Aarogya Care | 5 min read

Group Health vs Family Floater Plans: What are Their Features and Benefits?

Medically reviewed by

Table of Content

Key Takeaways

- Group health plans by organizations offer health coverage benefits

- Such plans may not cover your immediate family members

- Family floater plans cover all your family members in a single plan

Getting health insurance is an important part of financial planning. Taking a policy at the right time ensures that you do not face a financial burden when you need medical treatment. With modern lifestyles comes an increased risk of health ailments, and you need an adequate health cover for your family and yourself.

It is alarming to note that more than 39 million children less than 5 years old are affected by obesity [1]. Polycystic ovary syndrome is another common hormonal problem in women, affecting 1 in 5 in India [2]. With such problems becoming more prevalent, investing in a health policy for your family is important.

There are two ways you can cover your family. You can add your family members to your group health insurance policy or buy a family floater health insurance plan. Read on to know how the two are different so that you can make the right decision.

Additional Read: Top Benefits of Health Group Insurance PlansWhat Is Group Health Insurance?

As the name suggests, this policy provides coverage to a group of members. It is commonly used by organizations to insure their employees. Companies provide group plans as a part of their benefits, which may not cover your family. But there are certain group plans that give you the option of coverage for immediate family members. These include your children, spouse and dependent parents

Why Should You Choose Group Health Insurance?

The main reason for choosing a group plan is lower premiums. The benefits you get may be limited in comparison to comprehensive health insurance plans. Under group health plans, you get benefits such as:

- Coverage for day-care expenses

- Critical illness cover

- Accidental hospitalization

- Coverage for ambulance charges

- COVID insurance

- Maternity coverage

- Pre-and post-hospitalization expenses

- Coverage for pre-existing diseases

Here are a few common exclusions of group health policies:

- Ayurvedic and homeopathic treatment

- Congenital diseases

- Health ailments due to drug or alcohol abuse

What Are the Features of Group Health Insurance?

These are a few important features of group health plans:

- Provides medical coverage benefits to employees and, in some cases, family members as well

- Covers pre-existing illness and maternity expenses

- Includes ancillary costs

- Supports cashless hospitalization at network hospitals

How Do Employers and Employees Get Benefits from a Group Health Insurance Policy?

Here a few benefits of group health plans for employers:

- Offers tax benefits

- Motivates employees especially when medical expenses are rising

- Provides good coverage options at low costs

- Improves employee retention

Here are a few advantages of group health plans for employees:

- Provides coverage for pre-existing illnesses right from the first day itself

- Comes with sufficient coverage options

- Offers extensive maternity coverage

What Are the Beneficial Features of Family Floater Plans?

