Aarogya Care | 5 min read

Pre-policy Medical Checkup: Its Purpose, Importance, and Types of Tests

Medically reviewed by

Table of Content

Key Takeaways

- Pre-policy medical checkup helps determine the condition of your health

- Proper cover, adequate premium are important features of pre-policy checkup

- ECG, lipid profile, blood sugar check are some common tests included here

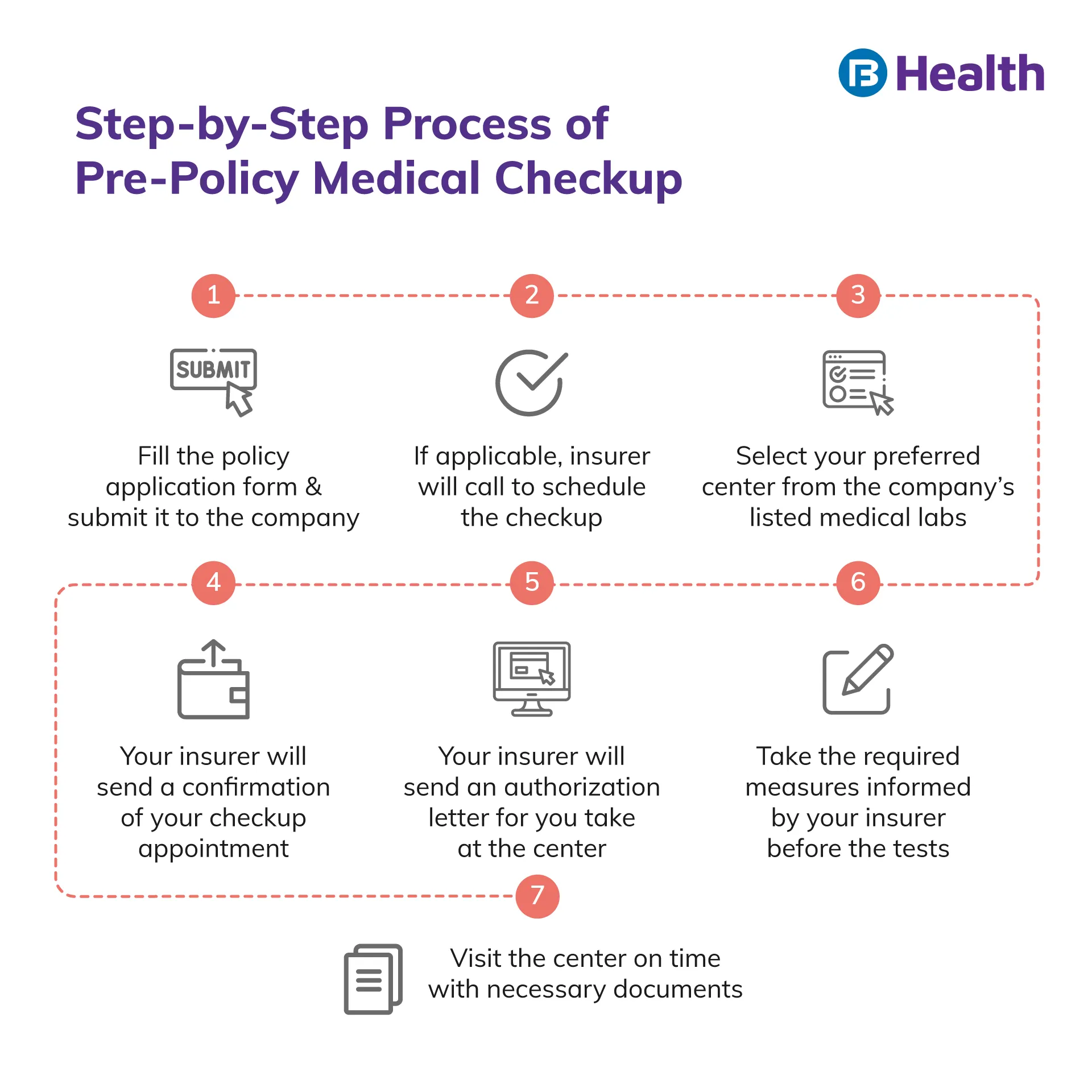

To make the most of your health insurance policy, understand its terms and wordings properly. One of the commonly used terms in insurance policies is pre-policy medical check-up. It refers to the medical tests requested by your insurer before issuing the policy.

Pre-policy checkup is not a compulsion in all health insurance policies. But after you cross a certain age, most insurance companies do request a medical checkup before issuing a health insurance policy [1]. If the policy term is of one year, your insurer will bear not more than 50% of the cost for pre-insurance medical checkups [2].

