Aarogya Care | 10 min read

18 Best Government Health Insurance Schemes in India

Medically reviewed by

Table of Content

Key Takeaways

- The government has initiated various health schemes for low-income groups

- Ayushman Bharat Yojana is a government health insurance scheme

- Aam Aadmi and Janshree Bima Yojana are government schemes for health

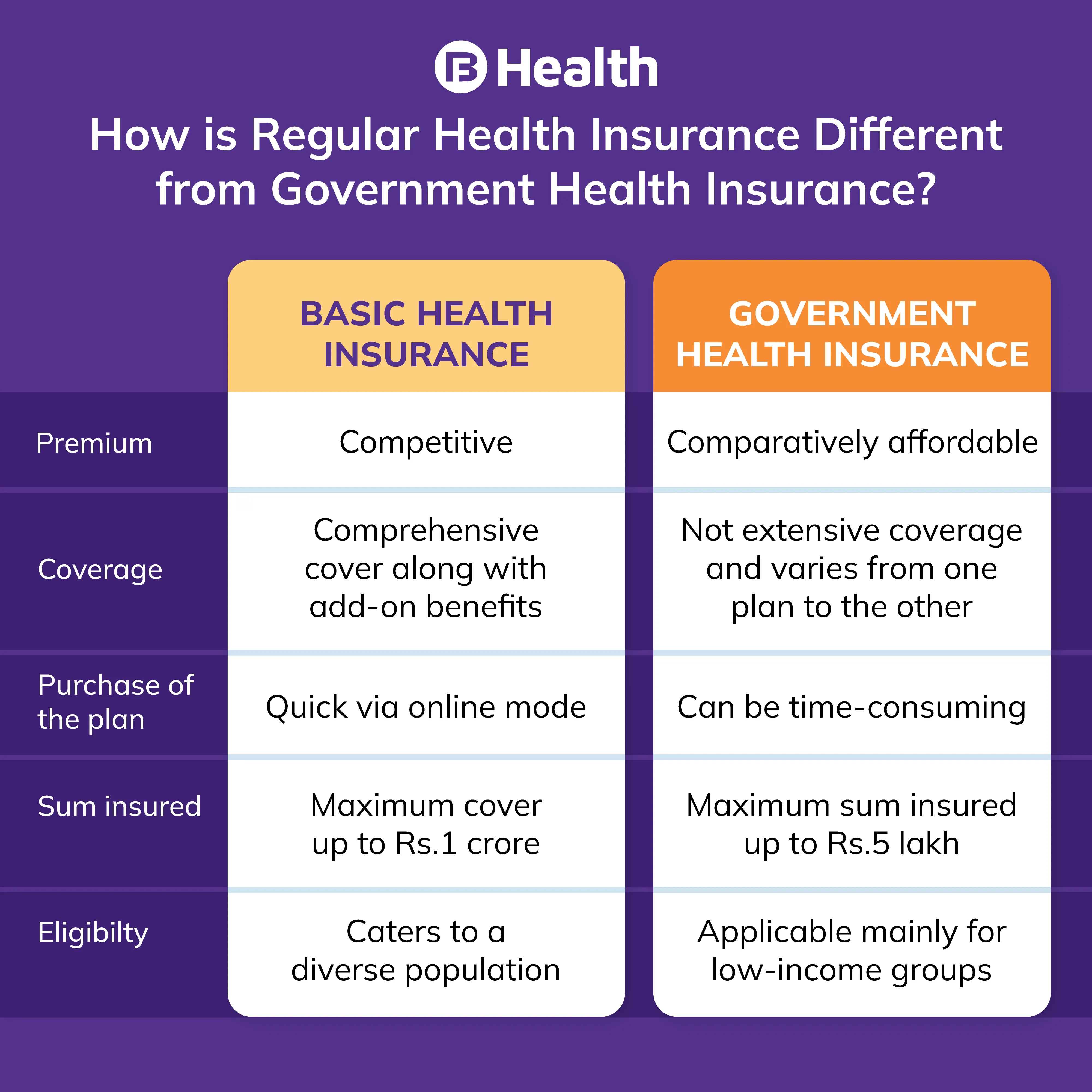

Different governments around the globe invest a part of their budget in healthcare. This includes creating health awareness, building infrastructure, and encouraging health insurance. Our government also formulates such measures that include the state and central government health insurance schemes in India. Several government schemes for health insurance have been launched with the aim of achieving universal health coverage. Some of these govt health insurance schemes are successful in lowering the mortality rate and reducing out-of-pocket expenses of the people [1, 2].

A government health insurance scheme is a state government insurance policy or a central government health scheme designed to provide health insurance benefits to citizens. You can avail these schemes of health insurance by Indian government at affordable rates. Read to know about some of these state and central government health schemes.

