Aarogya Care | 5 min read

11 Best Ways to Lower Your Health Insurance Premium

Medically reviewed by

Table of Content

Key Takeaways

- High medical costs force millions of people in India into poverty

- Health insurance can offer assistance when paying for costly treatment

- Premiums paid on top-up health plans are cheaper than buying new plans

With the rising number of diseases and medical inflation, buying a health insurance plan is a must today. Not every section of society can afford to pay for treatment and many are deprived of proper care. In fact, the high cost of medical services pushes around 55 million Indians into poverty every year [1]. This is where insurance helps, but premiums can also pose a problem.

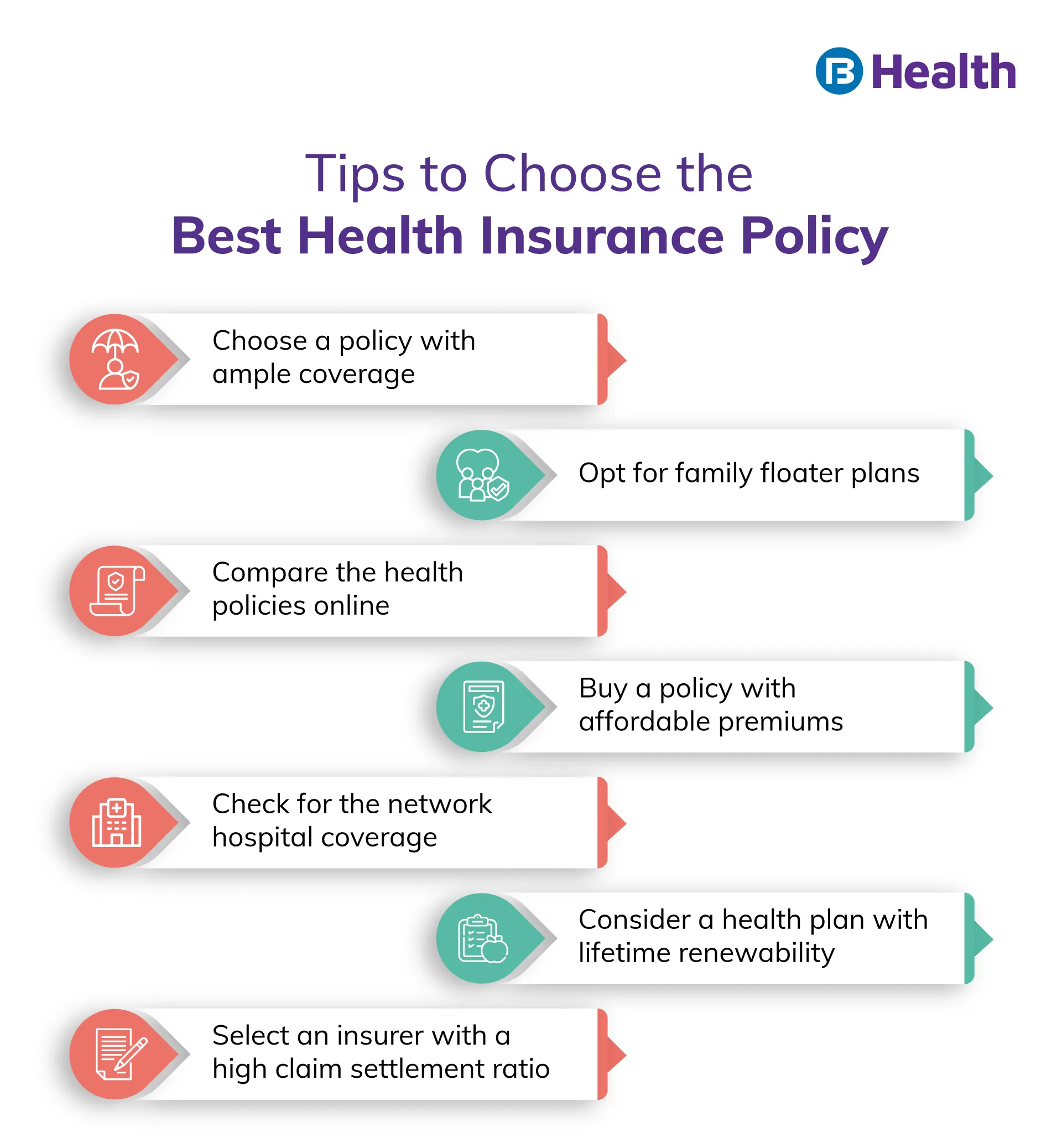

The premiums you pay for your health policy depend on several factors including age, location, and medical history. With around 30 health insurance companies offering a wide variety of plans, the best health policy is one with a premium you can afford. To help you have an affordable experience, here’s a guide on how to lower your health insurance premiums.

