Aarogya Care | 6 min read

Important Advantages and Disadvantages of Health Insurance

Medically reviewed by

Table of Content

Synopsis

There are many advantages and disadvantages of private health insurance. Read to know various advantages and disadvantages of health insurance and social health insurance advantages and disadvantages.

Key Takeaways

- Providing financial coverage is the main advantage of health plan

- Paying high premiums is a major setback of a health insurance policy

- Consider the waiting period and No claim bonus while purchasing a plan

Are you aware of the advantages and disadvantages of health insurance? Increasing medical inflation, mainly but not all because of the recent pandemic, has put a financial strain on many. While investing in a health insurance policy can help you easily manage your treatment costs, it is equally important to make an informed choice before buying a plan. The pandemic has seen an increase in the health insurance market from 48.03% in 2020 to 49.31% in 2021 [1]. Statistics also reveal that the highest premium income was witnessed in public health insurance plans in 2020 [2].

There are pros and cons for everything, and the same holds true for health insurance. Before you zero in on a specific plan, understand the advantages and disadvantages of health insurance. This will help you gain maximum benefits more cost-effectively. You may be familiar that a health insurance policy is a contract between you and the insurance company. The insurer agrees to manage your medical expenses through cashless or reimbursement mode as per the terms in the policy. For this, you need to pay an amount known as the premium either monthly, quarterly, or annually.

Before considering the advantages and disadvantages of health insurance, keep in mind that there are government health insurance schemes and private plans. While you can buy government plans at lower premiums, private health insurance schemes are available slightly at a higher rate but offer more cover.

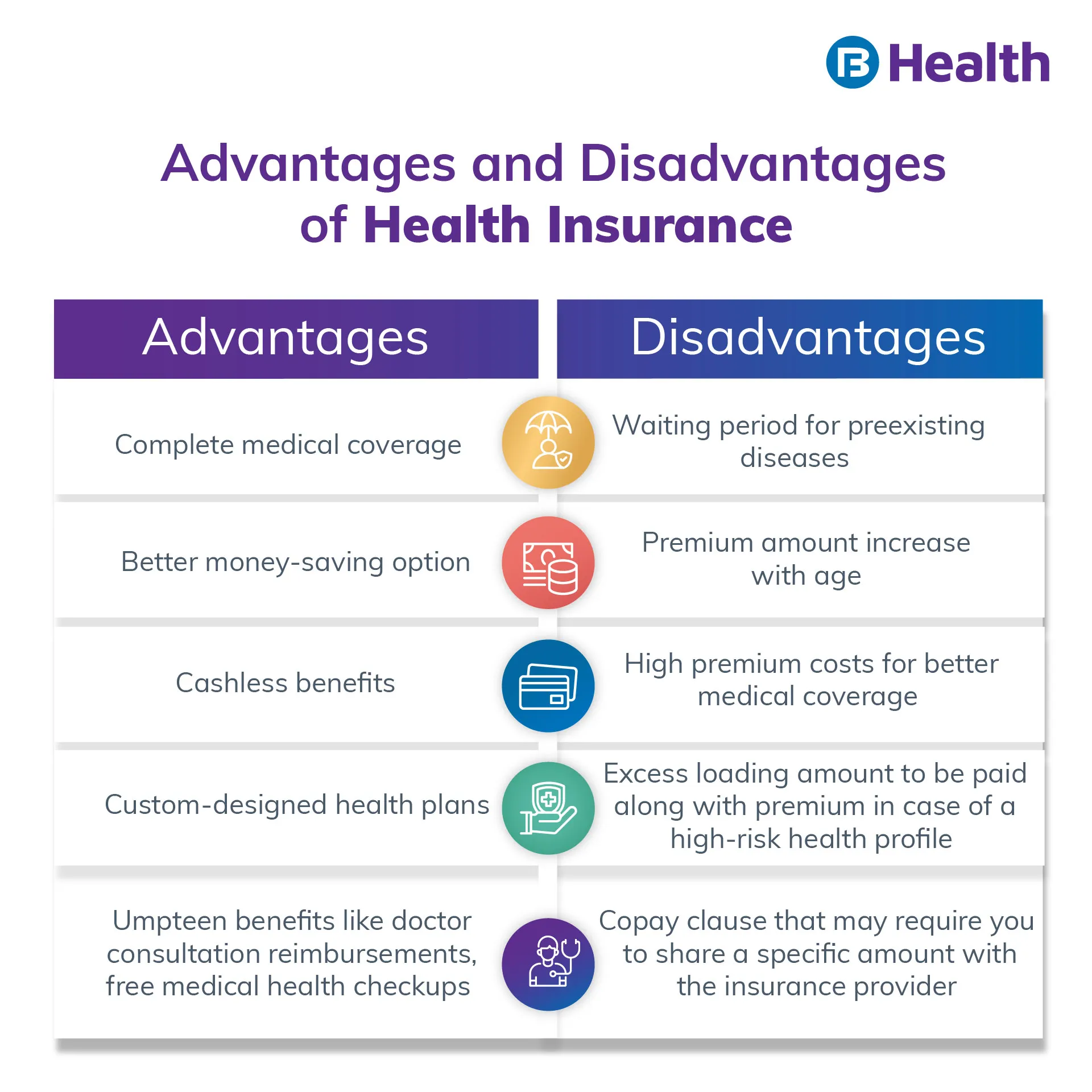

Based on the type of health plan you avail, you get a certain number of benefits combined with a few limitations. Take care to understand the advantages and disadvantages of a private health insurance plan before you select a suitable one. To help you finalize a specific plan, here are a few advantages and disadvantages of health insurance you need to be aware of.

