Aarogya Care | 5 min read

Why is It Important to Choose the Right Health Insurance Plans for a Family?

Medically reviewed by

Table of Content

Key Takeaways

- Choosing family floater health insurance plans for a family is beneficial

- A Mediclaim policy for a family only covers hospitalization expenses

- Plan your investment well ahead of time by using a premium calculator

A family's health insurance plans can come to your aid during unprecedented times when a loved one’s health requires diagnoses and treatment. A health policy provides the necessary coverage when an unexpected medical expense is owing to accidents, illness, or injury.

You can opt for monthly or annual premiums for a specific tenure once you decide on the plan you want. The insurance provider will bear any medical expenses included in its coverage during the term up to the sum assured. Other benefits offered by health insurance plans include coverage for hospitalization expenses, surgery procedures, and pre-and post-hospital expenses.

There are different types of health insurance plans in the market to choose from as per your requirements. When considering health insurance plans for a family, you can view either family floater health insurance or an individual insurance policy.

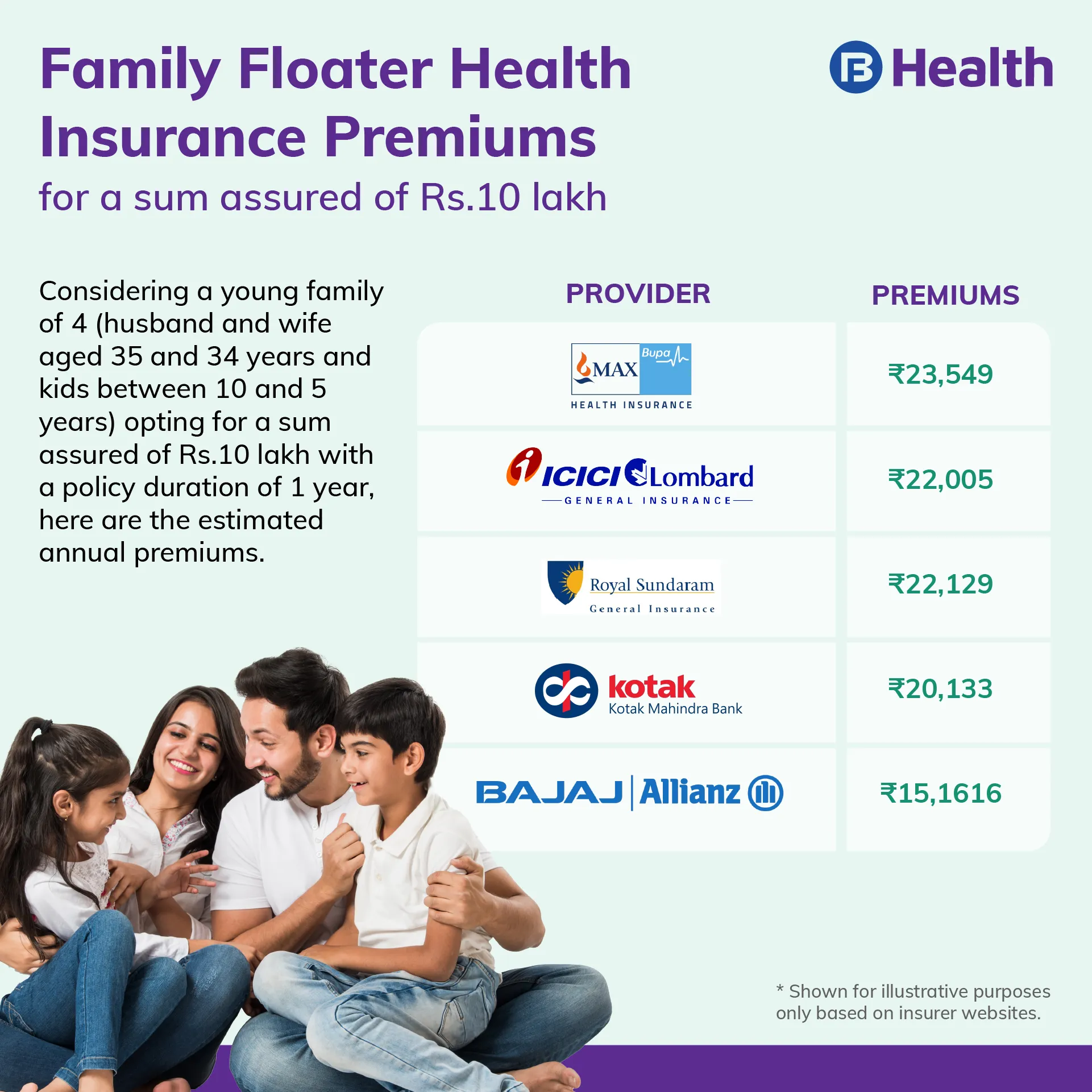

In a family floater health insurance plan, you pay a single premium and cover all your family members under the same plan. For example, if you choose a family floater insurance plan with a sum assured of Rs.10 lakh, this amount can be availed by any family members included in the plan when needed. On the other hand, each family member gets a particular sum assured if you benefit from an individual health policy. It entails paying separate premiums for all members.

Floater family, health insurance plans are tailor-made to suit the customized requirements of your family. These budget-friendly plans can help you meet medical expenses without causing financial strain. Here’s more on how you can make the most of such plans. [1,2]

Additional read: Why You Need Health Insurance?Why Choose a Family Floater Plan

You can compare a family floater plan to an umbrella as it provides complete coverage for all the members included in it. It is designed to suit every family member and the sum assured is shared among all members.

A family floater plan is a cost-effective option in comparison to individual health policies. Consider this example: Say A gets individual health plans for himself and his wife with a sum assured of Rs.2 lakh each and two more for his daughter and son at Rs.1 lakh each. Consider that the daughter requires surgery whose cost crosses Rs.1 lakh, and A uses Rs.1 lakh out of his policy for his needs. However, his wife and son make no claims. In this case, A would need to pay for his daughter out of pocket. A family floater plan is beneficial for all family members. It helps to ease the burden of maintaining different policies.

While most plans include coverage for a couple and their children, plans are also available to cover siblings, parents, and parents-in-law. However, keep in mind that the maximum limit of members in such plans is set at six by most providers.

