Aarogya Care | 7 min read

How Health Insurance Premium Calculator Compares Premiums?

Medically reviewed by

Table of Content

Synopsis

Health Insurance Premium paid to receive the coverage and benefits of a health insurance plan is calculated easily with a health insurance premium calculator. This tool helps you to compare various health insurance policies so that you can make a wise choice.

Key Takeaways

- A health insurance premium is a set amount of money that a policyholder must pay to their health insurance company

- A health insurance premium calculator helps to compare various health insurance policies and their associated premium

- Many factors influence your health insurance premiums

A health insurance policy is a complete health solution required to protect yourself and your family members from the high costs of care in a medical emergency. You can buy this coverage by paying a health insurance premium. However, before purchasing any insurance policy, it is critical to consider many factors, such as the sum insured, waiting period, policy inclusions and exclusions, etc. Similarly, calculating and comparing the insurance premiums you must pay for the policy is critical. A health insurance premium calculator is a helpful online tool that estimates the premium amount you must pay for a specific health insurance policy.

Health Insurance

Health insurance is a contract in which the insurer agrees to pay some or all of the insured person's medical expenses in exchange for a premium.

Health insurance is a complete health solution, typically paying for the insured's medical, surgical, prescription drug, and occasionally dental expenses. In addition, health insurance can reimburse the insured for illness or injury-related expenses or pay the care provider directly.

Health Insurance Premium

A health insurance premium is a set amount of money a policyholder must pay to their insurance company to receive the coverage and benefits a plan provides. A policyholder must provide the necessary information for the health insurance premium calculator to calculate the premium that must be paid. The information includes the sum insured, age, any pre-existing illness, the number of members the plan must cover, and so on. This information provided by the policyholder serves as a parameter for calculating the amount of insurance premium.

Suppose an unexpected healthcare emergency occurs or a specific illness is diagnosed. In that case, the respective insurance company pays all of the benefits and coverage listed in the insurance plan, subject to the terms and conditions specified in your health plan.

Additional Read: How Health Insurance Works in India

What is a Health Insurance Calculator?

A health insurance premium calculator is a free online tool for calculating insurance premiums and comparing various health insurance plans based on factors such as age, gender, profession, and the number of members covered under a policy. One can also customize their health insurance policies and see if the insurance premium changes. A health insurance premium calculator aids in making a more informed purchasing decision.

How to Use a Health Insurance Premium Calculator?

It is simple and convenient to use an online health insurance premium calculator. You must follow simple steps to enter your basic information and select an appropriate plan. Your health insurance premium will be calculated and displayed within a few seconds. Below are the steps you need to follow to calculate your health insurance premiums:

- Locate a health insurance premium calculator online. For example, you can use HDFC Ergo, PolicyBazaar’s insurance premium calculator.

- Enter your basic information, such as your date of birth and phone number

- Decide whether you want an individual or family floater health plan. In the case of a family floater plan, include the names and contact information of the family members you wish to cover

- Select the insured amount, policy duration, and add-on covers for your health insurance policy

- Click the calculate icon to estimate your health insurance premium.

- The health insurance calculator will show the annual premium amount you must pay for the policy based on your input.

