Aarogya Care | 4 min read

Want A Medical Bill Discount? Top 5 Ways That You Can Try!

Medically reviewed by

Table of Content

Key Takeaways

- Medical bill discounts can help reduce your financial burden

- You can also get a substantial discount for paying hospital bill in full

- An EMI health card can also help you get a hospital bill discount

With rising medical costs, a medical bill discount offers important financial relief. Today, you can avail a pharmacy or hospital bill discount in various ways. One way to reduce unnecessary costs is to be upfront with your healthcare provider and ask for the best yet most cost-effective procedure. Make sure you ask about the cost of treatment or a consult before making an appointment. That way, you can look for other options in case you do not find the current one suitable for your needs.

Why is availing a medical bill discount a wise choice? Other than improving your finances, a hospital bill discount can also help you stretch your medical insurance cover. In a 2015 order, the IRDA made it compulsory for all insurers to mandate hospitals to disclose all hospital bill discounts in the final hospitalization bill [1]. By utilizing a hospital bill discount, your claim amount will automatically be lower, and this helps you use your medical insurance cover for future needs. Apart from this, read to know the top 5 ways you can get a medical bill discount.

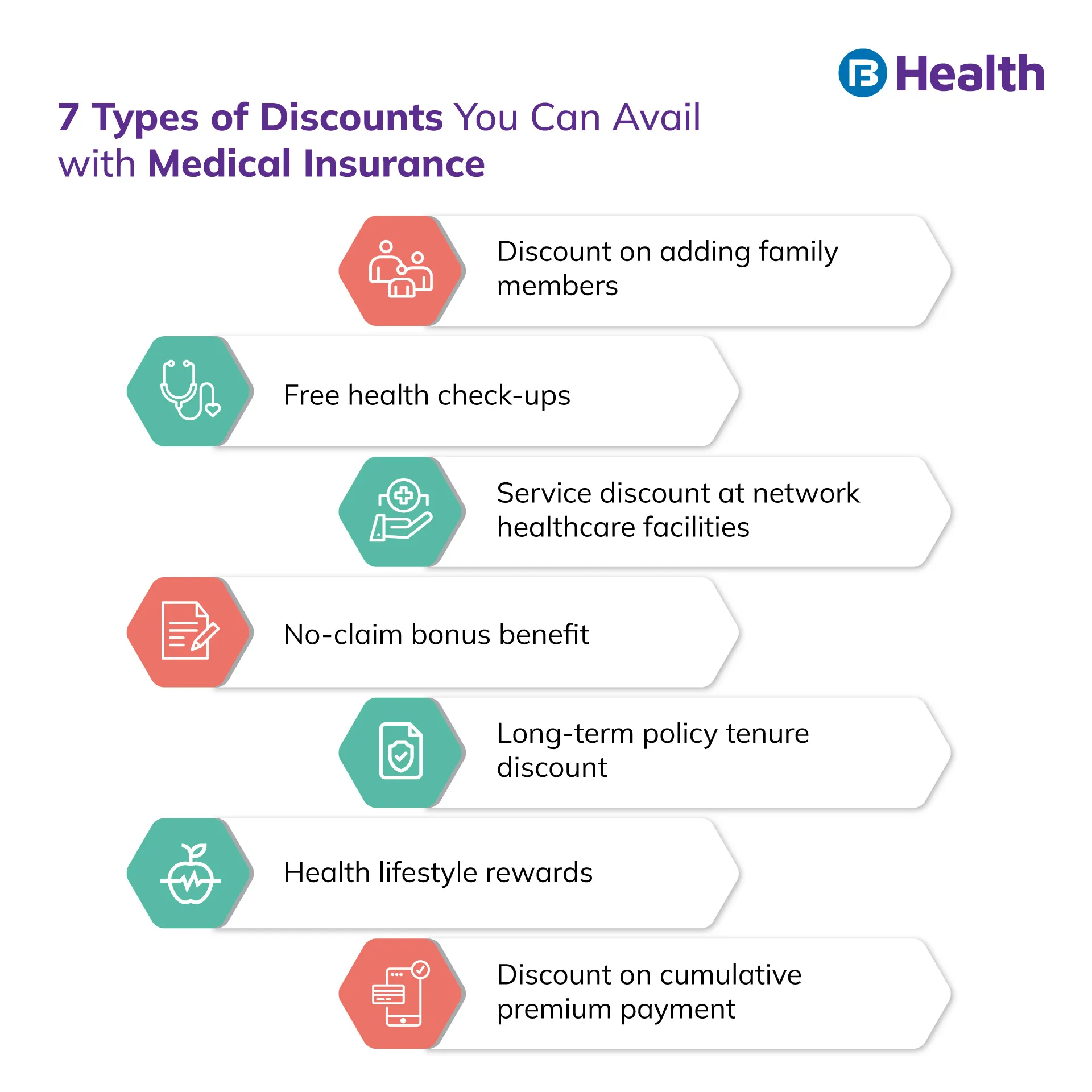

Review your medical insurance

A health insurance plan comes with a host of benefits which may include getting a hospital bill discount. This is usually called a network discount. You can contact your medical insurance provider to better understand the terms and conditions of this type of bill discount. It is also important to do a thorough review of your policy to meet your changing health needs. If needed, port to another insurer who offers higher network discounts to save more.

Additional Read: Why Review Your Medical InsuranceKeep an eye for billing errors and ask for an itemized bill

While this is not exactly a medical bill discount, being on the lookout of this can help you save money too. Billing errors can and do happen, so it is important to check whether or not you have received all the services, medicines, and other items mentioned in your bill. If you notice any sort of discrepancy, be sure to contact the billing department of the hospital. You can also request copies of your medical chart or pharmacy details so you can cross-check them with the doctor’s orders.

An itemized bill is different from EOB (explanation of benefits) statement that you may receive in your bill. Asking for an itemized bill can help you get a hospital bill discount because it contains details of the various charges. These bills have a detailed breakdown of the charges for services, inpatient stay, and other important factors. This will help you identify any unfair charges or errors.

Pay in installments via your insurer’s EMI health card

As the name suggests, this No Cost EMI health card lets you pay your medical bill in monthly installments, thereby helping ease your financial burden. You can avail this benefit by undergoing treatment at any network hospital of your insurer. Note that certain insurance companies also offer a medical bill discount when you use their health card.

Get a discount for paying hospital bill in full

Just like in other cash pay discount, medical bills also have this benefit depending on the hospital. This comes in handy when your medical bills are hefty. Hospitals often offer a substantial discount for paying hospital bill in full. But for this to work, you will need to make an instant payment. To avoid straining your finances, make sure you plan in advance and gather the funds beforehand.

Negotiate and ask for a medical bill discount

Another way is to simply speak to the manager of the healthcare facility and ask for a hospital bill discount. Many hospitals or diagnostic centers offer reasonable medical bill discounts if you negotiate because it helps them gain your loyalty.

Additional Read: Save Money on Healthcare PlansOne of the best ways to safeguard your finances against rising medical costs is by having a medical insurance plan and a health card. Check out the Aarogya Care plans on Bajaj Finserv health. Along with high insurance cover, these plans also come at an affordable premium. You can also get a medical bill discount with them and the health card available on the platform. The health card further allows you to take preventive measures for your health without burdening your finances. This way, you can prioritize your physical, mental and financial health!

References

- https://healthindiatpa.com/Downloads/Irda_Cir_117_dt_23_6_15.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.