General Health | 8 min read

Best Private Health Insurance: Benefits and Factors

Medically reviewed by

Table of Content

Synopsis

In this day and age, amongst so many options to choose from, it can be challenging to select the right private health insurance plan for yourself. But a few critical but simple factors about the best team insurance plan can help you with that:

- Simple to understand

- Additional rider options

- Tax benefits

Here are a few things everyone should do to know about Private health insurance and the benefits it comes with.

Key Takeaways

- A Private health insurance policy offers much-needed financial support to you and your family during medical emergencies

- Private health insurance plans available in the market, cover everything from pre to post hospitalization expenses

- Pre-existing diseases, suicide attempts, terminal diseases, etc., are not covered by private health insurance

Although some organizations now offer group health insurance to their employees, it is not unusual for many not to do so. Suppose your employing company does not offer group health insurance to you as part of an employee benefits package. In that case, you might consider purchasing your private health insurance from an insurance provider. However, due to the different options on the market, buying one yourself might be perplexing at times. Consequently, it is reasonable to be concerned about selecting private health insurance for yourself. However, depending on the desired coverage level, having several solutions and rates to pick from might also be advantageous.

Regardless, understanding what private health insurance is and what features and benefits to look for in these is the first step in obtaining adequate private health insurance for yourself and your family. So, without further ado, let us first define private health insurance.

What is Private Health Insurance?

Private health insurance is any healthcare coverage obtained from a private entity by a person for self, family, and dependents [1]. The buyer pays for this coverage through monthly, quarterly, half-yearly, or yearly EMIs. This is separate from any healthcare coverage given by state or national governments. It is available through insurance agents or directly from insurance companies. This is also separate from employer-provided health insurance or health group insurance, which an organization purchases for its employees.

Private Health Insurance Benefits

Now that we've defined private health insurance let's look at its top benefits.

Comprehensive Coverage

Purchasing insurance online will allow you to address health-related concerns and receive the best medical treatment without worrying about costs. Most health insurance policies cover the following medical expenses:

In-Patient Hospitalization Expenses

These are the costs incurred while in the hospital for at least 24 hours. Most health insurance policies cover in-patient hospitalization charges such as room rent, nursing, boarding expenses, pharmaceutical costs, ICU/ICCU fees, etc.

Expenses for Pre-Hospitalization and Post-Hospitalization

Pre-hospitalization and post-hospitalization expenditures are the costs incurred in the days preceding and following the hospitalization. These often include doctor's appointments, x-rays, medical reports, etc.

Ambulance Expenditures

Ambulance expenses incurred because of transporting the patient to the closest hospital are frequently covered by private medical insurance policies. In most cases, there is a restraint on coverage for ambulance charges, which may be confirmed with the insurance carrier.

Daycare charges

Charges that do not necessitate a hospital stay of at least 24 hours. Chemotherapy, radiation, cataract surgery, dialysis, rhinoplasty, and other procedures fall within this category. Most private health insurance policies cover a certain number of childcare operations, as specified in the policy text.

Domiciliary Hospitalization Expenses

These are the expenses incurred due to taking home-based treatment for a disease that would otherwise have made hospitalization compulsory. Most health insurance policies cover these costs; you may find the terms and conditions in the policy paperwork.

Cashless Treatment

In most cases, insurance firms have tie-ups with network hospitals that provide cashless care to the insured during hospitalization. These hospitals compensate the insured's treatment-related expenditures. This means that you may receive treatment at these institutions without spending anything on healthcare expenditures. Your insurance company will repay you later when you file a claim. It should be noted that the claim will be authorized if it is presented in line with the policy's terms and conditions.

Benefits of Health Insurance Portability

Health insurance portability allows members to migrate their current health insurance policy to a different health insurance supplier. It safeguards the clients from being taken for granted by insurance providers, allowing them freedom and better substitutes if they are displeased with their existing health insurance policies.

Financial Security Against Escalating Medical Costs

With rising medical costs in India, it is critical to obtain dependable health insurance coverage on time. The insurance provides broad coverage and safeguards you from hefty hospitalization expenditures in the event of a medical emergency, even if the inflation is high.

Tax Advantages

Under Section 80D per the Income Tax Act of 1961, the government encourages health insurance by giving tax deductions on premiums paid for them [2].

