Aarogya Care | 6 min read

Health Insurance Policy: 4 Benefits of Buying It When You Are Young

Medically reviewed by

Table of Content

Key Takeaways

- Buying a health insurance policy at a young age gives you multiple benefits

- Get covered without undergoing medical checkups and enjoy lower premiums

- With minimal health risks, avail maximum benefits of the no-claim bonus

Contrary to popular belief, it is important to purchase a health insurance policy at the earliest. This can really help you make the most of your coverage and finances. Buying a policy at a young age gives you the option of getting a lower premium with a good sum insured.

When you are young, between 18–25, your probability of health risks is lower. That is why experts recommend that you buy a health insurance policy at the age of 18 or in your early twenties. This also makes it easier for you to get the right preventive care depending on the terms of the policy. This way, you can address health issues right when they start instead of when they become severe.

Read on to know more about how buying a health insurance policy at an early age benefits you.

Additional Read: Looking for Medical Insurance Plans?

Additional Read: Looking for Medical Insurance Plans?Benefits of buying a health insurance policy at an early age

Pay Lower Premiums

When you are young, your health parameters are usually at their best. That is why insurers find it safe to cover you against a lower premium amount. On the other hand, when you are older, you may be more prone to certain health conditions. This becomes a liability for your insurance provider, which results in an increase in your premium. So, the younger you are when you buy a health insurance policy, the lower will be your investment.

Get a Policy Without a Medical Test

Usually, at a young age, you pose low health risks. So, insurance providers offer you a policy without requiring you to get medical check-ups. As you get older, you may develop ailments that do not show any symptoms. You too may be unaware of potential health issues. When you buy a health insurance policy later in life, you may need to undergo a medical checkups.

The cost of this checkup may come out of your pocket and not your insurance provider. On the basis of this test, the insurers calculate your health insurance premium. In some cases, they may deem you unsuitable for the policy, and as a result reject your application. That is why it is wiser to buy a health insurance policy when you are young.Enjoy the Cumulative Bonus

Most policies have a no-claim bonus. This means that if you do not apply for claim for a whole year, you get a bonus. This bonus may be put towards increasing your sum insured without any extra cost. This can be more beneficial if you invest early, because at a young age, you may not have the need to file a claim. The cumulative bonus when added to your sum insured can help you enjoy a larger cover at the same cost. This can come in handy when you have to make a claim. To enjoy the no-claim bonus, you will have to renew the policy every year, so keep this in mind.

Buy Without Any Stress About the Waiting Period

When you buy a new health insurance policy, there is usually a 30-day waiting period before your plan comes into effect [2]. During this time, you cannot file a claim. When you are young, you may not need to file a claim during this time as you are less prone to ailment. But if you buy a policy when you are already diagnosed with a health condition, your waiting period may be anywhere between 2-4 years. During this time, you will not be able to file a claim for pre-existing medical conditions. As you get older, the probability of a medical emergency also increases. During such times, abiding by the waiting period can be tough on your health and finances.