Additional read: What is Health Insurance PremiumAyushman Bharat Yojana

Launched in the year 2018, this scheme is now known as Pradhan Mantri Jan Arogya Yojana or PMJAY. If you are wondering what is Ayushman Bharat Yojana, it is a scheme initiated to help those from the low-income group who require healthcare facilities. This scheme helps economically backward sections of the society to access healthcare services with ease. If you avail this scheme, you get an e-card that you can use to avail services in both private and public hospitals anywhere in India. With the help of this scheme, more than 8 lakh COVID-19 cases were treated [3].

Here are a few important features of the PM Ayushman bharat registration you should know.

- Total coverage of Rs.5 lakh including 3 days pf pre-and 15 days of post-hospitalization expenses

- Eligibility criteria differs for rural and urban sectors

- You cannot avail this scheme if your monthly income exceeds Rs.10,000

- Covers critical illnesses such as prostate cancer, skull surgery

- Exclusions include organ transplants, fertility procedures

Pradhan Mantri Suraksha Bima Yojana

Pradhan Mantri Suraksha Bima Yojana is specifically designed to provide coverage against disability or death due to accidents. To avail this accident insurance coverage, you have to be an Indian national having a bank account. The age limit for availing this scheme is from 18 to 70 years. You can claim Rs.1 lakh in case of partial disability. For total disability or death, you get a cover of Rs.2 lakh. The premium is deducted directly from the linked bank account

Aam Aadmi Bima Yojana

Providing monetary support to low-income groups, this scheme is designed for people such as fishermen, handloom weaves, carpenters and more. To be eligible for this government scheme, you have to be the earning member of the family. You are eligible for this scheme even if you are not the head of your family. When you avail this scheme, financial aid is provided in the event of death or disability. If death occurs due to natural causes or accidents, your family members get monetary benefits. You also get support for partial or total disability. Pay Rs.200 annually to get a compensation of Rs.30,000 as a part of this scheme. This policy covers individuals between the age group of 18-59 years.Central Government Health Insurance Scheme

As the name indicates, this is a policy launched by the Central Government eligible for their employees. Central government employees like Supreme Court judges and Railway Board employees can avail this scheme. Initiated in the year 1954, this scheme aims to provide healthcare facilities with comprehensive coverage. Along with hospitalization benefits, you can also claim reimbursements for domiciliary care. All diagnostic and lab tests like X-ray and blood work are free under this scheme. One of the main benefits of this scheme is that you get free doctor consultations in clinics or hospitals.

Employees' State Insurance Scheme

Launched in the year 1952, this scheme provides financial cover in case of death, disability or illness to employees working in factories. This health scheme secures the medical needs of both workers and employees of factories. Some of its features include:

- Death payouts

- Unemployment allowance

- Maternity and medical benefits

- Financial benefits to dependents

To be eligible, you need to work in permanent factories containing more than 10 employees and earn a salary of Rs.21,000 per month or less (or Rs.25,000 per month or less for employees with disabilities). You get monetary benefits in case of illness or disability. Medical coverage is applicable for workers and their families as well.

Janshree Bima Yojana

This scheme caters to those who fall below or slightly above the poverty line. If you are between the age group of 18 and 59 years, you can avail this scheme. Launched in the year 2000, it is specifically introduced to provide life insurance cover. All you need to pay is Rs.200 to avail this scheme. Two special features of this scheme include:

- Women SHG groups

- Shiksha Sahyog Yojana

This term insurance plan provides a total coverage of Rs.30,000 and also includes scholarship benefits of Rs.600 to children studying in classes 9-12. This scholarship amount is offered once every 6 months.

Chief Minister's Comprehensive Insurance Scheme

This is a scheme initiated by the Tamil Nadu state government. This is a family floater plan that was launched in combination with the United India Insurance Company. Mainly aimed to provide quality medical care, it gives you a total cover up to Rs.5 lakh. You can avail medical treatment from both government and private hospitals. All individuals residing in Tamil Nadu having an annual income of less than Rs.75,000 are eligible for this scheme.

Universal Health Insurance Scheme

This scheme was launched to help families living below the poverty line. It covers the medical requirements of all members in a family. If there is a death because of an accident, this scheme provides cover for it as well. In case of hospitalization of any of the family member, you can claim medical expenses up to Rs.30,000. In a situation where the sole breadwinner of the family is hospitalized, you get a compensation of Rs.50 daily for a maximum period of 15 days.

West Bengal Health Scheme

Initiated by the Government of West Bengal, this scheme came into force in the year 2008. It is applicable for working individuals and pensioners as well. With a total sum insured of Rs.1 lakh, you get cover on both family floater and individual health plans. OPD treatment and medical surgeries are a few beneficial features available under this scheme. West bengal health Scheme is specifically designed to meet the medical requirements of state government employees.

