Aarogya Care | 5 min read

Meaning Of Sum Insured And How Is It Important

Medically reviewed by

Table of Content

Key Takeaways

- Meaning of sum insured in a health policy works on the principle of indemnity

- You get reimbursements for your medical bills based on the sum insured

- Choose the right sum insured to enjoy comprehensive coverage benefits

The different terms in a health insurance policy can be confusing at times. This can prevent people from availing a health plan due to fear of making mistakes. However, the pandemic has taught us how important it is to invest in a health insurance policy [1]. Rising medical costs combined with inflation and other factors have made it difficult to afford proper healthcare. This is why the meaning of sum insured in health insurance is important, as it assures access to medical care.

To ensure that you don’t miss out due to lack of information, take a look at these pointers to explain the important insurance term ‘sum insured’. Read on to understand what it means in an insurance policy and its benefits.

Additional read: Factors to Consider Before Buying Health Insurance

What meaning of sum insured in health insurance?

It is the maximum amount for which you can raise a claim during a medical emergency or treatment. The meaning of Sum insured is based on the principle of indemnity. This means you will get reimbursements for your medical expenses, when you raise a claim. In case your sum insured is either less or equal to the treatment cost, your insurance provider will cover the total bill amount [2].

However, in case your treatment cost exceeds the sum insured, you may have to pay the excess amount from your pocket. You get coverage only if you raise a claim with your insurer. This sum insured is applicable to non-life insurance products such as motor insurance, health insurance and home insurance to name a few.

Assuming you have a health insurance policy with a total sum insured of Rs.10 lakh. If you have been hospitalized with bills of Rs.5 lakh, you may be able to claim coverage for the full amount if you get approved. However, if you get hospitalized again with medical bills amounting to Rs.6 lakh, you may get approval for the amount, but you have to pay the excess Rs.1 lakh out of pocket.

How to calculate the right sum insured for a health insurance policy?

Before choosing the sum insured for your health insurance policy, research to know how much you may need for emergencies. When deciding the amount for a family floater plan, make sure to choose a sum insured that is sufficient enough to cover all members. You should also consider the premiums payable for the sum insured. A higher sum insured means a higher premium. It isn’t always better to have a high sum insured but do consider medical inflation when deciding on the sum insured.How is it beneficial for you when you choose the right sum insured?

When you opt for the right sum insured, you can enjoy the benefits of maximum financial coverage. This way you need not worry about your medical expenses as your insurer will pay for them. Selecting the right amount will help you raise claims until the policy term is over without the need to buy any extra coverage.

