Aarogya Care | 4 min read

Top-Up Health Insurance: Why is it so Important?

Medically reviewed by

Table of Content

Key Takeaways

- There are two types of top-up health insurance plans

- You can buy top-up or super top-up health insurance

- Each type of insurance plan has its own benefits

A top-up health insurance plan is a feasible option that comes in handy when your hospital bill exceeds the total coverage of your plan. With it, you can get additional funds in such cases. As spare tyres help your car run in emergency situations, a top-up plan enables you to meet unplanned medical expenses comfortably.

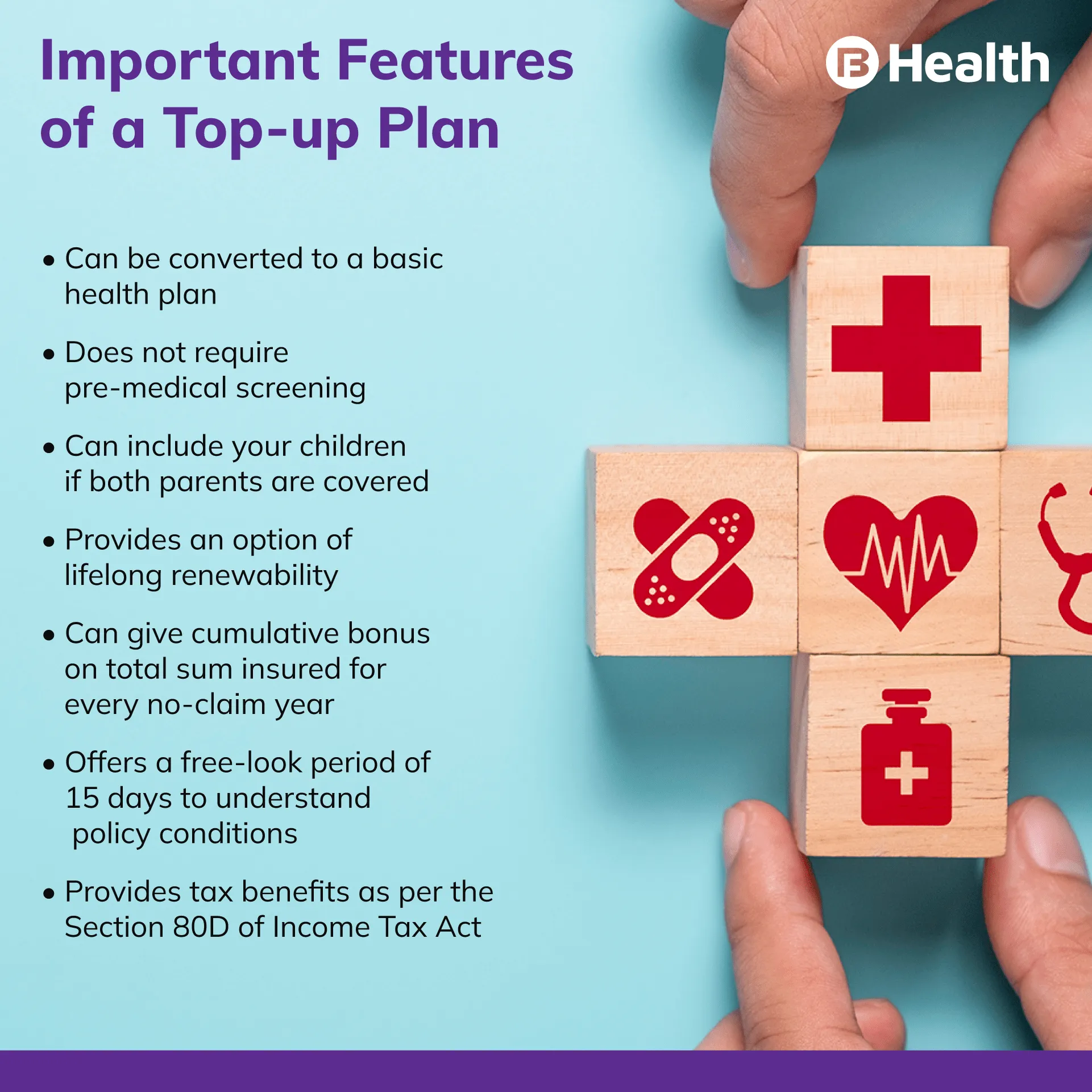

When you avail a health plan, your insurance provider will only cover the expenses within the total plan coverage. However, by opting for a top-up plan, you can get extra coverage exceeding the basic limit of your health insurance policy. Before investing in a top-up plan, you should be aware of the deductible amount. This amount is the base amount fixed by your insurance provider beyond which you can opt for a top-up plan. To know more about the deductible amount and other features of top-up health insurance plans, read on.

Additional read: 6 Types of Health Insurance Policies in India: An Important Guide

What is top-up health insurance plans?

A top-up is a regular health insurance plan to manage your medical expenses after a specific threshold limit. This threshold limit, which is called the deductible, is an amount that you need to pay to the insurance company before you file a claim [1]. Only after this amount is paid, the health insurance provider will pay for your policy coverage. Also known as add-on covers, these plans are available at nominal premiums. Top-up plans can be availed by individuals between the age of 18 and 80 years.

Here are the two types of top-up plans.

- Regular top-up health insurance plans

- Super top-up health insurance plans

In a regular top-up plan, only a single claim above the deductible amount can be covered for a financial year. So, if your medical expenses do not surpass this deductible amount in a single time no matter how many times you get treated, you may not be eligible for this top-up claim.

In a super top-up type of insurance plan, you get coverage for multiple hospitalization admissions and other medical procedures during the tenure of the policy. The main difference between top-up and super top-up plans is that the former provides coverage only for a single claim above the deductible, while the latter provides coverage for collective medical expenses in a year.

