Aarogya Care | 4 min read

Looking for Medical Insurance Plans? Check Out Complete Health Solution Plans

Medically reviewed by

Table of Content

Key Takeaways

- There are four different types of Aarogya Care plans you can choose from

- Complete Health Solution plans are a type of Health Protect plans

- These plans provide huge network discounts and do not require medical tests

With the threat of another COVID variant looming ahead, investing in medical insurance plans has become all the more necessary. Until now, more than 4 lakh people have lost their lives in India due to it [1]. Of these, many fatalities were caused by the lack of availability of the right medical care.

Rising medical costs prevented many people from getting access to treatment. So, it is important that you choose the best health insurance plan available in the market to manage unforeseen medical emergencies [2]. Some of the most useful yet cheapest medical insurance plans are offered under the umbrella of Aarogya Care from Bajaj Finserv Health.

The benefits of Aarogya Care medical insurance plans include preventive care facilities, network discounts, and free online consultations with top doctors. The different plans included within Aarogya Care are:

- Health Protect plans

- Health Prime plans

- Super Saving plans

- Personal Protect plans

What are Complete Health Solution Plans?

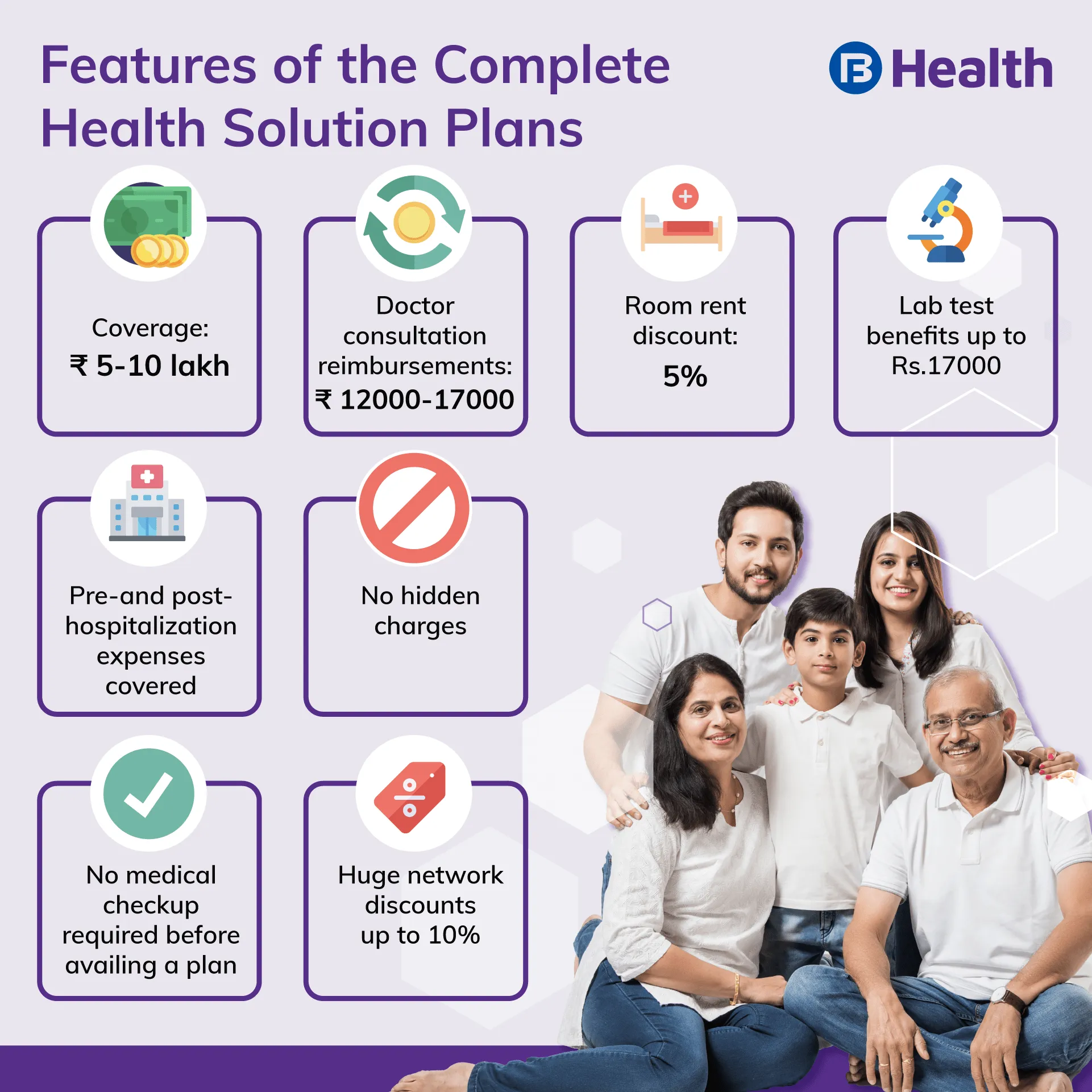

Amongst various medical insurance plans offered by Bajaj Finserv Health, these are some of the most cost-effective plans that cover all your requirements. These policies that takes care of both your wellness and illness needs. A few beneficial features of this plan include:

- Cover yourself and your family members coverage up to Rs.10 lakh

- Enjoy savings of up to Rs.17,000 on lab tests

- Get doctor consultation reimbursements between Rs.12000-17000

- Sign up for the plan without undergoing a medical checkup

- Avail the plan in just 2 minutes!

- Get fast cashless claim settlement in less than 60 seconds

- Sign up with ease with online documentation

- Get huge network discounts like 5% discount on room rent

- Pay no hidden charges

- Silver

- Platinum

- Silver Pro

- Platinum Pro

How Much is The Total Coverage?

You can either choose total cover of Rs.5 lakh or Rs.10 lakh. When you opt for Rs.10 lakh as the sum insured, your plan covers two adults and four children with usual pre-and post-hospitalization expenses. The premium amount varies based on the number of family members and age of the insured. For instance, the premium amount for a single insured member will differ based on his age category.

