General Health | 5 min read

Ayushman Bharat Yojana: 5 Important Things You Need to Know About It

Medically reviewed by

Table of Content

Key Takeaways

- GoI launched Ayushman Bharat Yojana to provide financial aid to poor people

- Ayushman Bharat Yojana eligibility depends on area of residence and occupation

- Ayushman Bharat card allows you to avail cashless healthcare services

Ayushman Bharat Yojana or PMJAY is a national scheme launched by the Government of India to achieve Universal Health Coverage. This scheme is also known as Pradhan Mantri Jan Arogya Yojana (PMJAY). Under this scheme, economically vulnerable Indians can get financial aid during medical emergencies. The aim for this strategy is to attain the Sustainable Development Goals. It is also to ensure that people are not pushed into poverty because of high medical bills.

Read on to know about Ayushman Bharat Yojana, its eligibility, benefits, and more.

What is Ayushman Bharat Yojana?

PMJAY is the largest healthcare scheme in the world [1]. The Government of India launched the scheme with the aim of covering more than 50 crore individuals and 10 crore underprivileged families, roughly 40% of the nation’s poorest population [2]. It will also prioritize treatment for senior citizens, women, and girl child of the nation’s population. It will further help reduce the out-of-pocket expenses of the people.

Additional Read: PMJAY and ABHA

Ayushman Bharat Yojana offers an annual cover of Rs.5 lakh to eligible families with no capping on the age and number of the family members. It covers both tertiary and secondary health expenses. Ayushman bharat scheme also offers cover for pre-existing diseases. With Ayushman Bharat card, one can avail cashless treatment.

What is covered under Ayushman Bharat Yojana?

PMJAY covers the following medical or health related expenses.

- Pre and post hospitalization – Post hospitalizations expenses cover will be for 15 days

