Aarogya Care | 5 min read

What Kind of Deaths are Not Covered in Term Insurance?

Medically reviewed by

- Table of Content

Synopsis

Death is inevitable, but so protecting and securing your family’s financial future. Know what kind of deaths are not covered in term insurance here and find answers to other related questions here.

Key Takeaways

- Investing in term insurance help secure your family members in your absence

- It is important to know about types of death not covered in term insurance

- To complement your term insurance, also get a health insurance policy

Term insurance gives your family a death benefit in case of the unfortunate demise of the policyholder. But before investing, it is important to know what kind of deaths are not covered in term insurance. You may also wonder, ‘Is suicide covered in term insurance?’

While the thought of death is uncomfortable for most of us, it is wise to look at it pragmatically and get answers to these important questions. Doing this helps you plan your life in a way that your absence does not create financial challenges for your near and dear ones.

One such way is opting for a term insurance plan where you need to make premium payments for a certain period, against which the beneficiaries would get financial support from the insurance provider in case of death. However, term insurance may not cover all types of death. That’s why it is important to know what kind of deaths are not covered in term insurance. In this way, you can make sure that the nominees of your term plan know all the terms and conditions before filing a claim.

If you’re wondering does, term insurance covers natural death, rest assured that it does. Read on for an inclusive list of the types of deaths covered and not covered in term insurance.

Death due to calamities

Most insurance providers do not provide life insurance cover for death due to natural catastrophes such as earthquakes, floods, tsunamis, wildfire, drought, and more. Make sure to inform your nominee or beneficiary about this clause. Any claims made against such deaths will lead to rejection.

Additional Read: Guide to Life Insurance Policy and its BenefitsAccidental death

Nobody can predict an accident, and that’s why insurers cover accidental death in a term insurance plan, but there are exclusions. If you’re wondering what kind of deaths are not covered in term insurance when it comes to accidents, keep the following in mind.

Term insurance usually covers accidents such as road accidents but not if the policyholder was driving under the influence of alcohol or drugs that impair functions.

It also doesn’t offer benefits if the accident was caused due to participation in adventure sports such as parasailing, skydiving, river rafting, bungee jumping, skiing, and other such activities. Even death due to exposure to radiation from sources that may be nuclear is not covered. This is true even due to accidental death if the insured is participating in criminal activity. However, with the help of an add-on or rider that covers accidental death, you can ensure wider coverage.

Demise due to STIs

As sexually transmitted infections like HIV, syphilis, and more are lifestyle-related disorders, insurers do not usually cover them.

Death caused by self-inflicted injuries

Death caused by self-inflicted injuries, especially during participation in hazards or dangerous ventures, is not covered in term insurance.

Murder by the beneficiary

If the insured is killed at the hands of the beneficiary, the latter cannot make a claim for the insurance unless proven innocent.

Suicide

Is suicide covered in term insurance? Yes, it is. Killing oneself is one of the major causes of demise in India. Sometimes people make such a drastic decisions due to certain mental health conditions, monetary debts, lifestyle diseases, and more. As per the NCRB report, the suicide rate in India was 11.3 in 2020, which is a big number [1]. In such a situation, insurers do their best to assist the bereaved family.

If the date of death by suicide falls after 12 months from the date of purchasing the policy, the beneficiary may be eligible to claim the death benefits. In case the policyholder dies by suicide within 12 months of purchasing the policy, the beneficiary may get back 80% or 100% of the premium amount paid by the policyholder. However, all these terms and conditions vary among insurers, and it is important to go through the terms before signing up.

Death on account of alcoholism

Overdose of alcohol can cause various kinds of severe ailments and may eventually lead to health. No term insurances cover death due to alcohol-induced diseases or ailments.

Additional Read: Health Insurance Benefits

Demise due to substance addiction

Just like alcoholism, term insurance does not support death caused by substance addiction. People who consume drugs are highly vulnerable to getting different kinds of fatal ailments, and that is why insurers don’t cover them in term insurance plans.

