Aarogya Care | 5 min read

Top-up Health Plans: Why is Having a Backup Plan Important?

Medically reviewed by

Table of Content

Key Takeaways

- A top-up plan works like a backup to your existing plan

- Your insurance provider fixes a deductible while buying plan

- Your hospital bill needs to cross this deductible amount

A suitable health insurance plan helps you tackle rising medical costs with ease. But before you invest in one, you need to know the approximate cover to meet your needs. How do you do this practically? There may be times when your medical bills overshoot your expectations. In such cases, having a backup plan can help you manage these additional expenses. A top-up health plan is designed to help in such circumstances. It comes into play in case you exhaust the total sum insured of your health policy [1]. For instance, say you take a health insurance policy for Rs.3 lakh, but your hospital bills have crossed into Rs.5 lakh. While you can pay out of pocket, your savings may not allow you to do so. In this scenario having a top-up health plan can help you efficiently. To know more how a top-up plan act as a backup, read on.

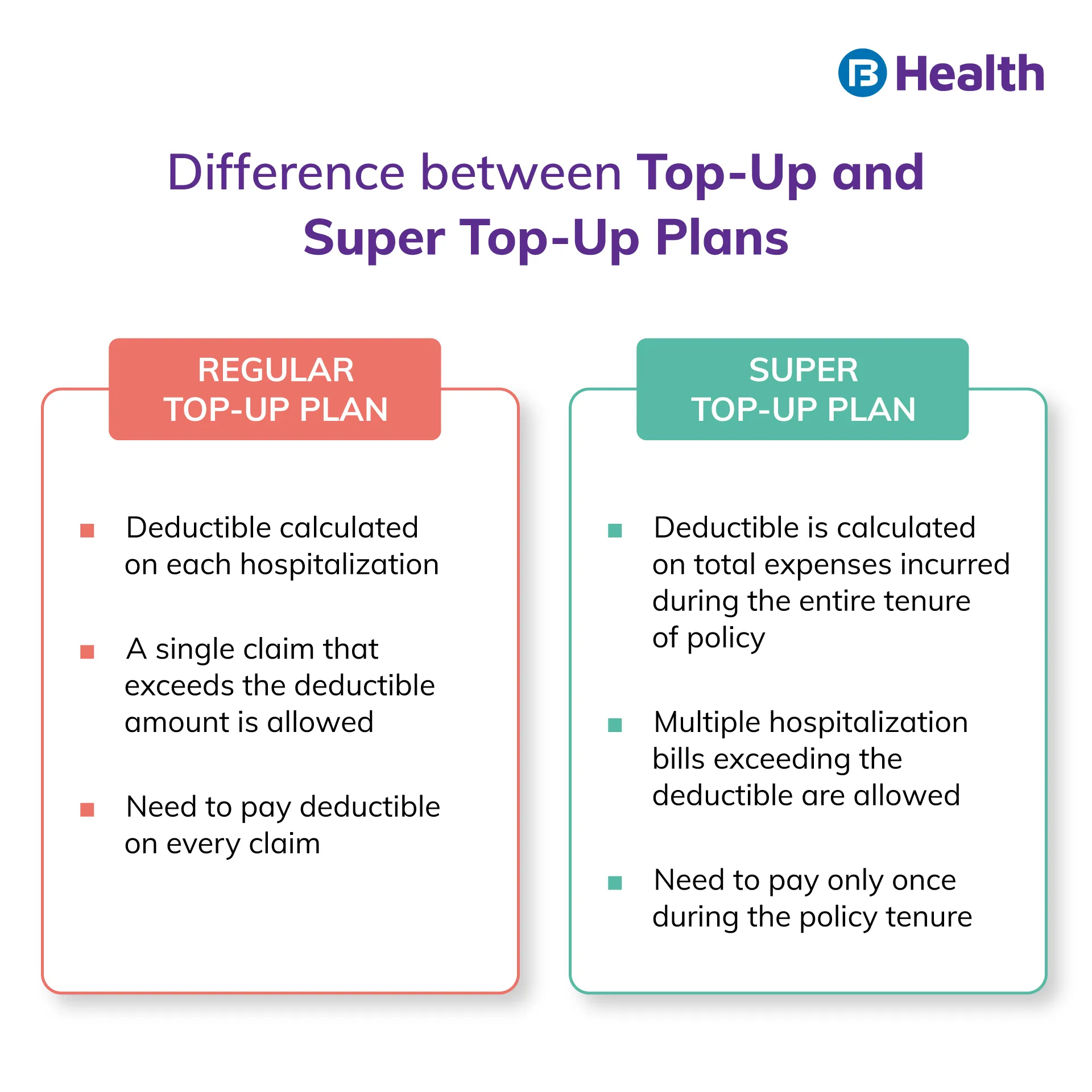

Additional read: Super Top-Up and Top-Up Health Insurance Plans

Additional read: Super Top-Up and Top-Up Health Insurance PlansWhy is it important to have a health backup plan?

Unexpected medical bills can burn a hole in your pockets when you don’t have a backup. If you are working in a company, you and your family will get coverage as a part of employer’s group health insurance. On completion of your service or if you resign, your policy will cease to exist. In such cases, having a top-up helps so that you do not have to utilize all your savings in case you get a hefty medical bill. Even if you have health insurance coverage, there is no guarantee that it will be sufficient to meet your treatment expenses. Thus, a top-up health plan is the best way to plan ahead.

You can buy a top-up insurance plan either from the same insurer with whom you have your basic policy or from a different company. You can choose it as an add-on to your basic policy. To buy a top-up health plan, you need to be above 18 years of age. If you are above 80 years, you cannot avail this plan. Your insurer will fix a deductible when you buy a plan. Only if your total bill exceeds this deductible amount, the insurance provider will settle your claim. Any amount less than deductible has to be borne by you. The premium is dependent on your total sum insured, age and deductible.What are the factors you need to consider before buying a top-up health plan?

Due to rising medical inflation, hospitalization expenses are increasing too. A top-up is required when your existing coverage does not meet your requirements. Before buying a plan, ensure that your existing plan and the top-up complement each other. This way you can manage your expenses better. Before choosing a top-up, analyze your budget and understand your requirements so that you can select an apt cover.