Additional Read: Tax Benefits with a Health Insurance Plan

Factors to Consider Before Purchasing a Health Insurance Policy

To make the best option when purchasing the best private health insurance plan, consider the following factors:

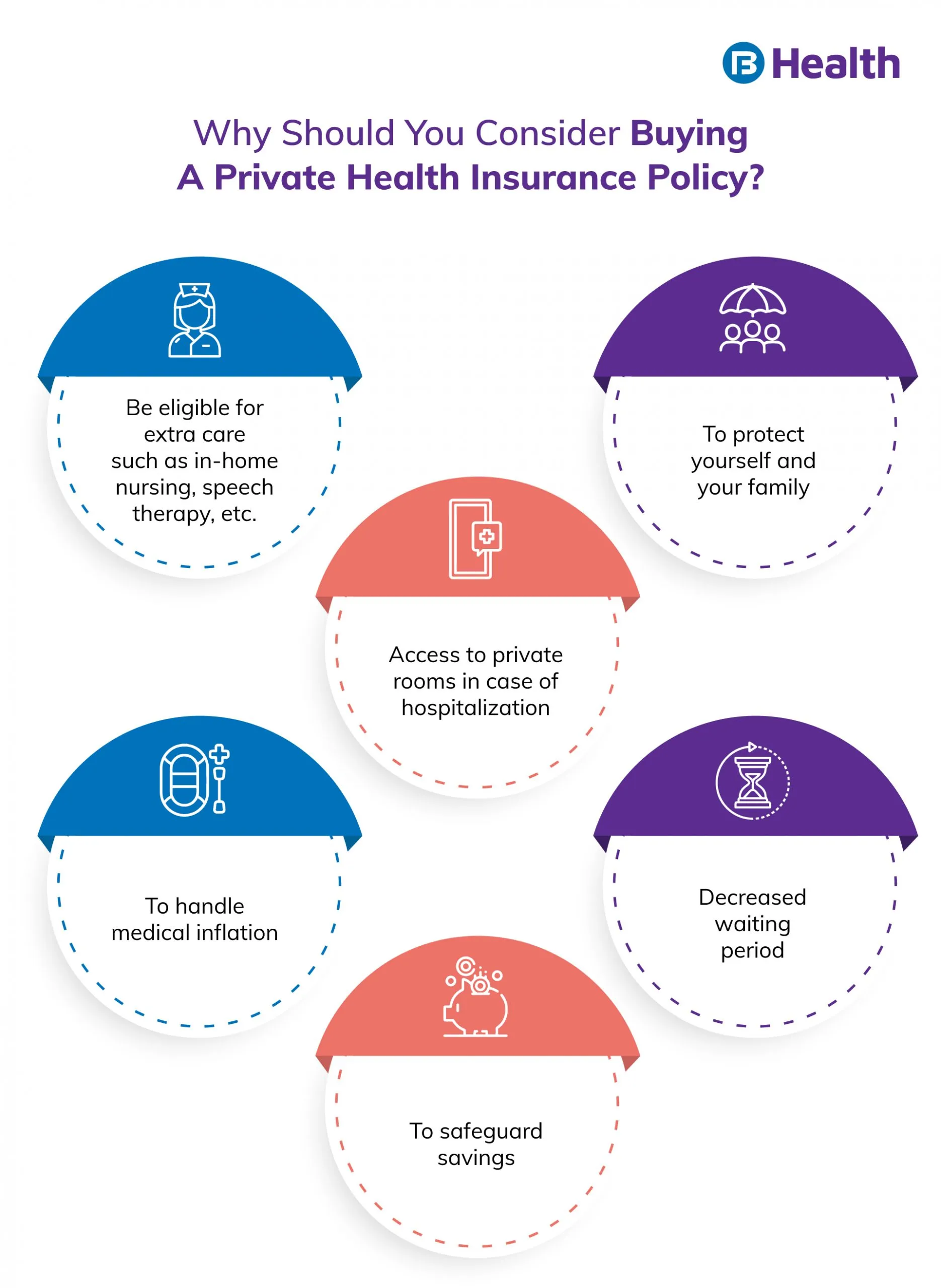

To Protect yourself and your family.

Rather than acquiring separate insurance policies for each family member, you can choose to have your complete family covered under the same health insurance policy. Consider taking a private health insurance policy for your elderly parents and dependent children at risk of catching the sickness. Conduct considerable research, seek the advice of an expert, and ensure that you pick a plan that provides comprehensive coverage.

