Aarogya Care | 8 min read

Diseases Under The Health insurance: A Detailed List

Medically reviewed by

Table of Content

Synopsis

Medical care expenses have alarmingly risen over the past few years. Owing to this, many people are considering health insurance plans to safeguard their health, treatment, as well as investments. Most illnesses and diseases are covered under health insurance, but some are not addressed by insurance plans.

Key Takeaways

- Health insurance has become the need of the hour for every individual because of lifestyle changes

- It allows you to choose cashless payment or expense repayment while protecting your prior investments

- Health insurance covers a wide range of health-related issues and provides benefits such as security and portability

Due to the exponential increase in medical care costs over the past several years, you and your family must have proper health insurance coverage. The COVID-19 epidemic has also illustrated why health insurance coverage should be mandatory. The epidemic provided proof of this point. Even essential treatments or hospitalizations at reputed private hospitals may cost tens of thousands of rupees if you lack medical insurance. Before acquiring a policy, you should consider the list of diseases covered under health insurance, the conditions your health insurance does not cover, and the exclusions that apply to those diseases.

Benefits of Possessing Health Insurance

Obtaining health insurance coverage is crucial for a multitude of reasons. Consider some of the most significant benefits of the list of diseases covered under Bajaj Health Insurance policies:

1. Security Against The Expense Of Medical Care

The primary purpose of acquiring health insurance is to guarantee access to high-quality medical care without imposing an undue financial strain on one's resources. Health insurance policies offer protection against the high cost of medical care. It includes costs related to hospitalization, daycare, domiciliary care, and ambulance service, among others. You should not be concerned about the costly charges but focus on achieving a speedy recovery.

2. Advantages Related To Portability

Portability in health insurance permits clients to move health insurance providers while retaining coverage under their current policy. Customers are safeguarded from having their business taken for granted by insurance carriers; as a result, they have a more excellent choice and access to better options if they are dissatisfied with the health insurance plans in which they are already enrolled.

3. Option Between Cashless Transactions And Expense Repayment

Using cashless treatment facilities eliminates paying for medical care out of pocket if you have proper insurance coverage. Transport the patient to any network hospital with which your insurance company has a contract, and immediately contact the third-party administrator (TPA) and an insurance company.

The bill would be resolved directly between the hospital and the insurer. You can also receive treatment from any hospital or healthcare provider of your choosing and then file a claim with the insurance for payment by submitting the original invoices and other required documents.

Additional Read: Health Insurance for Disabled People4. To Protect Your Prior Investments

An unexpected illness can create emotional agony and stress, but the costs are another component of handling health issues that can tire you. Managing health concerns can cause emotional and monetary exhaustion. If you obtain an adequate health insurance policy, you can manage your medical bills more effectively without using your finances.

Since certain insurance companies offer cashless payment options, you will not have to worry about being paid for medical expenses. Your funds can be utilized for specific reasons, such as the purchase of a property, the education of your child, or retirement. In addition, having medical insurance allows you to take advantage of tax benefits, which increases the amount you save.List of Diseases Covered Under Health Insurance

