Aarogya Care | 4 min read

Important Tips on How to Port Health Insurance Policy

Medically reviewed by

Table of Content

Key Takeaways

- Porting of health insurance allows you to avail better benefits

- Consider porting when your existing plan doesn’t provide needed cover

- Porting of health insurance policy retains the benefits you accumulated

The Insurance Regulatory and Development Authority of India (IRDA) safeguards the rights and interests of policyholders by formulating various rules. Health insurance portability is one such provision as per the IRDA [1]. You can port medical insurance policy to a new health insurance provider while retaining the benefits you have accumulated.

Earlier, transferring or porting of health insurance resulted in losing benefits such as the waiting period for pre-existing diseases. Now portability rules allow you to transfer existing individual or family health policies to any general or health insurance company without losing these benefits [2].

Read on to know when you should consider health or mediclaim policy portability and how you should go about it.

Additional Read: A Guide to Important Riders You Can Add to Your Health Insurance PlansWhat benefits does porting of health insurance policy offer?

Porting of health insurance provides many benefits. The main ones are affordable premiums and added features. Porting allows you to change the current policy as per your present health conditions, lifestyle changes, and requirements. For example, you can go for an extra cover or add a new nominee.

The bonus accrued on your previous policy gets clubbed with the existing sum insured to reach the new sum insured. No claim bonus also gets added to the new sum insured. So, all the benefits you had accrued remain in force even after health insurance porting.

When you port medical insurance, keep the continuity benefit in mind. For instance, consider that a medical condition was excluded in your previous policy for the initial 3 years. Say that the waiting period for this condition is 4 years with your new provider. In this case, your waiting period will be only 1 year for the said medical condition. This is because 2 years from your previous policy are also counted. In this way, you can choose the best policy keeping in mind pre-existing diseases and waiting periods.

When should you port your health insurance policy?

While you can avail a new policy at a more pocket-friendly cost and get better coverage, there are other reasons to port medical insurance too.

Poor service

If the customer support is not helpful enough or is not responding to your queries, you may consider changing your provider.

Better options

Inadequate cover

If your existing policy doesn’t cover a specific disease or provides insufficient cover, consider health insurance porting.

Lack of transparency

If your existing provider has hidden conditions or unfavorable terms, it is best to port your health insurance [3].

Poor claim settlement

It is always good to port to a health insurance provider with a high claim settlement ratio. This will benefit you in the long run.

Lack of cover

When you need more coverage to address rising medical costs, port to a new insurer.

Co-payment clause and room rent limits

When you get better deals in case of age caps for renewal, limits on room rents, co-payment clause, etc. it is time to port.

Hike in premium

When your existing insurance company increases your premiums in case a claim is made, port your health insurance plan.

Late reimbursements

If the health insurance company takes too much time to process your reimbursement request, change your insurer.

Personalization

Port your plan when you are able to get tailored benefits from an insurer.

