Aarogya Care | 5 min read

Health Insurance Policy: 10 Important Things For First-Time Buyer

Medically reviewed by

Table of Content

Key Takeaways

- The type of policy you need depends on number of people and coverage amount

- The premium is dependent on various factors like age and medical history

- It is good to opt for an insurer with numerous network hospitals and high CSR

The need for health insurance policies is on the rise. While the pandemic has taught us how to be careful of our health, it also brought to light the importance of having a health insurance policy. More than 14 lakh people filed insurance claims for COVID during the pandemic [1]. These policies come in handy during medical emergencies and for regular health expenses. Health policies reduce your financial stress and offer benefits apart from treatment expenses. Buying a health insurance policy for the first time can be daunting. There are many types of insurance plans available for you to choose from. However, it is important to buy a policy that has everything you need. Read to know more about what you should look for in your health insurance policy.

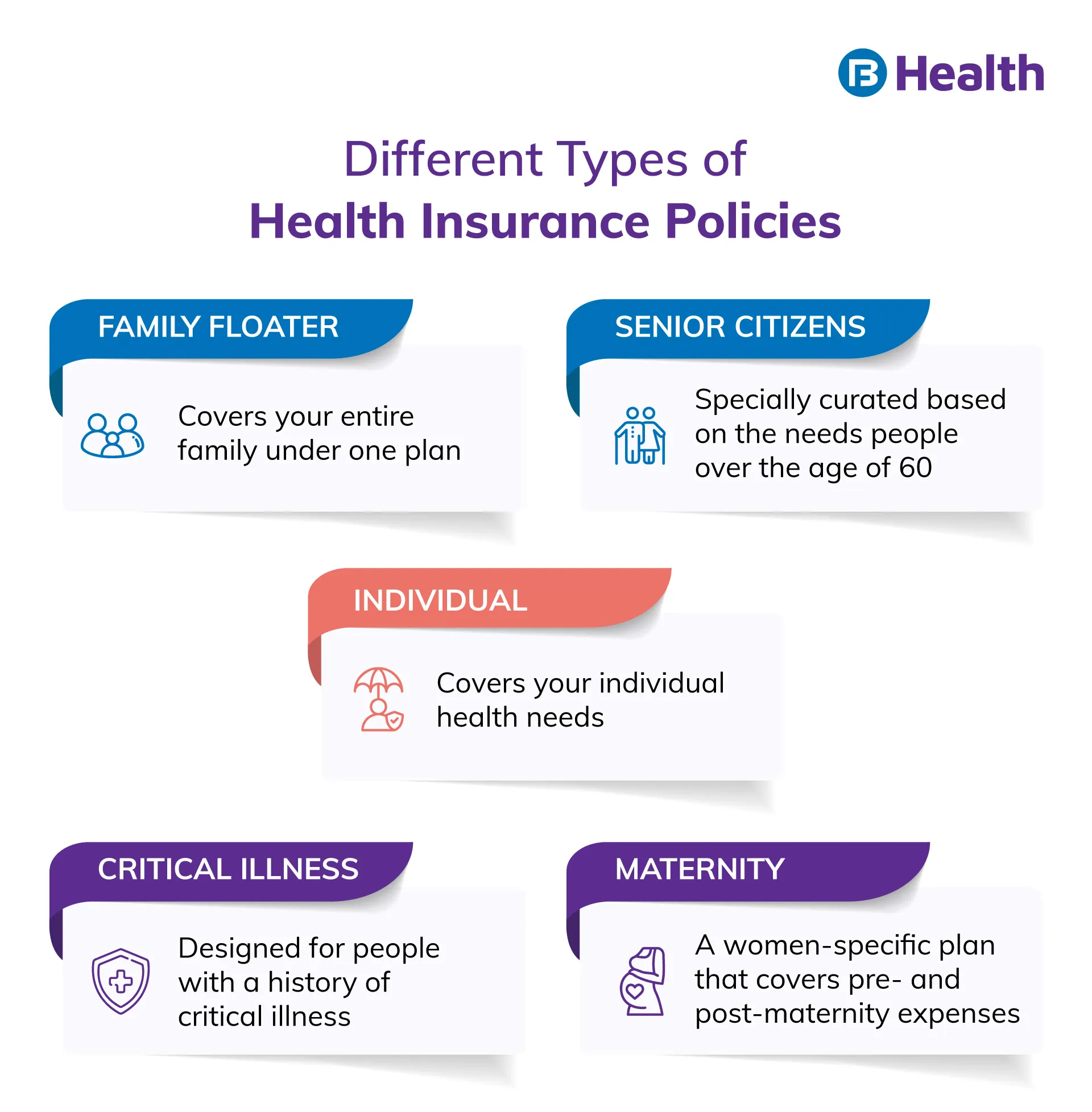

Types of Health Insurance Policies

The type of policy you need is dependent on the coverage you are looking for, as well as the number of people to be covered. You may opt for an individual plan if you have only yourself to cover. A family floater policy is the ideal option by which you can cover all members of your family under one plan. Other types of policies are maternal policy, senior citizen policy, and critical illness cover. Once you know for whom you are buying insurance and why, you can finalize a policy easily.

Additional Read: Types of Health Insurance Policies in India

Sum insured

Once you decide on the type of policy you need, compare the sum insured offered by different insurers. This is the amount you can make a claim for against your policy. However, it is important to remember that your premium amount is also dependent on the sum insured. The higher your sum insured is, the more premium you pay.

While deciding the sum insured, insurers take the following factors into consideration.

- Your age

- Your income

- Number of people covered

- Medical history

- Lifestyle

Cover offered for

After considering who will be covered under your policy, look for the ‘what’. Compare the benefits offered by different insurers to make an informed decision. An insurer may provide coverage for all or some of the following.

- Doctor consultations

- Pre- and post-hospitalization care

- Medical conditions

- Outpatient Department cover (OPD)

Make sure that the cover offered in your policy is comprehensive and adequate for your needs.

Premium amount

This is the amount you pay for your policy to come into effect. The premium is dependent on various factors. Some of these include your age, the number of people covered, medical history, and the type of policy. Your premium amount may be on the higher side if you are older, have many family members, and a high sum insured. To make a smart decision, you should compare different policies and benefits before finalizing your purchase.

