Aarogya Care | 5 min read

Women’s Health Insurance: 10 Things You Should Look at Before Buying One

Medically reviewed by

Table of Content

Key Takeaways

- Women-specific plans cover illnesses usually not covered in basic health plans

- You should opt for a women’s policy with a reduced waiting and survival period

- Having a women-specific policy with a long tenure is beneficial in many ways

Today, there are many types of health insurance policies available. Some of these policies are for a specific group of people or health conditions. The need for women's health insurance policies has arisen because there are some diseases that affect women more than men or children. A basic health insurance plan doesn’t cover these illnesses and that’s why you may need to buy a health insurance policy specially designed for women.

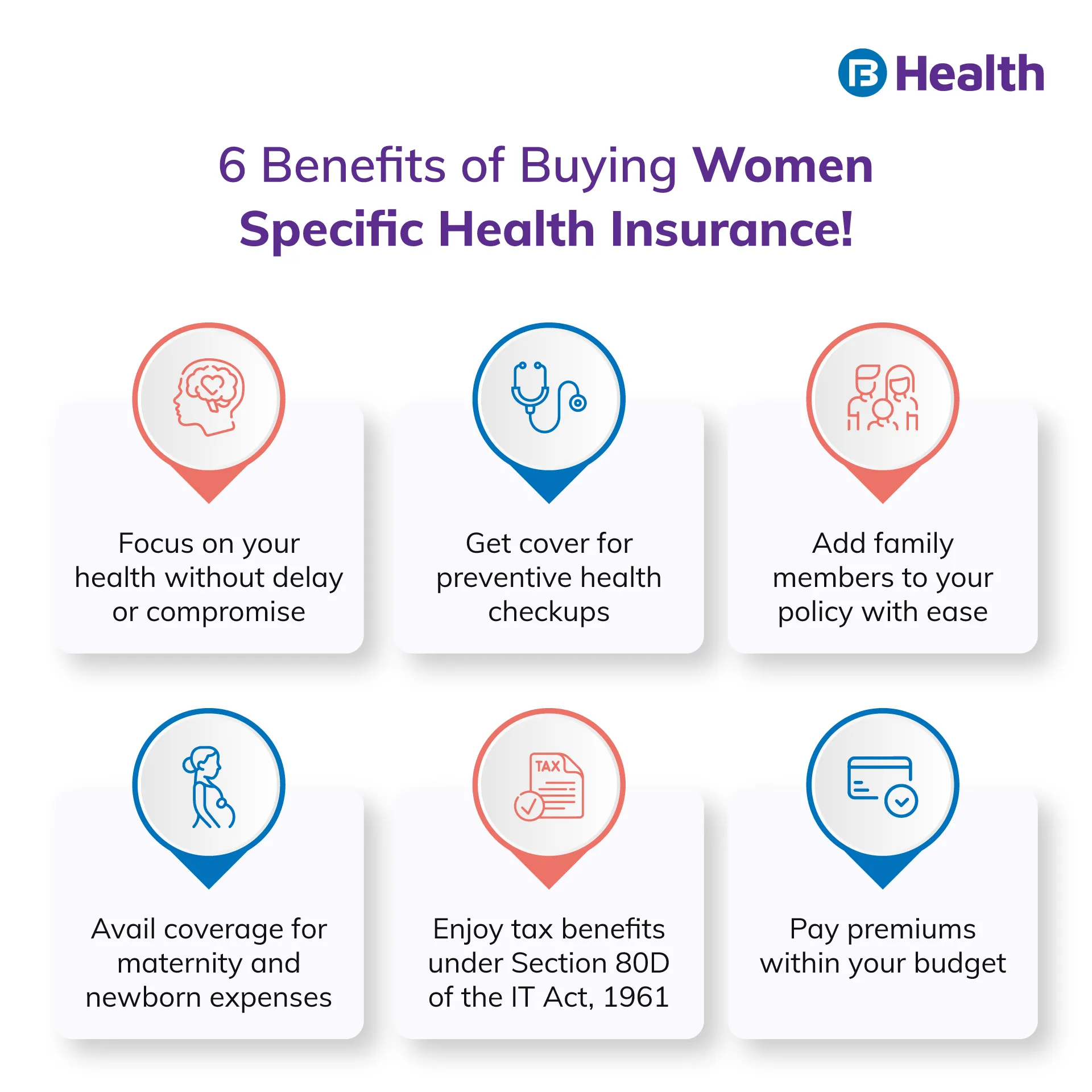

With these plans, you get cover for critical illnesses as well as maternity expenses. These may help you get treatment that is planned or during a medical emergency without adding to your financial stress. If you are considering buying a women's health insurance plan, do keep the following factors in mind. They will ensure your purchase is effective and affordable.