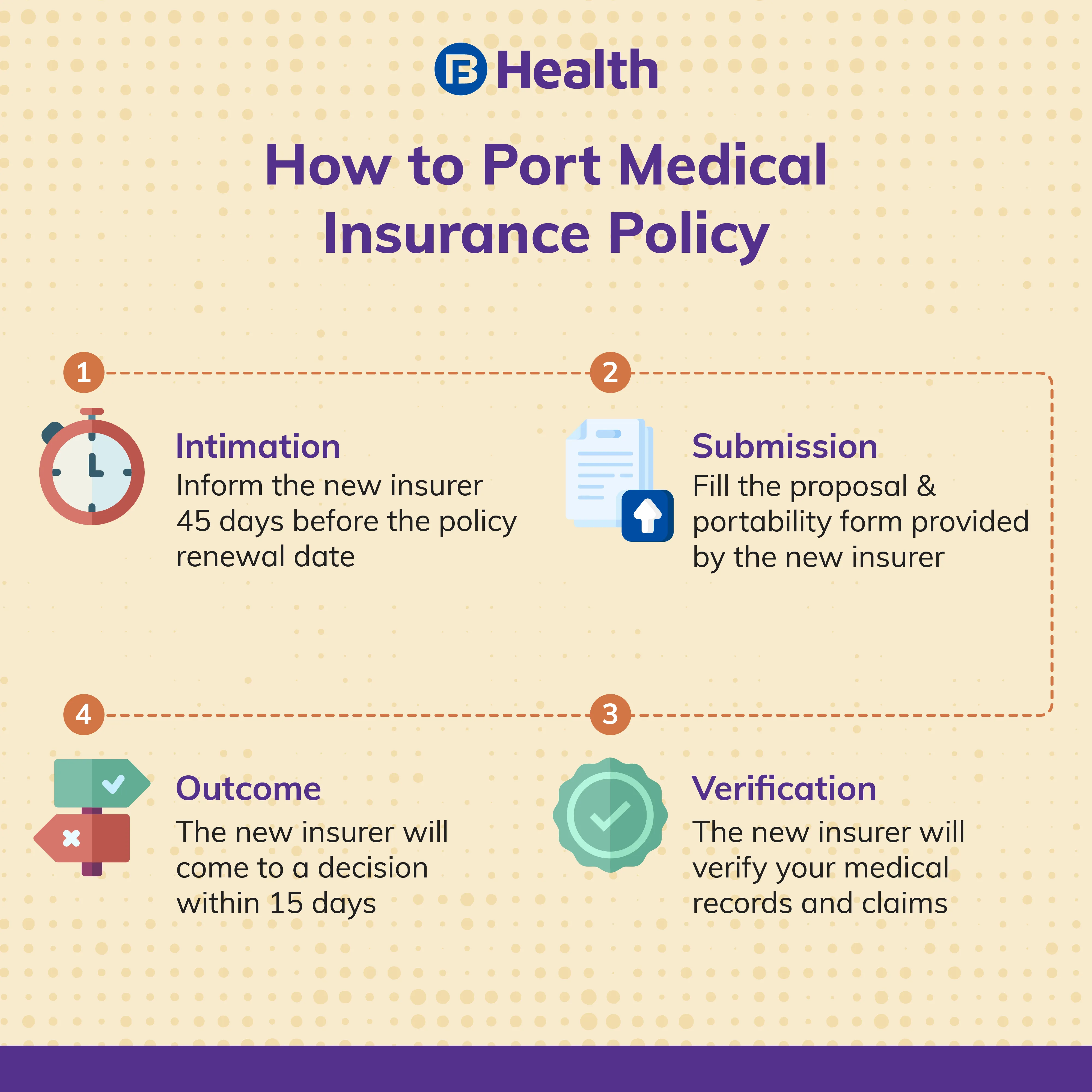

What is the procedure to port medical insurance?

Here are the steps to port your health insurance policy.

- Talk to the new insurance company 45 days prior to the renewal date of your existing policy.

- On submitting the request, fill the proposal and portability form provided by the new insurer. Provide complete details and submit the form along with the required documents.

- Upon receiving the documents, the new insurer will contact your existing insurer or log on to the IRDA website to check details like medical records, claim history, and more.

- The existing health insurance provider must submit all requisite details within seven working days through IRDA’s common data-sharing portal.

- After receiving all details, the new insurer accepts or rejects your request within 15 days [4]. If they fail to decide within this period, they are bound to accept the proposal.

Porting of mediclaim policy or a health insurance policy to a new insurer allows you to enjoy many benefits. However, porting of health insurance requires proper planning and comparison. Check various factors like the claim settlement ratio and network hospitals of the new provider. For instance, the Aarogya Care Health Plans by Bajaj Finserv Health offer individual and family floater plans at reasonable premiums and have a high claim settlement percentage. You can even avail of online doctor consultation and medical check-ups affordably with these plans.

References

- https://www.careinsurance.com/health-insurance-portability.html

- https://www.policyholder.gov.in/portability_of_health_insurance.aspx

- https://economictimes.indiatimes.com/wealth/insure/should-you-port-your-health-insurance-policy/articleshow/67851423.cms

- https://www.moneycontrol.com/news/business/personal-finance/explained-how-to-port-your-health-insurance-policy-without-losing-existing-benefits-6623221.html

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.