Aarogya Care | 6 min read

6 Reasons Why Health Insurance Is Better Than a Medical Loan

Medically reviewed by

Table of Content

Key Takeaways

- You invest in health insurance as a preventive measure for your health

- You take medical loans when there is an emergency or immediate need

- Affordability and availability are top reasons why insurance is better

During a medical emergency, one of the biggest worries is about planning funds so that you can start the treatment for yourself or your loved ones. Investing in insurance or taking a loan are two of the most common ways of arranging for required finances. A key difference between them is that you can avail an insurance plan beforehand whereas you take a medical loan only when an emergency arises. While both options have their pros and cons, health insurance has an edge over medical loans. Read on to know more about their differences and why in health insurance vs medical loans, health insurance is better.

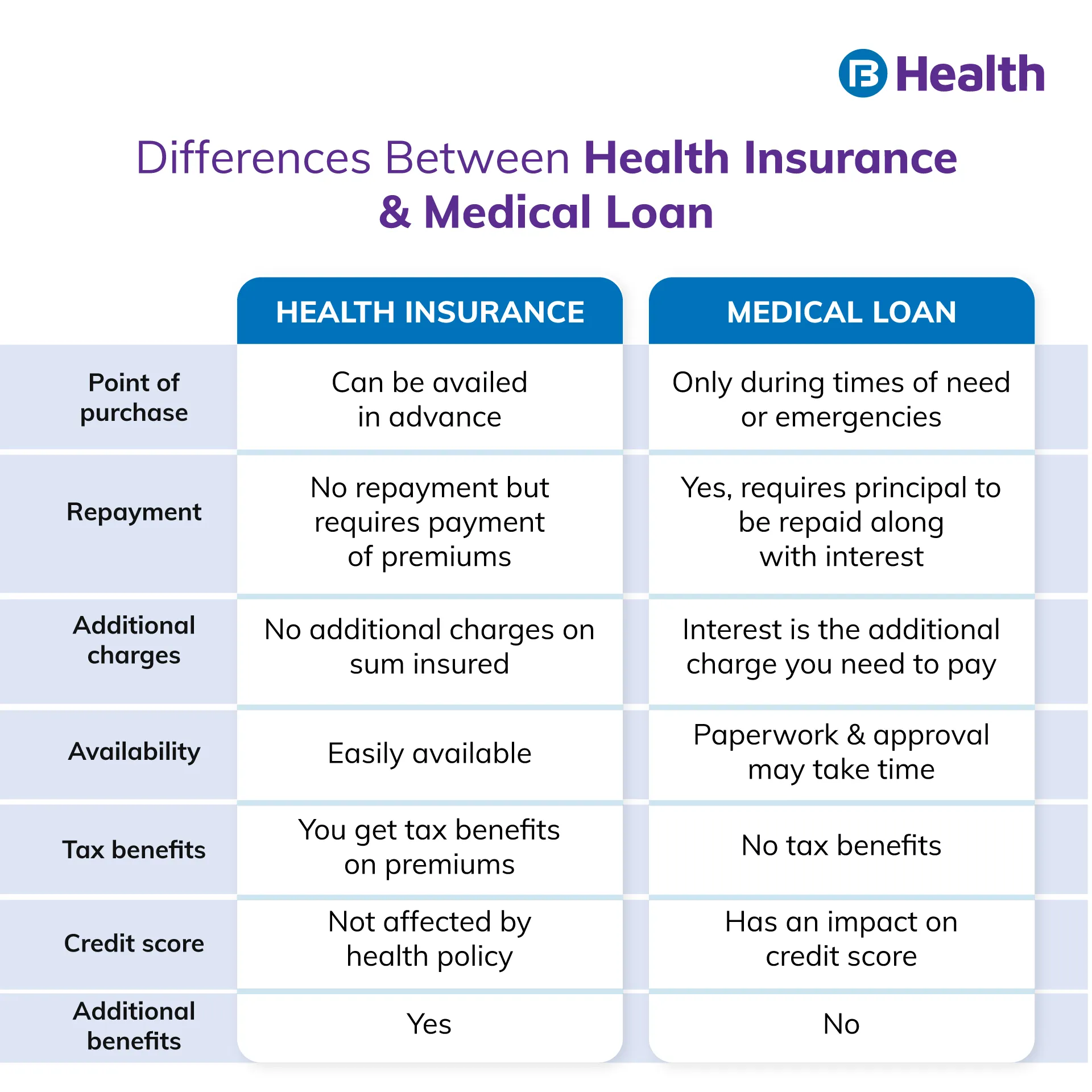

Additional Read: Difference Between Mediclaim and Health InsuranceHealth Insurance Vs Medical Loans

Health insurance plans can be viewed as preventive measures you take to safeguard your as well as your loved ones’ health. They provide financial cover for your health even if it is not an emergency. For instance, you may have a planned eye surgery and your health policy may cover this as per its terms. On the contrary, you avail a medical loan at the time of an emergency. Due to interest and repayment, it is not usually feasible to take a loan for regular situations.

