Aarogya Care | 4 min read

7 Important Factors to Consider Before Choosing Health Insurance Plans

Medically reviewed by

Table of Content

Key Takeaways

- Choosing the right health insurance protects your health and wealth

- Opt for health insurance plans with high coverage & low premiums

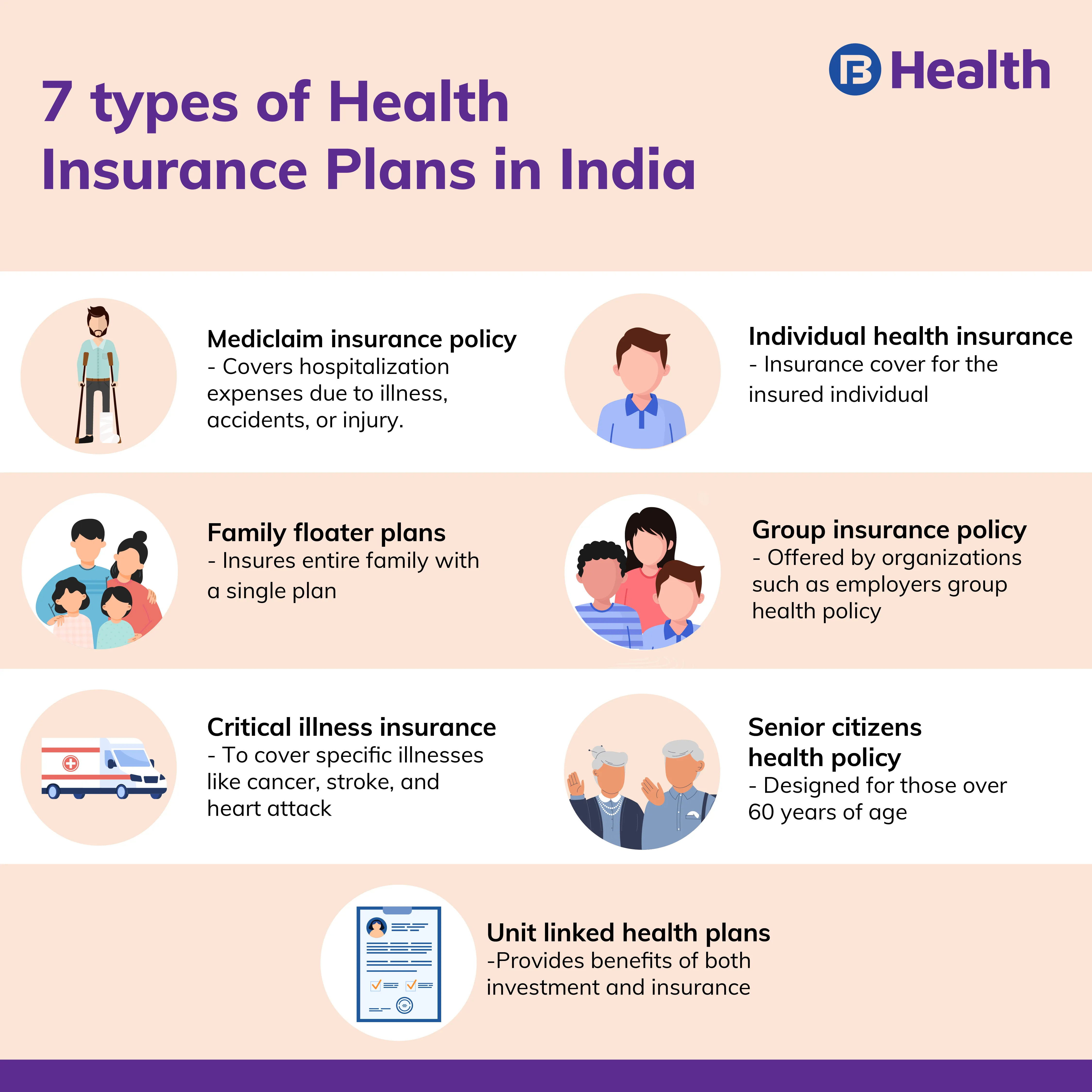

- Investing in <a href="https://www.bajajfinservhealth.in/articles/group-health-vs-family-floater-plans-what-are-their-features-and-benefits">family floater plans</a> covers medical expenses of the family

We often neglect the importance of health insurance plans until we fall sick or ill [1]. With the spread of infectious diseases, health insurance has become more valuable than ever. Rising medical expenses [2] and unforeseen events puts the spotlight on the need for health insurance plans as savings can take a huge hit due to treatment. Fortunately, you can now cover a range of medical expenses by buying health insurance.