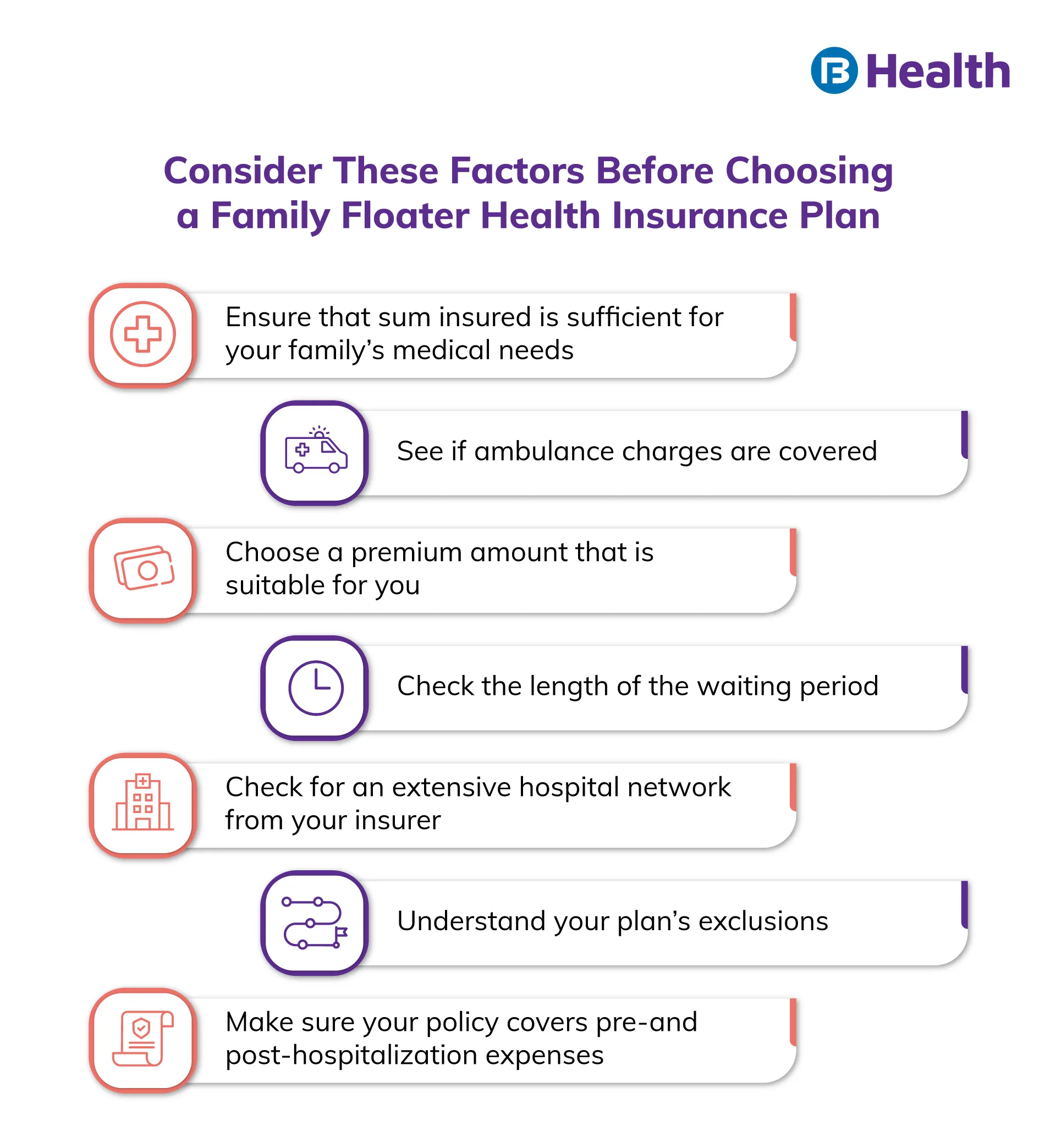

Family floater plans are designed to meet the medical requirements of families. With them you can cover all your family members under a single plan. This means that the sum insured is shared by all members included in the plan. In case any of your family members require hospitalization or other medical procedures, you can utilize the cover.

If you want to increase the sum insured, you can do so by paying additional premiums. Though a few family floater plans provide coverage only up to 65 years of age, many insurers also offer lifetime coverage. You can avail also cashless benefits at network hospitals for you and your family members.

Here is a list of a few benefits you can get with a family floater plan:

- Ambulance expenses

- Pre- and post-hospitalization expenses

- Maternity coverage

- Coverage for day-care procedures

- Coverage for mental illness

- Domiciliary treatment costs

- Daily cash allowance during hospitalization

Why Should You Choose a Family Floater Plan?

By choosing a family floater plan, you can safeguard the health of all your family members in a more comprehensive manner. When you sign up for family health plans, you don’t need to pay individual premiums for individual policies for each member. This way you can cover your children, spouse and parents at affordable premiums. If you want to add any new member to your plan, you can do so by paying additional premiums. There is no need to buy a new plan in such a situation. You also have the option of adding a maternity cover or a critical illness cover in these plans any time.

Additional Read: Types of Health Insurance Policies in IndiaIs It Possible to Shift from a Group Health Plan to a Family Floater Policy?

You can migrate from a group plan to a family floater policy. One of the biggest drawbacks of a group insurance policy is that the plan ceases to exist once you leave an organization. In this way, having a family floater plan is always beneficial. Moreover, you get comprehensive coverage in family floater policy when compared to a group plan.

Now that you have understood the differences between group health insurance and family floater plans, you can make an informed choice. While a group policy offers limited coverage, a family floater plan gives you more control and features. For budget-friendly plans, you can browse the range of Complete Health Solution plans on Bajaj Finserv Health.

With a diverse range of comprehensive benefits, these plans meet your illness and wellness requirements. You can choose between a sum insured of Rs.5 lakh and Rs.10 lakh. While all pre-and post-hospitalization expenses are covered, you can include up to 2 adults and 4 children in these plans. The premium is dependent on the number of members included. So, do your researches and choose the most suitable plan for you and your family members!

References

- https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight

- https://www.nhp.gov.in/disease/endocrinal/ovaries/polycystic-ovary-syndrome-pcos

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.