Aarogya Care | 5 min read

Top 6 Health Insurance Tips to Get Affordable Health Insurance Plans!

Medically reviewed by

Table of Content

Key Takeaways

- Financial protection is one of the major health insurance benefits you can get

- Premium amount can help determine the affordability of health insurance plans

- Health insurance tips for affordable plans include comparing different policies

Health insurance benefits you by relieving your financial stress for medical costs. Due to its features, investing in health insurance at the right time is a wise decision to take. However, despite the benefits and safety that you enjoy with health insurance, around 30% of the nation’s population is devoid of any health insurance plans [1]. Lack of awareness and high cost are a few of the reasons for this. Here are some tips to getting affordable health insurance.

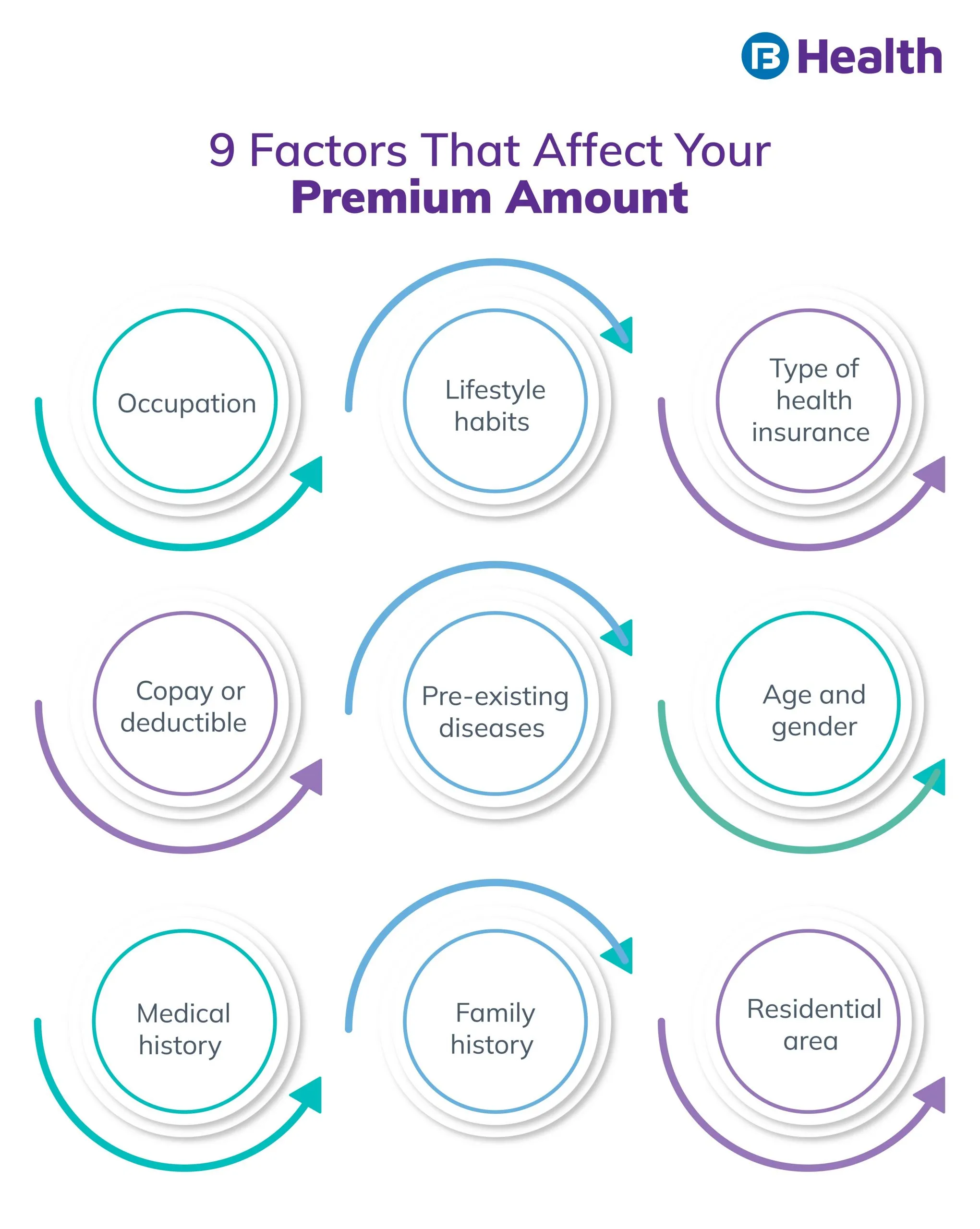

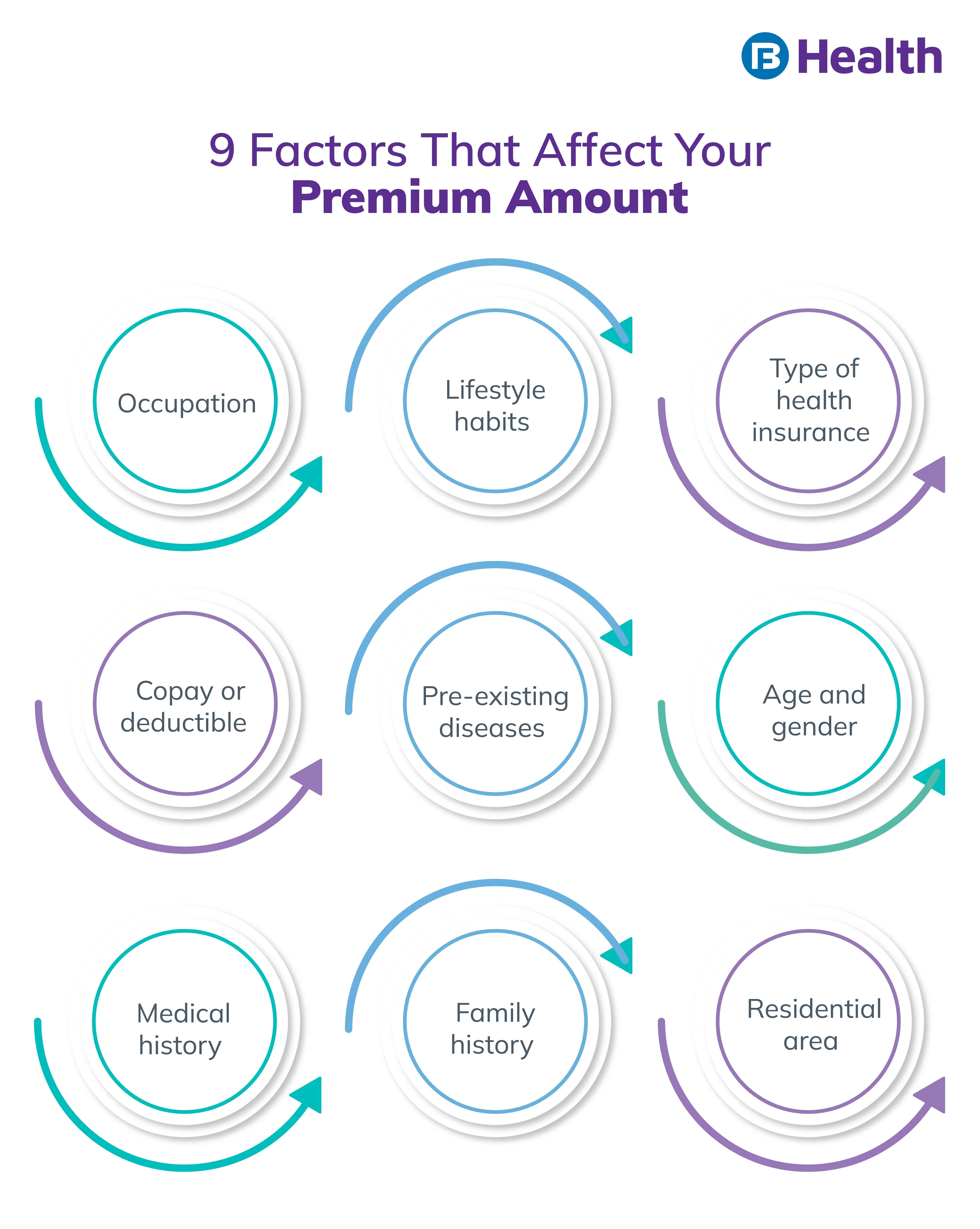

Note that the affordability of health insurance policies is majorly based on your premium amount. The premium makes it possible for your insurer to offer you cover for your medical costs. There are a lot of factors that affect the premium amount for your health insurance plans. You can control some of these factors and thereby reduce your premium. This will help you avail affordable health insurance policies.

Read on to know top 6 health insurance tips you can use to make it fit in your budget.

1. Choose your cover amount carefully

Your sum insured directly affects your premium amount. A high sum insured will result in a high premium and vice-versa. While working towards an affordable premium, make sure that your sum insured offers adequate cover. An inadequate one can result in increased out-of-pocket expenses. You can use a premium calculator to get an idea about premiums for varying sums insured. Another way to get a better cover at low cost is through top-up plans. With these, you can get the same benefits and additional cover more affordably as compared to comprehensive health insurance policies.