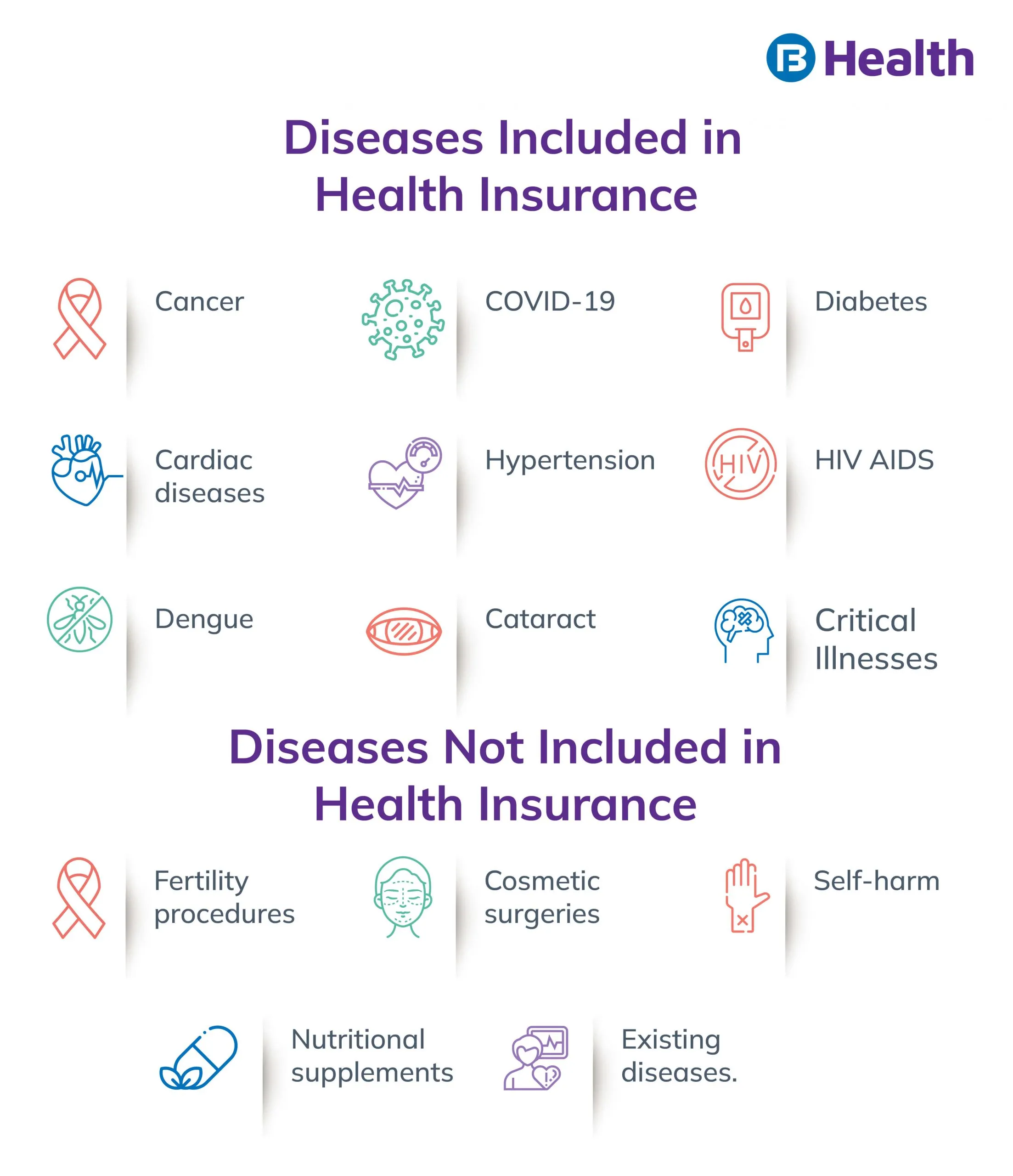

Here are given some prevalent diseases covered under health insurance and are supplied by a variety of insurers:

1. COVID-19

After being forced to do so by the IRDA, every health insurance provider now provides coverage against COVID-19. As a result of the epidemic, many individuals could not afford proper medical treatment for their loved ones, resulting in financial hardship. Consequently, health insurance firms have developed COVID-19-specific plans to aid individuals in overcoming issues of this sort.

In addition to covering the costs connected with hospitalization due to the coronavirus, these plans also cover the costs associated with pre-hospitalization and post-hospitalization care following a brief waiting period.

2. Cancer

Everyone is frightened of cancer. Depending on the severity of the patient's disease and the type of cancer they have been diagnosed with, the cost of cancer treatment can easily exceed several lakhs of rupees. Patients with cancer usually require specialized medical care, lengthy hospitalizations, and post-hospitalization therapies like chemotherapy, radiation therapy, and others.

Additional Read: In patient Hospitalisation with Aarogya careIt typically covers cancer treatment; however, it may be subject to specific restrictions. For instance, if cancer is diagnosed in its later stages, the policy may impose sub-limits on hospitalization expenses or a waiting time before the illness is included in the coverage spectrum. When filing the claim, ensure that you know the policy's terms.

In addition, many insurance companies offer separate cancer health insurance plans or add-ons to their ordinary policies.

3. Heart Conditions

In recent years, alarmingly rapid growth in the prevalence of cardiovascular illnesses has been seen. Heart diseases are ailments that result from abnormal heart and blood vascular function. Everyone should have a well-balanced diet and regular physical activity to lower their risk of cardiovascular diseases. Over-the-age-of-forty adults should undergo biannual heart examinations. Common cardiac problems include heart attacks, strokes, heart failure, excessive blood pressure, and other related conditions.

