Aarogya Care | 5 min read

Why is it Important to Invest in a Health Insurance Rider

Medically reviewed by

Table of Content

Key Takeaways

- A rider provides you additional benefits at affordable rates

- Common add-ons include maternity and critical illness riders

- You can enjoy tax benefits against different riders you purchase

A drastic increase in hospitalization expenses has highlighted the importance of proper financial planning. While the average hospitalization expenditure was approximately Rs.6500 in the year 2004, it increased more than Rs.20,000 in the year 2017 [1]. Investing in health insurance rider is a feasible preventive approach that can help you manage your medical costs without causing much strain on your pocket [2].

There may be times when you feel your existing health insurance policy is unable to cover all your medical expenses. In such situations, you may even think of buying a new health insurance policy. This is when riders come into play. Instead of availing a new plan, you can get additional covers that meet your requirements. What you need to understand here is that riders cannot replace your existing base plans.

They give you extra benefits at affordable costs since expenses of your riders are covered in the premium of your base plan. In short, you can meet the benefits lacking in your existing plan by investing in riders. With them, you are basically customizing your health plan to manage your medical needs better.

Read on to understand why it is really important to invest in riders and learn about the options you have.

Additional Read: How to Lower Your Health Insurance Premium

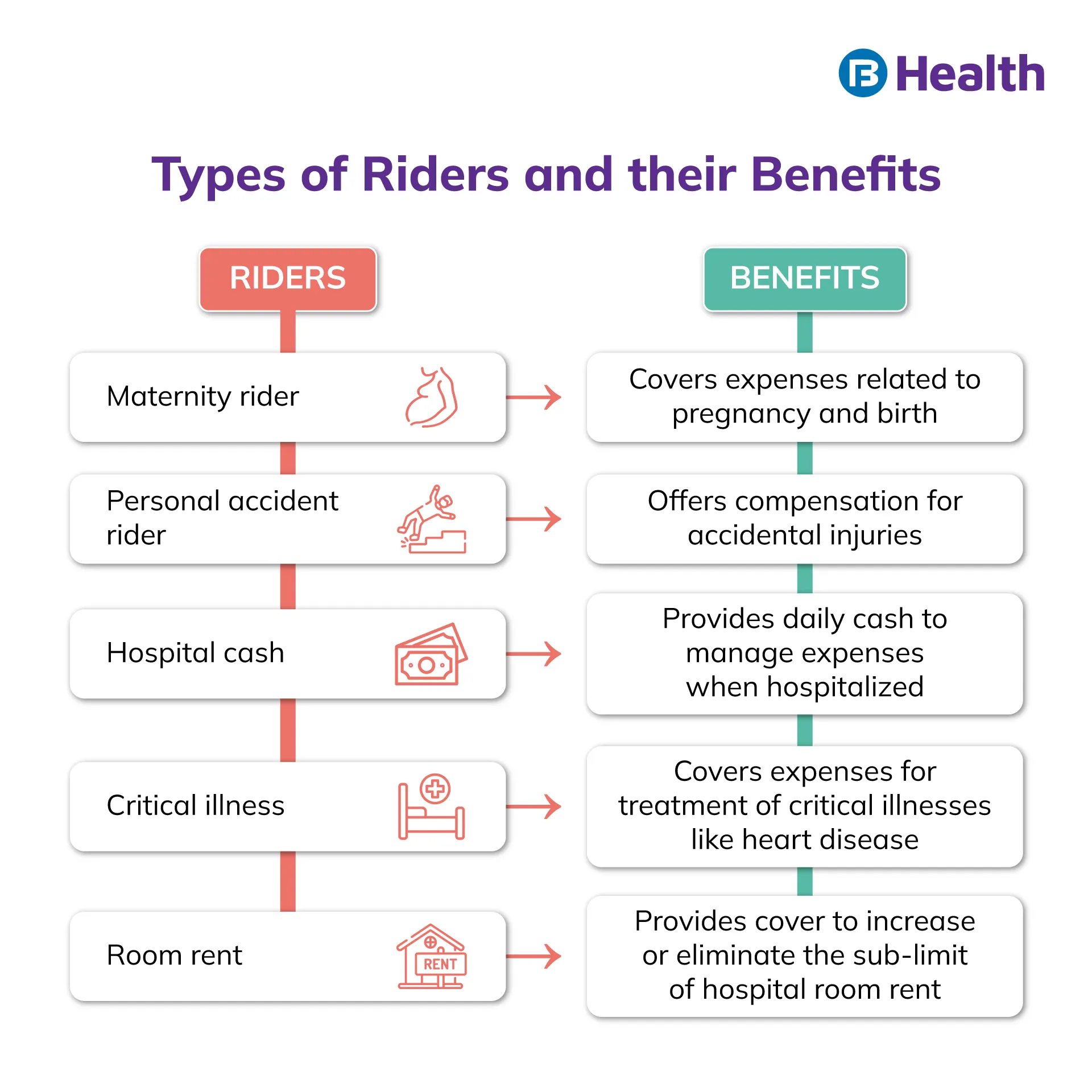

Different types of health insurance riders you should consider

Here are a few common riders you can opt for.

Maternity rider

Investing in this rider helps you cover all types of expenses that occur during childbirth. You can avail its benefits only after the waiting period, the duration of which may exceed 2 years depending on your health plan. In some cases, your newborn may also get coverage after birth until a specific timeline.Room rent waiver

Usually, insurers cover room rent to a certain limit. If you want to avoid limits on room rent during hospitalization, this is the perfect rider for you. In case you are looking for a higher sub-limit, this is an ideal option too. Using this add-on, you can choose a hospital room of your choice without the need for paying any additional amount up to the sum insured.

Hospital cash

This rider offers coverage by providing daily cash to manage expenses when you are hospitalized. The amount is paid once during the policy term and can be used for specific number of days as mentioned in the terms of your policy.

Critical illness rider

