Aarogya Care | 4 min read

6 Types of Health Insurance Policies in India: An Important Guide

Medically reviewed by

Table of Content

Key Takeaways

- Knowing the types of health insurance helps you make better investments

- Family floater insurance covers the entire family including spouse and parents

- Group health insurance is offered by employers to benefit employees

There is no doubt that health insurance is one of the important investments to make in life. The earlier you sign up, the better it is for you. Yet, not all insurance policies are the same. There are many different types of health insurance policies in India. As per your specific needs, you can determine which one is the best health insurance in India for you.

For instance, you may consider family floater health insurance plans over individual policies. While the latter caters to only to you, the former covers your entire family more affordably [1]. Read on to know about the various medical insurance plans available in India to make a wise decision.

Types of health insurance policies

Individual health insurance policy

These are the most common types of health insurance. These health insurance plans cover the medical expenses of an individual. They usually cover:

- Hospitalization expenses

- Pre- and post-hospitalisation costs

- Surgery costs

- Daycare procedures

- Room rent

- Ambulance expenses

- Compensation in case of accidents that cause loss of income

Family floater health insurance policy

To cover your entire family under a single plan, go for a family floater policy. Its premium is cheaper than buying individual health or mediclaim insurance policies for each member. In this single policy, you can include:

- Yourself and your spouse

- Your children

- Your parents

It is better not add family members above the age of 60 under this policy. As they are more prone to diseases due to age, it can impact the premium.

Additional Read: Why is It Important to Choose the Right Health Insurance Plans for a Family?Senior citizen health insurance policy

Senior citizen health insurance is designed for people older than 60 years. Usually, the maximum age of entry is 70 years with an advantage of lifetime renewability. As older people need medical attention and are more prone to illnesses, the premium on such health insurance plans is high. This policy covers hospitalization, medicines, pre and post-hospitalization expenses, and more. Some health insurance providers even pay for pre-existing diseases. However, the coverage depends on the insurer’s terms and conditions.

Group health insurance policy

Employers or organization typically opt for this to provide health insurance to employees. It is a part of the benefits provided by companies to cover various healthcare expenses. Thus, it is also referred to as Employer’s Group Health Insurance Plans. These types of health insurance policies usually have competitive premiums [2]. Moreover, some health insurance providers allow organizations to refill sum insured unlimited times.

