Aarogya Care | 6 min read

Benefits of Buying Term Insurance Plan

Medically reviewed by

- Table of Content

Synopsis

In this day and age, amongst so many options to choose from, it can be challenging to select the right term insurance plan for yourself. But a few simple critical factors about the best team insurance plan can help you with that:

- Simple to understand

- Critical illness component

- Additional rider options

- Tax benefits

Here are a few things everyone should do to know about term life insurance and the benefits it comes with.

Key Takeaways

- A term insurance policy can offer much-needed financial support to your family after you are gone

- Several types of term insurance plans available in the market and you must choose the one that suits your requirements

- Term life insurance policies are offering a higher sum assured in return of low premiums, additional rider benefits, etc

Throughout your life, you may achieve a plethora of financial objectives. Then do the mathematics to create the financial plans to best suit your needs. However, life is unpredictable. A premature death might threaten not just these aspirations but also leave your family high and dry. Though no monetary rewards in the world can ever suffice for the loss of a loved one, term life insurance benefits in financial support to your entire family in your absence.

Term insurance plans in India are often regarded as one of the most effective types of life insurance policies available today. That is because term insurance protects your family financially in the worst-case scenario and gives tax benefits. And given growing prices, changing lifestyles, and an increase in critical illness cases, understanding what term insurance is should be the first step in financial preparation.

What Precisely Is Term Insurance?

We're here to assist if you're wondering what term insurance is. Simply put, term insurance is an agreement between the policyholder, the insured, and the insurance company. Per this agreement, the insurance company pays a certain sum to the insured person's beneficiary in the incident of the policyholder's premature demise. That is why term plans come in handy when it comes to long-term financial planning.

Additional Read: Long Term vs. Short Term Health InsuranceHow Much Term Insurance Do I Require?

The basic rule of thumb here is that a person should purchase term insurance that covers 10X-20X of their yearly salary. For example, if you earn Rs 5 lakh per year, the term insurance cover you must choose should be between Rs 50 lakh and Rs 1 crore. Many term insurance policies additionally allow you to raise your sum assured by X% year after year, keeping you fully protected.How to Choose the Best Term Insurance?

There are many types of term insurance policies available on the market, each with its own advantages. However, it is always suggested not to opt for the one-size-fits-all approach when contemplating term insurance benefits.

You should obtain enough life insurance coverage depending on your financial responsibilities and pick appropriate add-ons based on your required coverage. Before purchasing a term insurance policy, the buyers must ensure they know and comprehend all the aspects of getting term insurance plans online or offline.

