Aarogya Care | 5 min read

5 Tips to Buy the Best Family Health Insurance Policy

Medically reviewed by

Table of Content

Key Takeaways

- Family floater plans provide health coverage to your entire family

- The cost medical expenses increases by 10-15% annually

- Check the family health insurance policy claim settlement ratio before buying

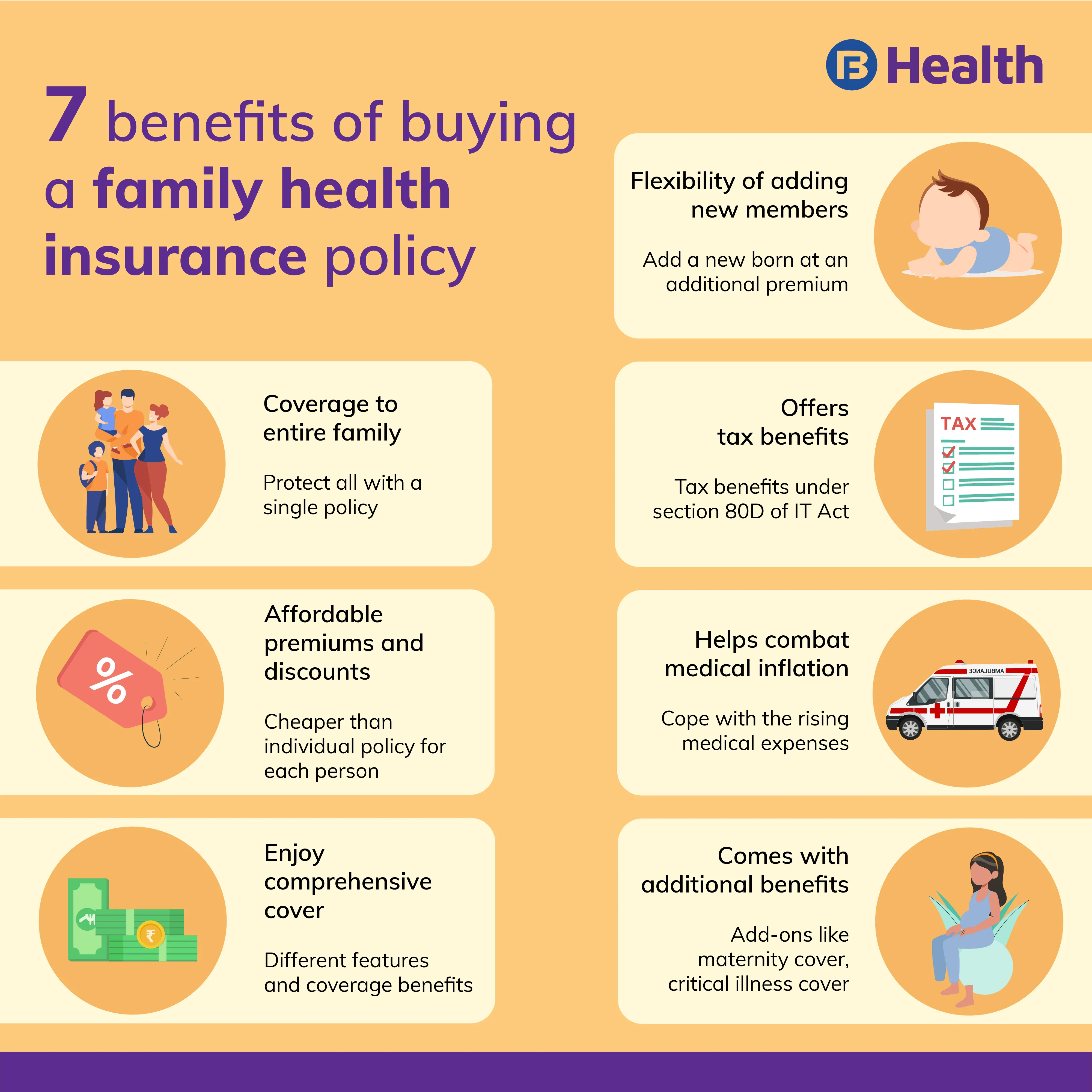

With medical inflation rising at almost 15% each year [1], buying a family health insurance policy is a wise decision. A family floater plan provides coverage for you, your spouse, children, and dependent parents. However, some family health insurance plans may also cover siblings, in-laws, and other extended family members.

Family health insurance benefits you in many ways, primarily offering much-needed financial coverage during medical expenses. However, people often make mistakes when choosing a policy. With many options available, it is imperative to consider important factors that affect both coverage and affordability.

To help you learn how to buy family health insurance and do it right, take a look at these pointers.