4. Diabetes

Diabetes is a lifestyle disease whose prevalence has increased in recent years. All types and severity levels of diabetes have the potential to be lethal if not appropriately controlled. A patient is diagnosed with diabetes when their blood sugar level is unusually high.

If the disease is left untreated for an extended period, it can lead to various catastrophic complications, including kidney failure, heart attack, and stroke. If you have diabetes-covering health insurance, you will be able to receive the most effective treatment for the disease without regard to financial constraints. However, to be covered against diabetes, you must obtain a comprehensive health insurance policy.

5. HIV / AIDS

Those with HIV or AIDS have a compromised immune system and are prone to various health issues. The cost of treatment can be exorbitant for middle-class Indian families. In India, various insurance policies offer financial support to pay the expense of HIV/AIDS treatment. Numerous accessible, comprehensive health insurance policies cover the price of hospitalization, treatment, fees associated with daycare therapy, and many additional costs.

6. Hypertension (High Blood Pressure)

Due to many reasons, including the increase in workplace stress and other medical disorders, many people are experiencing blood pressure issues today. Problems with hypertension that have been ignored for an extended period may eventually cause the blood vessels to constrict, resulting in a heart attack or stroke. It is advisable to seek medical help as soon as possible for blood pressure issues, which can be done without obstacles with a health insurance plan.

7. Dengue

This is a somewhat prevalent condition that is often covered by health insurance. Even while it is not a life-threatening condition, in some instances, it can lead to fatal effects if left untreated. The vast majority of insurance policies that cover dengue fever will reimburse you for all medical expenses incurred during treatment, regardless of whether hospitalization is required; the policy will also cover the cost of child care.

8. Cataract

A cataract is an eye ailment, and as a result, the affected individual's vision becomes clouded. The surgical expenses associated with cataract treatment can potentially deplete a person's savings. Consequently, you should be able to obtain financial aid from health insurance plans and enhance the quality of your vision without meeting financial obstacles.

9. Critical Illnesses

Specialized health insurance policies are provided to cover high expenditure risks in the case of severe sickness. Not only do these conditions pose a risk to patient's lives, but they also necessitate a substantial expenditure of time and resources.

As a result of several lifestyle factors and inherited illnesses, the chance of such dangers and the accompanying expenses have increased substantially. A critical illness health insurance plan is one of the most cost-effective ways to acquire protection against various severe disorders, including cancer, multiple sclerosis, Parkinson's disease, paralysis, and myocardial infarction. \

Additional Read: Family Health Insurance Policy TipsList of Diseases Not Covered Under Health Insurance

Here is the list of diseases not covered under health insurance:

1. Surgical Procedures

The insurance policy does not cover any connected charges with cosmetic surgery. This category includes liposuction, Botox, and any other related surgical procedures. This is the case until a doctor recommends reconstructive surgery or a hair transplant due to a severe incident, such as a deformity caused by an accident or urgent health issues.

2. IVF and Other Fertility Treatments

Most health insurance plans do not include In Vitro Fertilisation (IVF) procedures and fertility treatments.

3. Pregnancy and Abortion

Various types of health insurance policies in India do not cover the costs of medical care incurred due to pregnancy or abortion.

4. Additional Fees and Expenses

Most health insurance policies do not often cover other costs related to medical care, including registration fees, entry fees, and service charges.

5. Nutritional Supplements

In India, medical insurance does not cover nutritional supplements and protein drinks. These items must be paid for with personal funds.

6. Existing Medical Conditions Before Treatment

Typically, health insurance does not cover pre-existing diseases immediately. Some insurance does not cover diabetes and high blood pressure, but most coverage does. The insured may submit a claim for coverage of a pre-existing condition once a particular length has passed after the beginning of the waiting period. Depending on the insurer, the waiting period might run anywhere from 12 months to 48 months.

When policyholders obtain health insurance, they are protected against many diseases and those listed above. Following the policy's terms and conditions, the insured individual may get the complete list of illnesses covered by their plan to satisfy any medical requirements related to the plan.

Before obtaining a health insurance plan, consumers should research to determine which diseases are not covered by the plan they are applying for. This will also aid the insured in selecting the plan that best meets their unique health care requirements.

References

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.