Aarogya Care | 5 min read

Cashless Claim: Its Process, Documents Needed, and The Top 4 Benefits

Medically reviewed by

Table of Content

Key Takeaways

- In a cashless claim, your insurer settles medical bills with the hospital

- Make sure that you get your treatment done in a network hospital

- Submit all necessary documents required for your claim to be approved

When it comes to submitting a health insurance claim request, you may have two options available- reimbursement claims and cashless claims. Almost every insurance provider offers these two types of claims. In a reimbursement claim, you will have to pay the medical expenses out of your own pocket. After submitting the claim form and required documents, your insurance provider will reimburse you. However, for a cashless claim, you do not need to pay. Instead, your insurance provider will directly settle the bills with the hospital.

Read on to know how a cashless claim works and what you need to keep in mind while opting for it.

Additional Read: Health Insurance ClaimsProcess of Cashless Claim

In a cashless claim, your treatment costs are directly paid by the insurer. This reduces the stress of arranging funds for the treatment. Because of its benefits, cashless claims are becoming more popular. According to a survey, around 40% of hospitals approve 50% of cashless claims. Further, about 100% cashless claims were observed in approximately 7% of hospitals [1].

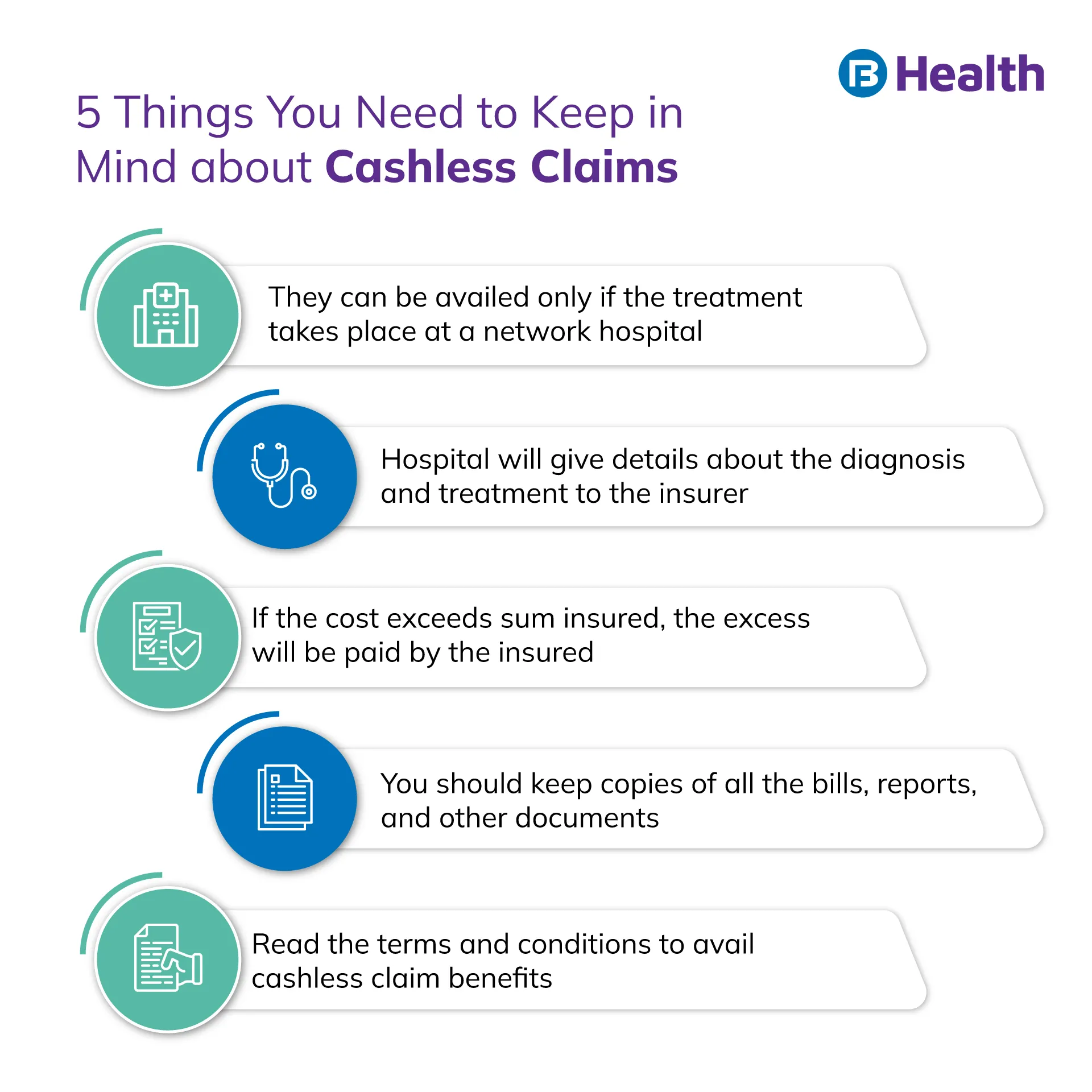

To get cashless claim benefits, your treatment has to take place at a network hospital of the insurer. Network hospitals have tie-ups with insurance providers. This makes the process of settlement feasible and easier for them. Cashless claims can be availed for planned as well as emergency treatments. The claim processes for both these treatments are as follows.

Planned Hospitalization

In planned hospitalization, you must intimate your insurance provider in advance. Generally, insurers ask the insured to inform about the treatment a week in advance. Following are the steps to avail cashless claim for a planned hospitalization

- Fill out the pre-authorization form. It can be obtained from the TPA desk of the hospital or by contacting the insurer. You and the doctor will have to fill the form.

- Submit the correctly filled form at the TPA desk or via email or post.

- After submission, the insurer will verify the details.

- After successful verification, both you and the hospital will receive a confirmation letter.

Emergency Hospitalization

As prior intimation is not possible in cases of emergency hospitalization, you will have to inform the insurer within 24 hours of admission. You or anyone from your family can contact your insurance provider through the TPA desk at the hospital. You will receive an authorization form for the cashless claim. In some cases, this may be filled by the hospital and sent to the insurance provider. After the form has been submitted, the process remains the same.

Documents Required for Approval

The documents required to process a claim may vary based on the insurer. Some commonly required documents are:

- Duly filled pre-authorization form