Waiting period and pre-existing conditions

The waiting period of a policy is a certain period of time after the purchase during which you cannot make a claim. It is 30 days for most health insurance policies [2]. However, it can vary among providers and plans. It is best to go for a policy that has a short waiting period to be able to avail the benefits at the earliest.

Pre-existing conditions are diseases, injuries or ailments that are diagnosed up to 48 months before you buy the policy. If you already have a medical condition, ensure that it is covered by your policy. However, insurers only cover it after a pre-defined waiting period, which is usually between 1-4 years.

Copay and deductibles

- Copay is the specific amount you have to bear at the time of the settlement process. This amount is fixed by the insurance company.

- Deductible is the amount beyond which the insurance provider will pay for your medical expenses.

Note these features of health policies so that you are better prepared financially. When your policy has a copay or deductible feature, your premium amount may be lower.

Claim process

A simple claim process makes things easier for you during a medical emergency or long-term treatment. Mainly there are two types of claims, reimbursement and cashless. While each of these has their pros and cons, make sure your policy has both these options to file a claim.

Claim settlement ratio (CSR)

This ratio is based on the number of claims settled by the insurer. A high CSR means a higher probability of your claim being settled. But make sure you look at how cashless or reimbursement claims are settled. Also note the duration of the settlement process. It is always better to go to an insurance provider with a high CSR.

Network hospitals

These are hospitals that have a tie-up with the insurance provider. When you get treated in a network hospital, you have the option of making a cashless claim. This is beneficial because it relieves you of the tension to pay and keep track of bills while getting treated. That is why you should opt for an insurer that has a larger number of network hospitals.

Additional Read: Benefits of Comparing Health Insurance PlansExclusions

All policies have some exclusions. Do take them into consideration before buying one. This way, you can make sure you have adequate cover. Knowing what is not covered also helps you plan better. Read more about health insurance exclusions to know the details.

It is easy to overlook some of these key factors while purchasing a health insurance policy for the first time. So, follow this guide to make the right choice. You can also check out the Aarogya Care plans on Bajaj Finserv Health. They offer family as well as individual cover with a range of benefits. You can get reimbursed for doctor visits and get full body checkups and enjoy network discounts too!

References

- http://insurancealerts.in/MasterPage/MediaView/23804

- https://www.policyholder.gov.in/Faqlist.aspx?CategoryId=73

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.