Aarogya Care | 5 min read

Health Insurance Claims: A Guide on Cashless and Reimbursement Claims

Medically reviewed by

Table of Content

Key Takeaways

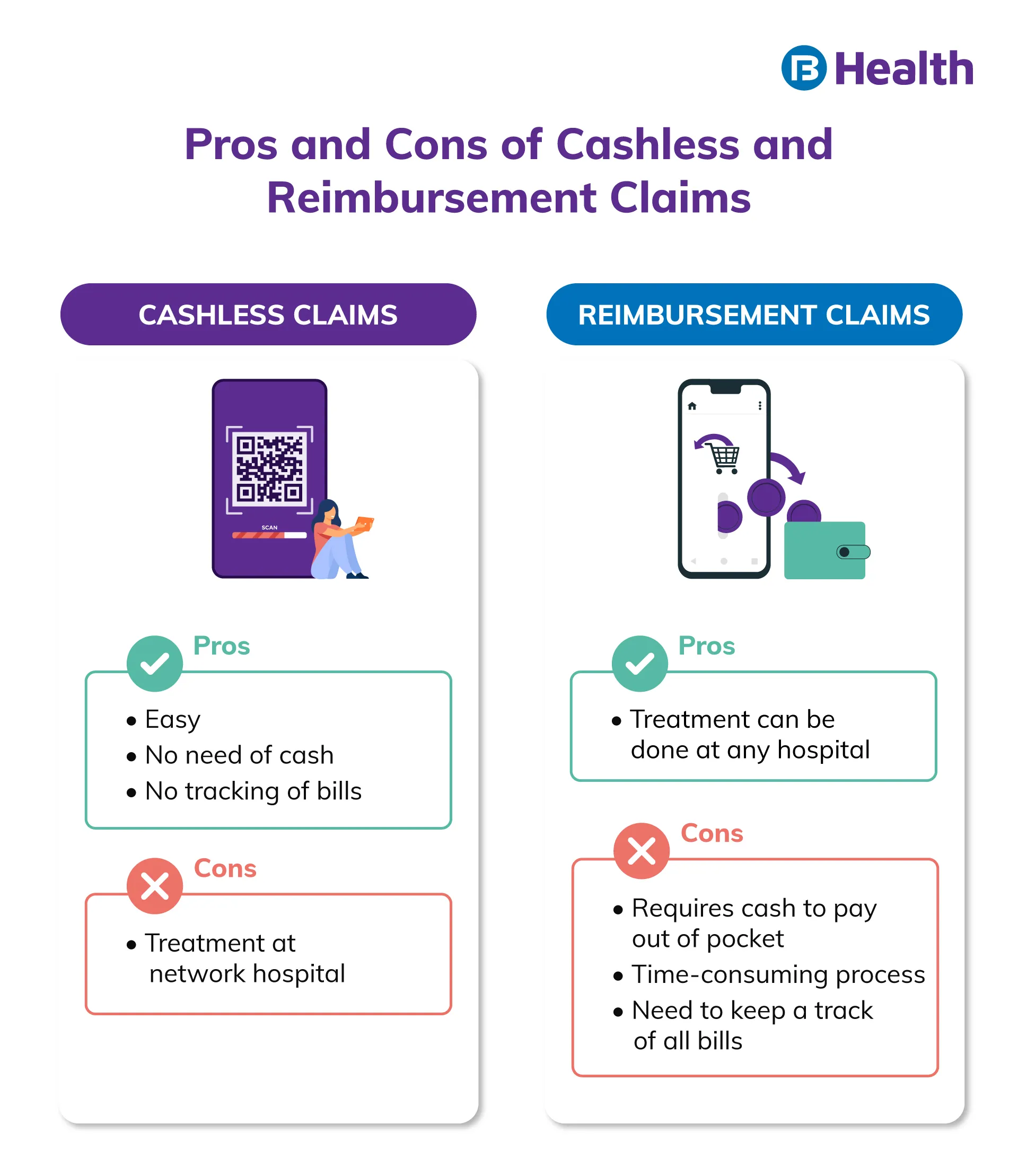

- Reimbursement claims allow you to get treated at any hospital

- Under cashless claims you will have to be treated at a network hospital

- Cashless claims are beneficial because they are easier and hassle free

When it comes to purchasing a health insurance policy, you have a huge range of options to choose from. One of the major things you should keep in mind while choosing a plan is the actual coverage you get and how you can claim its benefits. There are two types of health insurance claims was to get cover for your hospitalization expenses: in a cashless mode or by making a reimbursement claim.