- Intensive and non-intensive care

- Treatment, consultation, and medical examination

- Expenses that incurred because of complication from a treatment

- Treatment for COVID-19

- Food services and accommodation

Ayushman Bharat Yojana also offers cover for pre-existing conditions such as

- Pulmonary valve replacement

- Skull base surgery

- Carotid angioplasty with stent

- Tissue expander for disfiguration from burns

- Anterior spine fixation

- Prostate cancer

- Laryngopharyngectomy with gastric pull-up

- Double valve replacement

- Coronary artery bypass grafting

The scheme also has some exclusions, which are

- Drug rehabilitation

- OPD cover

- Cosmetic procedure

- Organ transplant

- Fertility procedure

- Diagnostic tests done for evaluation

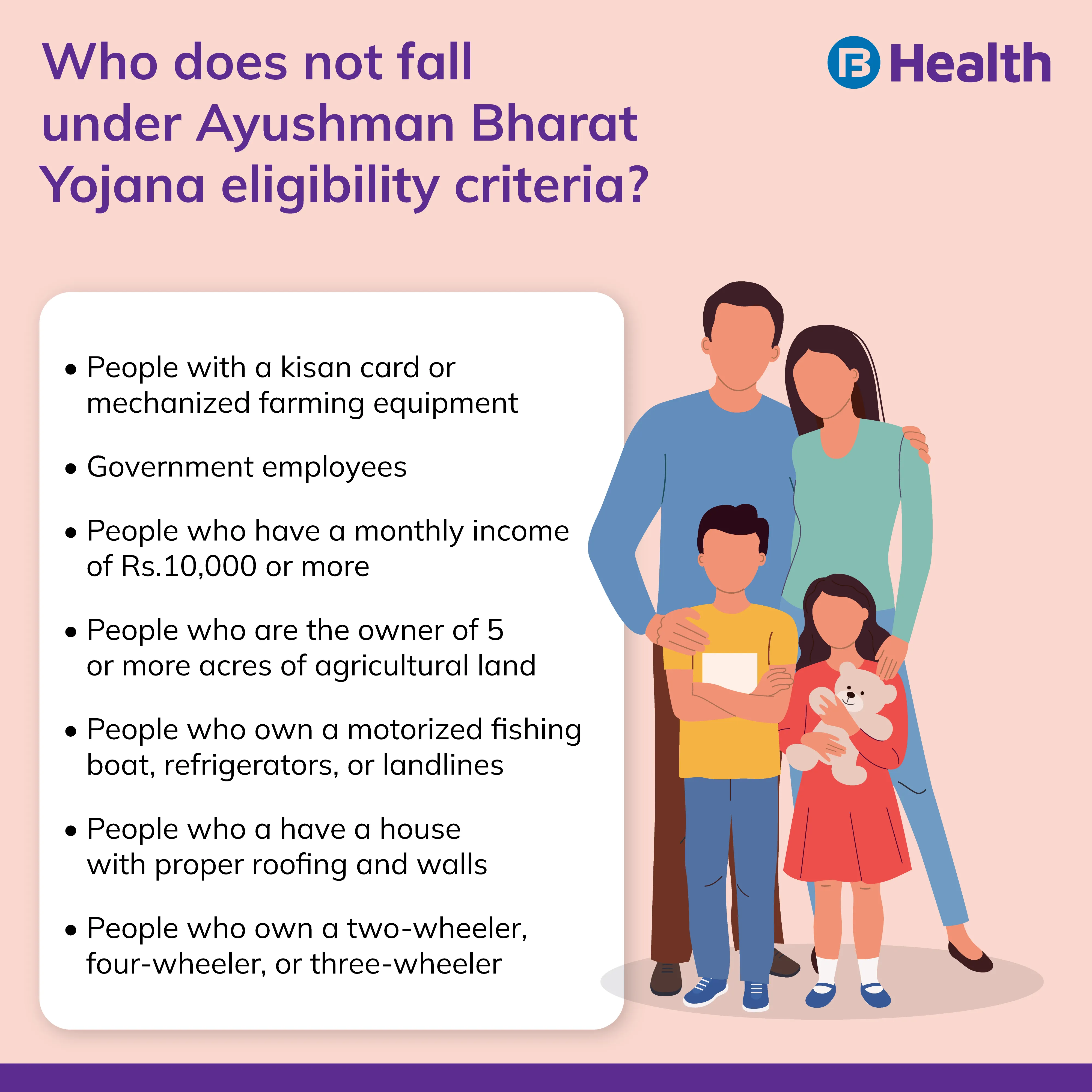

What are Ayushman Bharat Yojana eligibility benchmarks?

The eligibility of Ayushman Bharat Yojana can be broadly classified into two categories - area of residence and occupation of the beneficiary.

In rural areas, the eligibility benchmarks for PMJAY are the following.

- Families that have no adult member whose age is between 16-59

- Manual scavenger families

- People who make a living as manual laborers

- People surviving on alms

- Families that have one or more physically challenged member

- People who live in a makeshift house with no proper roof or walls

In urban areas, people with following occupations are eligible.

- Watchmen, washermen, domestic help

- Ragpickers, sweepers, gardeners, sanitation workers

- Mechanics, electricians, repair workers

- Vendors, hawkers, cobblers

- Construction workers, welders, plumbers, painters

- Peons, delivery men, assistants, waiters, shopkeepers

- Conductors, drivers, rickshaw driver, cart pullers

What is the registration process for Ayushman Bharat Yojana?

Ayushman Bharat Yojana is available to all the families that are present in SECC data. That is why there is no registration process for it. You need to check for your eligibility and if you are eligible, you can apply Ayushman bharat registration for it. The steps to check your eligibility for Ayushman Bharat Yojana are

- Visit the official website and click on “Am I Eligible”

- Generate OTP by submitting the required documents

- Select your state

- Search by your name, HHD number, mobile number, or ration card

- Get assured of your eligibility if your name appears in the search result

On confirmation of your eligibility, you can apply for Ayushman Bharat Yojana. The documents required for application are

- Age and identity proof (PAN and Aadhar)

- Income and caste certificate

- Documents that show your family status

- Personal details like residential address, e-mail address, and mobile number

What is Ayushman Bharat Card?

Ayushman Bharat Card is an e-card that will allow you to enjoy cashless healthcare services. All the beneficiaries of Ayushman Bharat Yojana will receive a Ayushman Bharat card. The card has a 14-digit unique number and it contains all the data of the card holder. The steps to download your Ayushman card download are as follows.

- Visit the official website and login with registered number

- Generate OTP after entering the Captcha conde

- Choose HHD

- Give the number to Ayushman Bharat representative so that they can verify

- The representative will verify and complete the process

- You will be asked to make a payment of Rs. 30 for get your card

The government Health ID card schemes help ensure that people get quality and affordable health services. Other than government schemes, you can also check out health insurance offered by private insurers. Many insurance policies come with an affordable premium. Check out the Aarogya Care plans available on Bajaj Finserv Health. These plans offer a comprehensive coverage with a pocket-friendly premium amount. They can offer a cover of Rs.10 lakh to a family of up to 6 members, and have additional benefits including doctor consultations and network discounts. This way, you can insure your and your family’s health while securing your finances. Bajaj Finserv Health Offers a Health EMI card that converts your medical bill into easy EMI.

References

- https://ddnews.gov.in/national-health/ayushman-bharat-worlds-largest-healthcare-scheme-completes-one-year

- https://www.niti.gov.in/long-road-universal-health-coverage#:

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.