Aarogya Care | 6 min read

In Patient Hospitalisation: How is Aarogya Care Useful?

Medically reviewed by

Table of Content

Synopsis

Learn about inpatient hospitalization benefits before you finalize a health plan. Aarogya Care plans offer a range of unique benefits like lab test reimbursements and preventive health checkups.

Key Takeaways

- Inpatient hospitalization requires at least 24 hours of hospital stay

- Aarogya Care hospitalization benefits include boarding expenses

- Accidents, complex surgeries, illnesses require inpatient hospitalization

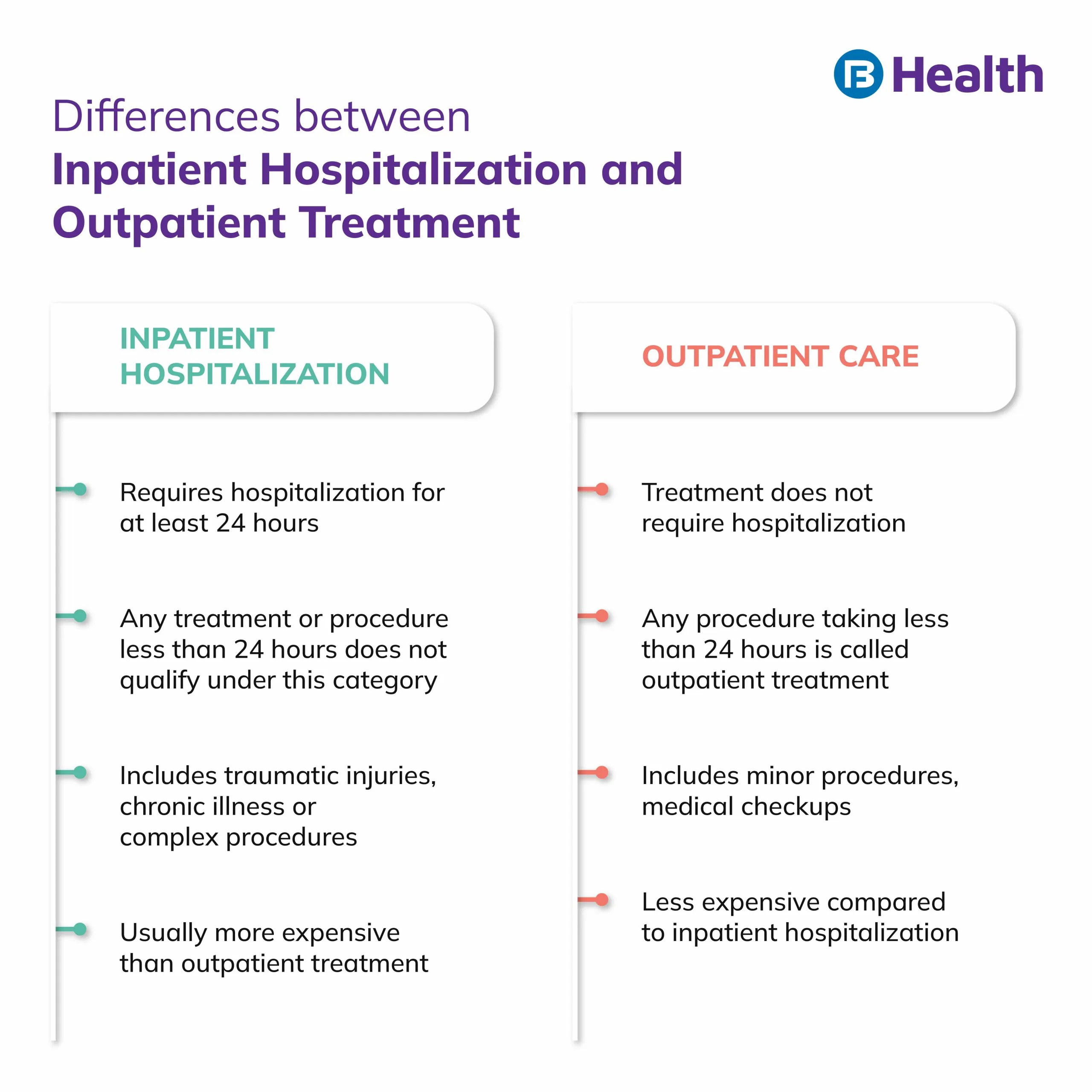

Investing in health insurance has become the need of the hour. However, you must study its features like in patient hospitalisation, total coverage, outpatient treatment benefits, and many others before you buy one. The term in patient hospitalisation means that your admission to a hospital lasts over 24 hours to complete the required medical treatment. This can be either preplanned or due to an emergency.

On the other hand, outpatient treatment is when your procedure or treatment can be completed without hospitalization. Knowing these health insurance terms before you finalize a suitable plan is essential. A study reveals that India had approximately 1.9 million hospital beds during the COVID-19 pandemic [1]. However, the vast hospitalization costs prevented many from utilizing them. Approximately 62.6% of the total health expenses in India are paid out of pocket [2]. This emphasizes the importance of investing in health insurance.