In reimbursement, as the name suggests, you have to pay the medical bill yourself and the insurance provider will pay you back. In a cashless claim, you do not have to pay anything, and the provider will directly settle the bills with the hospital-based on the amount and cover of your policy.

Types of Health Insurance Claims:-

Understand the process of each type along with their advantages, disadvantages, and claim processes.

Reimbursement claim for hospitalization

How it works

Reimbursements claims are one the oldest mode of health insurance claims. Here, you will have to shell out medical expenses from your pocket. You will be reimbursed for your expenses only after you get discharged or when the treatment is complete. The process of reimbursement will start once you submit the necessary documents within the time frame mentioned in the policy. The stipulated time for submitting documents is usually 7-15 days.

Claims process

Your claim process will begin after you submit the following documents:

- Completed claim form

- Treatment and pre-admission investigation papers

- Final bill and discharge summary

- Receipts from chemists, pharmacies and hospitals

- Receipts for tests and reports

- Receipts from surgeons, doctors, anesthetist

- Certificate of diagnosis from the doctor

- Copy of PAN card and cancelled cheque for bank details

Speed

The time for the reimbursed amount to reflect in your account may vary. It depends on the type of the treatment, due diligence by you and the insurer. Usually, the claims are reimbursed within a few weeks.

Pros and cons

The biggest advantage of reimbursement claims is that you can get treated at any hospital. You do not have to go to a hospital in the network list of the insurer. This is beneficial when you have a medical emergency and do not have the time to contact your insurer.

A few drawbacks of this claim are that you have to pay from your own pocket and need to keep track of all bills too. The other disadvantage is that this process is time-consuming. According to a survey, 62% of reimbursement claims were settled only after a month of submission [1].

Additional read: How to Make Health Insurance ClaimCashless claim for hospitalization

Despite being a more convenient mode, cashless claims are less popular than reimbursement claims. Only 7% of network hospitals reported cashless health insurance claims in the year 2019 [2].

How it works

Depending on your policy, you may be able to avail cashless claim for both planned and unplanned hospitalizations. However, the process for each kind is different.

For unplanned hospitalization

Contact your insurance provider using the customer care option. After getting the information on network hospitals, you can choose the one you prefer.

For planned hospitalizations

In this case, you may have to get pre-approval from your insurance provider. Provide treatment expenses and all other vital details. After evaluating and verifying all information, the insurance provider will inform the concerned hospital.

You may need to submit following documents in both cases:

- Health card provided by the insurance provider

- Your policy documents

- Pre-authorization letter

- ID proof

- Claims process

The process of availing a cashless claim requires you to fill a form to start with. In planned hospitalization, you have to fill the form and send it to the insurer. After evaluating, your insurer will send you a confirmation letter and inform the concerned hospital.

In case of unplanned hospitalization, you have to inform the insurer about your situation. On reaching the hospital, you may be asked to fill a form that will be sent to your insurer. The hospital will record and store the original copy of your bills but if your cost exceeds the insured amount, you may take the original copies with you.

Speed

For unplanned hospitalization, you can avail cashless benefits immediately after admission. During planned hospitalization, you will need pre-approval at least a week before the treatment.

Pros and cons

One of the major advantages of a cashless claim is that it eases your worries and is hassle-free. You do not have use your emergency funds if you make use of this option. Another advantage is that your expenses are settled instantly. Apart from non-medical expenses and purchasing medicines, all expenses will be paid by the insurer. An added advantage of this is that you do not have to keep track of original bills, reports, and treatment costs. All important communication regarding costs will take place between your insurance provider and the hospital.

A major drawback of a cashless claim is that your hospital has to be on the insurance provider’s network list. If it isn’t, you will have to claim reimbursement.

Additional read: Health Insurance BenefitsAs you can see, a cashless claim can be more convenient for you. But since you cannot always visit a network hospital, make sure your provider gives you both the options. This would not only make the claim process and treatment easier but also simpler for you. To enjoy both benefits, choose the Aarogya Care Complete Health Solution plans available on Bajaj Finserv Health.

It offers over 9,000 partner hospitals for you to get treated at. You can avail the cashless claim facility too. Along with this, you get exclusive network discounts and online doctor consultation and lab test reimbursement. You can choose from the 4 variants with ease and get a cover of up to Rs.10 lakh!

References

- https://www.beshak.org/insurance/health-insurance/india-health-insurance-xp-survey-2020/Beshak-India_Health_Insurance_XP%20Survey%20-%202020_Dec_2020.pdf,

- https://www.statista.com/statistics/1180517/india-share-of-cashless-insurance-claims/

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.