Aarogya Care | 5 min read

What is a Deductible? What are its Benefits in a Health Insurance Policy?

Medically reviewed by

Table of Content

Key Takeaways

- Compulsory and voluntary are the two common deductible types

- Compulsory deductible has to be mandatorily paid by the insured

- Voluntary deductible is optional that can lower the premium amount

While choosing the right health insurance policy to manage your medical finances is important, it is equally essential to understand key terminologies used in health insurance. This information can help you make the right decisions when buying insurance [1]. One of the most commonly used terms in health insurance is the deductible.

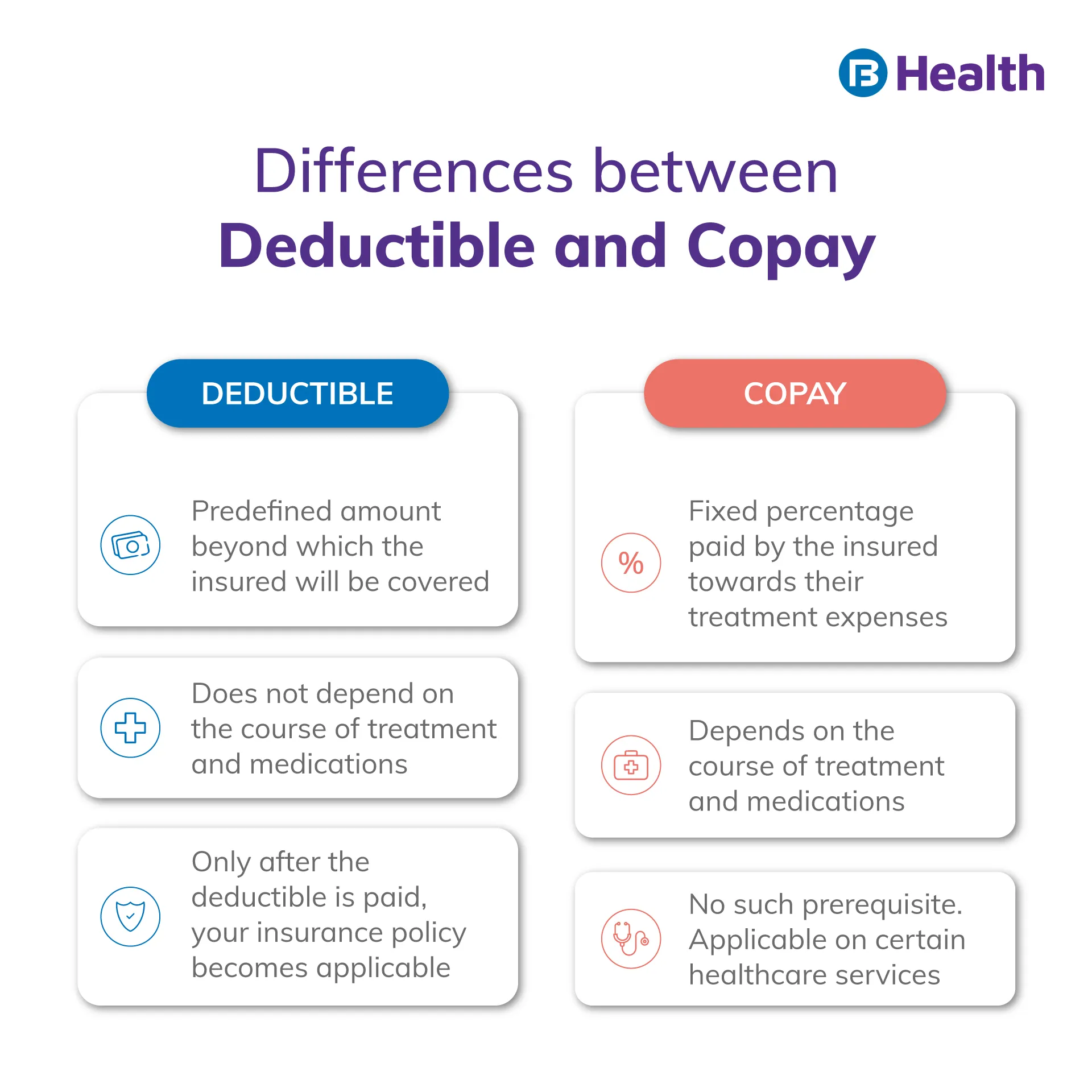

It is the amount that you have to pay upfront before your insurance provider settles your claim. In simpler words, whenever you raise a claim, you are required to pay a specific amount. The remainder will be settled by the insurance company [2]. For an insurance company to settle the remaining part of your claim, it is mandatory that your claim amount exceeds the deductible. Read on to know more about the this and how it works.

