Aarogya Care | 5 min read

How to File A Claim: A Quick Guide on The Process and Required Documents

Medically reviewed by

Table of Content

Key Takeaways

- Cashless and reimbursement options are two modes to file a claim

- In cashless, you have to inform the insurer prior to your treatment

- For reimbursement, you have to submit medical bills after discharge

A health insurance claim is filed and submitted to the insurer to avail the benefits and coverage of a health insurance policy. Depending on your policy terms, you may be able to file for a cashless claim or a reimbursement claim. Under a reimbursement claim, the insurer will pay you back for the expenses incurred. In a cashless claim, the insurer will directly settle the bills with the hospital. You will not have to pay for the treatment expenses.

To know which claim would work best for you, it is better to be familiar with the process of each type. Read on to know more about the claim process, documents required, and the key points of the claim form.

Health Insurance Claim Process

Cashless

In a cashless reimbursement, you do not have to pay the treatment cost. Your insurer will directly pay the hospital. Cashless claims are gaining popularity because of the benefits it offers. As per a survey, there was an increase from 26% to 50% of cashless claims [1].

To be eligible, make sure that your treatment takes place at a network hospital. You can opt for the cashless claim for both planned and emergency treatment. The process for both is different. Here is a breakdown.

For Planned Hospitalization

You will have to contact your insurer before you start your treatment. You may have to intimate your insurer at least 7 days prior to your treatment. After verification, your insurer will give confirmation to you and the hospital. At the time of admission, you will have to show your health or policy ID card, confirmation letter, and any other necessary documents. The medical bills are then directly settled with the hospital by your insurer.

For Emergency Hospitalization

For this, you will have to inform your insurer within 24 hours of starting your treatment. You can also contact the insurer from the TPA desk of the hospital. Anyone from your family can handle this process. In some cases, the hospital may send the cashless form directly to your insurer. Upon receiving the authorization letter, your cashless claim will come into effect. In any case, make sure to collect all copies of the bills. The original bills are directly sent to your insurance provider by the hospital.

Additional Read: Health Insurance DocumentsReimbursement

If your treatment is not done at a network hospital or is ineligible for a cashless claim, you can choose this mode. For this, you will have to pay the hospital bills and maintain a record of important medical documents. This may include test reports or discharge summary. After discharge, contact your insurance provider to make a claim. You will have to fill a claim form and submit it along with bills and other documents. After you submit the form, your insurer will process the request. On approval, the amount will be transferred to your bank account. Make sure to submit all documents and information required by your insurer. This will lower your chances of rejection.

Documents Needed

Cashless

Here are some common documents you will have to submit for a cashless claim.

- Duly and correctly filled cashless claim form

- Diagnosis or investigation report

- Valid ID proof or health insurance card

- Any other documents required by the insurance provider

Reimbursement

For a reimbursement claim, following are the common documents required by insurers:

- A duly filled claim form

- Original copy of all receipts and bills

- Form or medical certificate signed by the treating doctor

- Investigation report

- Cash memos and prescriptions from the hospital or pharmacy

- Original discharge card or summary provided by the hospital

- Any other document required by the insurance provider

While filing for a claim, make sure you understand the procedure and document requirements. In case you have a doubt, talk to your insurer.

Claim Form

Cashless claim form

In a cashless claim form, you may have to fill the following details.

- Name and location of the hospital

- Patient name, age, gender, and contact number

- Policy name and number

- Name of the policyholder

- Occupation and address

You will also see a part that is to be filled by the hospital or your treating doctor. It contains the following information.

- Name and contact number of treating doctor

- Diagnosis and relevant findings

- Medical history of the patient

- Treatment mode and its details

- Details of the patient (date and time of admission, expected duration of time, room type)

- Estimated charges (per day room rent, treatment cost, fees for surgeon, consultation, ICU or OT charges, medicines)

- Reimbursement claim form

The reimbursement claim form is also divided into two parts, one to be filled by the insurer and the other by the hospital. As a policyholder, you have to fill the following details.