Another advantage of availing of a family floater plan is to cover the expenses of both critical and minor illnesses and protect your savings while enjoying tax benefits. In addition, it can help you address lifestyle diseases as it covers you from diagnostical expenses to treatment-related costs. However, this depends on the type of plan you choose.

How to Decide On the Right Family Floater Plan

For uninterrupted medical coverage, there are certain important factors you should consider. Age is one of the most crucial considerations while choosing the right plan. In the case of children, these plans usually cover kids until the age of 20-25 years. Apart from this, the premiums are based on the age of the oldest member covered in the plan. Such plans also put a cap on the age of the oldest member, usually at 65. So, it is better to invest in a plan during your early years or consider a different one as a senior citizen.

Another critical factor to think about is the sum assured. Since the amount is shared amongst families, choosing a higher sum is better. However, this also affects premiums, so give a thought to affordability as well. Apart from that, factors like policy exclusions, waiting period for pre-existing diseases, network hospitals, availability of top-ups and super top-ups, discounts offered such as no-claim bonus, and coverage tenure also needs to be considered.

How to Calculate Premiums When Availing Of Family Health Insurance Plans

You can plan your premiums well ahead of time by using a health insurance premium calculator available online on the provider’s website. It is a hassle-free process and allows you to calculate the amount within minutes. All you need to do is click on the required fields and fill in basic details to see the cost of a suitable plan.

How Is a Mediclaim Policy for a Family Different From Health Insurance?

A Mediclaim policy works too. But it is limited when compared to health insurance. However, its premiums are even more pocket-friendly. This type of plan covers your hospitalization expenses along with surgery for accidents and certain pre-decided diseases.

Health insurance offers pre-and post-hospitalization cover. Additionally, it offers benefits like ambulance charges. However, you can avail Mediclaim only on hospitalization. This indicated a significant difference between the two. A Mediclaim policy is not as flexible. It doesn’t allow you to increase the coverage amount or opt for an add-on based on your requirements.

In this sense, health insurance is more comprehensive.

Now that you know of the various health insurance plans for family, you can choose one confidently. Check out the Aarogya Care plans on Bajaj Finserv Health to get access to a wide range of cost-effective options.

With a sum assured of 10 lacs, you get benefits like free doctor consultations, cashless claims, and a claims ratio that exceeds competitors. Take a proactive approach towards your family’s health by availing a holistic package today.

References

- https://www.nhp.gov.in/sites/default/files/pdf/health_insurance_handbook.pdf

- https://www.heart.org/en/health-topics/consumer-healthcare/why-is-health-insurance-important

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.