Aarogya Care | 4 min read

What is Sum Assured: What is its Importance in a Life Insurance Policy?

Medically reviewed by

Table of Content

Key Takeaways

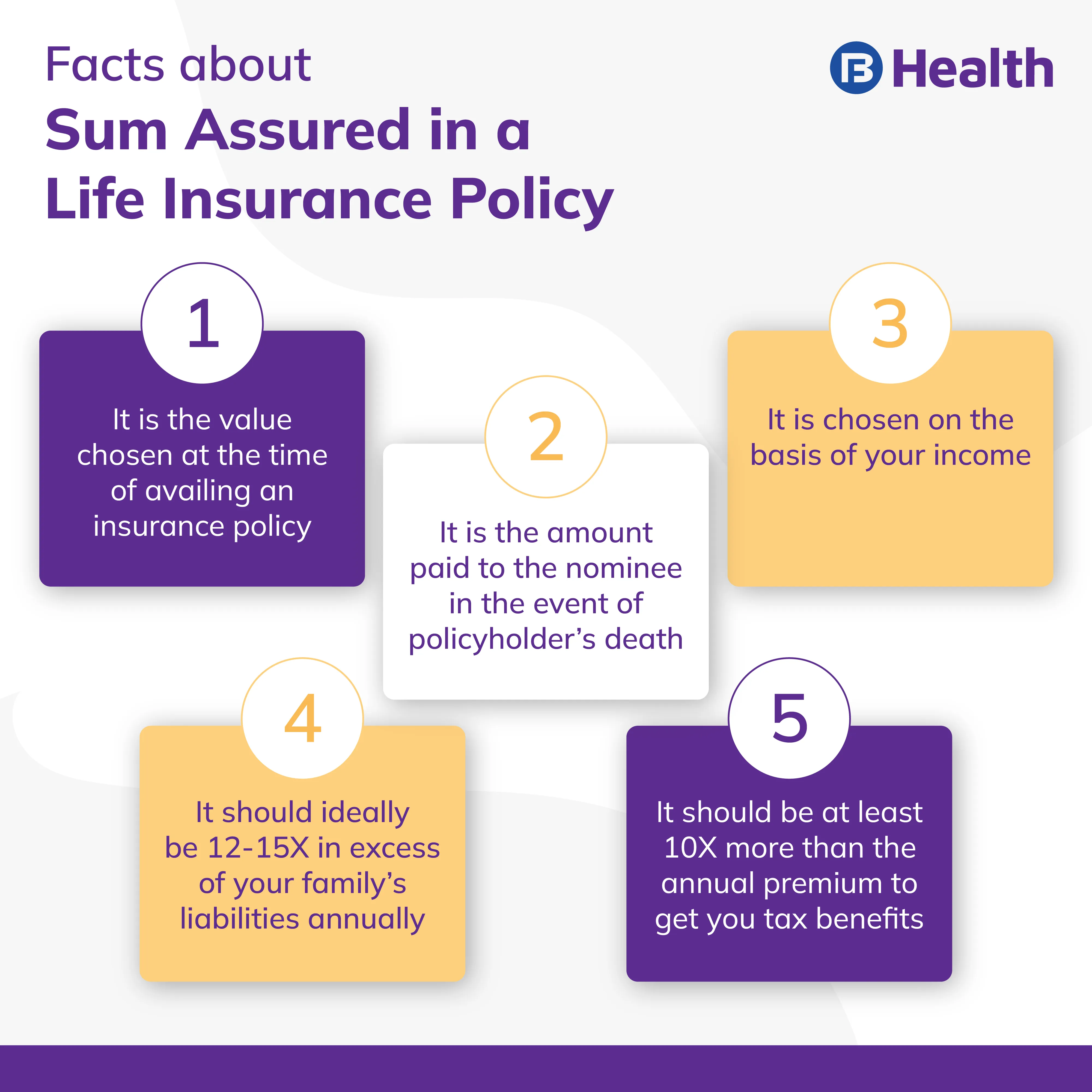

- Sum assured in life insurance is the original amount chosen while taking policy

