Life Insurance Plans

- The two most important benefits of life insurance are financial security and protection

- Payouts are tax-free

- A death benefit is guaranteed

- Tax advantages come with life insurance. However, tax savings should not be the primary motivation for purchasing a term policy. This policy provides tax benefits and exemptions under current tax laws

Benefits of Health Insurance Plans

The primary goal of health insurance is to ensure that you receive the best medical care possible without worrying about your finances. Health insurance plans provide coverage for unexpected medical expenses. The premium paid in one lump sum allows for tax benefits for the number of years of insurance coverage, which is just one of the advantages of having a health insurance policy. We offer a variety of additional benefits and add-ons to assist customers in dealing with life's uncertainties.

Restoration Benefit: A health insurance coverage in which, if your Sum Insured is depleted while treating an illness, the insurance company restores it

Critical Illness Coverage: Critical Illness Insurance available as an add-on or as part of the plan, covers hospital expenses in the event of a critical illness

Daily Hospital Cash cover: This cover assists you in managing expenses that exceed the hospital bill in the case of a medical emergency

Maternity Benefit: If selected, maternity insurance benefit covers hospitalization and all related expenses when a pregnant woman gets admitted for delivery. It also covers the costs of any necessary treatment in the case of complications

Home (Domiciliary) Hospitalization: This benefit is for you if any of your parents or family members require home care in a condition that would have required hospitalization

Pre and post-hospitalization expenses: Few pre and post-hospitalization expenses, like expenses on X-rays, scans, and medications, are also covered under this

Accidental Hospitalization: In the case of an accident, this benefit covers the costs of Ambulance, Daycare procedures, Pre-hospitalization, and Post-hospitalization expenses such as OT, ICU, Medication, Diagnostics, Physician Fees, and more

Additional Read: Advantages and Disadvantages of Health Insurance in IndiaLife and Health Insurance are extremely important from so many points of view. In the present day, not considering these both will just be foolish. So, if you want to stay healthy and fit to get a life, health, or medical insurance without any hassle, get in touch with the dietitians at Bajaj Finserv Health. They provide you with the best service.

- References

- https://www.investopedia.com/terms/p/permanentlife.asp

- https://fidelitylife.com/learn-and-plan/insights/factors-that-affect-life-insurance-premiums/

- Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.