Additional Read: Top 5 Reasons Why Investing in Health Insurance is Beneficial

Compare and choose the right sum assured and premium

Before you start comparing offerings, you must know your need. With the rising medical expenses [2], you will need a family health insurance policy that can offer coverage whenever necessary. Consider all the members in the policy and arrive at a figure accordingly. Do note that while it is best to get a high insured sum, you will have to pay a higher premium. Additionally, when comparing different premiums, do a thorough analysis of the coverage terms. This way, you know exactly what you’re paying for and can make a smarter decision.

Choose the lifetime renewability plan for family health insurance

Many people do not consider the validity of the policy. This is one of the main factors of any policy. Most health insurance companies offer insurance renewability up to 60-65 years. Once you cross this age, you won’t qualify for the same policy and will have to buy another, costlier policy. This is why you should buy family health insurance that provides lifetime renewability. It offers security against several age-related diseases [3], well past the age of retirement.

Go for comprehensive coverage and value-added benefits

Ensure that the health plan you buy has a comprehensive family health insurance coverage clause. Medical expenses are not just limited to in-hospitalization costs. They can include doctor visit fees, dispensary charges and more. Paying out of pocket for these expenses suddenly can be difficult. Additionally, look for coverage benefits that are suitable for your family. For instance, if you are newly married and are looking to start a family, look for a health plan that covers maternity expenses.

Likewise, if any member of your family needs OPD care frequently, look for a policy that covers those expenses. A plan with comprehensive cover provides wide coverage and includes pre-and post-hospitalization expenses. Further, many family health insurance policies offer value-added benefits. A policy with value-added benefits like free health checkups, telemedicine facilities, and free doctor consultations is something to look for.

Buy family health insurance plan with the least waiting period

Most family health insurance policies have a waiting period, which means you won’t get coverage for expenses until that time passes. This is a common condition for pre-existing diseases, for which the period can range between 2 and 4 years. So, when picking a policy, scout for one with the least amount of time. Also, be sure to declare all health conditions to the insurer, as they may reject a claim for coverage otherwise.

Consider sub-limits, co-payment, network hospitals, and exclusions

Health insurance plans will often have sub-limits on room rent expenses, ICU, and other charges. Sub-limits are also applied on OPD expenses, maternity coverage, organ transplant costs, AYUSH treatments, and domiciliary care expenses. This, along with the co-payment clause, is the percentage of the amount that has to be borne by you. Ideally, you want to pay as little as possible for treatment.Network hospitals are another benefit to look for. These are the hospitals that the insurance company has a tie-up with. At these facilities, you can avail cashless claim settlements, making the entire process a lot smoother as compared to a reimbursement.

Despite the comprehensive nature of family health insurance plans, some policies do not provide coverage on expenses like OPD treatments, medical check-ups, aesthetic treatments, plastic surgeries, and injury due to war conditions. These are known as policy exclusions. Read the policy document to know what is covered and what is excluded before buying the plan.

Additional Read: 6 Important Tips to Choose the Right Senior Citizen Health Insurance Policy

Additional Read: 6 Important Tips to Choose the Right Senior Citizen Health Insurance PolicyThese tips should help you find the best policy for your family. When comparing family health insurance coverage, be sure to check the claim settlement ratio too. This will help you identify policies that will actually benefit your family. For instance, the Aarogya Care health plans on Bajaj Finserv Health have the best-in-category claim settlement record and offer family health insurance at affordable premiums. If you’re looking for comprehensive coverage, find the best on Bajaj Finserv Health. Apart from Aarogya care Bajaj Finserv Health Offers a Health card that converts your medical bill into easy EMI.

References

- https://www.outlookindia.com/outlookmoney/insurance/health-insurance-is-a-necessity-in-todays-time-2965

- https://economictimes.indiatimes.com/tdmc/your-money/the-rising-cost-of-medical-treatment-infographic/tomorrowmakersshow/50187991.cms

- https://www.longdom.org/scholarly/agerelated-diseases-journals-articles-ppts-list-1058.html

- https://www.policybazaar.com/health-insurance/family-health-insurance-plan/

- https://www.forbes.com/advisor/in/health-insurance/how-to-choose-a-health-insurance-plan-for-your-family/

- https://www.icicilombard.com/blog/home-insurance/hoi/how-to-choose-the-right-health-insurance-plan-for-your-family?gclid=CjwKCAjwmqKJBhAWEiwAMvGt6OcxRWnkz9KGWZnxKbAAWfZZgutIaGvihpwBWiKMY20kvQUS7VAMKhoCN28QAvD_BwE&ef_id=YOQqCQACTMNKVABg:20210828055914:

- https://www.etmoney.com/blog/tips-to-choose-the-best-health-insurance-for-your-family/

- https://www.hdfcergo.com/health-insurance/family-health-insurance

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.