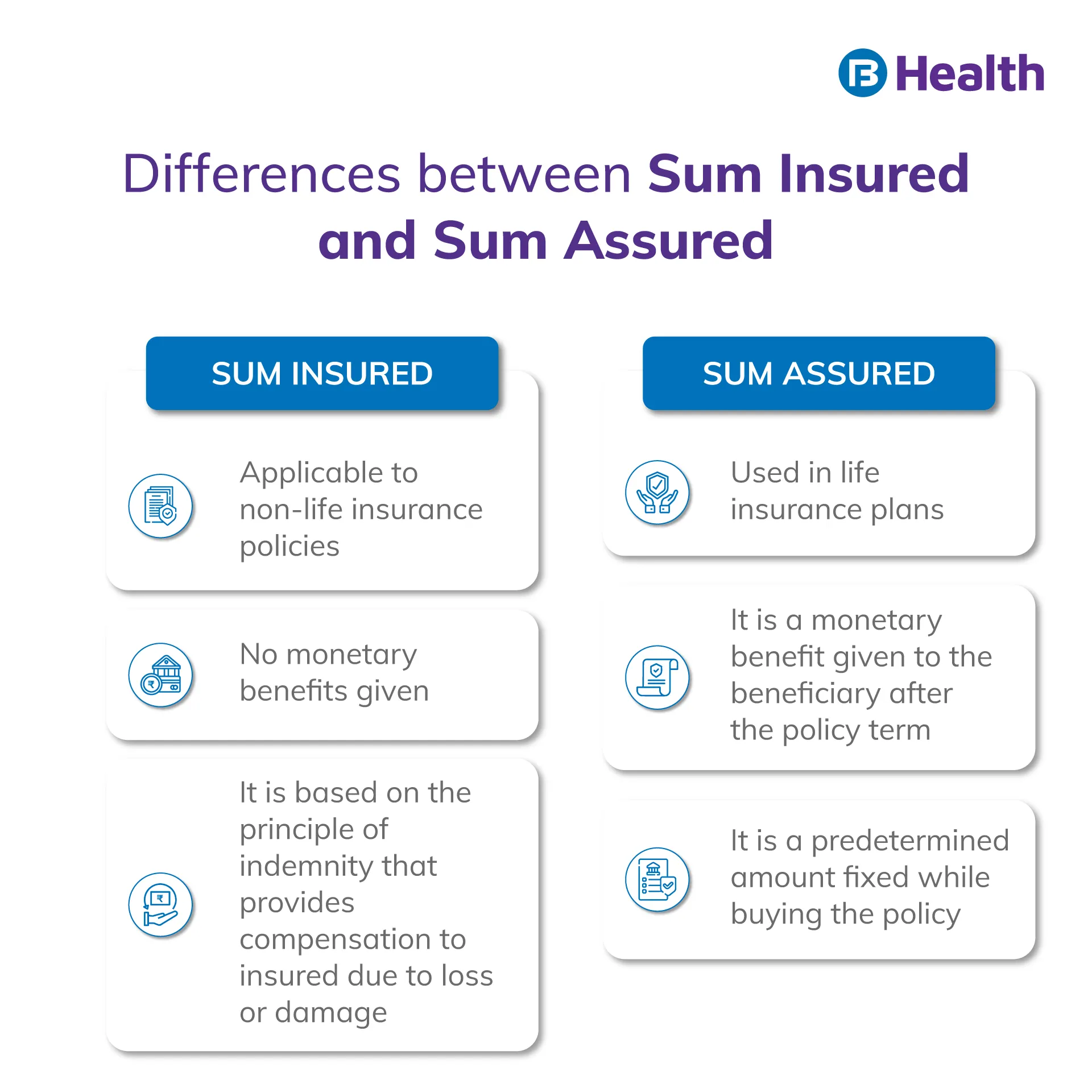

Additional read: Sum Insured Vs Sum AssuredWhy is it important to choose the right sum insured?

Choosing the right sum insured is important for the following reasons:

- Helps in keeping your savings intact

- Helps in managing unforeseen medical emergencies without any glitch

- Helps in relieving stress regarding medical treatment costs

- Helps provide good coverage to all members in a family floater plan

Having a large enough sum insured is key to enjoying maximum financial security. You may have instances wherein you make multiple claims during the policy term and if the sum insured is low, you could exhaust the coverage. In any case, it is important that you strike a balance between affordable premiums and an adequate sum insured.

Is the sum insured dependent on certain factors?

There are a few factors on which sum insured is dependent such as:

- Age

This is an important factor. If you are young, you can choose a higher sum insured at a lower cost.

- Type of policy

In case you choose a family floater plan, it is better to opt for a higher sum insured as all your members are covered in a single plan.

- Medical history

If you have a history of any previous health ailment, getting a higher sum insured is always beneficial

Is it possible to increase the sum insured?

It is possible to increase the sum insured and it can be done in many ways. One instance is during policy renewal. You can change your sum insured to a higher amount based on your new need. In case you do not claim during a policy year, your sum insured amount will be increased by your insurer. Another way to increase the sum insured is to get a top-up or a super top-up plan.

Now that you are familiar with sum insured, select the right health insurance policy that best suits your requirements. The benefits you get from a health plan are dependent on your sum insured. So, it is important that you choose an appropriate sum insured so that you are able to manage your expenses with ease.

If you are thinking about investing in a health insurance policy, do browse the Complete Health Solution range of plans on Bajaj Finserv Health. With features like doctor consultation and lab benefits up to Rs.17,000, you can avail these plans in a hassle-free manner. This is a cost-effective plan that covers all your healthcare requirements.

References

- https://www.policyholder.gov.in/you_and_your_health_insurance_policy_faqs.aspx

- https://www.researchgate.net/profile/Abhishek-Singh-130/publication/340808551_A_Study_of_Health_Insurance_in_India/links/5e9eb46b299bf13079adac51/A-Study-of-Health-Insurance-in-India.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.