Aarogya Care | 5 min read

What are the Tax Benefits on Preventive Health Check-ups under Section 80D?

Medically reviewed by

Table of Content

Key Takeaways

- Preventive health care includes blood tests, flu shots, and more

- Non-senior citizens can get a maximum deduction of Rs.75,000

- Senior citizens can get a maximum deduction of Rs.1,00,000

Buying health insurance is a wise health investment decision. It not only provides you financial security during medical emergencies but also helps you save tax. With Section 80D of the Income Tax Act 1961, you can avail tax deductions every year, which is up to Rs.25,000 for non-senior citizens and up to Rs.50,000 for senior citizens [1]. Individuals can also claim tax deductions on preventive health check-ups under this section, even if you have not yet bought any health insurance plan.

Read on to know more about tax benefits on preventive health check-ups and how to claim them.

What is Preventive Healthcare?

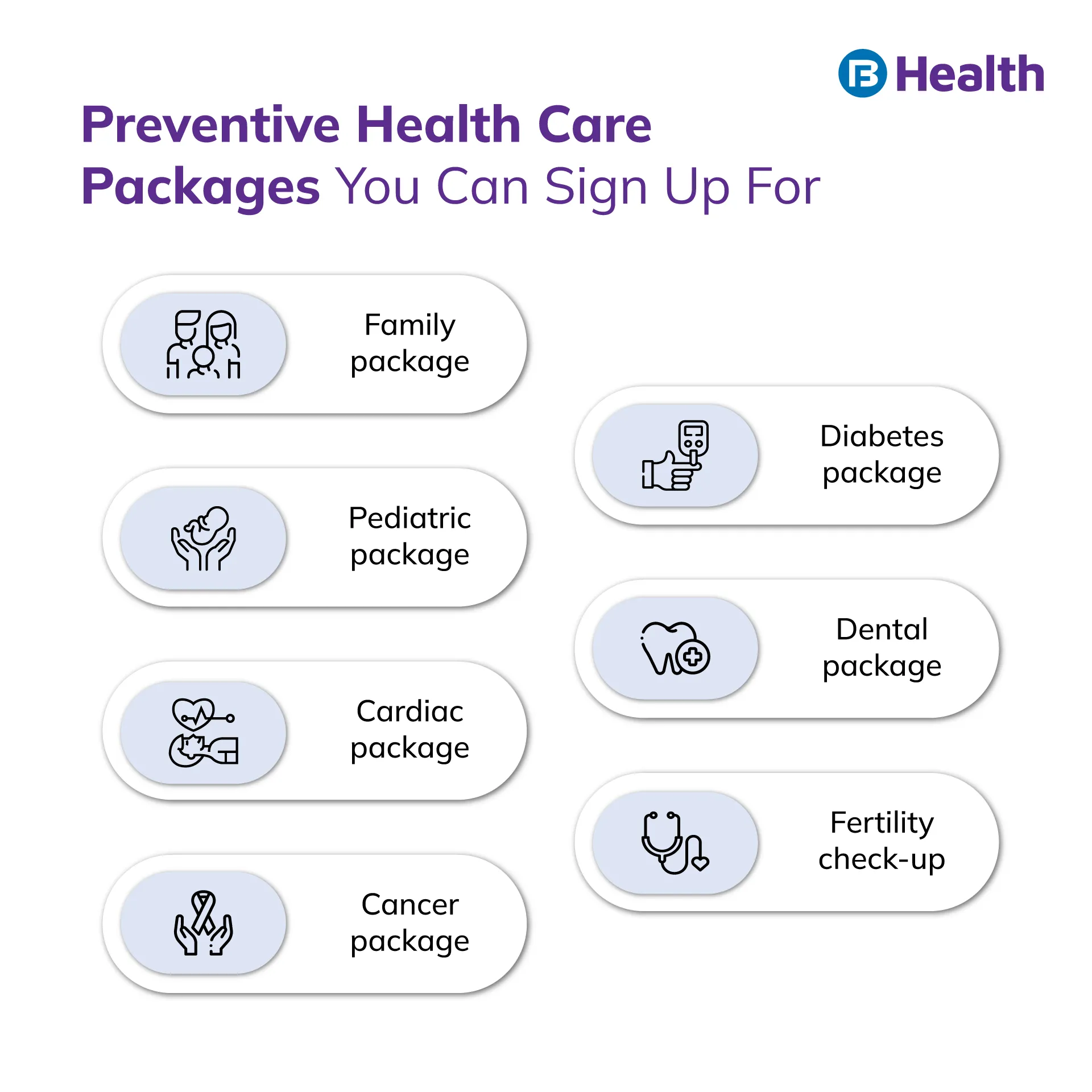

One cannot predict illness. Even if you take measures to keep yourself healthy, you may fall sick. Preventive healthcare means taking precautionary measures to keep illnesses at bay. These include undergoing blood tests, blood pressure monitoring, cancer screening, taking immunization, flu shots, and more.