- Investigation or diagnosis report

- ID proof and health insurance card

To ensure that your claim is approved, understand the claim process for your insurer. Contact your insurance provider if you have any doubts.

Inclusion and Exclusions

Following are the inclusions of cashless claim benefits

- Pre- and post-hospitalization expenses for 30 and 60 days respectively [2]

- In-patient and domiciliary treatment expenses

- OPD treatment and ambulance expenses

- Costs for medical checkups

Depending on your policy and insurer, following may be the exclusions of a cashless claim

- Cost for attendants or hygiene products

- Service charges

- Charges for documentation

- Expenses for diapers, oxygen mask, or nebulizers

- Conditions or treatment procedures that are excluded from the policy

A better understanding of the exclusions and inclusions in cashless claims is necessary. This will help ensure that your claim is not rejected.

Benefits of Cashless Claim

Reduced Financial Burden

Since the insurance provider pays for treatment expenses, you do not have to worry about arranging funds. This helps reduce the financial strain, especially in an emergency.

Reduced Document Tracking

As you do not have to pay bills, there is no need to gather any documents. This saves the effort that goes into maintaining records. However, it is always better to maintain copies of original bills and documents with you.

Keeps Focus on the Treatment

Not having to worry about paying for the treatment allows you to choose the best treatment option. Apart from this, there is no legwork involved and this reduces stress. You can focus on getting care and ensuring no compromises in this regard.

Quick and Hassle-Free Process

Cashless claims are quickly approved and require fewer documents. This makes the process much smoother.

Wide Network of Medical Centers

With top insurers, you can avail the facility of cashless claims throughout the country at their network hospitals. This ensures quality treatment during emergency situations when you are not in your residential state.

Additional Read: Health Insurance PolicyWhile cashless claims do come with many benefits, it also has drawbacks. One of the major cons of cashless claims is that you have to avail treatment at a network hospital only. This is why you should ensure that your insurance provider gives you the option of both claim facilities. Understand the terms and conditions of your insurance policy before you finalize your decision.

For health insurance plans, check out the Complete Health Solution plans available on Bajaj Finserv Health. The plans come with lab test benefits as well as doctor consultation reimbursement. You also have the option of almost 9,000 network hospitals. This way you can ensure that with a comprehensive health insurance plan, you also get the best possible treatment.

References

- https://www.statista.com/statistics/1180517/india-share-of-cashless-insurance-claims/

- https://www.irdai.gov.in/admincms/cms/uploadedfiles/Guidelines%20on%20Standard%20Individual%20Health%20Insurance%20Product.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.