With many companies providing a wide range of plans, choosing the right one can be challenging. Read on to know the crucial factors you may need to consider while choosing the right health insurance.

Select Right Amount While Choosing Health Coverage

With the rising cost of healthcare in India, choosing a high-value coverage is logical. However, there are other factors you need to consider while choosing health coverage. If you are young, you may need a lower sum insured. Always analyze your income before signing up so that your premiums are affordable. Any add-ons to the policy can also impact the premium. Therefore, an ideal policy would be one that provides you a high sum insured at low premiums.

Check for the network hospitals before buying health insurance

Look for a health insurance provider that offers a cashless claim facility and has a good number of network hospitals. In times of emergencies or uncertainties, you can get the treatment done at a network hospital and make a cashless claim. You needn’t bother about the medical expenses as the insurer directly settles the bills with the hospital.

Consider family floater plans while choosing right health insurance

Before choosing a health insurance policy, do consider your family’s health and age. Opt for family floater health insurance plans as they cover medical expenses of you and your immediate family members. Always check for any ailments, medical history, and pre-existing diseases in your family before buying the policy.

Additional Read: Why is It Important to Choose the Right Health Insurance Plans for a Family?Look for pre- and post-hospitalization benefits in health insurance plans

Visiting or consulting a doctor, undergoing health tests, and buying medications can add up to a big sum before hospitalization. Likewise, following up with your medical practitioner or buying the prescribed medicines after getting discharged from a hospital also adds up to your medical expenses. Look for a policy that covers both pre- and post-hospitalization charges.

Consider choosing health insurance plans with an easy claim process

Buying health insurance plans having a high claim-settlement ratio is important as it will give you a sense of safety and security. This refers to the amount of claims settled against the amount of claims filed with an insurer during a financial year. An easy and fast claim settlement process makes a health policy more beneficial for you. Thus, choose a health insurer that has a good reputation with claim settlement and has provides excellent customer support.

Go for health insurance plans offering lifetime renewal and NCB

The probability of suffering from diseases increases with age. The risk of developing health issues at old age is higher compared to when you are young. Considering this fact, opt for health insurance plans that will offer you a lifetime renewability benefit.

Look for a No Claim Bonus option while buying health insurance. In case you do not fall ill or do not claim health insurance for the policy year, the insurance company will provide you with a No Claim Bonus for that year. Every claim-free year will fetch you a bonus under this facility.

Choose health insurance plans with free medical checkups and other benefits

Compare the policies offered by different health companies and the various benefits they provide. Some policies insure you for a free medical checkup without affecting your premiums during renewal. Apart from the free check-up facility, look for a policy that covers daycare expenses. This helps you cover medical procedures completed in a day without the need of getting hospitalized for more than 24 hours. With the rising pregnancy costs [3], women should go for a health plan with maternity benefits as per their plans in life. Take into consideration factors like waiting period and the sub-limit too.

Additional Read: Why is Health Insurance During Pandemic a Safe Solution? Tips to ConsiderThe ideal health insurance plans are those that provide a high coverage amount at affordable premiums and have a simple, straightforward claim settlement process. Make sure to go through the terms and conditions carefully before you sign up to be well informed. Consider choosing right health insurance plans online for you and your family on Bajaj Finserv Health. The Aarogya Care plans offer a range of value-added features such as free doctor consultations, health checkups and loyalty discounts with one-click access to all benefits. Choose an affordable health insurance plan and take proactive measures towards your family’s health.

References

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4351276/

- https://www.bmj.com/content/370/bmj.m3506

- https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0156437

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.