Buying a good health insurance plan can help you manage your out-of-pocket medical treatment costs with ease. A study revealed that hospital expenses in the private sector are very expensive compared to the public sector hospitals. The average rate for inpatient hospitalization in a government hospital is approximately Rs.4452, while the same in a private hospital can go up to Rs.32,000. This cost is only compounded in metros and bigger institutions.

Along with their other benefits, Aarogya Care plans from Bajaj Finserv Health can ensure that you get timely medical support by covering your inpatient hospitalization costs. Read on to get an in-depth understanding of inpatient hospitalization meaning and how you can avail these benefits with Aarogya Care health insurance plans.

Additional read: Aarogya Care Health PlansWhat do you mean by inpatient hospitalization?

To understand the inpatient hospitalization meaning, consider a hypothetical example. A person has a blockage in his heart and requires surgery. This requires hospital admission for more than 24 hours, which includes the surgery period and post-surgery monitoring. In such a scenario, your health insurance provider covers your pre-and post-hospitalization expenses. Inpatient hospitalization comes into play when you are required to stay in the hospital for proper monitoring and observation as advised by your doctor.

There are number of hospitals in India that provide in-hospitalisation benefits under one or other health insurance plan.

When do you need to opt for an inpatient hospitalization?

Inpatient hospitalization is the basic and the most important benefit provided by health insurance plans. To avail of this benefit, you need to get admitted for at least a period of 24 hours for both planned and unplanned medical situations. With Aarogya Care plans like the Complete Health Solution policies, you get additional coverage benefits. This includes health checkups, doctor consultation reimbursements, lab test reimbursements, and many more. The best part is you get these benefits at affordable premiums on a monthly basis.

A few conditions for which you can avail inpatient hospitalization benefits include:

- Chronic health diseases

- Accidents

- Illness like flu

- Burns in your body that require medical treatment

Right from serious illnesses to complex surgeries like organ transplantations, Aarogya Care is a solution you can rely on. With features like instant consultation, you can talk to eminent specialists pan India via video or audio call. You also get pre- and post-hospitalization expenses covered for a period of 60 days and 90 days, respectively. You can also avail of network discounts of up to 10% on all your regular healthcare expenses across India.

What are the different features of inpatient hospitalization that Aarogya Care offers you?

One of the umpteen Aarogya Care benefits is its inpatient hospitalization feature. These plans provide coverage for various medical treatment procedures, inclusive of room rent and other boarding costs during your hospitalization. Read on to know more.

Hospital cover

When there is a necessity for you to get admitted to the hospital beyond 24 hours, you get the necessary cover from your insurance provider. Aarogya Care plans like Complete Health Solution can provide you with a total coverage up to Rs.10 lakh. With a cashless claim feature, you need to worry about your treatment costs as they will be settled directly by your insurance provider. Avail treatment in Bajaj Finserv Health’s list of network hospitals and enjoy cashless claim benefits. Other expenses that may be included are:

- Diagnostic test fees

- Operation theatre charges

- Doctor’s fee

- Medicine costs

- ICU charges during the inpatient hospitalization period.

- Room rent

This is the benefit you can avail yourself of during your inpatient hospitalization period. Whether you are admitted for surgery or due to an illness, plans like Complete Health Solution offer you many advantages. Keep this benefit in mind when you finalize a health plan. In simple words, room rent is your bed or room charge fixed by your hospital on a daily basis. Understand the limit set by your health insurance provider and choose a room within the permitted limit. Get a 5% waiver on room rent at network hospitals by choosing Aarogya Care plans.

Boarding expenses

These are the additional charges you may incur during inpatient hospitalization. A few examples include housekeeping, cleaning, and food costs during your hospital stay. In most cases, your room rent limit is inclusive of these boarding expenses along with nursing charges. Be alert and keep a close watch to check if boarding expenses form a part of your room rent limit. In case you opt for a room with charges higher than the mentioned limit, you may have to pay a part of your hefty bill. With Complete Health Solution plans, you can heave a sigh of relief as all your boarding expenses will be met at nominal rates.

Additional read: Bajaj Health Insurance Hospital ListNow that you know what inpatient hospitalization means and how it differs from outpatient care choose your plan carefully. Ensure that you have a thorough understanding of its features. By investing in Aarogya Care plans from Bajaj Finserv Health, you can get high coverage at affordable costs, and this includes costs related to hospitalization. There are various health plans under Aarogya Care that you can choose from, one of which include Health Protect Plans. These plans cover pre- and post-hospitalization costs up to Rs.10 lakh.

With a cashless claim process that takes less than 60 seconds, you need not worry about your inpatient hospitalization costs. Do check out the Health Cards available on the Bajaj Finserv Health too to enjoy more discounts and cashback on health services. Invest in a plan today and march towards a healthy future tomorrow!

References

- https://cddep.org/publications/covid-19-in-india-state-wise-estimates-of-current-hospital-beds-icu-beds-and-ventilators/

- https://bmchealthservres.biomedcentral.com/articles/10.1186/s12913-020-05692-7

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.