Additional Read: Private Health Insurance Benefits

Additional Read: Private Health Insurance Benefits What Are the Different Deductible Types in Health Insurance?

The two most common types of deductibles for health insurance are compulsory and voluntary deductibles. There are a few others as well and here is a breakdown of these to help you understand them.

- Compulsory deductible: It is a mandatory amount to be paid by the policyholder. This is governed by your insurance provider. It can also be a percentage of the total sum insured.

- Voluntary deductible: This is optional and you can go for it if you want to pay a lower premium in return for bearing an extra cost out of pocket during claims. Choosing this option is helpful when you are not suffering from any health ailments and do not raise claims regularly.

- Comprehensive deductible: It is a single amount that keeps increasing until you pay the full amount towards your health insurance plan. This is not available in the Indian insurance sector.

- Non-comprehensive deductible: You can use it only on specific medical services and not for the entire policy. You may have to pay a certain amount before the insurer pays for your specific medical treatment.

- Cumulative deductible: You can use it only with a family floater plan. The insurance provider applies this amount to all your family members. Your balance claim amount will be settled only after you pay the total deductible.

How Are Deductibles Beneficial to You?

Here are a few ways choosing a this can be beneficial for you.

- You can lower your health insurance premium.

If you opt for a voluntary deductible option, you may also be offered discounts from the insurance provider.

- Ensures access to benefits

It prevents you from raising small claims thereby helping you earn the No Claim Bonus. This way your policy coverage also increases.

- Assured coverage

It provides you access to medical coverage during unexpected hospitalization.

What Type of Policy Is the Deductible Most Commonly Found In?

A deductible is most commonly opted for in top-up plans. With a top-up plan, you can increase your sum insured and manage unexpected medical emergencies without any difficulty. When you avail a top-up, your insurance provider fixes a deductible amount. It is also called the threshold limit. Any claim that exceeds the limit only will be settled by your insurance provider. You can add a top-up to your existing health plan to get better coverage.

Additional Read: Top-Up Health Insurance Importance

What Are the Factors That Can Affect Your Deductible?

Here are a few factors that dictate your deductible.

- If you have any preexisting illness like asthma or diabetes before you buy a policy

- If you have suffered from any medical ailment in the past

- If you have unhealthy habits like smoking or drinking

- Your existing health conditions

- Your lifestyle choices

How Should You Choose a Deductible?

When you choose a higher deductible, you have the option to pay a lower premium. However, this may not seem a feasible option. While you know that a health insurance policy acts as a financial safety net during unforeseen medical situations, you need to consider all the pros and cons. Choose a higher deductible only if you are able to pay the amount from your pocket during claim settlement. If this isn’t possible, it is better to go for a lower deductible so that the majority of your expenses are covered by the insurer.

Consider a hypothetical situation to get a clear idea of deductibles work. Assume that you raise a claim of Rs.50,000 and the deductible of your health insurance policy is Rs.20,000. At this point, your insurance company will pay Rs.30,000, which is the difference. At this stage, you have to pay Rs.20,000 from your pocket. On the other hand, if your claim is Rs.15,000, which is less than your deductible, the insurer will not be paying any amount.

Are There Any Disadvantages of Using a Deductible?

While there are numerous benefits of using a deductible, you need to be aware of the disadvantages as well. You may have to pay your medical expenses from your pocket if they do not cross the deductible. This is true in case you opt for a compulsory deductible option. Your insurance company will pay only after the claim crosses the deductible amount. Note that opting for a higher deductible can also affect your savings.

Now that you have a clear understanding of deductibles, choose your policy wisely by considering all these factors. Whether you go for a deductible or not, your policy is always dependent on your medical history, current health status, age and insurer. Before finalizing a policy, make sure you understand the terms and conditions properly.

For affordable health insurance policies, you can check out a comprehensive range of Complete Health Solution plans on Bajaj Finserv Health. With four different subtypes such as CHS Silver, CHS Platinum, CHS Silver Pro and CHS Platinum Pro, you get to enjoy benefits such as network discounts, reimbursements on lab tests and doctor visits, and medical coverage up to Rs.10 lakh. Choose the right plan and manage your medical emergencies with ease.

References

- https://www.policyholder.gov.in/Faqlist.aspx?CategoryId=73,

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/Guidelines%20on%20Standardization%20in%20Health%20Insurance%202016.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.