Criteria for Purchasing a Health Insurance Policy

The qualifying conditions for purchasing a health insurance plan are determined by various factors, including the policyholder's age, pre-existing illnesses, etc. Adult and child entry age criteria vary and can range from 18-65 years and 90 days to 25 years, respectively. The actual age might differ across private medical insurance policies.

To Handle Medical Inflation

The expense of healthcare treatment is growing as the number of ailments increases and medical technology improves. And, if you aren't fully prepared, these fees might burden your resources. Consider paying an inexpensive health insurance premium each year as a solution. You can also cope with the weight of medical inflation while choosing excellent treatment without worrying about the costs.

To Safeguard Savings

By acquiring a proper health insurance plan, you may manage your spending more rationally while not jeopardizing your funds. Some private insurance providers can provide cashless treatment, so you won't have to worry about payment. You may now spend your funds on your children's home, school, and retirement plans.

Should Coronavirus (COVID-19) Treatment Cover by Your Health Insurance?

Yes, the cost of COVID-19 medication should be covered by your current health insurance coverage. Several health insurers and general insurers have previously developed coronavirus health insurance policies that cover medical expenditures incurred during coronavirus treatment. Following the IRDAI standards, two unique standard health insurance policies, namely the Corona Kavach policy and the Corona Rakshak policy, were launched and are now being acquired by many individuals.

Riders for Health Insurance

Riders in health insurance are additional benefits that you may purchase to make your healthcare policy more extensive. Your age determines the cost of the healthcare insurance rider, the sum insured, the kind of coverage, and other factors. Here are a few you must consider:

Maternity Cover Rider

The pregnancy cover rider may assist you in getting your maternity expenditures covered, such as childbirth, pre-, and post-natal expenses, and so on. Some insurers may provide reimbursement for newborn infant expenditures until the policy expires. However, depending on the health insurance, this rider has a waiting time ranging from 2 to 6 years.

Critical Illness Rider

The critical illness rider ensures that your best private health insurance policy covers acute diseases diagnosed for the first time during the policy's duration, such as heart attack or cancer. It will pay you a lump sum regardless of the medical expenditures incurred during treatment. It has a 90-day waiting time and a 30-day survival period, covering between 10 and 40 essential diseases, depending on the insurer.

Personal Accident Rider

The personal accident rider can assist you in obtaining compensation from your private insurance if an accident results in your incapacity or death. It will pay you the whole sum insured in the event of permanent total disability but only a portion of the sum insured in the event of partial disability, depending on the nature of the accident. It is commonly known as the double indemnity rider since it provides your family with an extra death payout in the event of an accident.

What Doesn't a Health Insurance Plan Cover?

A health insurance plan does not cover the following medical bills and situations:

- Claims made in the first 30-day period after buying a health insurance plan are not covered unless there is an emergency.

- Pre-existing disease coverage is also subject to a 2- to a 4-year waiting period.

- The typical waiting period for critical illness coverage is 90 days.

- War/terrorism/nuclear activity-related injuries

- Suicide attempts or self-inflicted injuries

- Terminal illnesses, AIDS, and other comparable ailments

- Cosmetic or plastic surgery or hormone replacement surgery, and so on.

- Expenses for dental or eye surgery

- Common diseases, bed rest/hospitalization, rehabilitation, etc.

- Wound claims resulting from adventure sports

Documents Required for Reimbursement of a Health Insurance Claim

In the case of hospitalization, the policyholder must provide the following documents:

- The hospital/network hospital issues a discharge card.

- For legitimacy, in-patient hospitalization invoices must be signed by the insured.

- Prescriptions from doctors and medical shop expenses

- Claim form with the signature of the insured

- A reliable investigative report

- Doctor-prescribed consumables and disposables with full details

- Medical consultation bills

- Copies of the prior year's and current year's insurance policies, as well as a copy of the TPA's ID card

- Any further documents requested by the TPA

The advantages of purchasing health insurance in 2022 are numerous. If you want to protect yourself against financial insecurity, especially if you are psychologically and physically fatigued, get a policy online right now!

So, don't wait any longer to make the most of your money by selecting an acceptable coverage for health insurance in India at a low rate. For more information on private health insurance, visit Bajaj Finserv Health.

References

- https://www.ehealthinsurance.com/resources/individual-and-family/what-is-private-health-insurance

- https://www.bajajfinservmarkets.in/markets-insights/income-tax/income-tax-exemptions-deductions/section-80d.html

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.