- Sum assured is mostly calculated using the Human Life Value or HLV method

- Choose the sum assured after proper calculation of your assets and liabilities

Good financial health can help you address expected and planned expenses related to your physical and mental well-being. It can also secure your loved ones in the unfortunate event that something happens to you. Investing in a life insurance plan is a feasible solution for mitigating financial expenses in case of an unexpected event. In such circumstances, your family can receive financial benefits that can help them manage expenses in your absence. With people across the nation aiming to secure their family’s financial future, there is a steady increase in the growth of the life insurance industry. Statistics reveal an expected increase of 5.3% in this industry between the years 2019 and 2023 [1]. While there are many life insurance plans available in the market to suit your requirements, it is necessary to note what is sum assured and how much premium you need to pay. Both are vital factors you need to consider while choosing a life insurance policy.

To get an in-depth understanding of what is sum assured in insurance and how to calculate sum assured, read on.

Additional read: 5 important points on why and how to buy medical insurance onlineWhat is sum assured in a life insurance policy?

The sum assured, applicable to a life insurance policy, is the guaranteed amount your nominee family member receives in the event of your death [2]. In fact, this amount is the complete coverage of your life insurance policy. For instance, if you take a policy with a sum assured of Rs.30 lakhs, your nominee receives the same amount after your death.

As it is the amount you have selected while availing the policy, this is the original amount you get after your policy term ends. There will be no change in the sum assured and it is one of the pre-determined benefits you will receive at the end of your policy tenor.

How to calculate sum assured in insurance policies?

The sum assured is paid either at the end of policy term or in the event of death. When selecting sum assured in life insurance, you need to consider certain factors based on your expected cost of living. Firstly, calculate possible one-time expenses that include loans, mortgages or even payment of credit cards. Check the outstanding amount of various credit facilities you have availed and based on the amount, choose the sum assured.

Don’t forget to consider different assets in your possession. Whether it is shares, provident funds, land, property or even gold bars, ensure that you calculate their total value. Once you have calculated the total worth of your assets, reduce the liability amount from it. What you have now are the net assets. Check if this is enough for your family to manage unexpected financial expenses. Forecast future expenses too, such as the amount required for the college education of your children in the future in case they are still in school now.

In case your liabilities exceed the assets, the amount you get after deducting assets from your liabilities should be the minimum amount for which you calculate sum assured in life insurance. This ensures that there are fewer financial obligations on your family’s shoulders in your absence.

The sum assured is calculated using a method called Human Life Value or HLV method. Using this method, your sum assured is calculated on the basis of your future and present expenses or earnings. You can use HLV calculators online to assess your capital based on existing market inflation. This helps you choose the right sum assured while investing in a life insurance policy.

How much premium do I need to pay while investing in a life insurance policy?

The recurring or a one-time amount you pay for a life insurance policy is called a premium. You need to pay your premiums regularly for maintaining the validity of your policy. Premiums can be paid half-yearly, annually, monthly or even quarterly. Some of the most common factors affecting your premium amount include tenor of life insurance policy, sum assured, your health condition, and age.

Additional read: Importance of Health Insurance in Present Times: 5 Key ReasonsNow that you are familiar with the concepts of sum assured and the premium amount to be paid while taking a life insurance policy, invest in one for a secure financial future. While you do this, ensure that you are also proactive about your and your family’s health. Various health plans and insurance policies offered by Bajaj Finserv Health give doctor consultation, lab tests, and other benefits. All these help you make your health a priority and with digital features at your fingertips, the process is easier and more convenient too!

References

- https://www.ibef.org/

- https://www.pimrindore.ac.in/Pdf/Prestige%20International%20Journal%20of%20Management%20and%20Research%2012%20(R),%201-2,%20%202019.pdf#page=215

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.