Additional Read: Sum Insured Amount2. Get health insurance from an early age

Health insurance policies at a young age usually come with low premium amount. This is because when you are young, you are healthy and less likely to make a claim. This reduces the risk of the insurer thereby making it possible to offer high sum insured at low premium.

Apart from this, having health insurance also leads to a long-term history and relation with your insurer. With this, you can enjoy the additional benefits such as lower costs of health insurance policies

3. Check for deductible and copay options

Deductible and copay are clauses of health insurance policies that lead to a shared risk between you and the insurer. Deductible is the fixed amount that you have to pay before your insurer will cover your medical costs. Copay is the fixed percentage of your medical expenses that you will have to pay. The shared risk makes it possible for the insurer to offer high sum insured at lower premiums. But make sure that the copay or deductible amount you choose does not add to your financial stress.

4. Opt for health insurance offered by employers

Employers offer group health insurance plans to their employees. The premium of these plans is paid by both, your employer and you. This helps ensure that your health insurance is affordable and adequate. You can also add members from your family to a group health insurance policy offered by your company. This way, you can cover the health of your family members without added financial stress. If you switch job, your insurance provider may offer continued cover under an individual policy [2].

5. Select a suitable health insurance policy

There are various health insurance policies specifically designed for unique health needs. From health insurance plans for family and senior citizens to health insurance plans for specific diseases, there are a number of policies available. Since these are for specific purposes, your premium amount will differ for each of them. Health insurance plans for family are a cost-effective way of covering the health needs of your family members under one plan. A disease-specific plan can help you cover conditions that are not usually covered in a regular plan. It is important to look at the health needs of your family, medical and family history, and finances before selecting a plan.

6. Compare different health insurance policies

Comparing different health insurance plans is important as it can help you select the best and most affordable policy. While comparing, look at the waiting period, grace period, what is covered and what is not. Though these factors do not have an immediate effect on the cost of health insurance, they offer long-term benefits. Compare and select a plan that can help you make the most of it without any added expenses. There are so many health insurances available in the market Ayushman health account is one of them provided by the government.

Additional Read: Benefits of Comparing Health Insurance Plans

Additional Read: Benefits of Comparing Health Insurance PlansThere are a number of health insurance benefits that you can enjoy when you have the right policy. Be sure to do thorough research so that you find a policy that’s best for your finances and health needs. Check out the Health Protect Plans available on Bajaj Finserv Health. These plans come with budget-friendly premium amounts and a host of other benefits like doctor consultation reimbursement, preventive health check-ups, network discounts, and more. Choose from a range of health insurance plans to cover your and your family’s health needs today!

References

- https://www.niti.gov.in/sites/default/files/2021-10/HealthInsurance-forIndiasMissingMiddle_28-10-2021.pdf

- https://www.policyholder.gov.in/group_insurance.aspx

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.