Aarogya Care | 5 min read

Role of TPA in Health Insurance: What are its Benefits for a Policyholder?

Medically reviewed by

- Table of Content

Key Takeaways

- TPA helps in processing claims both via reimbursement and cashless modes

- In cashless mode, TPA settles hospital expenses directly with the hospital

- For reimbursements, you need to submit medical bills and records to TPA

There may be situations in life where you or your loved ones may need immediate medical care. This usually includes hospitalization and, in such cases, having insurance helps. A health insurance policy protects your finances while granting access to quality care. This is why it is important that you are equipped with the right policy. There are umpteen health insurance providers in the market, and you should buy a policy that suits your requirements.

Just like these insurers, you can also find third party administrators or third-party administrators. A TPA is a company that provides a service to solve common problems related to health insurance claims. The process begins whenever you or your loved ones are admitted to the hospital. Third party administrators are given an intimation and are authorized by the IRDA to process your claims. Founded in 2001, the main purpose of a TPA is to act as a mediator between the insured and the insurance provider [1]. To learn more about the role of third party administrators in health insurance, read on.

Additional Read: Types of Health Insurance Policies in IndiaWhat Is a Tpa in the Health Insurance Sector?

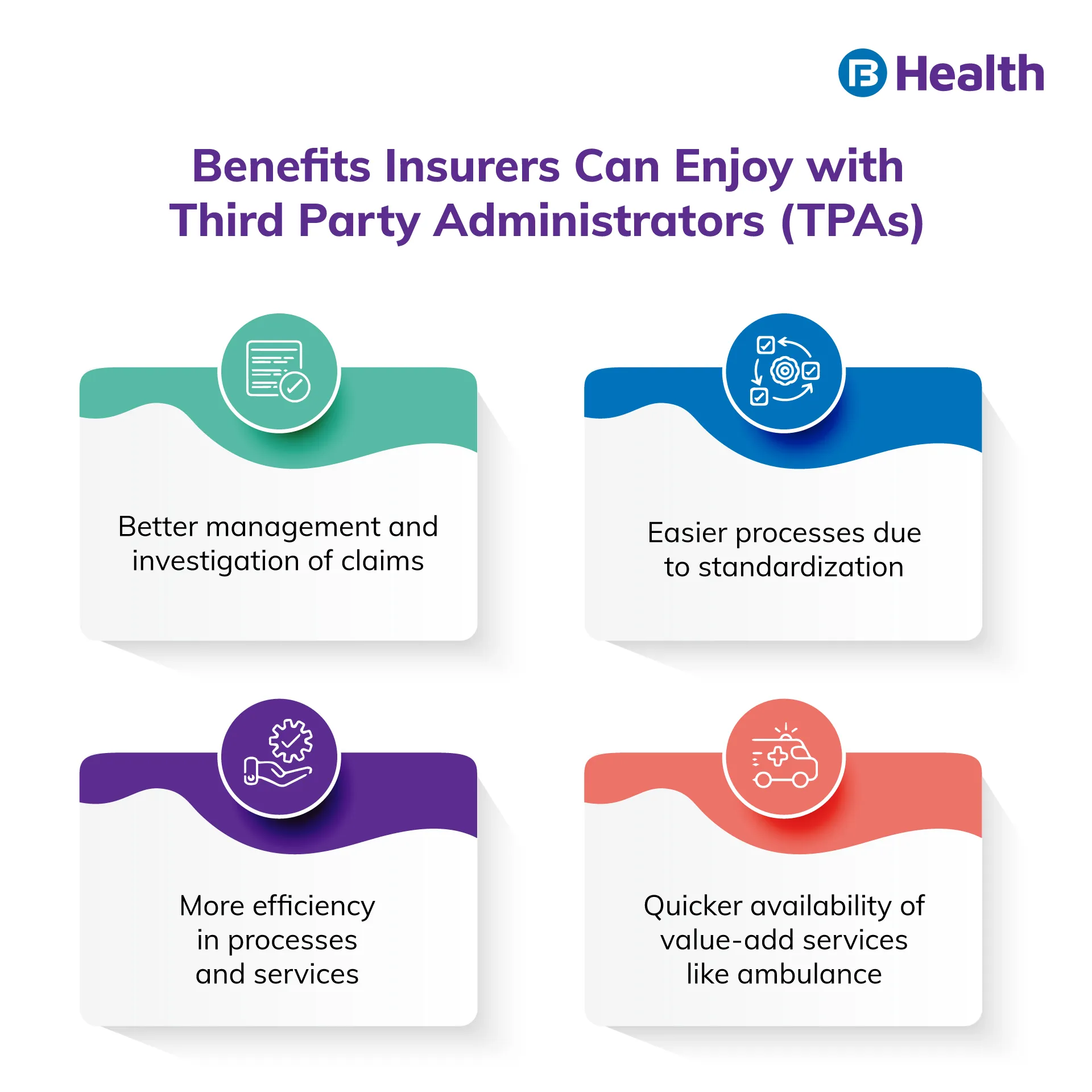

A TPA is an organization involved in processing insurance claims. Though it is an independent organization, it can also function as an entity representing the insurance provider. In India, there are many people availing health insurance policies and different types of health products. This increasing number makes it difficult to keep a track of policies and this affects the quality of services. To tackle this, the IRDA formed TPAs or third-party administrators. Their role is to ensure quality and consistent services. They are involved in processing a huge number of health insurance claims.

Why Are TPAs Important in Health Insurance?

The role of TPAs is vital as they help in processing health insurance claims. Some of the important functions performed by TPAs are as follows

- TPAs provide health cards to the policyholders

When the insurance company approves your policy, your TPA conducts a validation procedure. The next step is to provide you with an authorized health card. This card contains important policy details like the policy number and name of the TPA responsible for processing your claims. During hospitalization, you can produce this card to raise a claim and intimate your insurer or TPA. This is an important document required at the time of processing claims.

- TPAs expedite the claims process

- TPAs provide value-added services

This includes ambulance services and so on. TPAs also have a hand in ensuring you get treatment at a network hospital, where you can get proper treatment. They further ensure that their network offers the best features, which include the cashless facility [2].