Get More Options from the Market

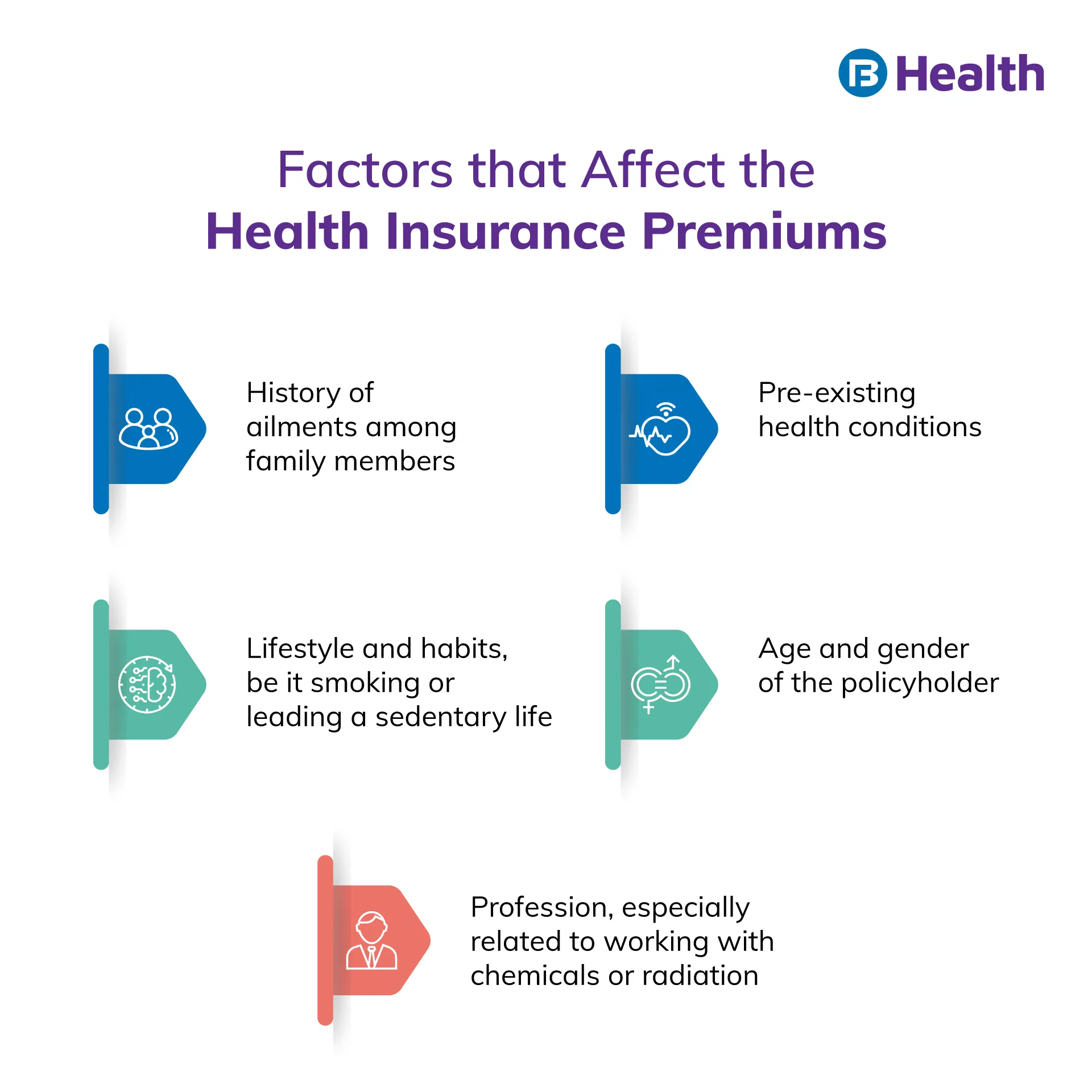

There are some insurance companies who do not provide insurance to people past a certain age. When you are young, you get more options and can make the best decision about a policy that is right for you. As you get older, here are certain factors that may affect your policy coverage and your premium.

- Your age

- Pre-existing medical conditions

- Number of people insured

How your health insurance policy premium changes as per your age

Buying a Policy in Your Late 20’s and 30’s

In your twenties and thirties, you may have less financial pressure and can pay your premiums easily. You may also have low premium amount and may be able to pay for add-ons which you may need in the future. In addition, you may get the option of life-time renewal and enjoy no-claim bonus for a longer period. During your thirties, you may be planning a family and need more cover for the same. At this phase of life, you may require a policy that includes certain health conditions that you may be at risk for. These factors may cause an increase in your premium amount.

Buying a Policy When in Your 40’s and 50’s

Your forties and fifties are the time when you may have more financial responsibilities. You may also be diagnosed with certain common health conditions like high blood pressure or diabetes. Due to these factors, you may need a higher cover in your health insurance policy. Opting for family floater may lower the premium to some extent but it will still be high when compared to your premium in your 20’s and 30’s.

Additional Read: Buy Medical Insurance for ParentsBuying a Policy When You Are Over 60

After 60, your chances of being diagnosed with health conditions are high. You may also need hospitalization and long-term treatment. At this age, a normal health insurance policy may not be enough for you. You may need to go for a senior citizen policy that gives you a higher insured sum. It may also give coverage for certain health conditions and treatments. This adds to your premium and may turn out to be heavy on the pocket.

Apart from buying a health insurance policy at a young age, one of the major things you should look for in a is what is being covered in it. Having a policy that covers your pre- and post-hospitalization expenses as well as consultation charges and lab tests is more beneficial for you. For all this and more, you can opt for the Complete Health Solution plans available on Bajaj Finserv Health. It has four different pocket-friendly plans tailor-made for your unique requirements. This way, you can choose the best plan for your needs and secure your as well as your loved ones’ future.

References

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.