Additional read: How to Choose Between Super Top-Up and Top-Up Health Insurance Plans?What are the benefits of top-up plans?

When it comes to health insurance, top-up plans come in handy due to a range of reasons.

- Provide coverage beyond your base or standard health plan

- Offer a higher coverage at nominal rates

- Reduce stress as you don’t have to worry about your medical bills

- Help you manage big-ticket medical expenses

- Offer you tax benefits

- Provides health cover against pre-existing diseases

What expenses are included in top-up health insurance?

With a top-up plan, you can get following coverage benefits.

- In-patient hospitalization expenses

- Organ donor expenses

- Pre-and post-hospitalization expenses

- Room rent charges

What expenses are excluded in a top-up health plans?

While there are many inclusions in the coverage, here are the exclusions.

- Sexually transmitted infections

- Injuries due to participation in adventure sports

- Injuries caused by self-harming

- Cosmetic surgery expenses, unless it is a necessity

What are the key factors to consider while investing in a top-up plan?

Before purchasing a top-up plan, do consider these important factors.

- Check if the premium amount is affordable.

- Choose a policy with a suitable deductible amount as it cannot be changed later.

- Opt for the same insurance company from whom you have purchased the base health plan.

- See if the base plan offers sufficient coverage. However, it is not mandatory to have a base plan before investing in a top-up plan.

Before choosing an affordable top-up plan, ensure that you opt for higher deductibles. Make sure that your benefits are not the same as your existing plan. It is important that you check the waiting period in case of any pre-existing conditions. Do check if the top-up plan provides coverage to your family members as well.

There is no doubt that top-up health insurance plans help in bridging the gap between actual treatment costs and your existing coverage limit. Check out the super top-up health insurance Aarogya Care plans on Bajaj Finserv Health and address your medical expenses. Avail up to Rs.25 lakhs using this super top-up plan while you spend only Rs.20 per day! With unlimited doctor consultations on the health app and consultation reimbursement charges up to Rs.6500, such plans make it easier for you to manage hospitalization and treatment costs.

References

- https://garph.co.uk/IJARMSS/Oct2015/7.pdf

- https://consumeraffairs.nic.in/sites/default/files/file-uploads/ctocpas/HEALTH_INSURANCE_plans.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.