Buy a Health Policy at an Early Age

The risk of contracting lifestyle diseases at a young age is lower. This lowers the risk for health insurers and allows them to offer health insurance policies at a lower premium. The premiums you pay at a young age are much lower than the premiums for older people. This is because there are low chances of age-related diseases like diabetes and hypertension adding to your medical history.

Additional Read: Benefits of Buying Health Insurance in 20s

Compare the Affordability of the Plans Before Buying

With many health insurance companies offering various health insurance products, you have a lot of options to choose from. Your best choice will always be a health insurance plan that you can afford easily. This does not mean that you compromise on the benefits. Choose a policy that offers you adequate coverage, a range of features and flexibility while fitting within your budget.

Choose a Policy with Less Sum Insured

A health insurance policy with a lower sum insured will have low premium payments. Buy a health insurance policy with an adequate coverage amount. You can start with a lower sum insured and then gradually increase the amount over time. This way you can make your health insurance policy more affordable.Buy Top-Up and Super Top-Up Plans

You definitely require a high coverage amount to cover your expenses and those of your family members. With medical inflation on the rise, do not compromise on this [2]. However, since a high sum insured will attract higher premium payments, buy top-up health insurance plans instead. These provide cover above the existing limit. The premiums on such top-up plans are much cheaper. In some cases the payments are a lot more affordable than buying a new comprehensive health plan.

Consider Opting for Copay and Deductibles

A co-payment is the fixed amount of treatment expenses you need to bear every time you receive a health service. A deductible is a fixed amount you need to pay in a year towards treatment costs before your health insurance policy becomes active. Opting for co-payment and deductibles lowers the premiums you pay towards the health insurance policy. But, select the right amount of copay and deductibles wisely. This ensures that you do not end up paying more towards the treatment costs than you save on premiums.

Additional Read: High and Low Deductibles in Health InsuranceMake Use of the No-Claim Bonus

A no-claim bonus is a benefit offered by health insurance companies for every claim-free year. Policyholders with this bonus get additional coverage without an increase in the premiums. This way, you can enjoy high sum insured at low premiums. So, check if your health insurer provides the benefit of a no claim bonus before buying the policy.

Purchase Family Floater Plans to Lower Premiums

Family floater health insurance policies cover the whole family under a single plan. It offers comprehensive coverage benefits to every single member covered under the plan at reasonable premiums. The premiums you pay on family floater plans are much cheaper than buying individual policies for each family member. You can include your spouse, children, and even parents under such health plans.

Go for Long-Term Health Insurance Plans

Opting for long-term health insurance plans saves you a substantial amount of money. The premiums on long-term health insurance policies are generally lower than traditional plans. Several health insurers offer long-term health insurance plans with 2-3 years of tenure that help you lower your insurance premiums. Remember to compare the health insurance policies before buying to suit your needs.

Select the Right Zone While Buying a Health Policy

Cities in India are sorted into zones based on medical costs. For instance, Delhi and Mumbai fall under Zone A, cities like Kolkata, Bangalore, and Hyderabad are part of Zone B. All the cities that do not fall under these two zones are sorted into zone C. The higher zone cities have higher medical expenses. This also increases the premium amount payable. So, buy a health policy for the zone you live in. For instance, do not buy a policy for zone A, if you live in Zone B or Zone C city. Choosing the right zone will help you pay your premiums effectively.

Purchase Health Insurance Online for Lower Premiums

With digitalization, health insurance companies now offer health insurance services online. Buying a health insurance policy online is cheaper as it does not have administrative costs, agent fees, and is sold directly by the insurer. This lowers the cost and the premiums too, in some cases. Further, comparing and buying health policies online is easier and a lot more convenient.

Buy a Health Policy for Your Parents Before They Become Senior Citizens

The premiums on senior citizens’ health insurance policies are usually higher when compared to other individual health policies. Therefore, you should avail health insurance for your parents before they turn 60 years of age. This will help you pay lower premiums to cover their health.

A priority at the time of choosing a health policy should be to buy a plan that provides comprehensive benefits at a reasonable premium. Check the Complete Health Solution plans offered by Bajaj Finserv Health. These plans offer you complete illness and wellness benefits. Buy these plans to get a medical cover up to Rs.10 lakh for yourself and your family along with benefits like preventive health check-ups, network discounts, reimbursements, and more. Sign up today and get started!

References

- https://www.tribuneindia.com/news/archive/comment/medical-debt-a-major-cause-of-poverty-in-india-866182

- https://www.livemint.com/market/mark-to-market/indias-already-stiff-healthcare-costs-get-a-pandemic-boost-11621582098264.html

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.