Additional read: Health Plans Can Benefit in a Pandemic

Advantages of Health Insurance

Here are some of the crucial benefits you get when you buy a plan:

Covers Your Medical Expenses

One of the major advantages of health insurance is that it helps you manage medical expenses without burning a hole in your pocket. Whether your hospitalization is planned or unexpected, you get the required financial coverage. When you buy a plan, your health insurance provider pays your medical bills according to the terms and conditions of the policy.

If you are suffering from any health issue, the treatment costs for the same would also be covered. However, it is essential for you to mention any existing health conditions to the insurance provider before you buy a plan. When it comes to the advantages and disadvantages of health insurance, this is the main benefit of buying a policy!Offers Cashless Hospitalization Benefits

Among the various advantages and disadvantages of health insurance, the next vital benefit is the cashless facility. If you undergo treatment from any of the hospitals listed in the insurance provider's network, you can avail of the cashless benefit. As per this feature, the insurance company will directly settle medical bills with the hospital. This ensures that you need not pay anything from your pocket. However, if you take the treatment from a non-network hospital, you can claim your medical expenses via the reimbursement mode.

Provides No Claim Benefits (NCB)

When you buy a health plan, you also get a bonus called NCB. Your health plans usually need to be renewed after the term gets over. If you do not make a claim in a financial year, you are entitled to enjoy the NCB benefit. By accumulating NCB, you get higher medical coverage by paying the same premium amount. Now you know why it is crucial for you to know about the advantages and disadvantages of health insurance as this benefit helps you save more while enjoying a larger cover.

Additional read: Save Money on Healthcare Plans

Disadvantages of Health Insurance

Here are a few disadvantages for you to know before buying a medical policy:

High Costs

When you buy a health plan, you may have to invest a substantial sum based on the cover you need. Making a place for this expense in your finances may seem like a disadvantage of health insurance. But remember, the premium amount varies with the total coverage you require. If you require higher coverage, you'll have to pay a larger premium. The premium also increases with age and for those who have existing illnesses.

Investing in a healthcare plan at a young age not only reduces your premium amount but also provides you with many benefits. However, as your age increases, the premium amount also increases. The main reason is that you are likely to develop a medical condition as you age. Moreover, if your income is nominal, investing in a quality healthcare plan can be a big challenge. When discussing the advantages and disadvantages of health insurance, this is the crucial issue you should keep in mind.

Waiting Period

Another major setback of buying a healthcare policy is the waiting period. If you have any preexisting medical conditions, you may need to wait for 2-3 years before you enjoy the coverage benefits. Amongst various advantages and disadvantages of health insurance, this is a crucial disadvantage you must know. For example, if you have hypertension or diabetes, your medical costs may not be covered until the waiting period is over.

Social Health Insurance Advantages and Disadvantages

While it is essential to know about the advantages and disadvantages of private health insurance, be aware of the social health insurance advantages and disadvantages. Social health insurance is different from private health policy. While private healthcare plans focus on individual policyholders, social health insurance works towards providing social adequacy benefits for everyone.

One such approach initiated in India is the PM-JAY scheme, which is funded completely by the government. The main agenda of this scheme is to work toward providing social health protection to Indian citizens. While it is crucial for you to know about the pros and cons of private health plans, it is equally important to know about social health insurance's advantages and disadvantages. Many social health insurance schemes are applicable only to low-income families. If you meet specific criteria according to the social health insurance, only then can you invest in the plan?

Now that you know about the advantages and disadvantages of health insurance, you may wonder if a health plan is essential. Yes, it is important to buy health insurance despite all the disadvantages, as your medical expenses will be taken care of. The only catch here is to analyze various health care plans available online before choosing a specific one.

For a cost-effective medical insurance plan, check out the wide range of Aarogya Care plans on Bajaj Finserv Health. The Complete Health Solution is a popular offering that provides total medical coverage up to Rs.10 lakh. With umpteen benefits like high network discounts, free unlimited teleconsultations, wide network, doctor consultation and lab test reimbursements, free preventive health checkups, and more, this is a policy you can trust. Make a smart choice by investing in a healthcare plan today. Apart from Aarogya care Bajaj Finserv Health Offers a Health card that converts your medical bill into easy EMI.

References

- https://www.ibef.org/industry/insurance-sector-india

- https://www.statista.com/statistics/657244/number-of-people-with-health-insurance-india/#:~:text=In%20the%20fiscal%20year%20of,the%20lowest%20number%20of%20people.

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.