Health insurance helps ease your financial burden during treatment as you do not have to pay all the medical bills out of pocket or repay your insurer. The amount you can claim depends on the policy, its terms, and your chosen features. Though a medical loan also helps ease your worries about treatment costs, it becomes a financial burden by putting you in debt. This is especially true if it is used for the primary wage-earner in the family.

You have the option of choosing an insurance plan that is feasible for you and offers the best coverage. In case of a medical loan, you may have to compromise and take a loan even if it expensive. Your eligibility also comes into play as most lenders have criteria that you will need to meet.

The premium of health insurance and the interest you pay for a medical loan may appear similar but are completely different. A major difference is regarding their payment terms. You have the option to pay premiums annually whereas you may have to pay the interest monthly or quarterly depending on the terms.

6 Reasons Why Health Insurance Is Better Than Medical Loans

Immediate Availability

Since you usually buy health insurance in advance, you can avail medical treatment immediately. You have two options of making claims and both require minimal paperwork today. However, this will not delay your treatment.

When you take a medical loan, you can get funds only after you complete the paperwork and get approval. This may be time-consuming and can delay your treatment.More Affordable

You can check the affordability of an insurance plan and a medical loan by comparing their premium and interest. Premium is the amount you pay annually or in other intervals to your insurance provider. This is the cost of the cover you get for your medical needs. Based on the coverage and plan you select, your insurer decides the premium you have to pay. Interest is the amount you pay your lender for the money you borrow over and above the actual sum you borrow. This is the cost of borrowing.

The premium you pay for health insurance is usually substantially lower than the interest you pay on a medical loan. Since you need not repay the sum insured to insurer and only pay the premium, having a health insurance plan becomes more affordable than taking a loan.

Facility of Cashless Treatment

Cashless treatment refers to the claim mode you can opt for in a health insurance plan. Here your insurer will directly pay the hospital bills and you do not have to pay from your pocket. However, for cashless facility, your treatment has to take place in a network hospital listed with the insurer. Network hospitals are those that have a tie-up with insurance providers for various services.

In a medical loan, you do not have the option of a cashless facility. You have to pay and keep track of your medical bills. You also do not get to enjoy the benefits of a network hospital.

Tax Saving Benefits

The premium you pay for a health insurance plan also gets you tax benefits. The premium amount of up to Rs. 50,000 is deductible under section 80D [1]. The limit of deduction is dependent on the type of policy you have and the age of members included in your policy.

In case of a medical loan, you do not get tax benefits.

Affect on Your Credit Score

Your credit score helps the lenders know about your past history with credit and your credit behavior. It allows them to assess the risk you pose as a potential borrower. While a medical loan affects this important score, repaying it on time is key to you getting a loan in the future.

The premium of a health insurance plan does not affect your credit score in any way. This reduces your chances of being rejected for a loan in the future.

Additional Benefits

Health insurance plans come with many benefits you can earn or use. Some of them are

No Claim Bonus (NCB)

Also known as cumulative bonus, it increases your sum insured without increasing your premium. NCB is offered only if you do not file a claim during a policy period. [2].

Preventive Health Checkups

These lab tests help you to stay on top of your health and many insurers cover the cost of these expenses as part of their benefits for you.

Additional Read:Preventive Care BenefitsFree Doctor Consultations

Many insurance companies also offer a certain number of free doctor consultations with their policies.

Long-Term Policy Discount

If you buy an insurance policy for a longer term, your insurance provider may offer a discount on the premium.

Network Discounts

These are applicable if you book a test or get treatment at a network hospital of your insurer. Because of the tie-up, the hospital may offer a discount on their services.

You do not get these additional benefits with a medical loan, in health insurance vs medical loans making health insurance a better choice.

Both medical loans and health insurance can help you get funds for your medical expenses. But health insurance is a more viable option when compared to a loan. It not only serves you financially, but also helps stay on top of your health. Check out the Complete Health Solution insurance plans available on Bajaj Finserv Health to get budget-friendly and comprehensive cover. These will help you insure the health of up to 6 members and offer benefits like preventive checkups and free doctor consultations!

References

- https://www.incometaxindia.gov.in/Pages/acts/income-tax-act.aspx

- https://www.policyholder.gov.in/you_and_your_health_insurance_policy_faqs.aspx

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.