Coverage for women-specific diseases

There are some illnesses that affect only women. They include cancer of the ovaries or cervix as well as complications in the reproductive organs [1]. The treatment of these ailments is costly. Without having a health policy, these expenses can deplete your savings. Further, these conditions are usually not included in a basic health plan. That is why you need to do proper research before buying a plan that helps you address such ailments.

Maternity cover

The emotional and physical toll of pregnancy is huge. The costs during and after pregnancy is also high and may add to your stress. But, the proper health of both the mother and baby is essential. Since pregnancy does not fall under the category of disease, most insurers do not give cover maternity expenses. However, some policies do have this as an add-on. In case your policy does not have it, you can choose a policy tailor-made for your maternal needs. Before picking a policy, carefully check its terms and conditions.

Coverage for congenital disability

Congenital disability is a disorder that a person is born with such as a cleft lip, cleft palate, or even down syndrome. Every year, more than 1.7 million children are born with a congenital disability [2]. When you have proper insurance coverage, your provider pays for the treatment of these. Be sure to check what is covered under your policy when you look for a women’s health plan.

Medical check-ups

As you age, certain health issues can come up. With a women-specific plan, you can avail of regular medical check-ups and ensure no health conditions remain undetected.Survival and waiting period

Survival period comes into play in cases of critical illness insurance policy. This is the number of days a patient has to survive after being diagnosed with a critical illness. If the patient dies before the completion of this period, family members will not be eligible for death benefits. Usually, survival period ranges from 15-30 days.

Waiting period is the time between the purchase of your policy and it coming into effect. Any claim made between this period will not be eligible for a claim. The length of this period depends on your age and health conditions. Most insurers accept no claims in the first 30 days. If you have pre-existing health conditions, the waiting period can be up to 4 years. This is why it is important to compare different policies to make the right choice. In some cases, you can reduce the waiting period by paying a higher premium.

Policy renewal

While it is good to have a policy at a young age, make sure you renew it every year. Some insurance companies will only let you renew your policy for a short period. Since women-specific plans are mostly useful during your later years, opt for one with a long tenure.

Claim process

The claim process is different for each company. This is why it is important that you have a good understanding of this. A comparison of these may help you choose a policy that has a process most convenient for you.

Claim settlement ratio

This indicates how many claims have been settled by the company in the recent past. A higher CSR is beneficial as it means you can rely on your insurer to clear your claims. While selecting a policy, you should go for a company that has a CSR of 95% or higher. This means the insurer settles 95 out of 100 cases.

Additional benefits

Value-added features in policies can help you be more proactive about your health. Some companies offer benefits for staying fit. Some insurers also have outpatient coverage. It’s better to look for policies that give you the option of adding critical illnesses in the future. Apart from these, you should take a look at the network hospitals for cashless reimbursement. This comes in handy during an emergency hospitalization. Tax benefits are also some additional advantages of having a health insurance policy.

Additional Read: Important Riders to Health Insurance PlansOther inclusions and exclusions

Don’t forget to pay close attention to what is included and what is not in your policy. Carefully read the policy document and contact your insurance provider to clarify any doubt you may have. You should also consider the following factors before buying a policy for women:

- Sum insured

- Premium amount

- Rider

- Top-ups

- No claim bonus

Researching and analyzing your options can help you find a policy that meets your medical as well as financial goals. If you want a plan that covers women as well as spouse and children, check out the Complete Health Solution plans available on Bajaj Finserv Health. The plans are comprehensive and affordable with high network discounts and lab test benefits. Its four variants cover up to six members and offer coverage of up to Rs.10 lakh. Select the one that suits you the best and insure your health with the best benefits.

References

- https://www.nichd.nih.gov/health/topics/womenshealth/conditioninfo/whatconditions

- https://www.who.int/india/Campaigns/and/events/world-birth-defects-day-2020

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.