With a preventive health check-up, you can minimize the risk of contracting diseases by detecting health problems early and getting timely treatment. As you age, your chances of getting sick and developing age-related illnesses increase. This is why undergoing preventive health check-ups is necessary.

Preventive healthcare is even more important after the age of 40. Opt for it earlier if you already have certain diseases or a genetic risk of illnesses like hypertension, cancer, or diabetes. Going for timely preventive check-ups can lower your financial burden as it helps detect health issues at an early stage, eliminating the need for expensive treatments. Top health insurance plans offer comprehensive health check-up benefits.

What Are the Advantages of Preventive Health Check-Ups?

Here are the major benefits of preventive healthcare:

- Improves chances of cure or successful management of diseases as it leads to early detection

- Lowers the risk of further complications if you have an existing health disorder

- Reduces your treatment cost as managing a disease at an early stage is less expensive

- Allows you to be proactive by detecting signs of possible health issues including high blood pressure and diabetes

- Helps you increase your lifespan if you focus on your health and follow a healthy lifestyle

- Promotes personal healthcare

What Are the Tax Deductions Under Section 80d Against Preventive Health Check-Ups?

- An individual below the age of 60 can claim a maximum deduction of Rs.25,000 for premium on health insurance paid for self, spouse, and children.

- If your policy includes parents below 60 years of age, your tax benefit can be up to Rs.50,000.

- The tax benefit can be up to Rs.75,000 if you are a non-senior citizen and your parents are senior citizens.

- Senior citizens paying premiums for their senior citizen parents and non-senior citizen children can get a maximum tax deduction benefit of Rs.1,00,000 under section 80D.

When you spend Rs.20,000 towards the premium and Rs.5,000 for preventive health check-ups, you can claim an amount of Rs.25,000. A majority of hospitals in India offer preventive healthcare packages. Fixed benefit insurance plans as well as indemnity insurance plans give you tax benefits.

Section 80D allows cash payments made towards preventive healthcare. However, do not pay health insurance premiums in cash to avail of tax benefits under the Income Tax rules. Use payments modes such as drafts, cheques, credit cards, and online banking.

Who Can Claim a Deduction for Preventive Health Check-Ups?

An individual or Hindu Undivided Family (HUF) can claim a tax deduction for money paid towards preventive health check-ups for

- Self

- Spouse

- Children

- Parents

In cases of HUF, any member of the HUF can make a claim.

What Amount Can Be Claimed for Preventive Health Check-Ups?

A maximum of Rs.5,000 can be claimed every financial year for payments made towards preventive health check-ups. The claim can be made by you, your spouse, your children, and your parents. For instance, if you had a preventive healthcare check-up worth Rs. 7,000, you are eligible for Rs.5,000 tax deductions while filing your IT returns.

Note that you can claim a maximum of Rs.25,000 as a tax benefit towards health insurance premiums and preventive healthcare. For example, consider you are 30 years old and have a maximum claim limit of Rs.25,000. Now, if you spent Rs.21,000 towards medical insurance premium and Rs.6,000 towards preventive health check-ups, the total amount you can claim is Rs.25,000.

Additional Read: Benefits of Buying a Health Plan with OPD Cover

Things to Consider While Claiming Tax Benefits on Preventive Healthcare

- You can claim a maximum tax deduction benefit of Rs. 5,000 against preventive healthcare services

- You can claim tax benefits on preventive health check-ups even if the payments are made through cash

- With effect from 1 July 2017, all financial services are charged at a GST of 18%

Consider opting for health insurance plans that offer maximum benefits at affordable premiums. Check the range of Complete Health Solution plans offered by Bajaj Finserv Health. These plans provide medical cover of up to Rs.10 lakh with preventive health check-up benefits. Apart from this, you get network discounts, doctor consultation reimbursements, and lab test benefits. Sign up now and start saving on your health insurance!

References

- https://www.incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.