Aarogya Care | 4 min read

Different Types of Health Insurance Plans for Family: Are They Important?

Medically reviewed by

Table of Content

Key Takeaways

- A medical insurance policy for family provides affordable medical care

- Invest in individual insurance plans or family floater plans to save money

- Children’s health insurance plans safeguard your child’s medical needs

Health plays an important role in your quality of life, and there’s nothing more important than your loved ones’ health. Illnesses can occur at any time, even if you’re active. Chronic diseases especially so, claiming the lives of more than 60 million people in India. A survey also revealed that more than 1.5 lakh people in India are suffering from respiratory diseases. To add to that, medical costs are rising in India and it now costs a lot more to get care.

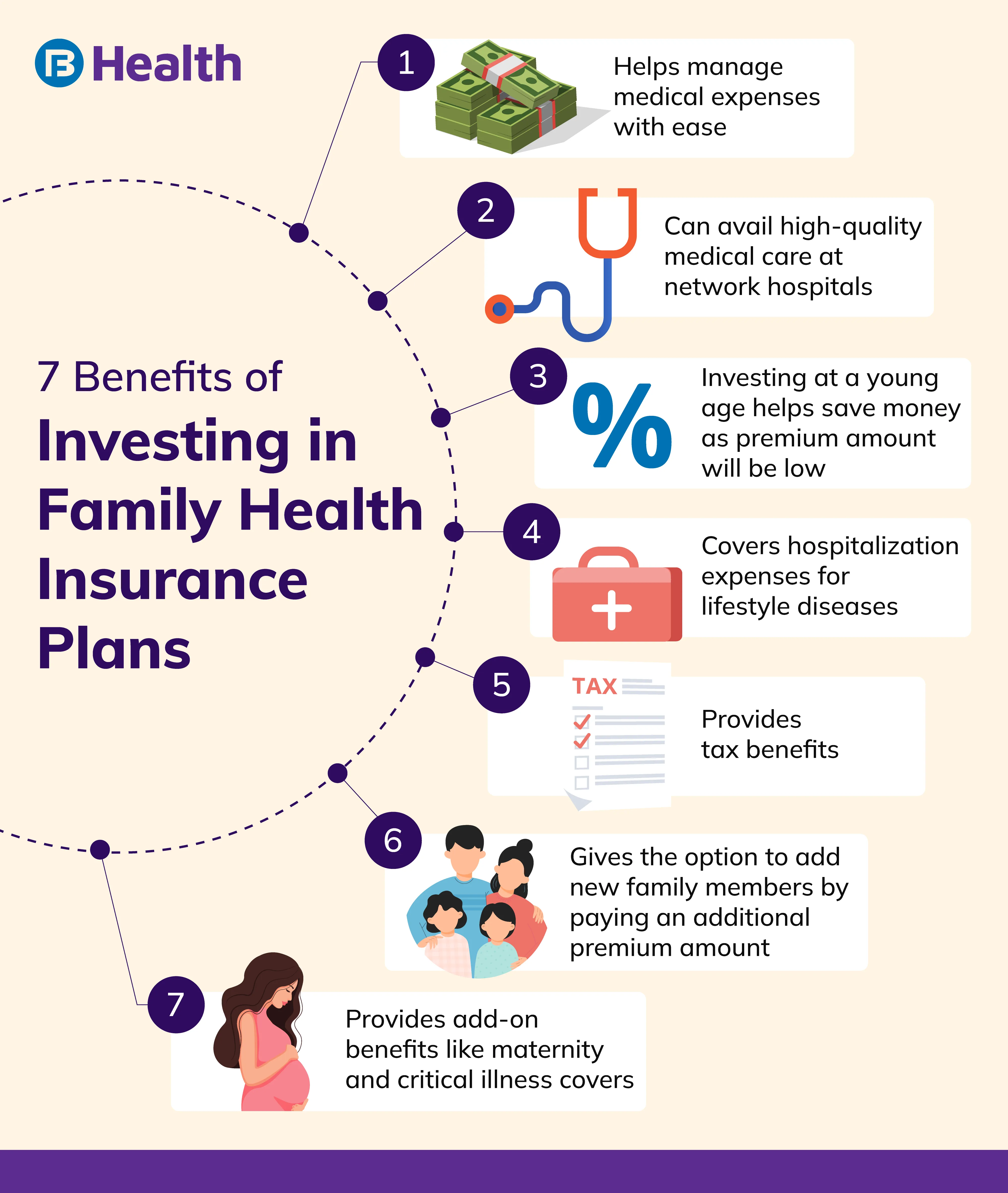

To handle healthcare without worry, be sure to get health insurance plan for family. Availing medical insurance for family helps you manage emergencies with ease. Before choosing an ideal family health plan, study the options in the market. Out of various types of health insurance plans, the best medical insurance for family is one that suits all your needs. In fact, you should get a medical insurance policy for family as early as possible. As your age increases you are more vulnerable to illnesses, and having coverage helps.

Data reveals that Type 2 diabetes is prevalent in approximately 30.42% in the geriatric population in India. Such diseases will increase your premium, but by buying a policy when you are young, you can get benefits that reduce these costs. To understand more about types of health insurance plans for family, read on.

Additional read: 6 Types of Health Insurance Policies in India: An Important Guide

What are individual insurance plans?

These plans cover only a single individual. The policyholder gets all the benefits included in the plan. The total medical expenses covered by the insurance provider is based on the total coverage opted for and the premiums paid. Few benefits offered as a part of individual insurance plans include:

- Pre- and post-hospitalization expenses.

- Daycare expenses.

- Doctor consultations.

- Domiciliary hospital expenses

- In-patient expenses.

These plans offer lifetime renewability options to the insured person. Another feature is that you can include your immediate family members but you must pay extra for each member. For instance, if your sum insured is Rs.5 lakh, you can avail this amount during the policy term. If you buy an individual insurance plan for 5 members, the total sum insured would then be Rs.25 lakh. Accordingly, the premium will be set. There are children’s health insurance plans as well. The best way to get these is to opt for family floater plans or individual plans.