What Doctor Consultation and Lab Test Benefits Do You Get?

With these plans, you can consult top specialists of your choice with the option of multiple consultations too. While the Silver and Silver Pro Complete Health Solution plans provide reimbursement benefits up to Rs.17000, the Platinum and Platinum Pro plans offer benefits up to Rs.11,000. There is no maximum limit set for individual usage as long you do not exceed the prescribed limit. With the Platinum and Platinum Pro plans, you can also get reimbursed for your lab tests up to Rs.17,000.

What Network Discounts Can You Get?

During hospitalization, you get 5% discount on room rent when you avail any of the plans from the Complete Health Solution package. If you are utilizing services from any of the hospitals or labs listed within the network hospitals, you get special discounts too. This is applicable across the country. What’s more exciting is that you get 10% off on doctor consultation charges as a part of the plan’s features.

What Preventive Health Checkup Benefits Can You Enjoy?

Preventive health checkups help you assess health complications by tracking your vitals regularly. The lab test package is inclusive of more than 45 vital lab tests that helps in monitoring your health conditions. The best part about this feature is that you do not have to step out of you home as a technician will collect the sample right from your home.

Additional read: How to Save Money on Doctor Consultation with Bajaj Finserv HealthNow that you are aware of the distinctive features of the Complete Health Solution plans, choose one that best fits your needs. While even the best mediclaim policy for family only allows you to pay hospitalization expenses, this type of comprehensive health insurance plan can be more beneficial. If you are looking to purchase budget-friendly plans with a better cover, check out Bajaj Finserv Health’s Aarogya Care Plans. This way you can enjoy numerous benefits like online doctor consultations, faster claim settlement and preventive health checkups. Invest in the right health insurance plan and secure the future of your loved ones!

References

- https://covid19.who.int/region/searo/country/in

- https://www.nascollege.org/e%20cotent%2010-4-20/ms%20deepika%20srivastav/deepikaSICKNESS%20INSURANCE%201%20LL%20M%20IV%20SEM%2011-4.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.