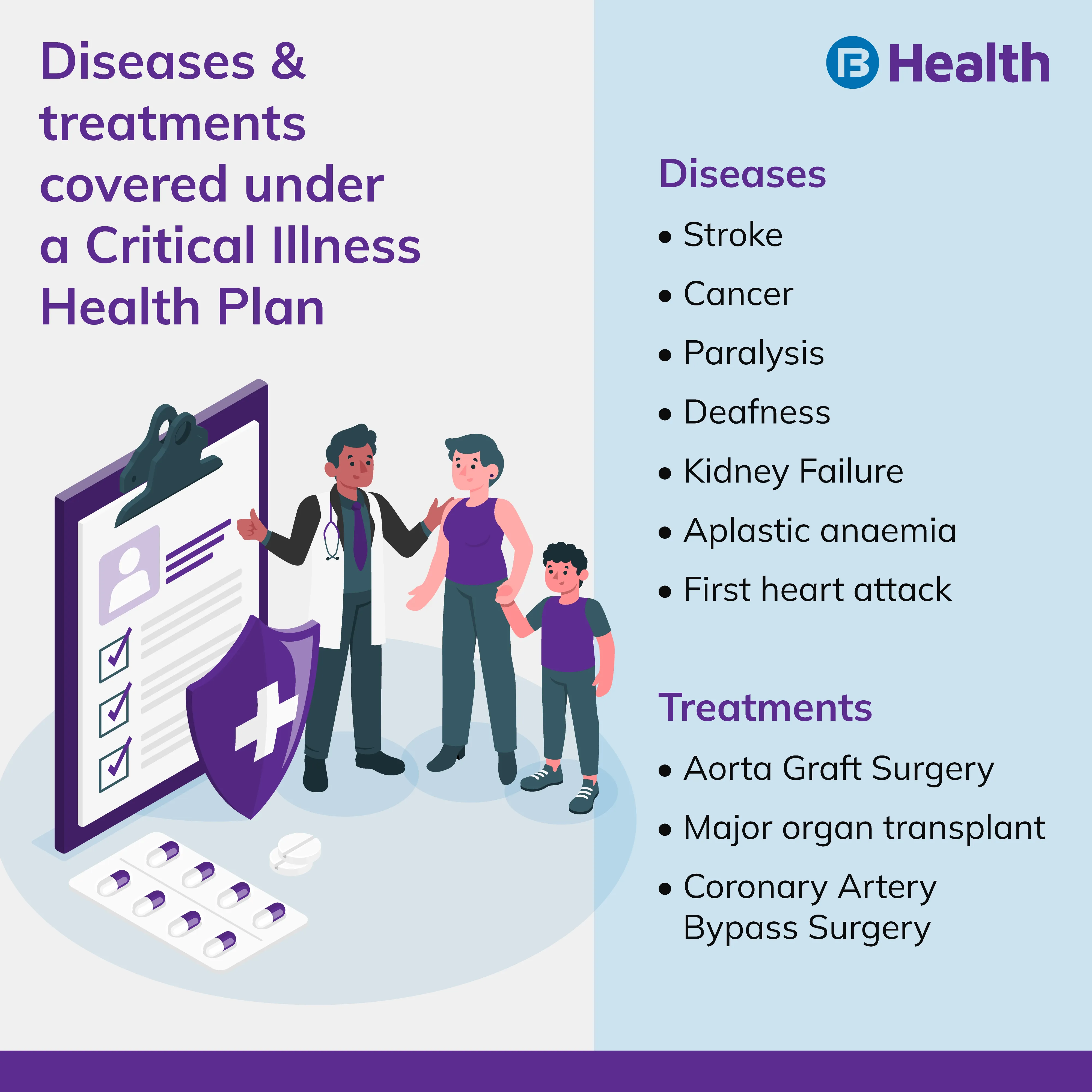

Critical illness health insurance policy

The cost of treatment for critical illnesses like kidney failure, heart attacks, cancer, stroke, paralysis, and more can be high. A critical illness plan covers medical expenses incurred due to these diseases [3]. The policyholder gets a large sanction on diagnoses of critical illnesses. However, there is no compulsion of hospitalization to make a claim. If you have a family history of certain diseases, these health insurance policies are beneficial for you.

Unit linked health insurance plan policy

Unit linked health plans, known as ULIPs, provide dual benefits of investment and insurance [4]. Here, only a part of your premium will provide you with a health cover. The remaining amount is invested into the stock market or a mixture of equity and debt. With these plans, you not only secure your health but also build your wealth. The returns you get depend on market performance. So, beware of the risk.

Additional Read: Health Insurance Benefits: 6 Advantages of Availing a Health Insurance PlanTo buy the best mediclaim policy or health policy, consider factors such as comprehensive coverage, premiums, and claim settlement ratio. Compare and check mediclaim insurance plans or medical insurance plans before you make a move. Aarogya Care Health Plans by Bajaj Finserv Health offer you a range of health insurance policies. These come at competitive premiums and offer wide coverage. They come with the highest claim settlement ratio in their category and offer a number of industry-first solutions that put your health first. These include online doctor consultation, health checkups, loyalty discounts, and more.

References

- https://economictimes.indiatimes.com/wealth/insure/should-one-choose-individual-or-family-floater-health-insurance-plan/articleshow/64604102.cms?from=mdr

- https://www.policyholder.gov.in/Group_Insurance.aspx

- https://www.godigit.com/health-insurance/types-of-health-insurance

- https://www.businesstoday.in/magazine/insurance/story/unit-linked-health-insurance-plans-safety-risk-factor-28704-2012-03-22

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.