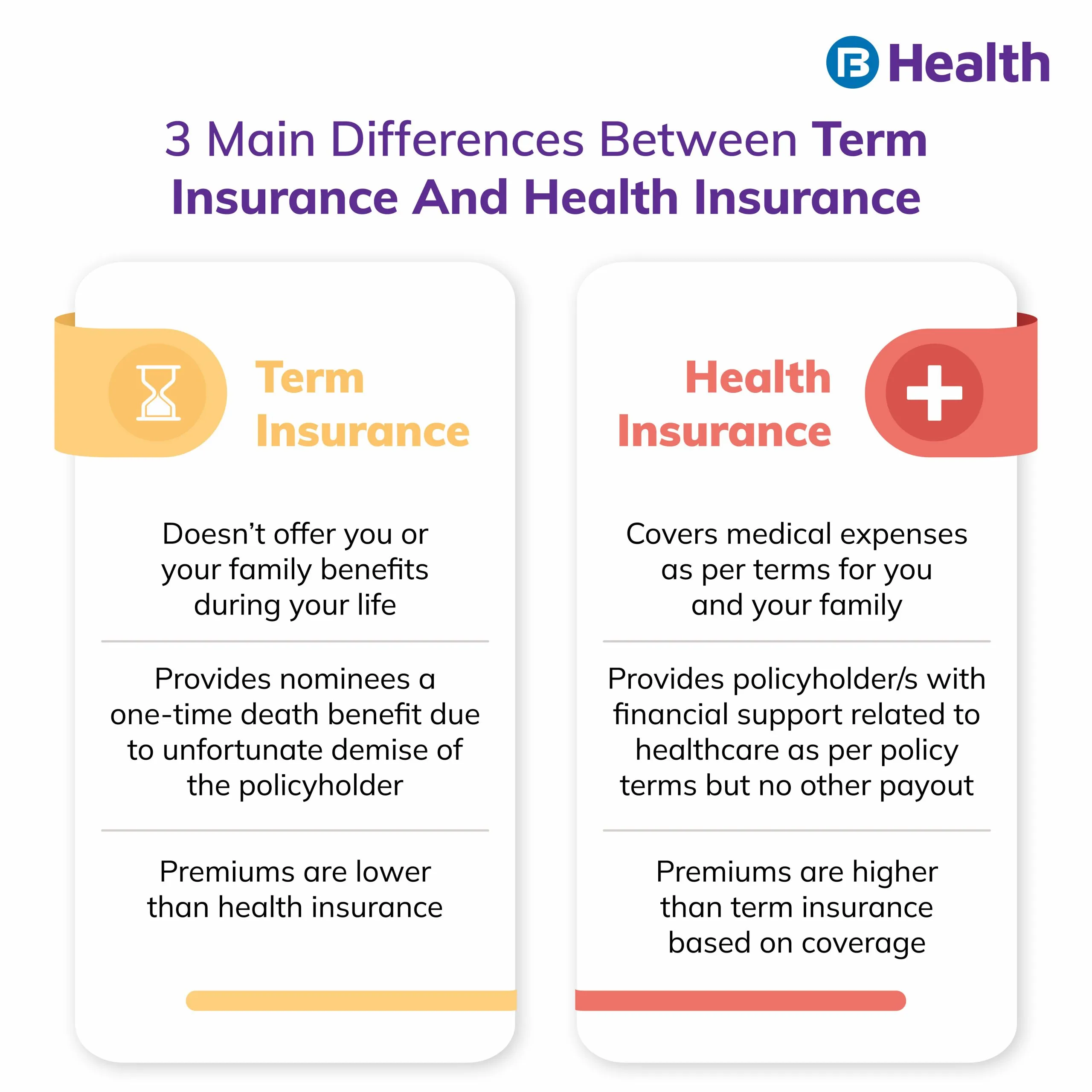

With a clear idea of what kind of deaths are not covered in term insurance, you can stay alert and away from the kind of lifestyle that puts your life at risk. However, it is important to note that subscribing to a term insurance plan is one step in securing your family’s finances. It is also important to address the medical inflation when you and your loved ones need healthcare. This is where a health insurance cover can give you a huge helping hand. It allows you to reduce your out-of-pocket expenses for both planned and emergency situations when you need medical care. For a comprehensive option, you can browse through the Aarogya Care medical insurance plans.

One of the best options is the Complete Health Solution Plan. Under it, you can get comprehensive healthcare coverage for two adults and four children for up to Rs.10 lakh. You can enjoy additional benefits like 40+ preventive health check-ups at no charge, coverage for daycare procedures, reimbursements for lab tests, and unlimited teleconsultations with a range of doctors via the Bajaj Finserv Health app or website. Apart from that, you can also sign up for a health card so you can get discounts and cashback from partners to pay for health services more affordably. Together, all these options with term insurance can help you live a financially secure life.

- References

- https://ncrb.gov.in/sites/default/files/adsi2020_Chapter-2-Suicides.pdf

- Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.