Any medical expenses related to critical illnesses can be covered using this add-on. For diseases like cardiac problems, cancer and more, you will be provided with a lump sum to meet your treatment expenses. Your policy will include a list of illnesses that this particular rider covers, which usually ranges between 10-38 health conditions.

Advantages of getting a health insurance rider

First, a rider is more affordable than investing in a new health insurance policy. When you buy a separate policy, your premium amount is higher in comparison to buying a rider. Another advantage you can get with riders is tax deductions under Section 80D of the IT Act, 1961. This is similar to what you get against your health insurance plan. The main benefit of a rider is that you boost the protection offered by your health policy. You can not only select from a wide range of riders, but you also have the flexibility to pick and choose what you need.

Additional Read: Important Riders Add to Health Insurance PlansDisadvantages of not adding a rider to your base plan

When you do not get a rider for healthcare expenses outside your plan, you may have to buy multiple policies to manage your needs or spend out of pocket. Since one policy usually does not cover all your requirements, you may have to port or keep investing in new ones. Tracking multiple premiums is not easy and can cost you a huge sum.

Add-ons you can skip buying

When you are planning to get riders, you may skip expensive ones like a maternity rider or a surgical benefit rider to have more cash in hand. But before you do so, ensure that your intended treatment plan during the policy period doesn’t require them. Sometimes, a standalone plan like a critical illness plan may be better than a rider as it offers a more comprehensive cover. So, buy riders on knowing your health and needs.

Remember, it is not a must for you to add a rider to your health insurance plan. If you plan to buy add-ons as a safety measure, choose it with case. Keep your health and finances in mind, as riders do increase the premiums you pay. There are so many health insurances available in the market Ayushman health accounts is one of them provided by the government. A good way forward is for you to choose a health plan with comprehensive features in the first place.

Then, you can add riders based on your needs. Browse through the coverage of Complete Health Solution Ultima plans on Bajaj Finserv Health. These plans come with illness and wellness benefits and provide you a total medical coverage up to Rs.10 lakh. With features like preventive health checkups, OPD consultation reimbursement benefits and huge network discounts, these plans have been perfectly designed to cover your medical requirements.

References

- https://www.statista.com/statistics/1267044/india-average-medical-expense-per-hospitalization-case-by-type/

- https://pubmed.ncbi.nlm.nih.gov/33557698/

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.