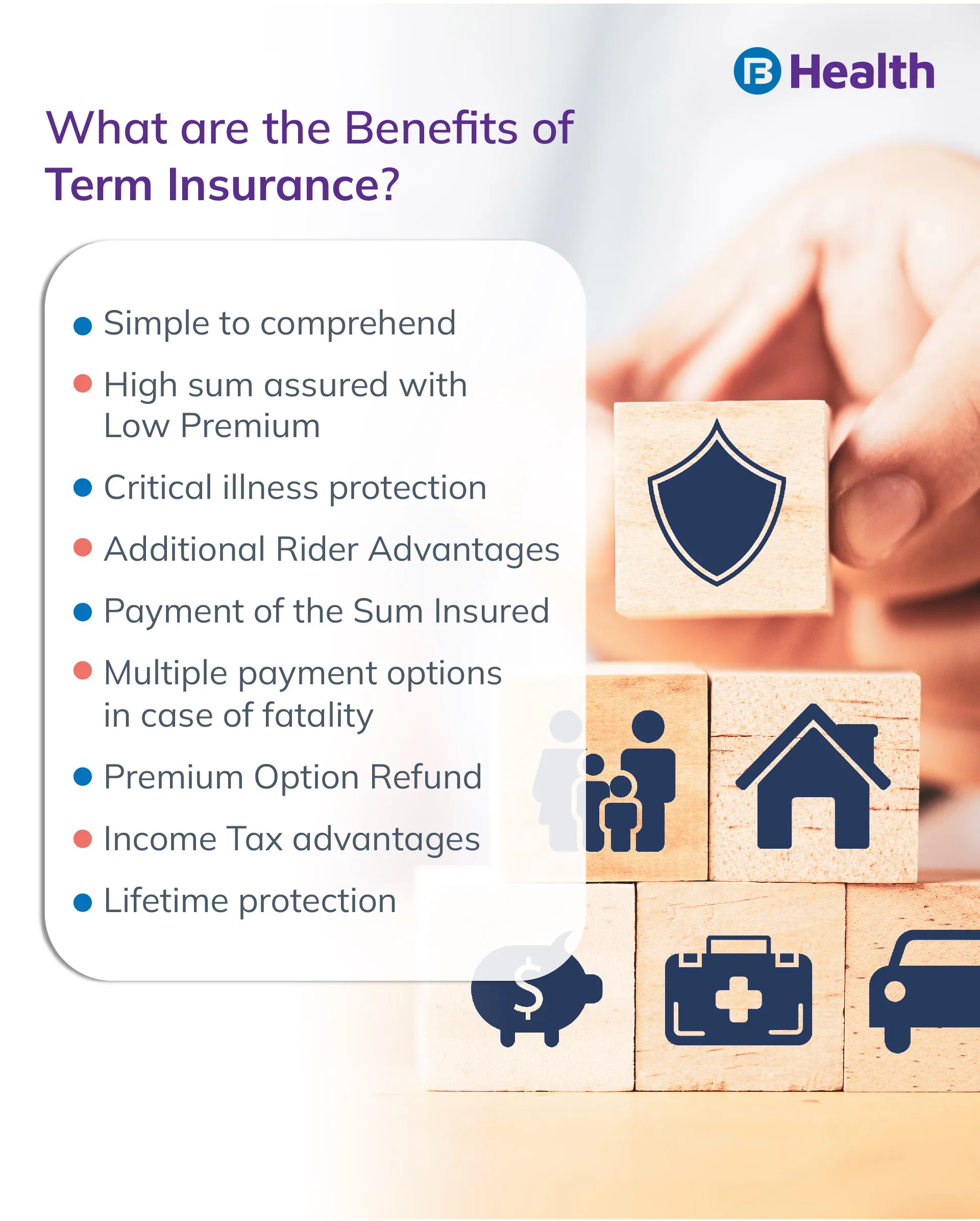

Benefits of Term Insurance

To get the most out of the term insurance policy you buy, it is also essential to understand its must-have benefits. That is because, with many insurance firms accessible in the market, you can narrow it down to the most beneficial policy and get adequate term insurance coverage.

Simple to comprehend

An advantage of term life insurance is that it is one of the most straightforward products to comprehend. Furthermore, because a term insurance policy is for the purpose of pure life insurance, it contains no investment component. One must pay the premium on time, and the insurance provides coverage for a set period and various term insurance benefits.

High Sum Assured with Low Premium

A term insurance plan is the most fundamental type of life insurance policy. The most crucial advantage of term insurance is the low cost. Compared to other insurance policies, term insurance has unquestionably lower premiums—the golden guideline for purchasing a plan is that the lesser the premium, the earlier you buy. Similarly, obtaining a term insurance policy online is preferable to buying it offline since the rates are lower. Furthermore, verifying the best life insurance and health insurance advantages online is an uncomplicated process.

Additional Read: Online vs. Offline Health Insurance

Critical Illness Protection

Any significant sickness can strike at any time in a person's life. Furthermore, the costs of treating these ailments might quickly deplete the funds. Though this fundamental term insurance benefit is life cover, one may select critical sickness cover, which is usually accessible as an additional rider option. You will not have to pay for the incurred medical bills and deplete your funds. It would help if you took advantage of this term life insurance benefit since you may be healthy now. You never know what will happen tomorrow.

Additional Rider Advantages

If you are unaware, you may strengthen your term insurance coverage by selecting various additional rider benefits. These extra rider benefits are accessible and supplied by practically every insurance company in India, and they may be included in the policy for a minimal fee. These term insurance benefits will vary depending on the carrier.

Payment of the Sum Insured

If the policyholder dies, the family will get the sum insured as a payment. This dividend can now be paid as a lump amount or as an income on an annual or monthly basis. This allows the family to pay attention to their daily costs and manage them properly.

Multiple Death Benefit Payment Options

You might be paying the EMIs on your new home, car, or personal loan. The monetary commitments that were yours originally may fall on your family members in your absence. Here, the abundant disbursement alternatives of a term insurance policy come into play.

In the event of your ill-timed demise, your dependents may receive a lump sum payment to assist them in managing the said financial commitments.

Some term insurance policies also allow you to receive a monthly income in addition to the lump sum amount as the death benefit. Your family may find it simpler to manage recurring costs with this monthly income.

Premium Option Refund

A term insurance policy does not provide a maturity benefit. However, you can only get a maturity grant if you have chosen the return of premium option from the list, which will require you to pay hefty premiums that will be repaid to you if you survive the whole policy duration. However, the entire amount for the premiums that will be reimbursed will be minus the taxes, rider premium, any levies, and the average total paid on the premium. You are also suggested to use the online term insurance calculator to get an estimate with and without maturity benefits. This will help you in making a reasonable decision and analyze your needs.

Income Tax Advantages

Term insurance also provides income tax benefits under Sections 80C and 10 (10D) of the Income Tax Act of 1961 [2]. Section 80C of the act allows you to deduct up to Rs.1.5 lakh per year for term insurance premiums paid. Aside from that, the death benefit of a term insurance plan is excluded under the Income Tax Act of 1961 Section 10 (10D).

The notable point here is that while the premium you pay for a term insurance plan is tax deductible, the payouts are likewise tax-free under current tax legislation.

Additional Read: Tax Benefits Avail with a Health Insurance PlanLifetime Protection

One of the most crucial term insurance advantages is whole life protection if you opt for it, which provides total security and covers the policyholder up to the age of 99 and beyond. A term insurance policy might assist in alleviating the financial strain on family members if the breadwinner dies.

Are You Ready to Buy Your Team Insurance Policy?

Term life insurance provides various advantages, as detailed in this article. It bids more coverage for a better deal on premium price, is easy to comprehend, and has significant tax advantages. However, before you consider all the benefits, keep in mind that the primary goal of insurance is protection, not money. Unlike most life insurance policies, term insurance adheres to this goal.

For more information on term life insurance, visit Apply for Loans, EMI Finance, Credit Card and Insurance – Bajaj Finserv.

- References

- https://www.canarahsbclife.com/term-insurance/term-insurance-tax-benefits.html

- Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.