How Can TPAs Benefit You as a Policyholder?

A TPA functions like an intermediary between you and the insurer. They make sure that a simplified procedure is followed for claim settlement. Whether it is a reimbursement or cashless claim, TPAs assist people to settle claims easily. Contacting a TPA is usually the first step when you require hospitalization.

To get started, just intimate your TPA or your insurance provider about your hospitalization. The TPA then informs the hospital to begin the cashless facility. In this mode, payment will be directly made to the hospital. This way, TPAs ensure that proper procedure is followed and your claim is settled without any problems. If the cashless facility is not available, the TPA will follow the procedure for reimbursement. In this option, your bills and medical records will be scrutinized by the TPA and then claims will be settled.

Is it Possible to Cancel my TPA?

TPA is a facilitator and if you are not happy with their services, you can cancel a particular TPA or change to a different TPA. All you need to do is discuss your concerns with your insurer. Follow these simple steps if you want to change your TPA.

- Step 1: Contact your insurance provider

- Step 2: Give your policy details

- Step 3: Mention your reasons for TPA cancellation

- Step 4: If your insurance company approves it, choose another TPA from the list

What are the Different Challenges Faced by TPAs?

TPAs normally function efficiently but there are numerous challenges they face as well. A few of them include:

- Weak networking

- Lack of proper reporting of claims across hospitals

- Lack of awareness among policyholders about TPAs

- Little information about the functioning and role of the TPA

- Absence of standard procedures in billing

How do TPAs Earn Revenue?

A majority of revenue for TPAs comes from commission or fees on the policy premiums as per IRDA regulations. The other streams of revenue for TPAs are:

- Claim administration

- Data management

- Benefit management

- Medical management

Besides these facts about TPAs you should know that you do not have to pay any money separately to your TPA as you will be dealing with your insurance provider. The team of TPA comprises eminent professionals like legal experts, doctors, IT professionals, and insurance consultants to name a few. Your health insurance provider decides which TPAs they work with. With the help of TPA services, they can reduce the number of fake claims.

This is why it is important to choose the right health insurance policy. One great option is the diverse range of Complete Health Solution plans on Bajaj Finserv Health. Browse through their comprehensive benefits such as total coverage of up to Rs.10 lakh and reimbursements on doctor consultations. Find a plan that suits your needs and manage your medical emergencies without any hassles.

- References

- https://www.irdai.gov.in/admincms/cms/frmGeneral_Layout.aspx?page=PageNo25&flag=1

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/Regulations/Consolidated/CONSOLIDATED%20HEALTH%20INSURANCE%20REGULATIONS%202016%20WITH%20AMENDMENTS.pdf

- Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.