Additional read: Sum Insured and Sum Assured: How Are They Different From Each Other?What are family floater health plans?

Family floater plans cover the whole family under a single policy. To explain it further, let’s assume you have availed a policy with sum insured of Rs.20 lakh. With a family floater plan, all members covered in the plan can share this amount during the policy term. This plan is ideal for newly married couples and nuclear families. This is a cost-effective option as the total premium is cheaper. The premium amount that you need to pay is based on the age of the eldest member or the policyholder. The sum insured can be used either separately or jointly by all the insured family members.

What are the benefits of family floater plans?

Few benefits of investing in family floater plans include:

- Covers critical illnesses like heart attack and kidney failure.

- Includes pre-and post-hospitalization costs.

- Offers maternity benefits.

- Ensures coverage for alternative therapies like ayurveda, siddha, or homeopathy.

- Can avail annual health checkup benefits.

You need to invest in family floater plans for the following reasons:

- To save money.

- To manage all medical treatment expenses.

- To get care for lifestyle diseases.

- To avail tax benefits.

- To ensure access to care.

What are the factors to consider before purchasing a medical policy for family?

Before you buy any types of health insurance policy for your family, go through this checklist.

- Check the coverage offered under a specific plan.

- Find a plan that allows you to increase your sum insured at the time of renewals.

- See if your hospital is included in the insurance provider’s network list of hospitals to get the claim cashless facility.

- Understand the claim settlement process of insurance companies to minimize delays.

Now that you are aware of different insurance plans for family, make your decision wisely. Consider investing in the Aarogya Care Plans on Bajaj Finserv Health. Get total family coverage of Rs.25 lakh and include up to 6 family members in a floater plan. Enjoy features like cashless claims, lab test benefits of up to Rs. 17,000, reimbursement of up to Rs.12,000 for doctor consultations, and a claim ratio that far exceeds competitors! Be proactive towards your family’s health and avail medical treatment affordably.

References

- https://www.who.int/chp/chronic_disease_report/media/INDIA.pdf

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6219134/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6130860/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3830346/#:~:text=Thus%2C%20the%20prevalence%20rate%20of,being%2D(1%3A0.97)

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.