Your top-up medical plan should add up to your existing coverage to offer you a significant sum insured. Before buying a top-up plan, ensure that you can port it. This way you can change your plan, if needed, from one provider to the other without losing any health coverage benefits. Health plans come with lifetime renewability options. This means that you do not need to search for another plan as you age. So, understand the features of your plan properly before you buy one.

How can you avail a top-up health plan?

Always choose a plan that gives you maximum benefits at low premiums. You may purchase it online or offline as this doesn’t matter in terms of benefits. You may buy a plan from the same insurer with whom you have a base plan or from a different provider.

Are there any benefits of having top-up health plans?

With a top-up health plan, you get comprehensive coverage with a higher sum insured. In case your first policy is discontinued, having a top-up can come handy. When you buy multiple policies, the chances that you will use all of them are bleak. This ensures that you get to earn a no-claims bonus on the unused policy.

Tips to follow before choosing the right top-up health plan

Before choosing a plan, ensure that you can pay your deductible effortlessly when the need arises. Though a high deductible reduces your premium, you need to buy a plan with an affordable amount. Always analyze the policy features well before availing one. Check if it covers preexisting illness, daycare procedures or other hospitalization expenses. Be aware that you can get tax benefits for the premium paid towards top-up health plans. This is applicable as per Section 80D of Income Tax Act [2].

Additional read: Health Insurance Tax BenefitsNow that you know how important it is to have a backup, invest in a top-up health plan. Since medical costs are increasing every year, having this helps you to manage uncertainties. When you have a top-up plan, you can handle an unexpected financial burden with ease. Do check out the Aarogya Care Complete Health Solution on Bajaj Finserv Health to boost your health cover.

With top-up coverage of up to Rs.25 lakh, you also get doctor consultation reimbursement benefits up to Rs.6500. This allows you to consult a specialist of your choice when you need to. Availing this plan also gives you up to Rs.16,000 off on lab test expenses. The best part about availing this plan is that you need not undergo a medical checkup. So, make a smart choice now and invest in a top-up!

References

- https://www.irdai.gov.in/admincms/cms/Uploadedfiles/ROYAL15/TOP%20UP%20INSURANCE-HEALTH%20XS%20AND%20SUPER%20HEALTH%20XS%20POLICY.pdf

- https://www.incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.