Aarogya Care | 6 min read

Health Insurance for Disabled People in India: 3 Top Facts

Medically reviewed by

Table of Content

Synopsis

When it comes to health insurance for disabled people in India, getting easy approval and decent cover may be challenging. Find out how you can choose the best health insurance for disabled people.

Key Takeaways

- More than 268 lakh people in India suffer from different forms of disabilities

- All private insurers may not offer health insurance for disabled people

- You can opt for any disabled health insurance plan offered by government

Getting the right health insurance for disabled people is a big concern as more than 2.68 crore people in India suffer from different forms of disabilities [1]. This number is as per the census of 2011, so the actual number may be even higher. This makes it a total of 2.2% of the overall population, which is too high a number to pass over. Whether a disability is physical or mental, the associated difficulties of living with it add to the complications and challenges it brings to the individual as well as their families and caregivers.

A common concern in such situations is medical inflation, which leads to financial strain in the lives of people with disabilities and their family members. To prevent such occurrences, health insurance for disabled persons is a prudent choice to opt for. According to the Rights of Persons with Disabilities Act, 2016, a disabled person is eligible for accessing the best healthcare measures, along with health insurance [2]. You can select a disabled health insurance plan from the ones provided by the government or go for a private insurer.

Remember that while the government plans have low coverage against low cost, the private ones have better coverage against higher premiums. Also, you may not find many private insurers offering health insurance for disabled people. To know about the types of disabilities, the current health insurance for disabled people scenario in India, and how to choose the best health insurance for disabled persons, read on.

How to view disability with regard to health insurance?

According to the Rights of Persons with Disabilities Act, 2016, there are two types of disabilities when it comes to their degree in affecting an individual’s normal functioning. When it comes to people who have complete impairment of specific functions or functions of their body or mental health or both, they are called persons with disabilities (PwDs).

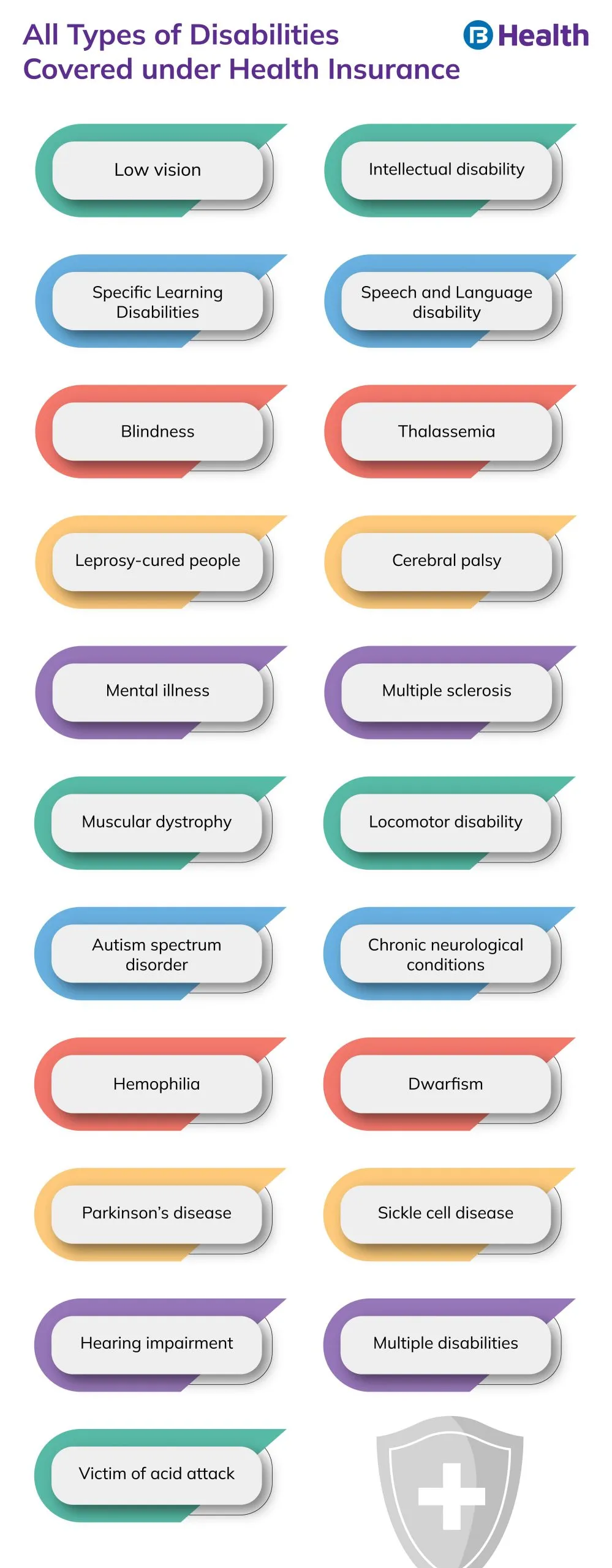

In the case of people who have 40% or more degree of impairment in their body or mental health, they are called persons with benchmark disability. Here are the usual types of disabilities one may have [3]:

| Physical disability | Intellectual disability | Disability related to mental behavior | Neurological conditions-related disability | Blood disorder-related disability | Multiple disabilities |

| Locomotor disability in cases of leprosy-cured person, individuals suffering from cerebral palsy, dwarfism, and muscular dystrophy, and acid attack victims | Specific learning disabilities, and autism spectrum disorder | Mental illness related to a substantial disorder of mental state with regards to thought process, changing moods, biased perceptions and orientations, and certain memories | Multiple sclerosis and Parkinson’s disease are some examples | Thalassemia, hemophilia, and sickle cell disease are some examples | More than one of the other conditions, causing a combination of impairments, and leading to more severe problems |

| Visual impairment such as blindness and low vision | |||||

| Hearing impairment such as deafness and hard of hearing | |||||

| Speech and language disability |

Before purchasing health insurance for disabled persons, make sure you fall under one of the mentioned categories. If not, there are high chances of the application being rejected. It is important to note that these disabilities are either congenital or acquired.

In case of disability from accidental injuries, it is classified into three categories which are total, partial, and temporary disability. An example of these includes limited mobility and performance due to injury to or amputation of limbs.

Additional Read: Making a Health Insurance Claim

What are the choices of health insurance for disabled persons?

When it comes to selecting a disabled health insurance plan, you may just get partial coverage as most insurers in India consider all forms of disability to be of high risk. However, in case of an accident, some private insurers provide personal accident cover along with a regular health insurance plan. For other types of disabilities, this may not work. Under such situations, opting for government health insurance for disabled persons can be a wise choice.

Take a look at the government-sponsored health plans offering health insurance for the disabled:

- Niramaya Health Insurance: Provides coverage of up to Rs.1 lakh to people suffering from mental disabilities. To apply for it, individuals do not need to undergo pre-insurance tests, but they must be registered with the National Trust to be eligible for the policy.

- Swavalamban Health Insurance: Any person suffering from a disability is eligible for this health insurance for the disabled, provided their family earning is below Rs.3 lakh per annum. Here, the sum insured is up to Rs.2 lakh.

What to check while buying health insurance for disabled persons?

Irrespective of whether your insurer is a government agency or a private player, it is important to check the following to make sure that your application has the best chances of success.

- Make sure you put in the correct information.

- Submit all the documents related to your disability or medical treatment, which your insurer may require

- Calculate your budget considering the premium amount and add GST

- Make sure you know the tax benefits you can get against your disability and apply for them in your Income Tax returns. Remember that under Section 80U of the IT Act, disabled persons can get a tax deduction of up to Rs.75,000 to Rs.1.25 lakh based on whether the disability is severe or not. Not just that, according to Section 80DD of the IT Act, family members of dependent disabled individuals can also get an exemption towards premiums paid for health insurance for their disabled dependent.

By knowing all these facts about options of health insurance for disabled persons, you can make the best decision to cover their medical expenses and reduce out-of-pocket expenditure. To supplement medical insurance for a disabled person, Aarogya Care plans on Bajaj Finserv Health offer a range of health cards such as the Apex MediCard. This allows you to get free screenings and consultations with doctors as well as discounts on medical services with specific partners across India, starting at a fee of just Rs.49.

A health card like this can help you save on costs associated with healthcare, check-ups, and more. What’s more, you can sign for the Bajaj Finserv Health EMI Network Card to pay your medical bills in easy EMIs. Using such means, you can reduce the strain on your finances as you give health the priority it deserves. Combined with other elements of financial wellness and security, such as a life insurance policy, you can address all your life goals and those of your dependents in a more prepared manner.

References

- https://disabilityaffairs.gov.in/content/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5419007/#:~:text=The%20RPWD%20Act%2C%202016%20provides,PWD%20by%20providing%20appropriate%20environment

- https://legislative.gov.in/sites/default/files/A2016-49_1.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.