Read on to know more about the purpose, importance, and different tests under pre-policy medical check-ups.

What Is the Purpose of a Pre-Policy Checkup?

The main purpose of a pre-policy checkup is to determine your health condition before the insurer offers you cover. It helps your insurer determine which plan is most suitable for your health needs.

A pre-policy medical checkup is usually requested in two cases. The first one is when the age of the insurer is above 45 years. This is because after a certain age, your body is more vulnerable to certain health ailments. These conditions often go unnoticed and may lead to complications and high risk in the future. Since, you are at a higher risk after 45 years, the risk undertaken by your insurer is also higher. This is why your insurer may request for medical tests before approving your policy.

The second case for pre-policy checkup is when the sum insured is higher than the average sum insured. This is because a high sum insured means a higher risk for the insurer. Generally, a sum insured higher than Rs.10 lakh requires pre-policy medical checkups. The following terms and conditions are decided before scheduling the appointment for a pre-policy checkup:

- Payment

- Location where you will undergo tests

- Type and number of tests

Why Is a Pre-Policy Checkup Important?

Here are 5 reasons why it is important and why you should opt for it.

Can Avoid Paying a Huge Premium Amount

If you avoid taking a pre-policy medical checkup, your insurer may classify you as a high-risk applicant. The premiums for a high-risk policyholder are comparatively higher than low-risk applicants. To avoid paying a high premium amount, you should go for pre-policy medical checkup.Helps Get an Early Diagnosis of Critical or Chronic Conditions

The purpose of a pre-policy checkup is to determine your health condition. This means that it helps in identifying symptoms or detecting chronic conditions. Early detection will ensure that you get timely and appropriate medical treatment. It also improves your chances of getting better and saves you from expensive treatments at a later stage.

Ensures You Get an Adequate Cover from Your Health Insurance Policy

Medical tests before a buying a policy will let you know if there is anything for you to look out for. Based on the results, if you see any potential risks, you can ask for better coverage. This will ensure that you have enough cover to tackle all your medical expenses in future.

Helps Your Insurer Determine If You Are a High-Risk Applicant

A pre-policy medical check helps determine if you are a high-risk applicant by detecting your health ailments. Your insurer may consider you to be a high-risk applicant if any critical or chronic condition is detected. Depending on that, your insurer may make some changes to your policy so that it is better suitable to your medical requirements.

Makes It Easy for Your Insurer to Assess Your Claim Requests

Non-disclosure and pre-existing disease are two common reasons for claim rejection. If you have a pre-policy medical checkup, your health condition is documented. This ensures in a proper assessment of your claim request. It also helps lower your risk of claim rejection.

Which Tests Are Conducted in a Pre-Policy Checkup?

The tests conducted vary depending on your insurance provider, your age and the coverage you opt for. Some of the basic tests performed in pre-policy medical checkup are:

- ECG

- Blood Sugar – fasting

- Lipid profile

- Complete blood count (CBC)

- Blood pressure, respiratory and heart rate

- Urinalysis

- Blood serum or serology test

What Happens After the Results of a Pre-Policy Checkup?

After getting the results, your insurer will determine the policy coverage along with terms and conditions. If your results show a condition or an ailment, your insurer can opt for any one of the following options:

Rejection of Your Application

In case the condition detected requires frequent hospital visits for treatment, the insurer may reject your proposal.

Increase Your Premium

If your insurer decides to issue your policy and offer cover, they may increase your premium. The increase will mainly depend on your age and the severity of your condition.

Exclude the Diagnosed or Detected Condition

In some cases, your insurance provider will issue the policy but after excluding the cover for the detected health condition. It means that if you avail treatment for that condition your insurer will not be liable to cover the treatment costs. This is mainly done if your insurance provider considers your condition to be high risk.

Additional Read: Common Health Insurance ExclusionsWith a brief understanding of pre-policy medical checkup, ensure that you carefully go through your policy document before finalizing your purchase. Be sure to check out other benefits offered by your insurance provider. For the best options, you can consider the Complete Health Solution plans available on Bajaj Finserv Health. The four variants of this plan offer a host of benefits including free teleconsultations and discounts at network hospitals. These plan also don’t require any medical checks beforehand! Choose a tailor-made plan that offers a comprehensive cover and additional benefits without depleting your finances.

References

- https://www.policyholder.gov.in/dos_and_donts_for_health_insurance.aspx

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/RTI_FAQ/FAQ_RTI_HEALTH_DEPT.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.