- Details of the policyholder

- Details of the patient

- Insurance details

- Hospitalization details (name of the hospital, cause, date and time of admission, discharge date, room type)

- Claim details (pre-and post-hospitalization expenses, miscellaneous expenses, already claimed benefits)

- Checklist for documents submitted

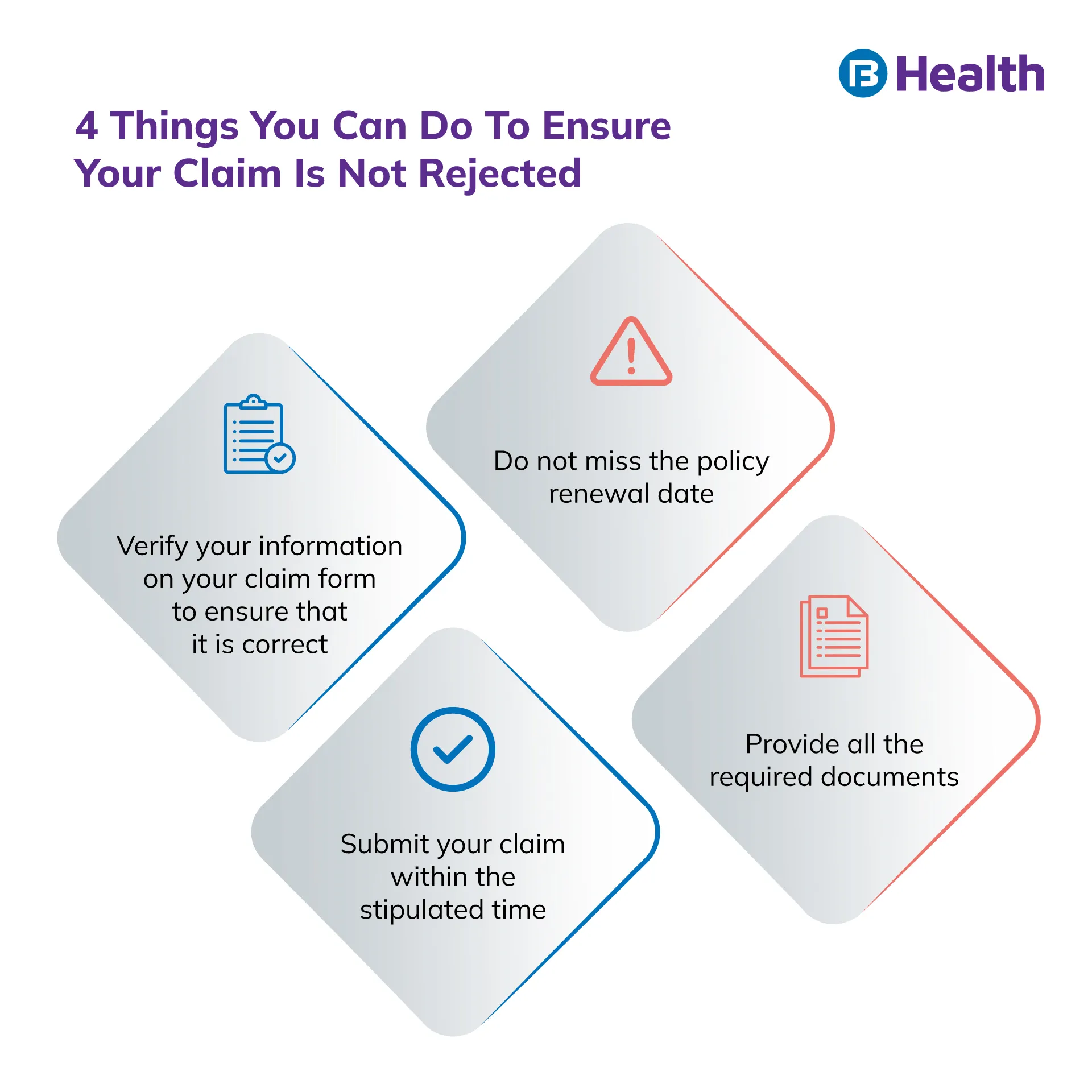

It is important that you check your forms before submitting them. Incorrect or omissions of information may result in your claim getting rejected. If you have any questions about the forms or the process, talk to your insurance provider. Apart from this, don’t forget to file your claim within the time period given by the insurer. That is how you can get a response for your claim in the stipulated time period. An insurer has to settle or reject a claim within 30 days of receiving all documents [2]. This will ensure that the claim settlement process happens smoothly.

If you are thinking about buying health insurance, check out the Complete Health Solution plans offered on Bajaj Finserv Health. The 3-step buying process and cashless settlement within a minute are sure to make things easier for you. With it, you can focus on your health and not worry about an extensive claim process. Apart from Aarogya care Bajaj Finserv Health Offers a Health card that converts your medical bill into easy EMI.

References

- https://www.statista.com/statistics/1180517/india-share-of-cashless-insurance-claims/

- https://www.irdai.gov.in/ADMINCMS/cms/whatsNew_Layout.aspx?page=PageNo4157&flag=1

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.