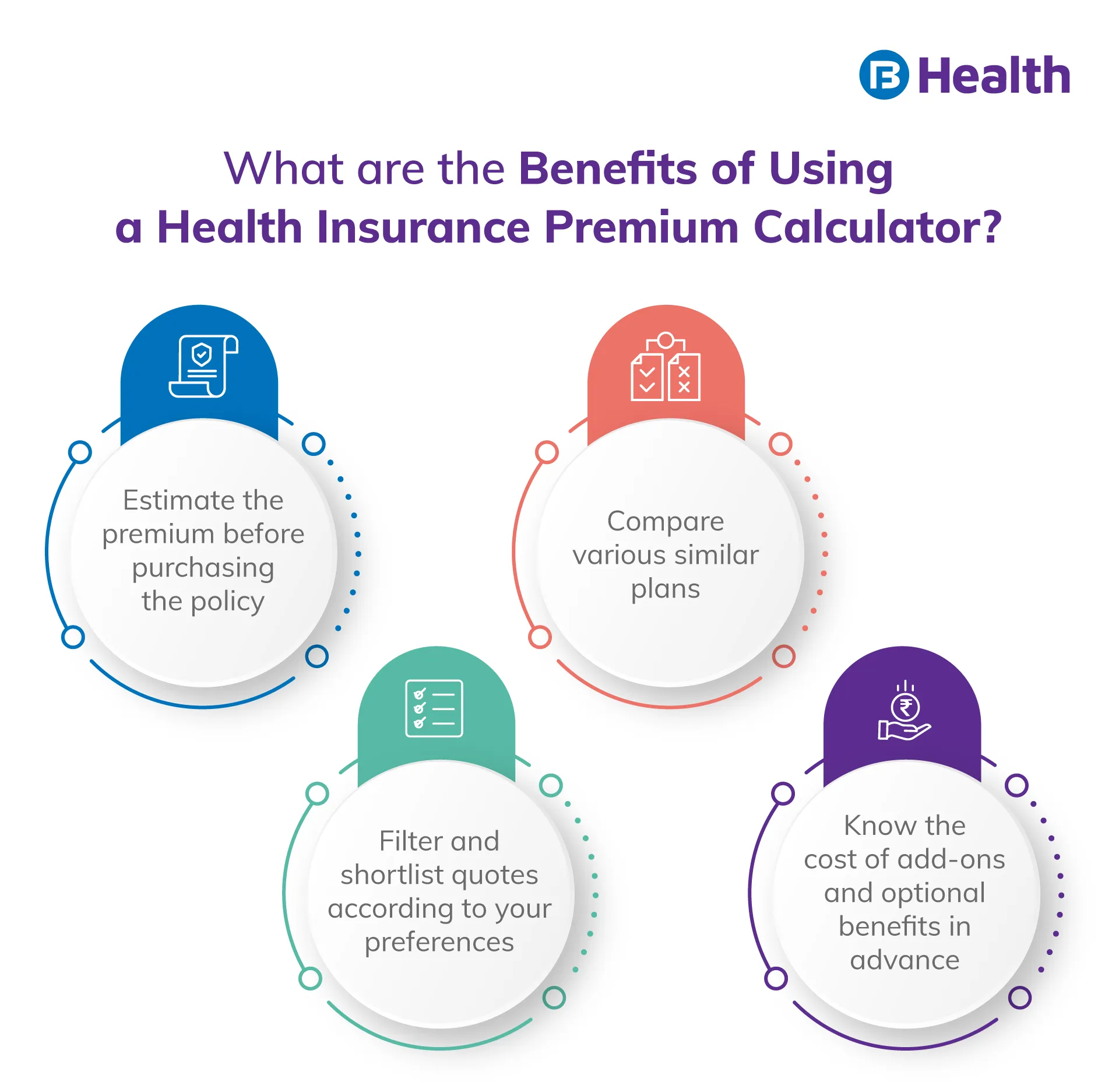

Benefits of a Health Insurance Premium Calculator

Insurance policies are complex, and policy documents frequently contain hidden terms and conditions. You'll pay far more than expected if you don't understand one or more insurance-specific terms. The following are some of the advantages of using a health insurance premium calculator:

- Estimate the premium before purchasing the policy by using a health insurance premium calculator

- Efficiently select a health insurance policy by comparing various similar plans.

- Filter and shortlist quotes according to your preferences

- The health insurance premium calculator also shows you the available discounts.

- Know the cost of add-ons and optional benefits in advance

- The health insurance premium calculator allows you to change the data you enter.

- Exclude or include add-on coverage through Riders provided by various insurance companies that offer their plans online.

- Because you are not required to meet with an insurance agent or a branch in person, you can decide when you are ready.

Factors That Affect Health Insurance Premiums

Insurance companies follow certain guidelines each time they issue an insurance policy to an individual; the same is true for a health insurance policy. The following are some of the factors that influence your health insurance premiums:

The applicant's age and gender

As you get older, you become more susceptible to illnesses and infections. [1] Consequently, as a buyer's age increases, so do their health insurance premiums. Furthermore, premiums for female applicants are typically lower than premiums for male applicants because they are at a lower risk of cardiovascular diseases such as heart attack, stroke, and so on.

Medical History

Although all insurance companies require a complete health check-up before issuing a health insurance policy, some leave it up to you and proceed with the information you provide on the application form. Before issuing a health insurance policy, insurance companies document current health conditions, family health history, and smoking/drinking habits. Based on this information, the health premium payable for the coverage is calculated, and you must pay it in order to receive the policy benefits. This also means that those with a medical history or a current condition will have to pay an additional premium to obtain coverage.

Existing medical conditions

A person with more pre-existing conditions is more likely to file a health insurance claim. As a result, the health insurance premium amount for such people is typically on the higher side. In contrast, the insurance provider will quote you a lower premium if you have no pre-existing diseases.

The applicant's lifestyle

Those who live a healthy lifestyle and exercise daily are healthier and thus pay lower health insurance premiums. On the other hand, if you smoke or drink alcohol frequently, your health insurance premiums may rise.

The type of policy you select

To some extent, the premium amount you must pay is determined by the type of health insurance policy you choose. For example, purchasing a family floater plan is always less expensive than purchasing individual health plans for different family members.

Selected add-on covers

You will have to pay an additional health premium if you want to supplement your health insurance policy with add-on coverage. As a result, your overall health insurance premium will rise.

Duration of the policy

Your health insurance premium amount is also affected by the length of the policy. If you choose a multi-year policy, your premium will be less than the equivalent amount for one year multiplied by the number of years. Most insurers offer a discount for multi-year policies.

Investments and Savings

Insurance companies put their money into public-sector investments. Due to the high risk involved, these firms typically avoid investing in the private sector. These investments adhere to the IRDA of India's guidelines to prevent future compliance issues.

The returns on such capitalizations determine the premium you must pay for a health insurance policy.

Additional Read: Parents Health Insurance Tax BenefitHealth insurance plans are intended to provide broader health coverage to reduce the financial burden in a medical emergency. A health insurance premium calculator allows you to compare various plans based on your needs.

We at Bajaj Finserv Health can assist you in selecting the best health insurance plan for your needs. You can find the best health insurance plan for your needs while staying within your budget.

References

- https://www.ncbi.nlm.nih.gov/books/NBK235606/

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.