Yeshashvini Health Insurance Scheme

This is a comprehensive scheme covering approximately 800 medical procedures launched by the Karnataka Government. This scheme aims to provide healthcare services to all the farmers associated with the cooperative societies of Karnataka. These societies help farmers and peasants enroll themselves under this scheme. The coverage benefits are applicable for family members too.

Mahatma Jyotiba Phule Jan Arogya Yojana

This health insurance policy has been introduced by the Government of Maharashtra to provide benefits for their people. Mahatma Jyotiba Phule Jan Arogya Yojana scheme is mainly for farmers and those below the poverty line in Maharshtra. When you avail this scheme, you get a total cover up to Rs.1.5 lakh for any specified illness according to terms and conditions of the policy. The best feature of this scheme is that there is no waiting period. This means you can raise a claim right after the first day of availing a policy.

Mukhyamantri Amrutam Yojana

A scheme launched by the Government of Gujarat in the year 2012, it provides benefits for people residing in the state. This scheme is eligible for individuals below the poverty line and those who are in the lower middle-income groups. It is a family floater plan that provides a total coverage of up to Rs.3 lakh. You can avail medical treatment from both government and private hospitals.

Additional Read: Is the Cost of the COVID-19 Test Covered Under Health Insurance Plans?Karunya Health Scheme

Launched by the Kerala Government in the year 2012, this scheme provides medical coverage for chronic illnesses. This critical illness plan is specifically intended to serve individuals below the poverty line. A few major diseases covered under this plan include:

- Cardiovascular diseases

- Kidney ailments

- Cancer

To enroll yourself in this scheme, submit a copy of your Aadhaar Card and your income certificate.

Telangana State Government Employees and Journalists

An initiative from the Telangana Government, this scheme is specially launched to cater to medical needs of its employees and journalists. It is applicable for retired, pensioners and employed individuals. You have the option to avail cashless treatment at registered hospitals for specific treatments as per the policy terms.

Dr YSR Aarogyasri Health Care Trust

With a main focus of offering quality medical care to low-income people of Andhra Pradesh, the former Chief Minister Dr. YSR had initiated this scheme. It provides a total medical coverage up to Rs.5 lakh. A few benefits you gain from this plan include:

- OPD facility

- Coverage for pre-existing illnesses

- Cashless treatment

- Follow-up visits

You get an Aarogyasri card when you invest in this scheme. With it, you get to enjoy seamless treatment.

Awaz Health Insurance Scheme

This health insurance scheme is applicable for migrant workers and was launched by the Government of Kerala in the year 2017. It provides insurance cover for accidental deaths. While the total health insurance cover is up to Rs.15,000, your family gets up to Rs.2 lakh cover for death. To be eligible, you have to be a laborer between 18 and 60 years. After enrolment, you will get a card that helps you avail medical care.

Bhamashah Swasthya Bima Yojana

An initiative started by the Rajasthan Government, this cashless claim scheme aims to provide health cover for the rural people of Rajasthan. It comes without any prescribed age limit. If you are a part of NFSA and RSBY plans, you can still invest in this scheme. As a part of this scheme, you get hospitalization cover for both critical and general illnesses. This plan also includes out-patient and in-patient treatment costs.

Rashtriya Swasthya Bima Yojana

This scheme is also called RSBY and was launched in the year 2008. The main aim of this plan was to provide better healthcare access to workers of various unorganized sectors, who are slightly above or below the poverty line. Since there is no job security, these workers are unable to save money. As a result, they are deprived of cash in hand during emergency medical situations. Rashtriya swasthya bima scheme offers a total cover up to Rs.30,000 to all members of their families.

Hospitalization and pre-existing illness cover are a few benefits you can avail under this scheme. All you need to do is pay a one-time registration fees of Rs.30. The respective state governments along with central government take care of premium costs.

Initiatives by the government such as the Abha card help people get access to healthcare when needed. To get covered without delay, know about them and apply for government health insurance schemes like the Rashtriya Swasthya Bima Yojana. If you do not qualify for government health insurance schemes, sign up for other policies to protect your health. If you are wondering how to choose best health insurance, check the Aarogya Care health plans on Bajaj Finserv Health.

Keeping in mind that every individual should have a health insurance policy, Bajaj Finserv Health offers affordable plans for you and your family. They offer a high sum insured along with benefits like doctor consultation and lab test reimbursements, preventive health checkups and network discounts. Sign up today to get comprehensive cover for your health. Bajaj Finserv Health Offers a Health EMI card that converts your medical bill into easy EMI.

References

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.